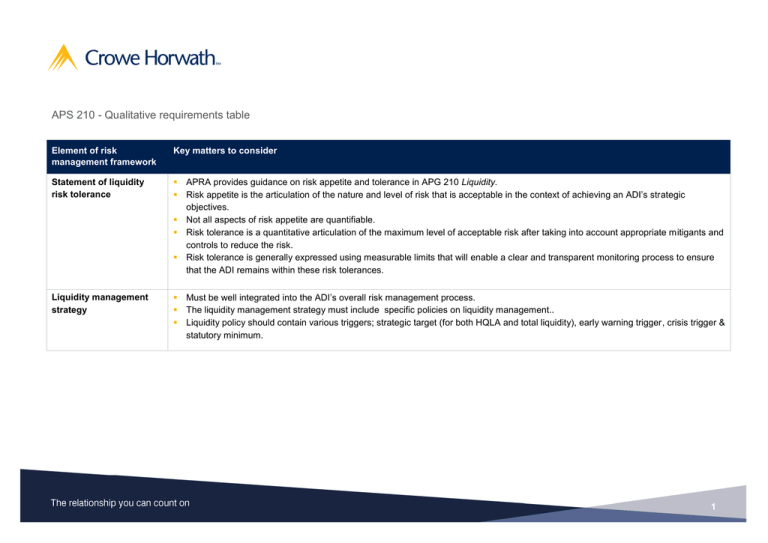

APS 210 - Qualitative requirements table

advertisement

APS 210 - Qualitative requirements table Element of risk management framework Key matters to consider Statement of liquidity risk tolerance APRA provides guidance on risk appetite and tolerance in APG 210 Liquidity. Risk appetite is the articulation of the nature and level of risk that is acceptable in the context of achieving an ADI’s strategic objectives. Not all aspects of risk appetite are quantifiable. Risk tolerance is a quantitative articulation of the maximum level of acceptable risk after taking into account appropriate mitigants and controls to reduce the risk. Risk tolerance is generally expressed using measurable limits that will enable a clear and transparent monitoring process to ensure that the ADI remains within these risk tolerances. Liquidity management strategy Must be well integrated into the ADI’s overall risk management process. The liquidity management strategy must include specific policies on liquidity management.. Liquidity policy should contain various triggers; strategic target (for both HQLA and total liquidity), early warning trigger, crisis trigger & statutory minimum. 1 Element of risk management framework Key matters to consider Operating standards for managing liquidity risk The annual funding strategy Will generally include both qualitative and quantitative items, key outcomes and strategies that will be used to achieve the outcomes. Funding strategy would combined expected funding outcomes with sensitivity analysis. APS 210 requires an ADI to maintain a presence in its chosen fund markets, have strong relationships with fund providers, and regularly gauge its capacity to practically and effectively raise funds quickly in the event of a funding crisis. Contingency funding plan ADIs must have in place a formal contingency plan that sets out the strategies of addressing liquidity shortfalls in emergency situations. Depending on the nature, severity and duration of a liquidity shock, the potential sources of funding during a crisis will vary. In the form of policies, procedures and controls. Should be in line with the Board approved liquidity risk tolerance. Should include the ADIs approach to: Ensuring sufficient liquidity is maintained at all times; Determining the structure, responsibilities and controls for managing and monitoring liquidity risk, including frequency; Ensuring adequate controls are in place to ensure the integrity of liquidity management processes; Ensuring stress tests, contingency funding and HQLA holdings are effective and appropriate; Establishing reporting criteria and process including exception reports and escalations; and Monitoring current trends, market developments and internal information on liquidity risk. 2 Support At Crowe Horwath we have the expertise and specialists who can support you in applying or understanding these revised liquidity standards. If you have any questions feel free to contact Brad Bohun, Anne Lockwood, David Munday or Pippa Hobson. Brad Bohun Partner - Audit and Assurance +61 2 6021 1111 brad.bohun@crowehorwath.com.au Anne Lockwood Partner - Audit and Assurance +61 3 9258 6802 anne.lockwood@crowehorwath.com.au David Munday Partner - Audit and Assurance +61 3 9258 9564 david.munday@crowehorwath.com.au Pippa Hobson Partner - Audit and Assurance +61 8 9488 1140 pippa.hobson@crowehorwath.com.au This document provides general information only, current at the time of production. Any advice in it has been prepared without taking into account your objectives, financial situation or needs. You should seek professional advice before acting on any material. Liability limited by a scheme approved under Professional Standards Legislation (other than for the acts or omissions of financial services licensees) in each State or Territory other than Tasmania. Crowe Horwath (Aust) Pty Ltd is a member of Crowe Horwath International, a Swiss verein. Each member firm of Crowe Horwath is a separate and independent legal entity. Crowe Horwath (Aust) Pty Ltd and its affiliates are not responsible or liable for any acts or omissions of Crowe Horwath or any other member of Crowe Horwath and specifically disclaim any and all responsibility or liability for acts or omissions of Crowe Horwath or any other Crowe Horwath member. Any general advice in this newsletter is provided by: Crowe Horwath (Aust) Pty Ltd ABN 84 006 466 351 and Australian Credit Licence No. 389054; Crowe Horwath Financial Advice Pty Ltd ABN 51 060 092 631 AFSL No. 238244; Crowe Horwath Corporate Finance (Aust) Ltd ABN 95 001 508 363 AFSL No. 239170; Crowe Horwath Insurance Brokers Pty Ltd ABN 17 139 730 528 AFSL No. 342526; Crowe Horwath Property Securities Ltd ABN 91 010 208 107 AFSL No. 247427. You should obtain and consider the Product Disclosure Statement for the financial products mentioned before making a decision to acquire the product. While all reasonable care is taken in the preparation of this newsletter, to the extent allowed by legislation Crowe Horwath accept no liability whatsoever for reliance on it. 3