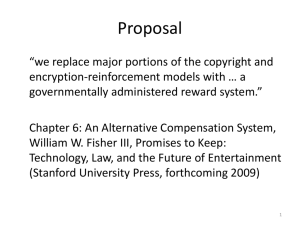

William W. Fisher III (Stanford University Press, August 2004)

advertisement