Trust Board Integrated Performance Report January 2014 ORBIT Reporting

advertisement

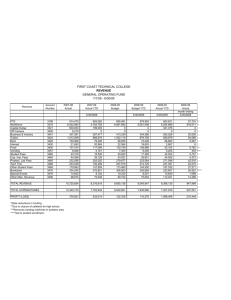

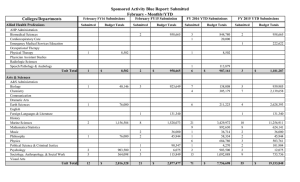

ORBIT Reporting Trust Board Integrated Performance Report January 2014 At A Glance report Data Quality Indicator Escalation report Graph Legend The data quality rating has 2 components. The first component is a 5 point rating which assesses the level and nature of assurance that is available in relation to a specific set of data. The levels are described in the box below. Rating Required Evidence 1 Standard operating procedures and data definitions are in place. 2 As 1 plus: Staff recording the data have been appropriately trained. 3 As 2 plus: The department/service has undertaken its own audit. 4 As 2 plus: A corporate audit has been undertaken. As 2 plus: An independent audit has been undertaken (e.g. by the Trust's internal or external auditors). 5 Underachieving Standard Plan/ Target Performance The second component of the overall rating is a traffic‐light rating to include the level of data quality found through any auditing / benchmarking as below Rating Green Data Quality Satisfactory Amber Data can be relied upon but minor areas for improvement identified. Red Unsatisfactory/significant areas for improvement identified. ORBIT Reporting Operational Access Standards Standard RTT ‐ admitted % within 18 weeks RTT admitted ‐ median wait RTT 95th centile for admitted pathways RTT ‐ # specialties not delivering the admitted standard RTT ‐ non‐admitted % within 18 weeks RTT ‐ non‐admitted ‐ median wait RTT ‐ 95th percentile for non‐admitted RTT RTT ‐ # specialties not delivering the non‐ admitted standard RTT ‐ incomplete % within 18 weeks RTT ‐ #waiting on incomplete RTT pathway Activity OUH ‐At A Glance 2013‐14 Current Data Period Period Actual YTD Forecast next Data period Quality 90% 11.1 Jan‐14 Jan‐14 86.76% 8.23 90.4% 7.31 87.6% 7.9 3 2 23 Jan‐14 28.43 24.11 27.4 3 0 Jan‐14 7 6 95% 6.6 18.3 Jan‐14 Jan‐14 Jan‐14 94.6% 6.08 18.77 96.3% 5.26 17.31 95.1% 5.6 18.1 0 Jan‐14 4 3.3 92% NA Jan‐14 Jan‐14 89.31% 41158 92.2% 90.3% 39612.7 2.2% Quality Outcomes Standard Hospital Standardised Mortality ratio* YTD Forecast next Data period Quality NA NA Oct‐13 Oct‐13 93.29 100.34 5 5 Summary Hospital‐level Mortality Indicator** NA Dec‐13 0.95 5 Proportion of Assisted deliveries 15% Jan‐14 16.45% 15.3% 15.8% Proportion of C‐Section deliveries Total # of deliveries 23% 62% NA Jan‐14 Jan‐14 Jan‐14 24.82% 58.74% 681 22.8% 61.8% 6962 24.2% 60% 669 Monthly YTD HSMR at weekends for emergency admission* 2 2 3 Current Data Period Period Actual Proportion of normal deliveries 3 Maternal Deaths NA Jan‐14 0 2 0.7 2 2 30 day emergency readmission 0% 0 Jan‐14 Jan‐14 3.27% 0 3.7% 1 3.6% 2 Number of CAS Alerts received by Trust during the month NA Jan‐14 8 144 5 5 Number of CAS alerts that were closed having breached during the month 0 Jan‐14 0 6 5 Medication errors causing serious harm 5 % Diagnostic waits waiting 6 weeks or more 1% Jan‐14 2.67% 7.00% % <=4 hours A&E from arrival/trans/discharge 95% Q4 13‐14 89.29% 93.6% Ambulance Handovers within 15 minutes 95% Jan‐14 75.86% 74.6% 59.3% Number of CAS Alerts with a deadline during the month NA Jan‐14 14 149 Number of attendances at A/E depts in a month NA Jan‐14 12020 109616 10807 2 Dementia CQUIN patients admitted who have had a dementia screen 90% Dec‐13 59.86% 53.9% 60% 2 Last min cancellations ‐ % of all elec admissions 0.8% Jan‐14 0.71% 0.6% 0.5% 2 Medication reconciliation completed within 24 hours of admission 80% Jan‐14 75.98% 77.5% 75.8% 4 2 Monthly numbers of complaints received NA Jan‐14 84 718 68 4 Patient Satisfaction‐ Response rate (friends & family ‐ED) 0% Jan‐14 11.33% 10.3% 8.3% Patient Satisfaction ‐Response rate (friends & family ‐Inpatients) 0% Jan‐14 27.56% 22.2% 27% Net promoter (friends & family ‐ED) NA Jan‐14 52 55.7 NA Jan‐14 73 71.7 0 Q4 13‐14 5 9 3 80% Jan‐14 91.84% 90.1% 89.8% 5 0 Jan‐14 1 4 0.3 5 % patients not rebooked within 28 days 5% Jan‐14 5.63% 9.1% Total on Inpatient Waiting List NA Jan‐14 11871 3 # on Inpatient Waiting List dates less than 18 weeks NA Jan‐14 9668 3 # on Inpatient Waiting List waiting between 18 and 35 weeks NA Jan‐14 1724 # on Inpatient Waiting List waiting 35 weeks & over NA Jan‐14 479 3 Net promoter (friends & family ‐Inpatients) % Planned Inpat WL patients with a TCI date NA Jan‐14 21.56% 3 Same sex accommodation breaches 4.8% Patient Experience 5 2 No of GP written referrals 11695 Jan‐14 13545 126075 12074.7 3 # patients spend >=90% of time on stroke unit Other refs for a first outpatient appointment 7821 Jan‐14 8781 77934 7807.3 3 HCAI ‐ MRSA bacteraemia 1st outpatient attends following GP referral 8537 Jan‐14 9944 96567 9277 2 HCAI ‐ Cdiff 6 Jan‐14 7 52 7 5 Total number of first outpatient attendances 15079 Jan‐14 17228 167698 16087.3 2 % adult inpatients have had a VTE risk assess 95% Q4 13‐14 95.46% 95.5% 95.4% 5 Non‐elective FFCEs Jan‐14 Jan‐14 Jan‐14 Jan‐14 5634 1853 7372 125 55912 19725 68336 1130 5662.3 1857.3 6939.3 110 2 3 3 2 Number SIRIs Delayed transfers of care: number (snapshot) 5893 1956 6302 0 Incidents per 100 admissions NA 8 NA NA Jan‐14 Jan‐14 Jan‐14 Dec‐13 1 6 6 12.57 42 43 5.53 11.87 3.7 7 5.7 12.3 5 2 2 2 Delayed transfers of care as % of occupied beds 3.5% Q4 13‐14 11.57% 10.9% 11.1% # acquired, avoidable Grd 3/4 pressure Ulcers NA Dec‐13 2 29 3 5 Theatre Utilisation ‐ Total 75% Jan‐14 73.87% 75.2% 74.2% 2 % of Patients receiving Harm Free Care (Pressure sores, falls, C‐UTI and VTE) 0% Jan‐14 90.68% 92.5% 92.2% 2 Theatre Utilisation ‐ Elective 80% 70% Jan‐14 Jan‐14 78.02% 59.78% 78.3% 65.2% 77.7% 62.4% 3 2 Never Events NA Jan‐14 0 3 0.3 5 Number of Elective FFCEs ‐ admissions Number of Elective FFCEs ‐ daycases Theatre Utilisation ‐ Emergency Safety Number of Patient Falls with Harm Patient Falls per 1000 bed days Operational Cancer Waits Standard Current Data Period Period Actual YTD Forecast next Data period Quality %patients cancer treatment <62‐days urgt GP ref 85% Dec‐13 76.98% 81.7% 77.1% 5 %patients cancer treatment <62‐days ‐ Screen 90% Dec‐13 95.24% 94.1% 94.9% 5 % patients treatment <62‐days of upgrade 0% %patients 1st treatment <1 mnth of cancer diag 96% Dec‐13 96.28% 97.2% 96.1% 5 %patients subs cancer treatment <31days ‐ Surg 94% Dec‐13 90.91% 96.7% 94.8% 5 %patients subs cancer treatment <31‐days ‐ Drugs 98% Dec‐13 100% 99.7% 100% 5 %patients subs treatment <31days ‐ Radio 94% Dec‐13 80.41% 91.2% 80.3% 5 %2WW of an urgt GP ref for suspected cancer 93% Dec‐13 94.86% 95.2% 95.7% 5 %2WW urgent ref ‐ breast symp 93% Dec‐13 100% 96.1% 97.7% 5 0% Finance Balance Sheet Standard Jan‐14 21% 5% BPPC by value (%) All 95% Jan‐14 86.5% 85.1% 95% Capital Capital Programme Compared to Plan 2808 Jan‐14 1529.2 7816.59 3531 5 Cash & Liquidity Cash Held at Month End cf. Plan (£000s) 59761 Jan‐14 96021 66531 5 4 Jan‐14 3 4 5 Net Income Compared to Plan (Displayed in £000s) 2276.01 Jan‐14 2302.93 8083.98 ‐735 5 Pay Compared to Plan (Displayed in £000s) ‐38343 Jan‐14 ‐40655.74 CIP Performance Compared to Plan 4079 Jan‐14 3844.57 34819.57 4077 5 EBITDA Compared to Plan 7725 Jan‐14 7787.01 61053.86 4693 5 Break Even Surplus Compared to Plan 2484 Jan‐14 2307.11 10178.36 ‐527 5 3 5 Jan‐14 Jan‐14 3 4 3 4 5 5 3 2 Jan‐14 Jan‐14 3 3 3 3 5 5 5 EBITDA Margin (Score) Staff Experience Standard Current Data Period Period Actual YTD Forecast next Data period Quality Agency usage (Displayed in 000s) 10147.04 NA NA Jan‐14 Jan‐14 Jan‐14 9863.2 £ ‐807 £ ‐2115 £ ‐6925 £ ‐739 £ ‐19583 £ ‐2115 4 5 5 Total costs of staff (000s) £ ‐38343 Jan‐14 £ ‐40656 5 6.3% 3% 10% Jan‐14 Jan‐14 Jan‐14 6.66% 3.3% 11.37% £ ‐ £ ‐38343 402467 3.3% 11.4% Bank usage (Displayed in 000s) Vacancy rate Sickness absence*** Turnover rate Forecast next Data period Quality 5% I&E Worked WTE against Plan YTD Debtors > 90 Days as % of Total debtors Liquidity Ratio (Score) Workforce Head count/Pay costs Current Data Period Period Actual EBITDA Achieved (Score) NRaF net return after financing I&E Surplus Margin (Score) ‐ ‐38343 402466.9 5 3 3 3 * This measure is collected on a year to date basis and displays the latest available values Year: 2013‐14 Division: Division of Children's & Women's,Division of Clinical Support Services,Division of Corporate Services,Division of Medicine, Rehabilitation & Cardiac,Division of Neuroscience, Orthopaedics, Trauma & Specialist Surgery,Division of Operations & Service Improvement,Division of Research & Development,Division of Surgery & Oncology,Legacy Division of Cardiac, Vascular & Thoracic,Legacy Division of Musculoskeletal and Rehabilitation,Trust‐wide only,Unknown Directorate: Acute Medicine & Rehabilitaion ,Ambulatory Medicine ,Anaesthetics, Critical Care & Theatres,Assurance,Biomedical Research,Cardiology, Cardiac & Thoracic Surgery ,Central Trust Services,Chief Nurse Patient Services & Education,Children's ,Children’s,CRS Implementation,Division of Clinical Support Services,Division of Corporate Services,Division of Medicine, Rehabilitation & Cardiac,Division of Neuroscience, Orthopaedics, Trauma & Specialist Surgery,Division of Operations & Service Improvement,Division of Research & Development,Division of Surgery & Oncology,Estates and Facilities,Finance and Procurement,Gastroenterology, Endoscopy and Churchill Theatres ,Gastroenterology, Endoscopy and Theatres (CH),Horton Management,Human Resources and Admin,Legacy Cardiac, Vascular & Thoracic Surgery,Legacy Cardiology,Legacy Division of Cardiac, Vascular & Thoracic,Legacy Division of Musculoskeletal and Rehabilitation,Legacy Rehabilitation & Rheumatology,MARS ‐Research & Development,Medical Director,Networks,Neurosciences ,OHIS Telecoms & Med Records,Oncology,Oncology & Haematology ,Orthopaedics,Pathology & Laboratories,Pharmacy,Planning & Communications,Private Patients,Radiology & Imaging,Renal, Transplant & Urology,Specialist Surgery ,Strategic Change,Surgery ,Teaching Training and Research,Trauma ,Trust wide R&D,Trust‐wide only,Uknown,Unknown,Women's IPF Red Escalation Report FY 2013‐14 Debtors > 90 Days as % of Total debtors What is driving the reported underperformance? What actions have we taken to improve performance Steady progress has been made in Debt Recovery Clinic continues to maintain reducing the level of debt in finance team focus on historic debt and rigor in excess of 90 days with the process improvements. exception of Private Patient debt which is now subject to a targeted process and systems review. Expected date to meet standard Lead Director Director of Finance and Procurement The focus remains on steady progress on historic debt whilst maintaining low levels of current debt, resulting in the standard not being achieved until 2014/15. Standard Current Data Period Period Actual YTD Forecast next period 5% Jan‐14 21% 5% Liquidity Ratio (Score) What is driving the reported underperformance? What actions have we taken to improve performance Although the cash held by the Trust is higher than planned, operating expenditure is also higher and therefore the Trust needs more cash than originally anticipated to achieve the higher score of “4”. None. A score of “3” still indicates a level of liquidity sufficient to support the day‐to‐day operations of the Trust. Expected date to meet standard Lead Director The score is likely to remain “3” Director of Finance & Procurement for the remainder of the financial year. Standard Current Data Period Period Actual YTD Forecast next period 4 Jan‐14 3 4 Pay Compared to Plan (Displayed in £000s) What is driving the reported underperformance? What actions have we taken to improve performance Pay costs are being driven by the continuing high use of bank & agency staff, and additional payments made to medical staff to work weekend sessions that is required to meet waiting list and activity targets. It is estimated that the Trust has paid £16.4m in additional premium payments to date. The Trust has introduced a number of workforce measures to reduce the usage and cost of agency staff, and has also initiated recruitment drives to replace temporary staff with permanent employees. Expected date to meet standard Lead Director Director for Finance & Procurement Pay is likely to continue to overspend while activity remains above plan, with the funding from over‐performance being used to cover the additional cost incurred. Standard Current Data Period Period Actual YTD Forecast next period ‐38343 Jan‐14 ‐40655.7 ‐402467 ‐38343 CIP Performance Compared to Plan What is driving the reported underperformance? What actions have we taken to improve performance Higher than planned activity levels Performance is monitored regularly by the CIP are resulting in slippage on some Programme Board. Where it is believed that savings schemes some schemes may not deliver the full level of planned savings then schemes originally due to start in 2014/15 are being re‐evaluated to see whether they can be brought forward into 2013/14. The Trust has still delivered 95% of its planned savings to date and forecasts it will still generate £42.6m total savings in the year, with only £2.5m of this being non‐recurrent. Expected date to meet standard Lead Director Q4 2013 Director for Finance & Procurement Standard Current Data Period Period Actual YTD Forecast next period 4079 Jan‐14 3844.6 34819.6 4077 Break Even Surplus Compared to Plan What is driving