Corporate Sponsorship Information Corporate Sponsorships

Corporate Sponsorship Information

Corporate Sponsorships

•

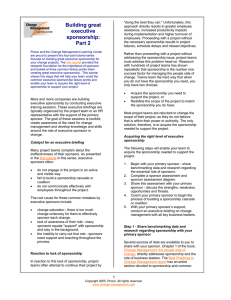

Calling something a sponsorship does not always mean the sponsor gets something in exchange.

•

Sponsorships are typically encouraged when you want to have an event underwritten.

•

You need to handle standard quid pro quo benefits such as receiving a table or certain number of tickets to the event.

•

Usually all a sponsor is looking for is name recognition.

What recognition a sponsor can receive in order to receive a tax deduction:

•

Mention of location, phone number and website.

•

Value neutral descriptions including displays or visual depictions of the sponsor’s product line or services.

•

Displays of brand or trade names and product services.

•

Logos or slogans that are an established part of the sponsor’s identity.

•

Mere display or distribution (free of cost) of the sponsor’s product at a sponsored activity.

What recognition a sponsor cannot receive:

•

Qualitative or comparative language.

•

Price information or other indications of savings or value.

•

An endorsement or inducement to purchase sell or use the sponsor’s service facility or product.

•

A single message containing the advertising and acknowledgement – this would be 100% advertising.

Red Flags to the IRS

•

Try to keep words out of sponsorship documents: Sponsorship agreement, partnerships, joint venture, royalty agreement, and advertising.

More Information

See Federal Register, Vol. 67 No. 80, page 20433

Taken from the Accountability 101 workshop presented by John Taylor

Winthrop University Foundation

Corporate Sponsorship Information Page 1 of 1