Background: Importance of hospital capital investment An Evaluation of Hospital Capital Investment

advertisement

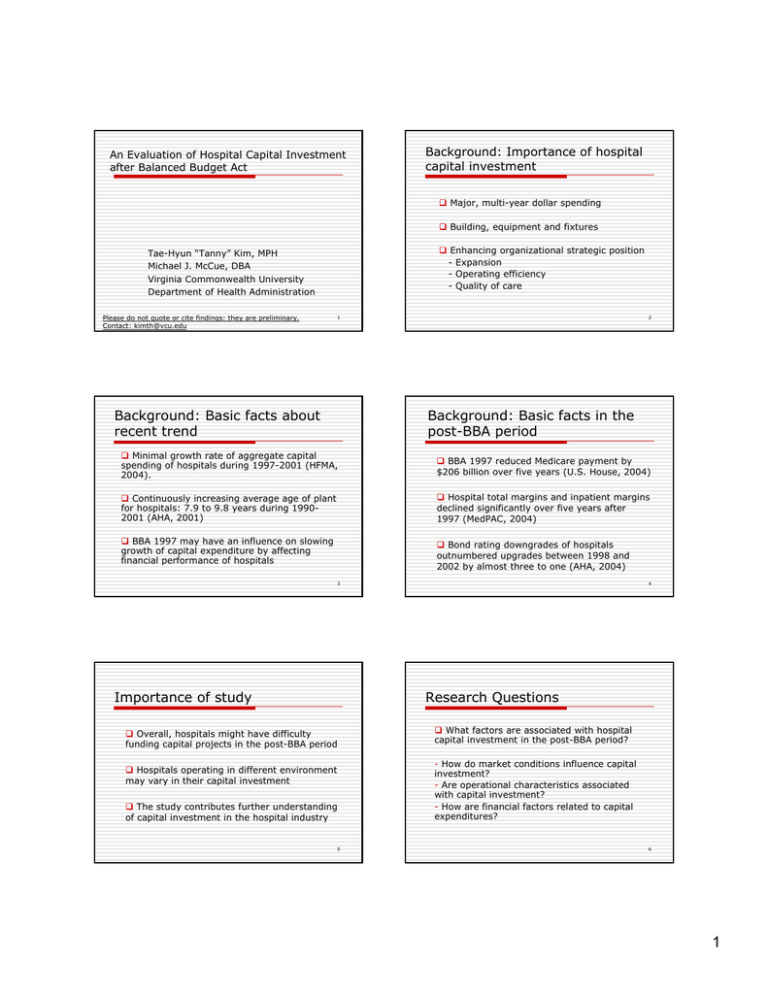

An Evaluation of Hospital Capital Investment after Balanced Budget Act Background: Importance of hospital capital investment Major, multi-year dollar spending Building, equipment and fixtures Enhancing organizational strategic position - Expansion - Operating efficiency - Quality of care Tae-Hyun “Tanny” Kim, MPH Michael J. McCue, DBA Virginia Commonwealth University Department of Health Administration Please do not quote or cite findings: they are preliminary. Contact: kimth@vcu.edu 1 Background: Basic facts about recent trend 2 Background: Basic facts in the post-BBA period Minimal growth rate of aggregate capital spending of hospitals during 1997-2001 (HFMA, 2004). BBA 1997 reduced Medicare payment by $206 billion over five years (U.S. House, 2004) Continuously increasing average age of plant for hospitals: 7.9 to 9.8 years during 19902001 (AHA, 2001) Hospital total margins and inpatient margins declined significantly over five years after 1997 (MedPAC, 2004) BBA 1997 may have an influence on slowing growth of capital expenditure by affecting financial performance of hospitals Bond rating downgrades of hospitals outnumbered upgrades between 1998 and 2002 by almost three to one (AHA, 2004) 3 Importance of study 4 Research Questions Overall, hospitals might have difficulty funding capital projects in the post-BBA period Hospitals operating in different environment may vary in their capital investment The study contributes further understanding of capital investment in the hospital industry 5 What factors are associated with hospital capital investment in the post-BBA period? - How do market conditions influence capital investment? - Are operational characteristics associated with capital investment? - How are financial factors related to capital expenditures? 6 1 Hypotheses Methods Hospitals located in higher market demand will be more likely to have higher amount of capital investment Study design: a pooled cross-sectional time-series design Study period: 1998-2002 Hospitals with higher complexity and limited capacity will be more likely to have higher amount of capital investment Data: CMS, AHA, and ARF database Sample: non-federal, short-term general U.S. hospitals (16,520 hospital-years) Hospitals with higher amount of financial sources will be more likely to have higher amount of capital investment 7 Measurement 8 Measurement Independent variables: Dependent variable: capital purchase for buildings, fixtures and moveable equipment during a fiscal year - Market factors (county level)- number of physicians, population size, % of population over 65, per capita income, and unemployment rate - Operational factors - bed size, number of total services, case-mix index and occupancy rate - Financial factors - days cash on hand, cash flow, and debt ratio 9 Descriptive Statistics Variable Capital investment ($1000s) Ln(capital investment) Market factors MDs per population 1,000 Ln(population) % Population