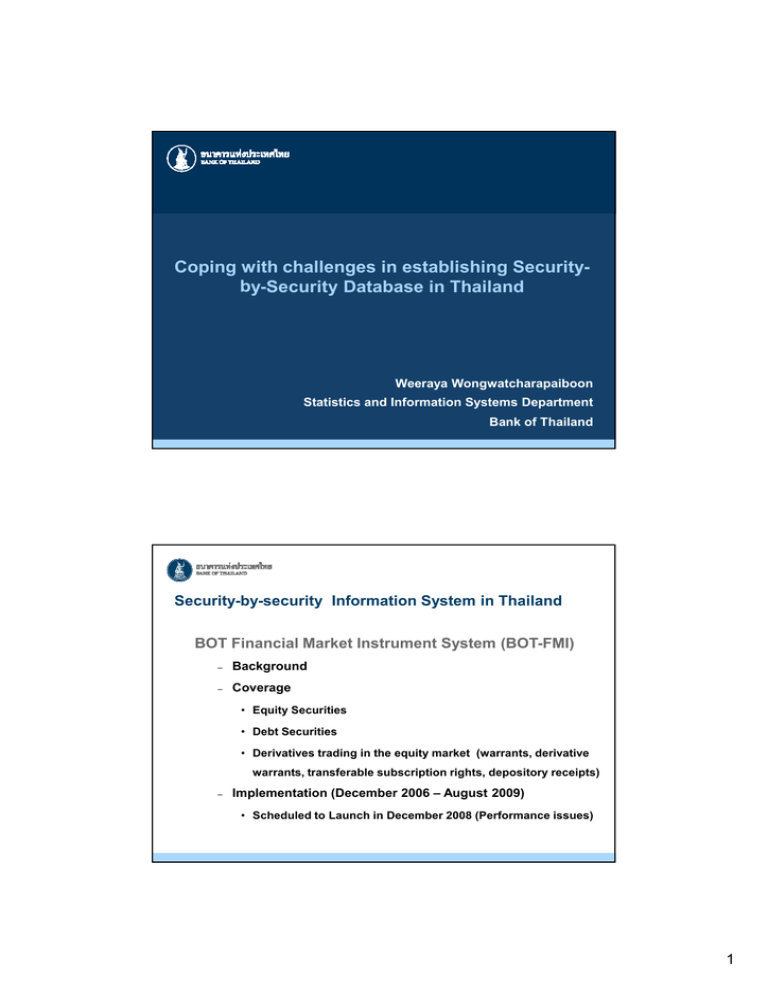

Coping with challenges in establishing Security- by-Security Database in Thailand

advertisement

Coping with challenges in establishing Securityby-Security Database in Thailand Weeraya Wongwatcharapaiboon Statistics and Information Systems Department Bank of Thailand Security-by-security Information System in Thailand BOT Financial Market Instrument System (BOT-FMI) – Background – Coverage • Equity Securities • Debt Securities • Derivatives trading in the equity market (warrants, derivative warrants, transferable subscription rights, depository receipts) – Implementation (December 2006 – August 2009) • Scheduled to Launch in December 2008 (Performance issues) 1 BOT-FMI Architecture Data Quality Management Process Input Output Central Data Warehouse BOT Data Completion SEC ETL Multidimensional database Data Comparison TSD Prorating SET CDW Validation Basic Validation Input Acquisition BOT Website Fixed Reports/ Ad hoc Reports Adjustment Reconciliation Custodian Input Preparation ThaiBMA Overview Data Model of BOT-FMI Financial Instrument Reference Data Reference data Involved Party Reference Data Security Reference Id ISIN Code Issuer ID Involved Party Name Security Name Country of Residency Issued Date Maturity Date CFI Security Code Market IDType Involved Party ID Sector … Par Value Trading Symbol Coupon Security Type Currency … Outstanding Security Reference Id ISIN Code Holder Type Price Security Reference Id ISIN Code Market Prices Security Reference Id ISIN Code Holder ID Total Unit Issued Total Unit Issued Total Value Issued Portfolio Investment in Thailand Transaction data Total Value Issued 2 Data Provider for BOT-FMI: Reference Data Data Provider Reference Data BOT SEC TSD ThaiBMA Data Provider for BOT-FMI: Transaction Data Data Provider Transaction Data BOT SEC TSD Equity +Derivatives TSD Debt + Equity+ Derivatives SET Custodian ThaiBMA 3 Benefits Challenges Centralize all BOT Data Consistency securities data • Identification and of Increase efficiency Deletion of Data data management Duplication system • Lack of Unique Ensure Data Identifier Code Consistency • •Aligned securitywith •international involved party standard Reduce Reporting Complex Data Entities Burden and Preparation System Improve Data • Quality Data Quality Management process •at Data Aggregation the security level done at the BOT side • Statistical methods or •predefined Change of Datato rules requirement NOT automate the data affect Reporting preparation process Entities • Trade-off between •costs Dataand Quality benefits Management process at the security level Satisfy the user Selection demand of BI tool and model design • Flexibility to cope • Extremely large with the rapidly amount of transaction changing data data requirement • Data cube with a great number of dimensions Establishment of TFIIC Thailand Financial Instrument Information Center (TFIIC) – Background – Implementation (Phasing) • Phase I (March 2010 - December 2012) – Data Coverage (Same as BOT-FMI) – Focus on Infrastructure • Phase II (TBD) – Data Coverage (expand to cover all derivatives in the market) – Data Visualization for public users 4 Challenges Balancing between organization benefits and public benefits • Resources devotion Flexibility of the TFIIC data model • Support all types of securities • Financial innovation • Information exchange in the security-by-security level for five founders Next Step and Conclusion BOT-FMI Next Step – Enhancement on BOT security statistics • Scrip Holding • Security Repurchase Transaction • Add more flexibility to BOT-FMI Data Model Conclusion 5