the reported underperformance? Although the Trust was slightly behind plan in the achievement of its break even target in Month 10, its year‐to‐date “bottom line” position is on plan and “green”. This is due to “technical” reasons and it is believed that these technical reasons will remain for most of the rest of the year. What actions have we taken to improve performance At Month 7 the Divisions were challenged at performance meetings to control their costs. In addition, the Director of Clinical Services and Director of Finance & Procurement wrote to each Division setting them an expenditure target, based on their Month 7 forecasts, which they should not plan to exceed. Divisions are being monitored against this target and are expected to take further action to control their costs should it appear that they will spend more than their limit. Expected date to meet standard Lead Director Q4 2013/14 Director for Finance & Procurement Standard Current Data Period Period Actual YTD Forecast next period 2484 Jan‐14 2307.1 10178.4 ‐527 EBITDA Achieved (Score) What is driving the reported underperformance? What actions have we taken to improve performance Although the Trust was slightly behind plan in the achievement of its EBITDA target to Month 10, its year‐to‐date “bottom line” position is on plan and “green”. This is due to “technical” reasons and it is believed that these technical reasons will remain for most of the rest of the year. The Trust currently believes it will meet its key financial targets for the year but that there are key risks which, if they materialise, could change this assessment. It will be important for the Trust to maintain a tight grip on its expenditure over the remainder of the year and Divisions have been set expenditure targets against which their performance will be monitored. Expected date to meet standard Lead Director This score is likely to remain a “4” Director for Finance & Procurement at 31 March 2014. Standard Current Data Period Period Actual YTD Forecast next period 5 Jan‐14 4 4 RTT 95th centile for admitted pathways What is driving the reported underperformance? What actions have we taken to improve performance The growing trend in the 95th The Trust has agreed a planned failure of the percentile of admitted waits is a RTT admitted standard for the last quarter clear indication that, despite the whilst patients who have waited over 18 weeks high levels of elective activity, the are seen and treated. numbers of long waiting patients are growing in a number of Recovery plans are being implemented to services. This has been confirmed ensure the numbers of long waiters are reduced by the results of the recent by the end of March. The majority of patients service level IMAS capacity and waiting are with the NOTSS division. demand modelling showing that there are a significant number of Additional theatres lists are being undertaken services with growing elective over six days per week and external providers backlogs. are been used to support some surgical activity. This work is likely to progress in to Q1 2014/15 A recovery plan with the NOTSS to ensure sustainability. division is being implemented, though this is likely to run into the new financial year. Expected date to meet standard Lead Director Trust‐wide standard April 2014. Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 23 Jan‐14 28.43 24.11 27.36 % <=4 hours A&E from arrival/trans/discharge What is driving the reported underperformance? Q4 performance has seen a further deterioration in performance compared to Q3. January performance was finalised at 89.29% without any weeks achieving the standard. February (up to week ending 23rd) has continued in a similar pattern performing at 89.68% with no weeks achieving the standard so far. The total number of A/E attendances was 12,020 in January, 2,794 more patients that in January 2013. What actions have we taken to improve performance The Trust has an urgent care group meeting every 2 weeks to ensure the ED/winter action plan is completed. Key focus areas have been: • Admission avoidance • Implementing rapid nurse assessment • Increase medical workforce & senior decision making • Improving access to diagnostics & pharmacy 24/7 • Expanding EAU • Improving patient flow • Timely escalation • Delays to patient being discharged. Weekly Summit meetings with OCCG, OH and OCC colleagues to improve patient flow across the system Expected date to meet standard Lead Director On‐going Director of Clinical Services Standard Current Data Period Period Actual YTD 95% Q4 13‐14 89.29% 93.6% Forecast next period Ambulance Handovers within 15 minutes What is driving the reported underperformance? What actions have we taken to improve performance The data is provided by South We have worked up a combination of Central Ambulance Service (SCAS) assumptions which need to be made to be able has got some data quality issues. to report on this data. Below is a table showing The trust information team has the different OUH results for January for each of been working with SCAS team to these assumptions. understand them but there are some handover times and SCAS have supplied us with: locations that are missing (the • 3,778 ambulance arrivals in January latter prevents the OUH • ~20% do not have the handover time allocating arrivals to either ED or • ~10% do not have a handover location non‐ED). • A small proportion are supplied with no arrival date We are currently validating data with SCAS and Oxfordshire Clinical Commissioning Group. Expected date to meet standard Lead Director On‐going Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 95% Jan‐14 75.86% 79.4% 76.03% No of GP written referrals What is driving the reported underperformance? January’s received referrals levels were around 2,000 above the plan, compared to the lower level seen in December. What actions have we taken to improve performance Joint work with the OCCG is ongoing to identify where and why these elevated levels are occurring. The Trust is working with CCG colleagues to look at ways of reducing demand. Expected date to meet standard Lead Director On‐going Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 11695 Jan‐14 13545 126075 12075 Other refs for a first outpatient appointment What is driving the reported underperformance? What actions have we taken to improve performance Other referrals, which will include The Trust is working closely with commissioner consultant referrals showed as colleagues to understand the reasons for the being significantly above plan increase in referrals. (~900) during January. This is a very similar pattern to what was seen in December. Expected date to meet standard