Building Bridges: Making a Difference in Long-Term Care 2010 Policy Seminar

advertisement

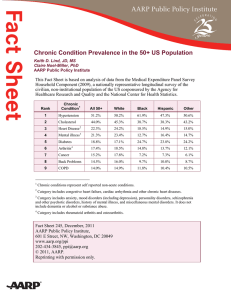

BuildingMaking Bridges:a Making a Difference in Building Bridges: Difference in Long-Term Care Care 2010Long-Term Policy Seminar Rhonda Richards Senior Legislative Representative, Federal Government Relations Nora Super Health and Long-Term Care Director, Federal Government Relations Health and Long-Term AARP Care March 23, 2010 February 10, 2010 AARP 1 Improving Long-Term Services and Supports: An AARP Priority • Throughout the health care reform debate, AARP has insisted that improving LTSS be part of any final package. • The vast majority (89%) of Americans age 50+ want to live in their homes and communities as long as they can. This also resonates personally with our members who help care for their aging parents. • AARP supports multiple and complementary provisions that have the promise of: – – – – – Increasing personal choice and independence Helping people live in their homes and communities Bending the cost curve on Medicaid Reducing caregiver stress Offering financing options to middle class families paying out-of-pocket for long-term care needs AARP 2 Personal Stories I am a single woman, who worked in medical transcription for eight years and have been laid off due to company going electronic. I only draw unemployment weekly and a small social check. I am trying to care for my mother who is 90 years old with Lewy Body dementia, macular degeneration, and VRE colonized. The government will pay a nursing facility $6,000. per month and I have been unable to get very much help at all by caring for her at home. The system is not as it should be. I can take better care of her and cheaper with some help, which is almost impossible to get. Home health will come in and help a little, but very little. So I have no way of leaving her to go on errands, grocery store, etc. I would really like an answer to some of these problems. I am certainly not alone in this situation. Please help me! My mom does not have long term insurance. She draws a small social security monthly. No savings. Is there help out there anywhere for someone trying to care for an elderly person? Please help us older citizens who have worked a lifetime and been good citizens. I have looked many places for work and feel that I am not being hired because of my age, then what will happen to my mother if I do find job. She cannot be left alone. It is like taking care of a baby. Sharon P., Evansville, IN AARP 3 Personal Stories My parents had worked very hard and had a lot of saving; then my dad got ALS Lou Gehrigs disease. Luckily he had VA insurance, through the Railroad, and Medicare -HOWEVER -- IT WAS NOT ENOUGH FOR A 10 YEAR BATTLE. My mom was not yet old enough to get Medicare. Luckily they had a bit left. However, 15 months later she had a stroke. It was a right sided stroke so she recovered most of her mind and speech, however the fall on her hardwood floors left her with a unrepairable broken shoulder, a broken arm, a broken hip that required replacement. Unfortunately she was never able to walk due to her shoulder, so was wheelchair confined. I had to leave my job, leave my kids with their dad and come care for her -- as she was in the hospital for almost 6 months straight --- she used all her insurance, and eventually Medicare -- even some of her life days as she could not get out of the hospital for 30 days. She went on to rehab which at least prepared her to go to a Nursing Home, namely as she did not want to move, could not afford a sitter 24 hours a day, so could not stay at home. She died a year later in a nursing home -- which although was from pneumonia and cardio pulmonary disease (rheumatic heart disease from childhood) -- I really believe she died of a broken heart ! Not being able to get back home. Jacque M. , Shreveport, LA AARP 4 Need for Long-Term Services is Growing • This year about 9 million Americans over the age of 65 will need long-term care services. By 2020, that number will increase to 12 million. • While most people who need long-term care are age 65 or older, a person can need long-term care services at any age. • Forty percent of people currently receiving long-term care are adults 18-64 years old. • About 70 percent of individuals over age 65 will require at least some type of long-term care services during the lifetime. While about one-third of today’s 65-year-olds may never need long-term care services, 20 percent will need care for more than five years. (Source: National Clearinghouse for Long-Term Care Information) AARP 5 Projected Growth in the Older Population in United States as a Percentage of 2000 Census, by Age Group, 2000-2030 Source: AARP Public Policy Institute calculations using data from U.S. Census Bureau, Population Division Population (% of 2000 Census) 240% 220% 200% 180% 85+ 160% 140% 50-64 65-74 120% 75-84 100% 80% 2000 2005 2010 2015 2020 2025 2030 From 2007 to 2030, the population age 65+ is projected to grow by more than four times as fast as the population as a whole AARP 6 CLASS Program • CLASS is a personal responsibility program designed to provide an affordable, accessible and fiscally solvent way to ensure millions of Americans who are elderly or disabled receive the services they need without draining the federal budget. AARP 7 CLASS Program • CLASS is a voluntary insurance program totally funded by participants’ premiums and earned interest, not tax dollars. In fact, the Senate health reform bill prohibits using federal tax funds to pay for benefits. • The bill also mandates that CLASS charge premiums sufficient to