over 65 Ln(per capita income) Unemployment rate (%) Operational factors Beds Number of services Occupancy rate Case-mix Financial factors Days cash on hand Cash flow Debt ratio Mean 5,614 10.932 Descriptive Statistics (cont.) Std. Dev. 13,700 6.603 2.201 11.866 0.135 10.141 5.080 1.960 1.761 0.037 0.271 2.396 189.32 33.531 0.463 1.295 179.78 13.436 0.213 0.250 41.457 13.661 0.836 10 74.669 249.83 8.063 11 Variable Control factors Herfindahl Index Ownership Not-for-profit For-profit Public System affiliation Teaching hospital Urban Region North East Central South West Mean Std. Dev. 0.289 0.267 0.618 0.157 0.225 0.562 0.280 0.600 0.486 0.364 0.418 0.496 0.450 0.489 0.153 0.266 0.384 0.181 0.361 0.442 0.486 0.385 12 2 Results Methods Table 2: OLS regression with robust standard errors Dependent Variable: Log of capital investment Independent Variables Multiple regression Hospital & year fixed-effect model CIit = αi + γ t + a1MKTit + a2OPERit−1 + a3FINit−1 + εit Coef. Std. Err. P>t MDs/capita -0.043 0.046 0.349 Ln(population) -0.085 0.085 0.313 % Population over 65 -4.078 * 2.019 0.044 Ln(per capita income) 0.530 0.398 0.183 Unemployment rate 0.006 0.030 0.850 Beds 0.002 ** 0.001 0.000 Occupancy rate 1.733 ** 0.382 0.000 No. of services 0.033 ** 0.007 0.000 Case-mix index 1.100 ** 0.386 0.004 Days cash on hand 13 0.001 Cash flow 0.0002 * Debt ratio -0.086 0.001 0.082 0.0001 0.035 0.052 0.098 14 R-squared: .1451 * Statistically significant at the 5 percent level ** Statistically significant at the 1 percent level. Results Summary of results Table 2: OLS regression with robust standard errors Dependent Variable: Log of capital investment Control Variables Coef. Std. Err. P>t Herfindahl index 0.313 0.245 0.201 For-profit -0.694 0.497 0.163 Public -0.549 ** 0.167 0.001 0.058 0.134 0.667 FP*SYS -0.371 0.541 0.492 Teaching System affiliation -0.099 0.172 0.563 Urban 0.074 0.186 0.689 Northeast 1.089 ** 0.182 0.000 Central 0.753 ** 0.165 0.000 West 0.182 0.213 0.393 yr2000 -0.626 ** 0.091 0.000 yr2001 -2.267 ** 0.133 0.000 3.864 0.084 _cons 6.685 Operational factors appear to be significant: number of beds, occupancy rate, case-mix index and number of services were positively associated with capital investment Cash flow was positively associated with capital investment 15 Discussions/implications 16 Discussions/implications In the post-BBA period, internal aspects (e.g., operational factors) may have been more important than external factors (e.g., market factors) in hospital capital investment - Hospitals may have not been able to or needed to incorporate market conditions in their investment decision - However, operational characteristics reflect market demand to some extent - The impact of market factors at the MSA level may be different Overall, market factors were not significant (except % of elderly) 17 The results partially support a growing literature suggesting that availability of internal funds is a significant factor affecting investment activity Increase in debt may act as a monitoring device rather than a facilitating factor in the postBBA period 18 3