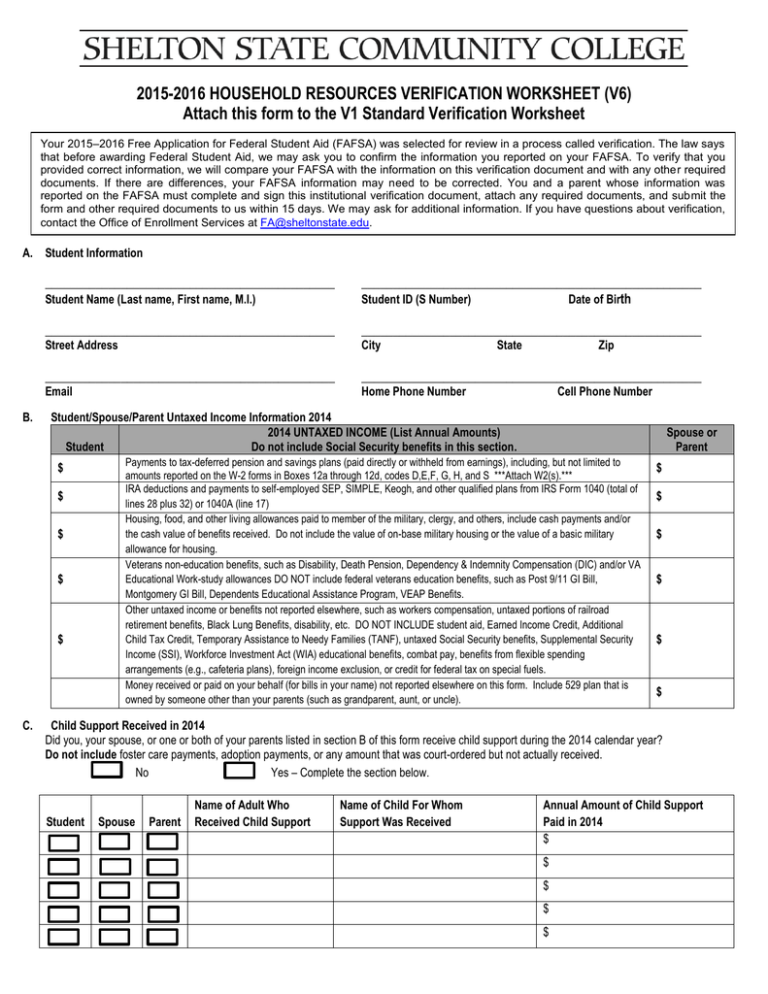

2015-2016 HOUSEHOLD RESOURCES VERIFICATION WORKSHEET (V6)