Lead Director On‐going Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 7821 Jan‐14 8781 77934 7807 1st outpatient attends following GP referral What is driving the reported underperformance? What actions have we taken to improve performance The number of first attendances is The Trust is working with CCG colleagues to look still tracking above plan, in line at ways of reducing demand to outpatient with the increased (above plan) services. levels of GP referrals being received. However, since October As part of the Outpatient Reprofiling Project new clinic profiles have now started to be attendances seen reduced, but implemented, starting with Specialist Surgery. this is likely a reflection of the reduced activity around Christmas and New Year holiday periods. In addition, implementing the 18 weeks RTT Activity in January has returned to action plan will mean that more patients will be seen over the next couple of months. levels similarly with those of November. February is likely to see a further increase as the 18 week backlog clearance plan should start to impact. Expected date to meet standard Lead Director On‐going Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 8537 Jan‐14 9944 96567 9277 Total number of first outpatient attendances What is driving the reported underperformance? What actions have we taken to improve performance The number of first attendances is The Trust is working closely with commissioner still tracking above plan, in line colleagues in looking at ways of reducing GP with the increased (above plan) referrals. levels of GP referrals being received. However, since October In addition, implementing the 18 weeks RTT action plan will mean that more patients will be attendances seen reduced, but seen over the next couple of months. this is likely a reflection of the reduced activity around Christmas and New Year holiday periods. Activity in January has returned to levels similarly with those of November. February is likely to see a further increase as the 18 week backlog clearance plan should start to impact. Expected date to meet standard Lead Director On‐going Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 15079 Jan‐14 17228 167698 16087 Number of Elective FFCEs ‐ daycases What is driving the reported underperformance? The over performance in outpatient activity is likely to be a significant driver in the continued over performance in elective admissions, as well as the drive to improve the 18 week performance at a specialty level for patients on an admitted pathway. Oversized waiting lists are being experienced in a significant proportion of the clinical services, and this is likely to mean that the over performance may well become more pronounced during the remaining months of the year as the backlog clearance plan makes an impact. What actions have we taken to improve performance Significant demand analysis work is been undertaken using the IMAS model across surgical specialties to understand both current waiting list size, backlogs and additional theatre capacity requirements. Additional theatres lists are being undertaken to ensure patients are treated within 18 weeks. External providers are been used to support some surgical activity and this is likely to increase in the final quarter. Expected date to meet standard Lead Director On‐going Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 6302 Jan‐14 7372 68336 6939 Delayed transfers of care as % of occupied beds What is driving the reported underperformance? What actions have we taken to improve performance Total number of delays has Supportive Hospital Discharge Scheme is open to remained constantly high through 50 patients reviewing the establishment of team the year to date, and at the end to increase patient capacity over the coming of January are at the highest point months. during the year. Daily whole system teleconference calls remain in place. The most recent figures for February (20th February snapshot) show similar levels of delays Weekly Urgent Care Summit with OH,OCC and during January at 119 patients. OCCG colleagues to manage the winter plans and funding and reprioritise where necessary. Escalation to Oxfordshire colleagues when system is on RED. Further work is progressing internally to improve the discharge process for all patients, review of policy, standardized documentation, improving training and competency skills at all levels. Expected date to meet standard Lead Director On‐going Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 3.5% Q4 13‐14 11.57% 10.9% 11.12% Theatre Utilisation ‐ Emergency What is driving the reported underperformance? Emergency theatre utilization figures continue to be volatile. What actions have we taken to improve performance Clinical Teams are focused on real time emphasis on booking procedures and start and finish times ensuring maximum productivity. Daily monitoring of emergency lists is on‐going. The last three months of 2013/14 will be the greatest challenge due to reduced inpatient capacity as increased pressures on A/E. Expected date to meet standard Lead Director On‐going Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 70% Jan‐14 59.78% 65.2% 62.37% %patients cancer treatment <62‐days urgt GP ref What is driving the reported underperformance? The main reasons for the under performance in 62 day pathway treatments are late receiving of referrals, patient choice to delay appointments and complex treatments and the scheduling. What actions have we taken to improve performance The Trust are working closely with the OCCG and have produced a joint agreed Cancer Action plan to achieve all the cancer standards over the next few months. Patient Choice issues; Work with CCG to raise awareness of CWT to GP's ‐2WW/62 day pathways. Joint CCG/OUH Education sessions to: •Re launch TWEEK leaflets to GP Practices •Improve use of clinical referral proformas •Raise awareness of CWT to GP's ‐2WW/62 day pathways. Working with other trust to reduce late referrals on 62 day pathway. Expected date to meet standard Lead Director June 2014 Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 85% Dec‐13 76.98% 81.7% 77.12% %patients subs treatment <31days ‐ Radio What is driving the reported underperformance? Upgrades to the Radiotherapy equipment has resulted in delays to planning and treatment of patients, and this has had a knock‐on effect. Additionally, staff recruitment and therefore available resource remains an issue, however, this is not a unique problem being experienced by the OUH as there is a national shortage of therapeutic radiographers What actions have we taken to improve performance Current position: Backlog of approximately 68 patients which