assure that the program is solvent for at least 75 years from day one and is kept that way. • The Congressional Budget Office and other analysts have extensively modeled CLASS and found that the program meets this requirement. AARP 8 CLASS Program • The CLASS provisions would help to provide individuals a basic level of coverage for LTSS without them depleting their assets or being denied coverage due to a pre-existing condition. • The cash benefit is also an important feature, because it gives individuals choice and control over the services and supports they need to help them live independently in their homes and communities. • Individuals could also receive the benefit as long as they remain eligible. AARP 9 Benefits of CLASS • Importantly, CLASS would also help family caregivers caring for their loves ones. CLASS could help pay for services, such as adult day care, that help give caregivers a break and let them work or attend to their own needs. The CLASS benefit could help pay family caregivers who work part-time or not at all because of their caregiving responsibilities. AARP 10 Participation in CLASS • CLASS premiums are based on maintaining 75 year program solvency and individuals will be automatically enrolled in the program, unless they choose to opt-out. The aim is a large pool to spread the risk and help keep premiums affordable. The auto enrollment design would help increase the number of individuals who participate in the program. AARP 11 Impact of 401(k) Auto Enrollment Default is nonparticipation Participation % 100 Default is participation 86 80 75 80 60 40 35 19 20 13 0 Females Hispanic Under$20k $20kininearnings earnings Under Actual results for employees with between 3 and 15 months tenure. Study by Professor Source: Madrian and Shea Brigitte Madrian, University of Pennsylvania’s Wharton School, and Dennis Shea, United Health Group. AARP 12 www.retirementsecurityproject.org CLASS one part of the Solution • CLASS would help provide a foundation of basic coverage for LTSS. It would not cover all the services and supports that some individuals need and it is not meant to do so. • Individuals could build on their CLASS benefit and together with private insurance, personal savings, other public programs and care from friends and loved ones, the CLASS program would help offer peace of mind to individuals and their families. • An extensive outreach and education component will need to be part of the CLASS program. AARP stands ready to help with that effort. AARP 13 Medicaid HCBS Spending Source: AARP Public Policy Institute calculations based on date from Brian Burwell, Kate Sredl, and Steve Eiken, “Medicaid Long Term Care Expenditures FY 2007” Thomson Reuters, 2008 AARP 14 Medicaid HCBS • There are also individuals who may need HCBS in the short-term and long-term who are no longer working and who would not be able to pay into CLASS and who rely on Medicaid. • Medicaid is the largest payer of LTSS in the country but it is historically biased towards institutional care. While an individual is entitled to institutional care, the state may limit the number of people they serve in HCBS. • Currently, we spend approximately 73 percent of Medicaid long-term care resources devoted to older people and adults with physical disabilities on institutional care, even though most individuals prefer the often less expensive and more cost effective HCBS. AARP 15 Medicaid HCBS • • • • AARP’s Public Policy Institute found that Medicaid dollars can support nearly three older people and adults with physical disabilities in home- and community-based settings for every person in a nursing facility. (PPI, 2009) A study published in Health Affairs found that states that invested in HCBS, over a relatively short period of time, were able to slow their rate of Medicaid spending on long-term care. (Kaye, 2009) That is why AARP strongly supports the inclusion of the State Balancing Incentives Payments Program, the Community First Choice Option, improvements in the Medicaid HCBS state plan option and spousal impoverishment protections for HCBS, as well as provisions to extend the Money Follows the Person Rebalancing Demonstration and to allocate resources Aging and Disability Resources. A SCAN Foundation survey released in July 2009 found that nearly 8 out of 10 people surveyed would be more likely to support health reform if it improved coverage of home- and community-based services. AARP 16 Family Caregivers: The Backbone of the LTC System AARP 17 Middle Class Task Force Proposals to Help Family Caregivers The Middle Class Task Force, led by Vice President Biden, put forward two proposals to help family caregivers: 1. 2. AARP 18 A $52.5 million increase in caregiver support programs and a $50 million increase for services such as transportation, in-home services, adult day care, etc. A modification of the child and dependent care tax credit (CDCTC) to allow more individuals to claim a larger tax credit. The CDCTC provides a tax credit for a percentage of child and dependent care expenses for a qualifying individual paid by a taxpayer so that s/he could work or look for work. Conclusion • AARP believes there is no “single” solution to address the long-term care needs of Americans. • What it is clear is that today’s system is too costly, falling far short of the needs and desires expressed by consumer and their families. • The CLASS program, private insurance, personal savings, other public programs and care from friends family, and other loved ones, are all necessary building blocks to create a system that better meet needs and desires of older Americans and people with disabilities. AARP 19