advertisement

2015-2016 HOUSEHOLD RESOURCES VERIFICATION WORKSHEET (V6) Attach this form to the V1 Standard Verification Worksheet Your 2015–2016 Free Application for Federal Student Aid (FAFSA) was selected for review in a process called verification. The law says that before awarding Federal Student Aid, we may ask you to confirm the information you reported on your FAFSA. To verify that you provided correct information, we will compare your FAFSA with the information on this verification document and with any other required documents. If there are differences, your FAFSA information may need to be corrected. You and a parent whose information was reported on the FAFSA must complete and sign this institutional verification document, attach any required documents, and submit the form and other required documents to us within 15 days. We may ask for additional information. If you have questions about verification, contact the Office of Enrollment Services at FA@sheltonstate.edu. A. Student Information ______________________________________________ Student Name (Last name, First name, M.I.) ______________________________________________________ Student ID (S Number) Date of Birth ______________________________________________ ______________________________________________________ ______________________________________________ ______________________________________________________ Street Address Email B. State Zip Home Phone Number Cell Phone Number Student/Spouse/Parent Untaxed Income Information 2014 2014 UNTAXED INCOME (List Annual Amounts) Student Do not include Social Security benefits in this section. $ $ $ $ $ C. City Spouse or Parent Payments to tax-deferred pension and savings plans (paid directly or withheld from earnings), including, but not limited to amounts reported on the W-2 forms in Boxes 12a through 12d, codes D,E,F, G, H, and S ***Attach W2(s).*** IRA deductions and payments to self-employed SEP, SIMPLE, Keogh, and other qualified plans from IRS Form 1040 (total of lines 28 plus 32) or 1040A (line 17) Housing, food, and other living allowances paid to member of the military, clergy, and others, include cash payments and/or the cash value of benefits received. Do not include the value of on-base military housing or the value of a basic military allowance for housing. Veterans non-education benefits, such as Disability, Death Pension, Dependency & Indemnity Compensation (DIC) and/or VA Educational Work-study allowances DO NOT include federal veterans education benefits, such as Post 9/11 GI Bill, Montgomery GI Bill, Dependents Educational Assistance Program, VEAP Benefits. Other untaxed income or benefits not reported elsewhere, such as workers compensation, untaxed portions of railroad retirement benefits, Black Lung Benefits, disability, etc. DO NOT INCLUDE student aid, Earned Income Credit, Additional Child Tax Credit, Temporary Assistance to Needy Families (TANF), untaxed Social Security benefits, Supplemental Security Income (SSI), Workforce Investment Act (WIA) educational benefits, combat pay, benefits from flexible spending arrangements (e.g., cafeteria plans), foreign income exclusion, or credit for federal tax on special fuels. Money received or paid on your behalf (for bills in your name) not reported elsewhere on this form. Include 529 plan that is owned by someone other than your parents (such as grandparent, aunt, or uncle). $ $ $ $ $ $ Child Support Received in 2014 Did you, your spouse, or one or both of your parents listed in section B of this form receive child support during the 2014 calendar year? Do not include foster care payments, adoption payments, or any amount that was court-ordered but not actually received. No Yes – Complete the section below. Student Spouse Parent Name of Adult Who Received Child Support Name of Child For Whom Support Was Received Annual Amount of Child Support Paid in 2014 $ $ $ $ $ Student Name:______________________________________________________ Student Number:___________________________________ Student Spouse Parent Name of Adult Who Received Child Support Name of Child For Whom Support Was Received Annual Amount of Child Support Paid in 2014 Total Amount of Child Support Received 2014 $ If more space is needed, please attach a separate page with your name and Student ID number at the top. Note: If we have reason to believe that the information regarding child support paid or received is inaccurate, we may require additional documentation: A copy of the separation agreement or divorce decree showing the amount of child support to be provided; A statement from the individual receiving the child support certifying the amount of child support received; or Copies of the child support payment checks or money order receipts. D. If you had low income in 2014 (less than $3,000 per person in household), please explain how you met your living expenses from January 1, 2014 through December 31, 2014. Documentation, such as benefit statements, bank statements, and/or letters from people who provided, support will be required. ______________________________________________________________________________________________________________________ ______________________________________________________________________________________________________________________ ______________________________________________________________________________________________________________________ ______________________________________________________________________________________________________________________ E. Certification and Signatures: Each person signing this worksheet certifies that all of the information reported on it is complete and correct. If dependent, the student and one parent must sign and date this worksheet. ________________________________________________________ ____________________________________ ________________________________________________________ ____________________________________ Student Signature Parent Signature (if dependent student) Date Date WARNING: If you purposely give false information on this worksheet, you may be fined, sentenced to jail, or both. Also, you may be subject to disciplinary action by the College. IMPORTANT: Once we receive your completed documentation please allow seven (7) business days for verification/corrections to be processed and indicated on your Myshelton account. Do not mail this worksheet to the U.S. Department of Education. Submit or mail this worksheet to the following: SSCC Enrollment Services Office 9500 Old Greensboro Road Tuscaloosa, Alabama 35405 Email: fa@sheltonstate.edu Fax: 205-391-2372 You should make a copy of this worksheet for your records. The Free Application for Federal Student Aid (FAFSA) is the only form a student is required to complete to be considered for student assistance from any of the Title IV, HEA programs. No additional application or other request for information can be required by an institution in support of the student’s request for Title IV, HEA program assistance, except for information needed to ensure the student’s eligibility for such assistance (e.g., information needed to complete verification or to demonstrate compliance with the student eligibility provisions of the HEA and the regulations). It is the official policy of the Alabama Department of Postsecondary Education, including postsecondary education institutions under the control of the State Board of Education, that no person shall, on the grounds of race, color, handicap, gender, religion, creed, national origin, or age, be excluded from participation in, be denied the benefits of, or be subjected to discrimination under any program, activity, or employment. Shelton State Community College will make reasonable accommodations for qualified disabled applicants or employees.