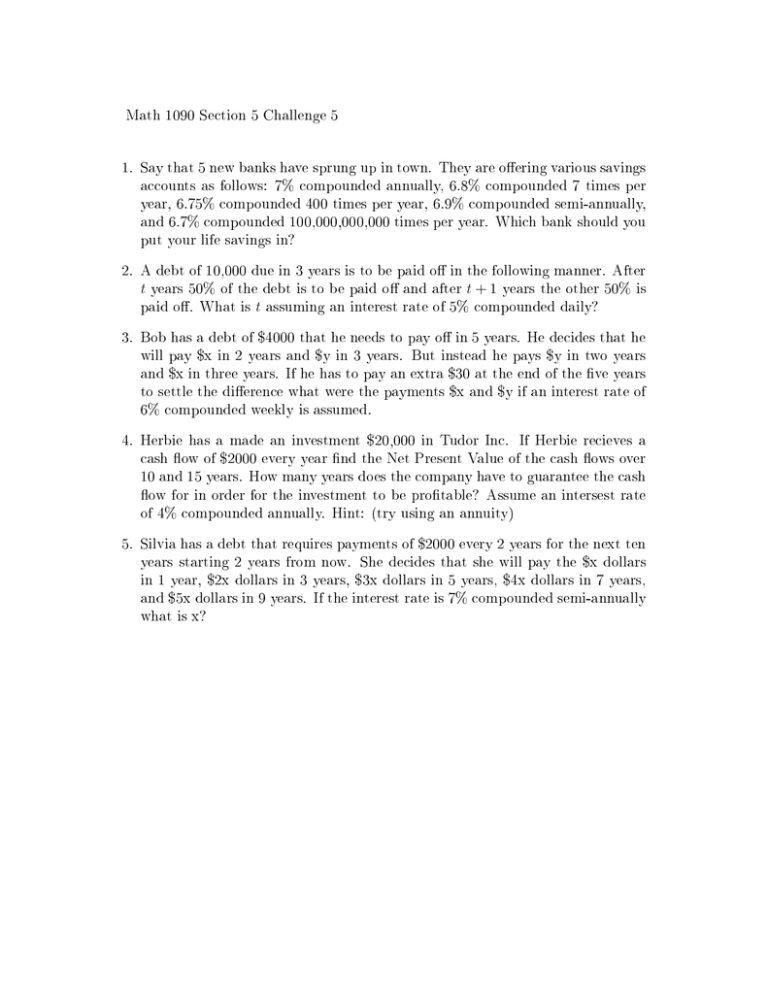

Math 1090 Section 5 Challenge 5

advertisement

Math 1090 Section 5 Challenge 5 1. Say that 5 new banks have sprung up in town. They are oering various savings accounts as follows: 7% compounded annually, 6.8% compounded 7 times per year, 6.75% compounded 400 times per year, 6.9% compounded semi-annually, and 6.7% compounded 100,000,000,000 times per year. Which bank should you put your life savings in? 2. A debt of 10,000 due in 3 years is to be paid o in the following manner. After t years 50% of the debt is to be paid o and after t + 1 years the other 50% is paid o. What is t assuming an interest rate of 5% compounded daily? 3. Bob has a debt of $4000 that he needs to pay o in 5 years. He decides that he will pay $x in 2 years and $y in 3 years. But instead he pays $y in two years and $x in three years. If he has to pay an extra $30 at the end of the ve years to settle the dierence what were the payments $x and $y if an interest rate of 6% compounded weekly is assumed. 4. Herbie has a made an investment $20,000 in Tudor Inc. If Herbie recieves a cash ow of $2000 every year nd the Net Present Value of the cash ows over 10 and 15 years. How many years does the company have to guarantee the cash ow for in order for the investment to be protable? Assume an intersest rate of 4% compounded annually. Hint: (try using an annuity) 5. Silvia has a debt that requires payments of $2000 every 2 years for the next ten years starting 2 years from now. She decides that she will pay the $x dollars in 1 year, $2x dollars in 3 years, $3x dollars in 5 years, $4x dollars in 7 years, and $5x dollars in 9 years. If the interest rate is 7% compounded semi-annually what is x?