ANALYSIS OF A NICHE MARKET FOR FARM-RAISED BLACK SEA BASS

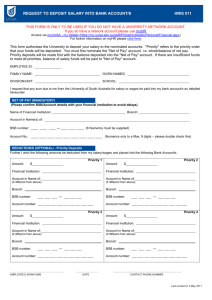

advertisement