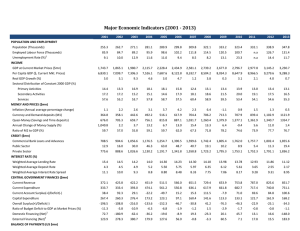

T Statistical Appendix

advertisement