Insurance Parity and the Use of Outpatient Hospitalization Amal Trivedi, MD

advertisement

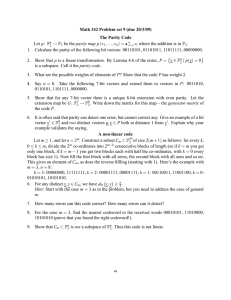

Insurance Parity and the Use of Outpatient Mental Health Care following a Psychiatric Hospitalization Amal Trivedi, MD Shailender Swaminathan, PhD Vince Mor, PhD Background Historically, mental health services have had larger cost sharing requirements than physical health services Some plans have excluded mental health services from benefit package Copayments/coinsurance typically greater for mental health Plans more likely to impose limits on coverage Parity Federal legislation passed in 2008 required equivalent benefits for mental and physical conditions Same levels of cost-sharing Equivalent restrictions Law only applies to group health plans in firms with more than 50 employees Effects of Mental Health Parity Federal Employee Health Benefits Program After mandating parity, no significant increase in spending and utilization compared to control plans State parity laws not associated with increased use of mental health services Very little known about the effect on quality of care Objective What are the cost sharing requirements for mental health services compared to physical health services in Medicare health plans? What is the effect of health insurance parity on quality of mental health care? Follow-up in 7 and 30 days after hospitalization for mental illness Methods - Data Medicare HEDIS data - 2001-6 Medicare enrollment file – 2001-6 Demographic characteristics Plan benefits data 2001-6 Information on quality of care for 5-6 million MMC enrollees per year Required copayment or coinsurance for primary care, specialist, and mental health care Interstudy Competitive Edge database Health plan organizational characteristics Methods – Independent Variable Recorded each plan’s required copayment for mental health, specialist, and primary care visit Classified plans into 3 groups: Full parity: Cost-sharing for mental health visit equal to primary care visit Intermediate parity: Cost-sharing for mental health visit > primary care but <= to a specialist visit No parity: Cost-sharing for mental health visit > than specialty and primary care Methods-Dependent Variables Follow-up visit after hospitalization for a mental illness within 7 days Follow-up visit after hospitalization for a mental illness within 30 days Indicators apply to 43892 enrollees from 2002-6 Methods - Analyses Constructed regression models predicting adherence to the indicators as a function of parity status, controlling for: Age, sex, race, area-level income and education, plan size, plan age, modeltype, profit status, census regions, and clustering within plan Difference-in-differences analysis of 10 plans that dropped full parity compared to 10 matched controls Parity for Outpatient Mental and Physical Health Services in Medicare Health Plans, 2001-2006 Trivedi, A. N. et al. JAMA 2008;300:2879-2885. Cost Sharing for Outpatient Mental and Physical Health Services in Medicare Health Plans, 2001-2006 Trivedi, A. N. et al. JAMA 2008;300:2879-2885. Sociodemographic and Health Plan Characteristics of Enrollees, by Mental Health Parity No Parity (n=24220) Intermediate Parity (n=19510) Full Parity (n=4348) Mean Age (Years) 65 65 67 Female (%) 60 59 61 Black (%) 13 11 9 Below Poverty† 11 10 10 Some College or Above‡ 35 32 33 Figure 2. Rates of 7 day and 30 day Follow-up after Hospitalization for a Mental Illness, by Health Plan Parity Status Follow-up Rate (%) 100 80 64.3 60 51.8 57.1 45.3 40 32.4 37.2 20 0 Follow-up in 7 days No parity Follow-up in 30 days Intermediate parity Full Parity Table 3. Adjusted Effect of Mental Health Parity