my prospectus Myer Holdings Limited Joint Lead Managers

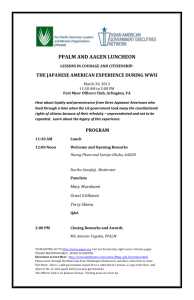

advertisement