BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA )

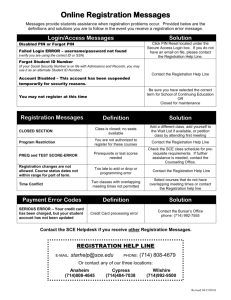

advertisement