Document 11888908

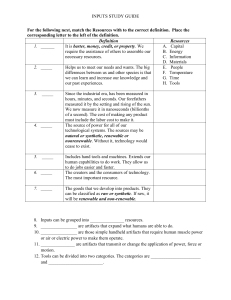

advertisement