equates to 2094 fractions (attendances) for treatment. Summary of actions : • Implementing the short term action of utilising the 6th linac from April 2014 plus either continued weekend working or extending the day on two linacs would reduce the backlog of fractions by 1692 to 402 by the end of the week of 2 June. By June there should also be an expected positive impact of RapidArc . • Re‐negotiating the software contract so that it can be upgraded out of hours. Expected date to meet standard Lead Director June 2014 Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 94% Dec‐13 80.41% 91.2% 80.34% Dementia CQUIN patients admitted who have had a dementia screen What is driving the reported underperformance? The EPR completion of cognitive assessments continues to be low within all areas of the Trust. Recorded cognitive screening rates have continued to be stable at around 60% for the past 3 months. Processes for data collection are now stable. What actions have we taken to improve performance Specialty break downs continue to be trialed. The Dementia Steering Group has met with representatives from across the Trust, providing an enhanced structure for education and dissemination. Information on compliance methodologies is being sought from peer trusts to allow for a more evidence based strategy to be developed. Expected date to meet standard Lead Director Ongoing Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 90% Dec‐13 59.86% 53.9% 60.03% Same sex accommodation breaches What is driving the reported underperformance? What actions have we taken to improve performance Clinically unjustified mixed sex This was a result of a breakdown in accommodation breach on EAU at communication between Operational Managers the Horton. This resulted in five and the Nursing Team and all issues have now patients being accommodated in a been resolved with assurance that there will not mixed sex bay. be a recurrence. Expected date to meet standard Lead Director On‐going Chief Nurse Standard Current Data Period Period Actual YTD Forecast next period 0 Q4 13‐14 5 9 3 HCAI ‐ MRSA bacteraemia What is driving the reported underperformance? The fourth unavoidable MRSA bacteremia to date. The patient required intravenous fluids and had problems with vascular access. What actions have we taken to improve performance Add review of all intravenous lines during each ward round Re‐assess the standard of practice for all staff who administer intravenous medication. Expected date to meet standard Lead Director Medical Director Standard Current Data Period Period Actual YTD Forecast next period 0 Jan‐14 1 4 0 HCAI ‐ Cdiff What is driving the reported underperformance? What actions have we taken to improve performance The OUH Trust remains within its Review the necessity for continuing antibiotics annual objective during daily ward rounds. Expected date to meet standard Lead Director Medical Director Standard Current Data Period Period Actual YTD Forecast next period 6 Jan‐14 7 52 7 Total costs of staff (000s) What is driving the reported underperformance? What actions have we taken to improve performance Pay costs are being driven by the continuing high use of bank & agency staff, and additional payments made to medical staff to work weekend sessions that is required to meet waiting list and activity targets. It is estimated that the Trust has paid £16.4m in additional premium payments to date. The Trust has introduced a number of workforce measures to reduce the usage and cost of agency staff, and has also initiated recruitment drives to replace temporary staff with permanent employees. Expected date to meet standard Lead Director Director for Finance & Procurement Pay is likely to continue to overspend while activity remains above plan, with the funding from over‐performance being used to cover the additional cost incurred. Standard Current Data Period Period Actual YTD Forecast next period £ ‐38343 Jan‐14 £ ‐40656 £ ‐402467 £ ‐38343 Vacancy rate What is driving the reported underperformance? Despite consistent rises in the number of staff in post, the vacancy rate for January 2014 is currently above trajectory. Staff in post has not reached the level in month that is required to meet the target. Retention will be a factor in determining vacancy levels as will recruitment to difficult to fill vacancies. What actions have we taken to improve performance The Trust has introduced a new recruitment system, TRAC, which has improved the efficiency of the recruitment process. The system manages applications from advertising, through the recruitment activity to booking the new employee onto their induction programme. TRAC has provided the Trust with increased automation and leaner recruitment processes. The retention of staff remains a prime focus for the Workforce Directorate, working in close partnership with Divisional leadership teams. A Recruitment and Retention Strategy will aim to establish a number of key initiatives and interventions centred on the attraction, recruitment and retention of staff across all professional groups. A further international recruitment programme is being scoped for implementation in early 2014/15. The programme will seek to further augment the nursing workforce. Expected date to meet standard Lead Director April 2014 Director of Organizational Development and Workforce Standard Current Data Period Period Actual YTD 6.3% Jan‐14 6.66% Forecast next period Sickness absence*** What is driving the reported underperformance? What actions have we taken to improve performance The Trust’s absence rate is 3.30% at The Trust continues to manage its sickness proactively, with month 10. This is 0.27% higher than line managers, HR and Occupational Health Teams working the same month last year. closely together. Absence rates tend to rise during There are a number of initiatives in place regarding the the main winter months. Since Health and Wellbeing agenda. These include smoking October monthly absence rates cessation support for staff; the training of “Go Active” have been consistently in excess of champions within divisions, and the promotion of healthier 3.50%. lifestyles. Despite not meeting the monthly The Trust vaccinated 67% of its front line staff in this trajectory the Trust’s absence rate winter’s flu vaccination programme. This is a rise of 10% on does compare favourably with the the previous year. NHS as a whole, which was 4.24% for 2012/13. Training has commenced for line managers for the introduction of the FirstCare absence management system. This will continue into March in readiness for an April 1st start. Line managers will also receive training in the new absence procedure. The benefits