Individual Taxpayer Identification Number

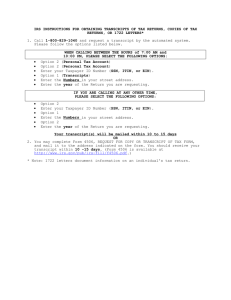

advertisement