Status on 7 and 30 day follow-up visits after hospitalization for Mental Illness Adjusted estimate No Parity Intermediate Parity No Parity Followup in 7 days Ref 3.0 % 10.5 % (95%CI -0.5, 6.5) P=0.10 (95%CI 3.8, 17.1) p=0.002 Followup in 30 days Ref 4.0% 10.9 % (95% CI 0.2,7.8) p=0.04 (95%CI 4.6, 17.3) p<0.001 Table 4. Change in Adherence rates in plans that dropped parity compared to plans that maintained full parity Measure Plan type F/up in 7 days F/up in 30 days Year before change (%) Year after change ∆ ∆-∆ Adj ∆-∆ p Dropped 46.9 full parity 35.7 -11.2 20.2 19.0 0.003 Maintain 45.8 ed full parity 54.8 +9.0 Dropped 64.8 full parity 57.4 --7.7 Maintain 68.5 ed full parity 76.0 (95%CI 6.6, 31.3) -15.1 -14.2 (95% CI 4.5, 23.9) +7.5 0.007 Table 4. Change in Adherence rates in plans that dropped parity compared to plans that maintained full parity Measure Plan type F/up in 7 days F/up in 30 days Year before change (%) Year after change ∆ ∆-∆ Adj ∆-∆ p Dropped 46.9 full parity 35.7 -11.2 20.2 19.0 0.003 Maintain 45.8 ed full parity 54.8 +9.0 Dropped 64.8 full parity 57.4 --7.7 Maintain 68.5 ed full parity 76.0 (95%CI 6.6, 31.3) -15.1 -14.2 (95% CI 4.5, 23.9) +7.5 0.007 Table 4. Change in Adherence rates in plans that dropped parity compared to plans that maintained full parity Measure Plan type F/up in 7 days F/up in 30 days Year before change (%) Year after change ∆ ∆-∆ Adj ∆-∆ p Dropped 46.9 full parity 35.7 -11.2 20.2 19.0 0.003 Maintain 45.8 ed full parity 54.8 +9.0 Dropped 64.8 full parity 57.4 --7.7 Maintain 68.5 ed full parity 76.0 (95%CI 6.6, 31.3) -15.1 -14.2 (95% CI 4.5, 23.9) +7.5 0.007 Table 4. Change in Adherence rates in plans that dropped parity compared to plans that maintained full parity Measure Plan type F/up in 7 days F/up in 30 days Year before change (%) Year after change ∆ ∆-∆ Adj ∆-∆ p Dropped 46.9 full parity 35.7 -11.2 20.2 19.0 0.003 Maintain 45.8 ed full parity 54.8 +9.0 Dropped 64.8 full parity 57.4 --7.7 Maintain 68.5 ed full parity 76.0 (95%CI 6.6, 31.3) -15.1 -14.2 (95% CI 4.5, 23.9) +7.5 0.007 Table 4. Change in Adherence rates in plans that dropped parity compared to plans that maintained full parity Measure Plan type F/up in 7 days F/up in 30 days Year before change (%) Year after change ∆ ∆-∆ Adj ∆-∆ p Dropped 46.9 full parity 35.7 -11.2 20.2 19.0 0.003 Maintain 45.8 ed full parity 54.8 +9.0 Dropped 64.8 full parity 57.4 --7.7 Maintain 68.5 ed full parity 76.0 (95%CI 6.6, 31.3) -15.1 -14.2 (95% CI 4.5, 23.9) +7.5 0.007 Table 4. Change in Adherence rates in plans that dropped parity compared to plans that maintained full parity Measure Plan type F/up in 7 days F/up in 30 days Year before change (%) Year after change ∆ ∆-∆ Adj ∆-∆ p Dropped 46.9 full parity 35.7 -11.2 20.2 19.0 0.003 Maintain 45.8 ed full parity 54.8 +9.0 Dropped 64.8 full parity 57.4 --7.7 Maintain 68.5 ed full parity 76.0 (95%CI 6.6, 31.3) -15.1 -14.2 (95% CI 4.5, 23.9) +7.5 0.007 Limitations Adverse selection into plans without parity Cohort of persons with severe mental illness Similar demographic composition Consistent findings in cross-sectional and longitudinal analyses Plans may have other mechanisms to reduce use of mental health care Conclusions ~80% of Medicare managed care enrollees were required to pay higher copayments for mental health services compared to primary or specialty care Little evidence of selection by parity status Full parity plans have substantially higher performance on two important measures of mental health care quality Implications Federal parity legislation did not clarify whether parity means equivalent cost-sharing for primary or specialty care Federal legislation left out many groups Mandating