of FirstCare have been documented in previous reports; however it will involve increased information to line managers and greater automation of process. First Care was originally introduced at the Nuffield Orthopedic Centre, where it has proved to be highly successful. Expected date to meet standard Lead Director June 2014 Director of Organizational Development and Workforce Standard Current Data Period Period Actual YTD Forecast next period 3% Jan‐14 3.3% 3.27% Turnover rate What is driving the reported underperformance? What actions have we taken to improve performance Turnover has reduced marginally The Trust will be reviewing the results of the from 11.45% in December 2013 to 2013 Staff Survey and divisional plans will be 11.37% in January 2014. Despite developed to ensure issues raised are this decrease, current levels are in addressed. The Survey feedback will provide excess of the 10% KPI. important data upon which the Trust can act and improve the retention of its staff. Additional information will be provided by With the exception of Medical and Dental, turnover in all main quarterly “Pulse” surveys which will commence staff groups is above the target in the new financial year. level. Turnover from May 2013 onwards has remained relatively High impact initiatives have been reviewed and constant throughout the financial a Recruitment and Retention strategy is being developed. year. Nursing and Midwifery staff account for circa 38% of all leavers. Expected date to meet standard Lead Director June 2014 Director of Organizational Development and Workforce Standard Current Data Period Period Actual YTD Forecast next period 10% Jan‐14 11.37% 11.36% IPF Amber Escalation Report FY 2013‐14 BPPC by value (%) All What is driving the reported underperformance? What actions have we taken to improve performance The calculation methodology has been reviewed following an external audit recommendation and a new approach in accordance with that used by other NHS organisations was considered by the Audit Committee. This will change the reported performance. The Trust had an external audit finding to review of the calculation methodology, this work is complete and was reported to the Audit Committee as part of the year end accounts planning in February 2014. The calculation which will now be applied across the full year and follows precisely the same methodology as is used by NHS Shared Business Services who provide Finance & Accounting to all 243 NHS Commissioning organisations, and have 70 NHS Trusts accessing their full contract portfolio. Expected date to meet standard Lead Director To be reviewed once corrected methodology is introduced. Director of Finance and Procurement Standard Current Data Period Period Actual YTD Forecast next period 95% Jan‐14 86.5% 85.1% 95% IPF Amber Escalation Report FY 2013‐14 RTT ‐ admitted % within 18 weeks What is driving the reported underperformance? January’s admitted RTT position for the Trust has continues to show a decline, now below 87%. This reflects the significant numbers of services with oversized waiting lists (backlogs) across the Trust. Some services are attempting to clear these backlogs by undertaking extra activity and sub‐contracting cohorts of activity throughout February and March. The Trust is planning to clear part of the backlogs in ENT, Orthopaedics, Plastic Surgery, Maxillo‐facial surgery and Gynaecology before the end of March which will lead to a dip in the admitted performance during February and March. What actions have we taken to improve performance The Trust has agreed a planned failure of the RTT admitted standard for the last quarter whilst patients who have waited over 18 weeks are seen and treated. Recovery plans are being implemented to ensure the numbers of long waiters are reduced by the end of March. The majority of patients waiting are with the NOTSS division. Additional theatres lists are being undertaken over six days per week and external providers are been used to support some surgical activity. This work is likely to progress in to q1 2014/15 to ensure sustainability. Expected date to meet standard Lead Director Trust‐wide standard April 2014. Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 90% Jan‐14 86.76% 90.4% 87.59% IPF Amber Escalation Report FY 2013‐14 RTT ‐ # specialties not delivering the admitted standard What is driving the reported underperformance? ENT (69.78%), Ophthalmology (65.29%), Neurosurgery (79.63%), Plastic Surgery (84.13%), Gynaecology (87.94%), Urology (85.99%) and Trauma and Orthopaedics (80.94%) are the services that failed the admitted standard of 90% admitted within 18 weeks. What actions have we taken to improve performance The Trust has agreed a planned failure of the RTT admitted standard for the last quarter whilst patients who have waited over 18 weeks are seen and treated. Recovery plans are being implemented to ensure the numbers of long waiters are reduced by the end of March. The majority of patients waiting are with the NOTSS division. Additional theatres lists are being undertaken over six days per week and external providers are been used to support some surgical activity. This work is likely to progress in to q1 2014/15 to ensure sustainability. Expected date to meet standard Lead Director Trust‐wide standard April 2014. Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 0 Jan‐14 7 6 IPF Amber Escalation Report FY 2013‐14 RTT ‐ non‐admitted % within 18 weeks What is driving the reported underperformance? Trust wide performance dipped below 95% for the first time this year. It is not currently thought that this will recover until the April reporting period. What actions have we taken to improve performance The Trust has agreed a planned failure of the RTT 18 weeks admitted standard for the last quarter whilst patients who have waited over 18 weeks are seen and treated. Closing a number of incomplete pathways will have a direct impact on the non‐admitted performance. Recovery plans are being implemented to ensure the numbers of long waiters are reduced by the end of March. The majority of patients waiting are with the NOTSS division. Additional outpatient sessions lists are being undertaken and external providers are been used to support some of this work. This work is likely to progress in to Q1 2014/15 to ensure sustainability. Expected date to meet standard Lead Director Trust‐wide standard April 2014. Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 95% Jan‐14 94.6% 96.3% 95.11% IPF Amber Escalation Report FY 2013‐14 RTT ‐ 95th percentile for non‐admitted RTT What is driving the reported underperformance? What actions have we taken to improve performance The growing trend in the 95th The Trust has agreed a planned failure of the percentile of admitted waits is a RTT 18 weeks admitted standard for the last clear indication that, despite the quarter whilst patients who have waited over 18 high levels of outpatient activity, weeks are seen and treated. Closing a number the numbers of long waiters is of incomplete pathways will have a direct growing in a number of services. impact on the non‐admitted performance. This has been confirmed by the results of the recent service level Recovery plans are being implemented to IMAS capacity and demand ensure the numbers of long waiters are reduced modeling showing that there are a by the end of March. The majority of patients waiting are with the NOTSS division. significant number of services with growing elective backlogs. Additional outpatient sessions lists are being undertaken and external providers are been used to support some of this work. This work is likely to progress in to Q1 2014/15 to ensure sustainability. Expected date to meet standard Lead Director Trust‐wide standard April 2014. Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 18.3 Jan‐14 18.77 17.31 18.1 IPF Amber Escalation Report FY 2013‐14 RTT ‐ # specialties not delivering the non‐admitted standard What is driving the reported underperformance? The four specialties that didn’t achieve the non‐admitted standard in December were Trauma and Orthopaedics (89.95%), ENT (80.76%), Ophthalmology (90.29%) and Other (94.96%). The numbers of specialties not achieiving this standard is not likely to reduce before the end of the financial year. What actions have we taken to improve performance Expected date to meet standard Lead Director Enter text Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 0 Jan‐14 4 3 IPF Amber Escalation Report FY 2013‐14 RTT ‐ incomplete % within 18 weeks What is driving the reported underperformance? What actions have we taken to improve performance The Trust has dipped below 90% Detailed analysis of the back log on the in January which is the first time incomplete pathways, validation of patient this year. This is a reflection of the waiting and implementation of the recovery large backlogs and numbers of plans to improve the position has resulted in the long waiting patients both in the incomplete pathways becoming transparent. outpatient and inpatient waiting Plans to recover the trust‐wide position are in lists. The incomplete position is place. likely to improve before the end of March with backlog clearance aiming to clear the longest waiting patients first. Expected date to meet standard Lead Director End of Q4 Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 92% Jan‐14 89.31% 92.2% 90.3% IPF Amber Escalation Report FY 2013‐14 % Diagnostic waits waiting 6 weeks or more What is driving the reported underperformance? The number of longer waiting patients has deteriorated again during January. The majority of the longer waiters are within MRI, echocardiography and sleep studies, with smaller numbers spread across the other 13 reportable diagnostic tests. What actions have we taken to improve performance The total diagnostic waiting list has slightly increased, the number of patients over 6 weeks is 250. 42 patients are waiting over 6 weeks for sleep studies, the increase in patients waiting has been due to staff sickness & recruitment which has now been resolved. Finalising the move to the JR by the end of March will secure more will help in booking appointments. 96 patients are waiting for an MRI scan, additional Saturdays GA lists are being put on to ensure delivery over the coming weeks. Expected date to meet standard Lead Director On‐going Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 1% Jan‐14 2.67% 7% 2.2% IPF Amber Escalation Report FY 2013‐14 % patients not rebooked within 28 days What is driving the reported underperformance? What actions have we taken to improve performance The proportion of patients not rebooked within 28 days following a cancellation has risen above 5% for the first time since October. This is likely to be a reflection of the general pressures being felt across the hospital. Expected date to meet standard Lead Director Enter text Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 5% Jan‐14 5.63% 9.1% 4.79% IPF Amber Escalation Report FY 2013‐14 Theatre Utilisation ‐ Total What is driving the reported underperformance? January saw an improvement of overall theatre utilisation (2%), which seems as though this is entirely attributable to the recovery in the utilization of planned sessions. However, this is still well below the levels that we being achieved before December. What actions have we taken to improve performance Clinical Teams are focused on real time emphasis on booking procedures and start and finish times ensuring maximum productivity. Expected date to meet standard Lead Director On‐going Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 75% Jan‐14 73.87% 75.2% 74.22% IPF Amber Escalation Report FY 2013‐14 Theatre Utilisation ‐ Elective What is driving the reported underperformance? A corresponding 2% increase in Elective sessions as seen in the total theatre sessions on the previous page. What actions have we taken to improve performance Clinical Teams are focused on real time emphasis on booking procedures and start and finish times ensuring maximum productivity. Expected date to meet standard Lead Director On‐going Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 80% Jan‐14 78.02% 78.3% 77.69% IPF Amber Escalation Report FY 2013‐14 %patients subs cancer treatment <31days ‐ Surg What is driving the reported underperformance? There are a number of reasons for the under performance in 31 day pathway – surgery • patient choice to delay appointments • Late referrals from other Trusts • complex treatments and the scheduling • Lack of surgical capacity • Lack of Consultant capacity What actions have we taken to improve performance The Trust are working closely with the OCCG and have produced a joint agreed Cancer Action plan to achieve all the cancer standards over the next few months. Specific specialty actions include: Gynae – additional operating lists at weekends Urology – locum consultant appointed, additional operating sessions. Discussion around patients requesting additional thinking time – ensuring decision making is timely Lung – additional operating sessions. Expected date to meet standard Lead Director June 2014 Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 94% Dec‐13 90.91% 96.7% 94.77% IPF Amber Escalation Report FY 2013‐14 Proportion of Assisted deliveries What is driving the reported underperformance? There is a direct correlation between