Handout 5th Lecture ECON 4230/35 Kjell Arne Brekke 1

advertisement

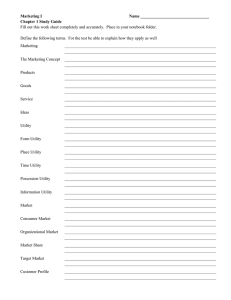

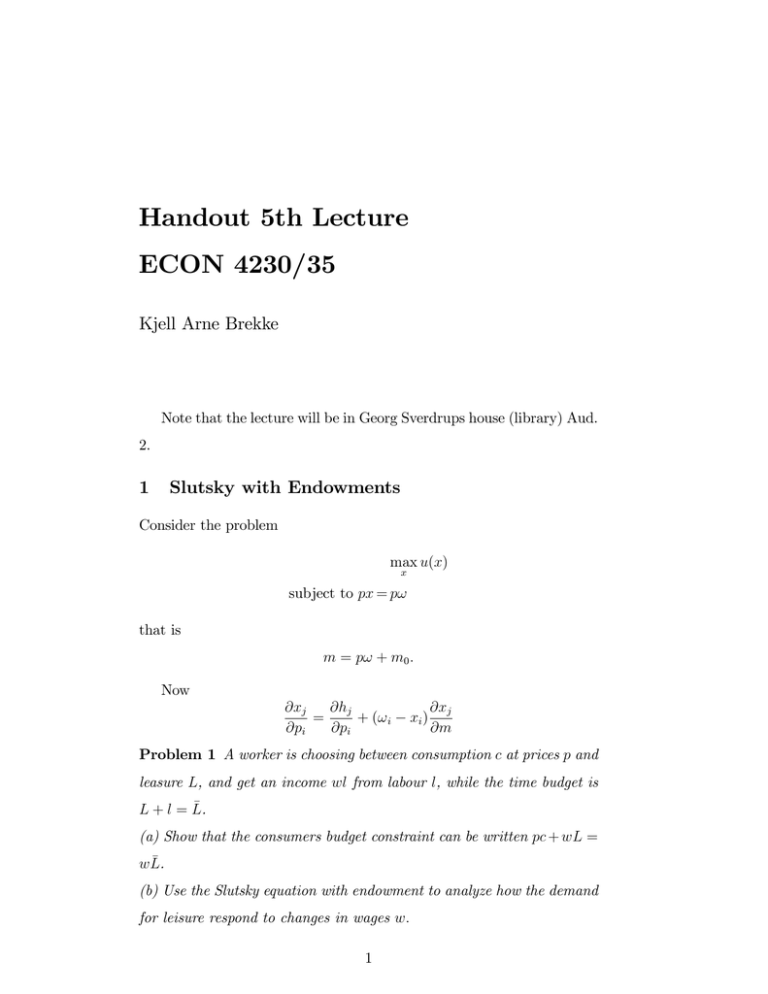

Handout 5th Lecture ECON 4230/35 Kjell Arne Brekke Note that the lecture will be in Georg Sverdrups house (library) Aud. 2. 1 Slutsky with Endowments Consider the problem max u(x) x subject to px = p! that is m = p! + m0 : Now @xj @hj = + (! i @pi @pi xi ) @xj @m Problem 1 A worker is choosing between consumption c at prices p and leasure L, and get an income wl from labour l, while the time budget is L + l = L. (a) Show that the consumers budget constraint can be written pc + wL = wL. (b) Use the Slutsky equation with endowment to analyze how the demand for leisure respond to changes in wages w: 1 1.1 Aggregation There is no such good as a jacket, or a car. There are thousands of models of jackets, and the condition of a used car is more like a continuum. Still to make analyses tractable we will consider things like the demand for cars or the demand for clothes, the demand for food etc. Does this make sense? Assume that p = tp0 and de…ne the commodity, e.g. food X = p0 x while the price is P =t De…ne the indirect utility function V (P; q; m) = max u(x; z) x;z such that P p0 x + qz m Problem 2 V satisfy the conditions of an indirect utility function. How do we then proceed to get the utility function U (X; z) taking the aggregate commodity as an argument? 1.2 Aggregating across consumers Given the individual demand xi (p; mi ) we can de…ne an aggregate demand x(p; m) = I X xi (p; mi ) i=1 m = (m1 ; :::; mn ) 2 It will inherit the structure from individual demand concerning prices. but does it satsify the general properties of individual demand. Does there exist a representative consumer? That is can we de…ne an income M such that x(p; m) = x(p; M )? Due to Walras law, the only candidate is (why?): M= X mi Problem 3 Show that if x(p; m) = x(p; M ) then redistribution of income cannot have an impact on aggregate consumption and moreover that this imply @xkj @xki = for all i and j @mi @mj Do you think this is a reasonable assumption? 2 Expected utility When grading exams I have often been surprised by how many students that are unable to write down the equation for expected utility of a lottery. If you are unable to do this, it is unlikely that you will earn a single point on the exam on questions about uncertainty. Before proceeding to more subtle points about justi…cation of expected utility, risk aversion etc, make sure that you know what expected utility is: Suppose you got at lottery x probability p y probability 1 3 p If you get x you utility will be u(x) while if you get y your utility will be u(y) and the expected value of your utility (before the outcome is known) is Expected Utility = pu(x) + (1 p)u(y): Notation. Varian write (x p y (1 p)) for the lottery that I will write: x with probability p y with probability 1 2.1 p The independence axiom Axiom 4 (Independence) Suppose L1 L2 then L1 