parity in cost-sharing for primary care and mental health care could yield substantial improvements in quality of mental health care Unintended Consequences of Increasing Ambulatory Copayments among the Elderly Amal Trivedi, MD, MPH Husein Moloo, MPH Vince Mor, PhD Alpert Medical School of Brown University Providence VA Medical Center Supported by a Pfizer Health Policy Scholars Award Background Increasing the copayment for ambulatory care reduces the number of outpatient visits Ambulatory copayments have increased markedly in recent years Background If patients forego important outpatient care, they may be more likely to use acute hospital care Few studies of the hospital utilization offsets from greater ambulatory copayments RAND Experiment found no increased hospital admissions in group exposed to an outpt deductible RAND HIE excluded the elderly Aims Assess whether increased ambulatory copayments are associated with increased use of hospital care among the elderly Determine whether increases in copayments has differential effects among vulnerable populations low-income and education, black race, and chronic disease Methods – Data Sources Individual-level utilization data from all Medicare health plans from 2001-2006 linked to Medicare enrollment file Health plans benefits data for all Medicare plans Interstudy Competitive Edge for health plan organizational characteristics Methods – Study Population Identified 18 Medicare plans that increased ambulatory copayments between 2001 and 2006 without changing prescription drug benefits Randomly matched these plans to 18 control plans that did not increase copayments Plans were matched on the basis of census region, tax status, and model type Final sample: 899,060 enrollees in 36 plans Methods – Statistical Analyses Difference-in-differences design Assessed change in inpatient and outpatient utilization in plans that increased copayments compared to concurrent trends in control plans Used GEE to account for clustering by plan, repeated measures Stratified analyses by race, income, education, presence of chronic medical conditions Cost-Sharing in Case and Control Medicare Plans Case Plans that Increased Ambulatory Copayments Control Plans where Ambulatory Copayments were Unchanged Year before increase Year after increase Year before case Year after case plans increased plans copayment increased copayment Primary Care $7.38 $14.38 $8.33 Unchanged Specialty Care $12.66 $22.05 $11.38 Unchanged Inpatient $148.33 $329.17 $111.11 $177.08 Enrollee Characteristics of Case and Control Medicare Plans Case Plans that Increased Control Plans where Ambulatory Ambulatory Copayments Copayments were Unchanged Year before increase Year after increase Year before case Year after case plans increased plans increased copayment copayment Mean Age, y 74.2 74.4 74.6 74.8 Female, % 58 59 57 58 Black, % 9 8 5 5 Below poverty, % 10 10 9 9 College attendance, % 31 32 35 34 Change in Rates of Use of Outpatient and Inpatient Care in Case and Control Medicare Plans Measure Type of plan Annual Rates Per 100 Enrollees Yr before Change Case Plans 702.0 Change Yr after Change 720.5 Control Plans 753.4 798.9 +45.5 Increased copayments 25.3 27.6 2.3 Copayments unchanged 25.8 26.1 Unadjusted Adjusted (95% CI) -27.0 -19.8 (-16.6,-23.1) 2.0 2.3 (1.8-2.7) +18.5 Outpatient Visits Annual Inpatient Admissions/ 100 Enrollees Between-Group Difference 0.3 Change in Rates of Use of Outpatient and Inpatient Care in Case and Control Medicare Plans Measure Type of plan Annual Rates Per 100 Enrollees Yr before Change Annual Outpatient Visits/100 Enrollees Inpatient Admissions Change Yr after Change Increased copayments 702.0 Copayments