higher instrumental (assisted) deliveries & caesarean sections and normal births. This is reflected for the reporting period. A number of these were complex deliveries reflecting the Trust’s role as a Tertiary Centre for high risk deliveries. What actions have we taken to improve performance YTD performance is on track for the required standard of performance and is monitored closely at Directorate, Divisional and Executive Committees via Performance Management and Clinical Governance. Expected date to meet standard Lead Director Ongoing Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 15% Jan‐14 16.45% 15.3% 15.79% IPF Amber Escalation Report FY 2013‐14 Proportion of C‐Section deliveries What is driving the reported underperformance? What actions have we taken to improve performance The higher proportion of All caesarean section deliveries are reviewed Caesarean Section deliveries and audited on a case by case basis as is during the reporting period is necessary and appropriate to ensure learning principally due to a higher number and themes are generated and shared. of emergency caesarean sections as a consequence of inductions in The service also reviews its clinical caseload and staffing requirements on a shift by shift basis so labour especially in first time mothers. as to ensure a clinically safe, effective, responsive, caring and well‐led service is A number of these were complex maintained. deliveries reflecting the Trust’s role as a Tertiary Centre for high YTD performance is on track for the required standard of performance and is monitored risk deliveries. closely at Directorate, Divisional and Executive Committees via Performance Management and Clinical Governance. Expected date to meet standard Lead Director Ongoing Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 23% Jan‐14 24.82% 22.8% 24.17% IPF Amber Escalation Report FY 2013‐14 Proportion of normal deliveries What is driving the reported underperformance? What actions have we taken to improve performance The normal birth rate is lower if The service has robust arrangements in place to assisted births and caesarean discuss with Women their wishes for a section rates are higher as was the caesarean delivery to ensure they are informed case in during this reporting as to the risks associated with this and to period. promote normalization of birth so far as possible. A number of these were complex deliveries reflecting the Trust’s In addition, caesarean deliveries are reviewed role as a Tertiary Centre for high and audited on a case by case basis as is risk deliveries. necessary and appropriate to ensure learning and themes are generated and shared. The YTD performance is on track and below the standard set which is itself lower than the national average for caesarean deliveries and is monitored closely at Directorate, Divisional and Executive Committees via Performance Management and Clinical Governance arrangements. Expected date to meet standard Lead Director Ongoing Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 62% Jan‐14 58.74% 61.8% 59.99% IPF Amber Escalation Report FY 2013‐14 Medication reconciliation completed within 24 hours of admission What is driving the reported underperformance? What actions have we taken to improve performance Standard Current Data Period Period Actual YTD Forecast next period 80% Jan‐14 75.98% 77.5% 75.76% Stage 2 medicine reconciliations The introduction of the Oxfordshire Care Summary performed by pharmacists are record which gives staff access to Oxfordshire GP records currently completed during normal has been introduced to improve access to information office hours i.e. Monday to Friday supporting stage 2 medicines reconciliation. 08:00 to 17:00. As a result all new admissions out of these hours may The introduction of 4 pharmacists, supported by winter not have a stage 2 medicines pressures funding, on medical wards at the JR will focus reconciliation completed within 24 on completing stage 2 medicines reconciliation on hours of admission. This has a Saturdays and Sundays reducing the significant impact of significant impact when the audit day new admissions during the weekend in these areas. (which rolls every month to a new day) falls on a Monday. Pharmacy technicians are undergoing internal training and validation to support pharmacists in completing Delays to the introduction of the JR stage 2 medicines reconciliation during normal office pharmacy robot has impacted on hours during the week. training and support to pharmacy technicians who can support Planning is underway to review how pharmacy can pharmacists completing stage 2 support a 7 day working pattern across the 4 hospital medicines reconciliation at ward level. sites for potential introduction in 2015/16. Expected date to meet standard Lead Director October 2014 Director of Clinical Services Year: 2013‐14 Directorate: Acute Medicine & Rehabilitaion ,Ambulatory Medicine ,Anaesthetics, Critical Care & Theatres,Assurance,Biomedical Research,Cardiology, Cardiac & Thoracic Surgery ,Central Trust Services,Chief Nurse Patient Services & Education,Children's ,Children’s,CRS Implementation,Division of Clinical Support Services,Division of Corporate Services,Division of Medicine, Rehabilitation & Cardiac,Division of Neuroscience, Orthopaedics, Trauma & Specialist Surgery,Division of Operations & Service Improvement,Division of Research & Development,Division of Surgery & Oncology,Estates and Facilities,Finance and Procurement,Gastroenterology, Endoscopy and Churchill Theatres ,Gastroenterology, Endoscopy and Theatres (CH),Horton Management,Human Resources and Admin,Legacy Cardiac, Vascular & Thoracic Surgery,Legacy Cardiology,Legacy Division of Cardiac, Vascular & Thoracic,Legacy Division of Musculoskeletal and Rehabilitation,Legacy Rehabilitation & Rheumatology,MARS ‐ Research & Development,Medical Director,Networks,Neurosciences ,OHIS Telecoms & Med Records,Oncology,Oncology & Haematology ,Orthopaedics,Pathology & Laboratories,Pharmacy,Planning & Communications,Private Patients,Radiology & Imaging,Renal, Transplant & Urology,Specialist Surgery ,Strategic Change,Surgery ,Teaching Training and Research,Trauma ,Trust wide R&D,Trust‐wide only,Uknown,Unknown,Women's Division: Division of Children's & Women's,Division of Clinical Support Services,Division of Corporate Services,Division of Medicine, Rehabilitation & Cardiac,Division of Neuroscience, Orthopaedics, Trauma & Specialist Surgery,Division of Operations & Service Improvement,Division of Research & Development,Division of Surgery & Oncology,Legacy Division of Cardiac, Vascular & Thoracic,Legacy Division of Musculoskeletal and Rehabilitation,Trust‐wide only,Unknown