probability p y probability 1 L2 probability p y probability 1 p p Theorem 5 The independence axiom (+ some less controversial assumption) implies expected utility Basic argument: Assume there is a best, b, and a worst, w, outcome. For any x there is a probability u(x) such that x b probability u(x) w probability 1 u(x) Do the same for y and we end up with a lottery where the probability of winning (getting b) equals Eu = pu(x) + (1 4 p)u(y) We want this probability to be as high as possible, that we want to maximize expected utility Problem 6 Consider the two lotteries 4000 probability 80% L1 = 0 probability 20% L2 = 3000 for sure and the lotteries L3 = 4000 probability 20% 0 probability 80% 3000 probability 25% L4 = 0 probability 75% Show that L3 = L1 probability 25% 0 probability 75% L4 = L2 probability 25% 0 probability 75% If L2 L1 what does the independence axiom imply about the ranking of L3 versus L4 . 3 Only Linear transforms Consider two lotteries x1 with probability p1 Lx = :: :: xn pn y1 with probability q1 Ly = :: :: ym qm 5 then Lx i¤ and only if n X Ly pi u(xi ) > i=1 m X qj u(yj ) j=1 An alternative utilityfunction v(x) represents the same preferences if and only if v(x) = au(x) + b with a > 0 4 Risk aversion Now consider gambles with monetary outcome. Consider a person with wealth W who is o¤ered a lottery 100 probability 50% 100 probability 50% Expected utility accepting the gamble is 1 1 u(W + 100) + u(W 2 2 100) while declining yields u(W ): A risk seeker will accept the gamble 1 1 u(W + 100) + u(W 2 2 100) > u(W ): while a risk averse person will decline: 1 1 u(W + 100) + u(W 2 2 100) < u(W ): Graphically this depends on the shape of the utility function, e.g. for risk aversion 6 y x The Arrow pratt measure of risk aversion u00 (W ) u0 (W ) r(W ) = We can prove that 1 probability p 1 probability 1 p 1 r(W ) 2 More used is the relative risk aversion = 5 u00 (W )W u0 (W ) Subjective probability If you ‡ip a choin it will sometimes land head and sometime tail. Doing it over and over, we get a frequency. Some scholars would like to preserve the idea of probability to such cases. What is the probability that doubling CO2 concentration will increase temperature more more than 5o C? What is the probability that the interest rate will have increased by the end of the year. Or even: what is the probability that Zürich is the capital of Switzerland? 7 Some claim that it makes no sense to talk about probabilities in these cases. There are no frequencies. But you may still be faced with gambles. L1 = you win 1000 kr if Zürich is the capital L2 = you win 1000 kr if Bern is the capital L3 = you win 1000 kr if Wien is the capital If your preferences over such lotteries satisfy cerntain conditions they can be represented by a utility function and a probability distribution of cities that are candidates for being the capital of Switzerland. These probabilities are subjective probabilities. (Some will know the capital for sure, others have no clue.) 8