unchanged 753.4 798.9 +45.5 Case Plans 25.3 27.6 2.3 Control Plans 25.8 720.5 26.1 Between-Group Differencea Unadjusted Adjusted (95% CI)b -27.0 -19.8 (-16.6,-23.1) 2.0 2.3 (1.8-2.7) +18.5 0.3 Change in Rates of Use of Outpatient and Inpatient Care in Case and Control Medicare Plans Measure Type of plan Annual Rates Per 100 Enrollees Yr before Change Annual Outpatient Visits/100 Enrollees Annual Inpatient Admissions/ 100 Enrollees Inpatient Days % with inpatient days Change Yr after Change Increased copayments 702.0 Copayments unchanged 753.4 798.9 +45.5 Increased copayments 25.3 27.6 2.3 720.5 25.8 26.1 0.3 Case Plans 133.5 145.9 +12.4 Control Plans 125.6 126.7 +1.1 Case Plans 15.39 16.30 +0.91 15.86 16.15 Unadjusted Adjusted (95% CI)b -27.0 -19.8 (-16.6,-23.1) 2.0 2.3 (1.8-2.7) 11.3 13.7 (10.4-16.9) 0.62 0.74 (0.5-0.9) +18.5 Copayments unchanged Control Plans Between-Group Differencea 0.29 Annual Inpatient Admissions/100 Enrollees Difference-in-differences Estimates by Area-level Income and Education 5 4 3 2 1 0 Poverty Education High Med Low Annual Inpatient Admissions/100 Enrollees Difference-in-differences Estimates by Race 8 7 6 5 4 3 2 1 0 Race White Black Other Annual Inpatient Admissions/100 Enrollees 18 16 14 12 10 8 6 4 2 0 Difference-in-differences Estimates for Persons with Chronic Disease Race Hypertension Diabetes Myocardial Infarction Limitations Non-random assignment of enrollees in health plans Only followed enrollees for a max of 3 years Unable to distinguish between effects of increasing primary care vs. specialty care copays No information on primary diagnoses of inpatient and outpatient visits Conclusions Increasing ambulatory copayments reduced use of outpatient care but was offset by a substantial rise in hospital use Effects magnified among vulnerable groups with low socioeconomic status and chronic disease Implications Assuming an average outpatient visit of $60, then the average Medicare plan that raised ambulatory copayments would avert $7150/100 enrollees in annual outpatient spending Assuming an average cost of $11,065 per admission, the plan would pay over $25000 /100 enrollees in the year after the copayment increase Increasing ambulatory copayments may have adverse clinical and economic consequences Table 3. Baseline Utilization of Enrollees that Exited and Remained in Case and Control Medicare Plans Acute Hospital Admission/100 Enrollees Type of plan Case Plans that Increased Ambulatory Copayments Control Plans with Unchanged Ambulatory Copayments Exited plan (n=43641) 22.0 Remained in plan (n=314,245) 20.2 Difference (95% CI) 1.8 (1.2, 2.4) Exited plan (n=35307) 18.9 Remained in plan (n=281,505) 20.9 Difference (95%CI) -2.0 (-2.7, -1.3) Table 4. Change in Rates of Use of Outpatient and Inpatient Care in a Cohort of Continuously Enrolled Beneficiaries in Case and Control Medicare Plans Type of plan Annual Outpatient Annual Acute Visits/100 Enrollees Hospital Admission/100 Enrollees Case Plans that Increased Ambulatory Copayments (n=330,782) Year before increase 699.3 20.2 Year after increase 747.1 28.5 Change 47.8 8.3 Control Plans with Unchanged Ambulatory Copayments (n=291,980) Year before change 766.2 20.9 Years after change 825.5 27.3 Difference 59.3 6.4 Between-group difference Unadjusted -11.5 1.9 Adjusted(95% CI) -10.2 (-13.4, -7.0) 2.1 (1.6, 2.5) Sensitivity Analysis of Health Plans with 2 years of unchanged Ambulatory and Prescription Drug Benefits prior to Ambulatory Copayment Increase Case Plans 2 years before Copayment Increase 26.1 (SE 1.0) Year before Copayment Increase 26.1 (SE 1.0) Control Plans 27.3 (SE 0.7) 27.7 (0.7) Year after Copayment Increase 27.9 (SE 1.0) 27.5 (SE 0.7)