ECO 745-01: Advanced Econometric Theory University of North Carolina Greensboro Fall 2015

advertisement

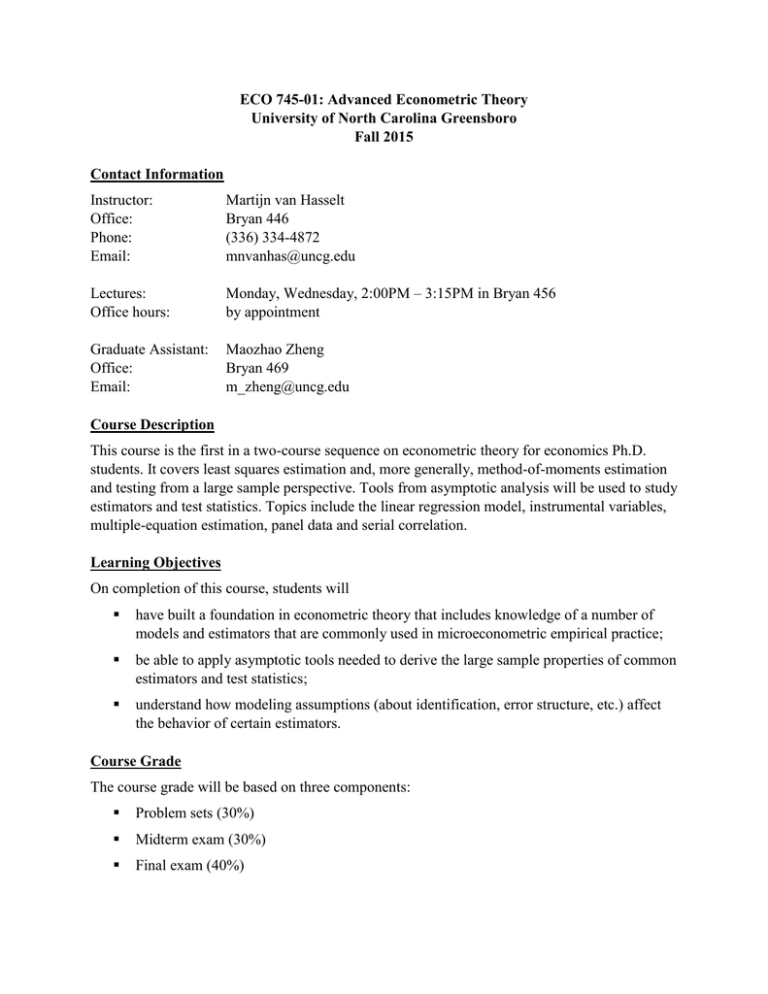

ECO 745-01: Advanced Econometric Theory University of North Carolina Greensboro Fall 2015 Contact Information Instructor: Office: Phone: Email: Martijn van Hasselt Bryan 446 (336) 334-4872 mnvanhas@uncg.edu Lectures: Office hours: Monday, Wednesday, 2:00PM – 3:15PM in Bryan 456 by appointment Graduate Assistant: Office: Email: Maozhao Zheng Bryan 469 m_zheng@uncg.edu Course Description This course is the first in a two-course sequence on econometric theory for economics Ph.D. students. It covers least squares estimation and, more generally, method-of-moments estimation and testing from a large sample perspective. Tools from asymptotic analysis will be used to study estimators and test statistics. Topics include the linear regression model, instrumental variables, multiple-equation estimation, panel data and serial correlation. Learning Objectives On completion of this course, students will have built a foundation in econometric theory that includes knowledge of a number of models and estimators that are commonly used in microeconometric empirical practice; be able to apply asymptotic tools needed to derive the large sample properties of common estimators and test statistics; understand how modeling assumptions (about identification, error structure, etc.) affect the behavior of certain estimators. Course Grade The course grade will be based on three components: Problem sets (30%) Midterm exam (30%) Final exam (40%) Problem sets will be handed out periodically throughout the semester. For some of them you will use Stata. The midterm exam will be a take-home exam. The final exam is cumulative and will cover the entire semester. Course Materials The following text is required for this course: Hayashi, F. (2000). Econometrics. Princeton University Press Additional readings (e.g., articles, book chapters) may be used. If this happens, these will be provided to you via Canvas. You may also find the following references helpful as supplemental reading (these are not required). Casella, G. and Berger, R.L. (2001). Statistical Inference. Duxbury. [This text is a good source for mathematical statistics.] Greene, W.H. (2011). Econometric Analysis. Prentice Hall. [The book is currently in its 7th edition, but older editions can be used as well.] Wooldridge, J.M. (2010). Econometric Analysis of Cross Section and Panel Data. MIT Press. [This is a very popular graduate-level textbook.] Cameron, A.C. and Trivedi, P. K. (2005). Microeconometrics: Methods & Applications. Cambridge University Press. Goldberger, A.S. (1991). A Course in Econometrics. Harvard University Press. Tentative Schedule Week (1) Aug. 17, 19 Topics Review of probability and matrix algebra The linear regression model Assumptions The algebra of ordinary least squares (OLS) (2) Aug. 24, 26 Finite sample properties of OLS Hypothesis testing under normality (3) Aug. 31, Sep. 2 OLS and maximum likelihood estimation Generalized least squares (GLS) (4) Sep. 9 No class on September 7 (Labor Day) Tools for asymptotic analysis Convergence in probability and distribution Laws of large numbers and central limit theorems (5) Sep. 14, 16 Time series concepts Ergodic stationarity Martingale differences OLS Large sample properties Variance estimation Readings H: 1.1, 1.2 H: 1.3, 1.4 H: 1.5, 1.6 H: 2.1 H: 2.2, 2.3, 2.5 Week (6) Sep. 21, 23 Topics OLS Hypothesis testing Homoscedasticity Linear prediction (7) Sep. 28, 30 Endogeneity and bias of OLS Instrumental variables Generalized method of moments (GMM) (8) Oct. 5, 7 GMM Large sample properties Testing over-identifying restrictions (9) Oct. 14 No class on October 12 (Fall Break) GMM Two-stage least squares (2SLS) (10) Oct. 19, 21 GMM in multiple-equation models Estimator and large sample properties Singe-equation versus multiple-equation estimators (11) Oct. 26, 28 Special cases of multiple-equation GMM Three-stage least squares (3SLS) Seemingly unrelated regressions (SUR) Common coefficients Pooled OLS (12) Nov. 2, 4 Panel data models Individual heterogeneity Fixed effects estimation (13) Nov. 9, 11 Panel data models Random effects estimation The Hausman test Unbalanced panels (14) Nov. 16, 18 Serial correlation Lag polynomials Moving average processes Autoregressive moving average (ARMA) models Vector autoregression (VAR) (15) Nov. 23 No class on November 25 (Thanksgiving Break) Serial correlation Estimation of ARMA models (16) Nov. 30 Serial correlation Asymptotic tools Serial correlation in GMM Final Exam: Monday, December 7, 3:30PM – 6:30PM Readings H: 2.4, 2.6, 2.9 H: 3.1-3.4 H: 3.5-3.7 H: 3.8-3.9 H: 4.1-4.4 H: 4.5-4.6 H: 5.1-5.2 H: 5.2-5.3 H: 2.10, 6.1-6.3 H: 6.4 H: 6.5-6.6