A New Consumerism in Health Care and Jon R. Gabel

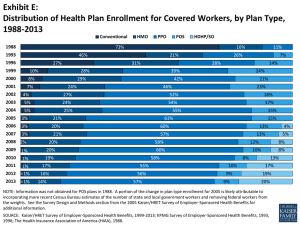

advertisement

A New Consumerism in Health Care and What It Means for Health Plans Jon R. Gabel Vice President Health Research and Educational Trust Objectives • To review changes in employer-based health insurance over the past decade • To identify the forces setting the stage for consumer-driven health care • To examine the pros and cons of consumer-driven health care • To examine the experience of one pioneer employer and health plan with consumer-driven health care products • To predict the future course of employer-based health insurance Premium Increases Compared to Other Indicators, 1988-2001 14.0 Percentage 12.0 10.0 8.0 6.0 4.0 2.0 ^ 0.0 1988 1993 1995 Health Insurance Premiums 1996 1997 1998 Workers Earnings 1999 2000 2001 Overall Inflation Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999, 2000; KPMG Survey of Employer-Sponsored Health Benefits: 1988, 1993, 1996, 1998; Bureau of Labor Statistics, 2000. * Estimate is statistically different from the previous year for years 1997-1998, 1998-1999, 1999-2000. No tests were done on years prior to 1997 or for Workers Earnings or Overall Inflation. ^ Sample included firms with 200 or more workers only. Chart #4 Percentage Change in Premiums, by Firm Size, 2001 11.0% All Firms 12.5% All Small Firms (3-199 Workers) (3-9 Workers) 16.5% (10-24 Workers) 14.4% (25-49 Workers) 11.5% (50-199 Workers) 10.8% 10.2% All Large Firms (200 or More Workers) Midsize (200-999 Workers) 10.0% Large (1,000-4,999 Workers) 9.0% Jumbo (5,000+ Workers) 10.8% 0% 2% 4% 6% Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits: 2001 8% 10% 12% 14% 16% 18% Chart #5 Average Annual Premium Costs for Covered Workers, 2001 All Plans Single $2,650 $7,053 Family Conventional Single $2,851 $7,685 Family HMO Single $2,402 Family $6,538 PPO Single $2,730 Family $7,202 POS Single $2,667 Family $7,059 $0 $1,000 $2,000 $3,000 Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits: 2001 $4,000 $5,000 $6,000 $7,000 $8,000 Trends in Provider Revenues from Non-Medicare Patients, 1991 – 2000, (Annual Percent Change Per Capita) 20 15 10 5 0 -5 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 -10 Hosp. Inpat. Hosp. Outpatient Physician Precription Drug Blue Cross-Blue Shield Underwriting Gains and Losses, 1990-1999 (in percentages of revenue) 2.5 2 1.5 2.2 1.5 1.1 1.3 1.1 1 0.6 0.5 0.1 0 -0.5 -1 -1.5 90 91 92 93 94 95 -0.2 96 -1 97 -1.2 98 99 -1 Source: Authorís analysis of unpublished data provided by the Blue Cross-Blue Shield Association 2000 % of Expenditures Distribution of Health Expenditures For the US Population 100 90 80 70 60 50 40 30 20 10 0 96 50 26 1970 96 97 97 55 56 55 29 28 27 1980 1987 Top 50% Top 5% Top 1% 1996 Source: Data for 1970 are from the National Center for Health Services Research tabulations of the 1970 Center for Health Administration Studies (CHAS)/NORC survey; 1980 data is from the National Medical Care Utilization and Expenditure Survey; 1987 data is from the 1987 National Medical Expenditure Survey; 1996 data is from the 1996 Medical Expenditure Panel Survey Health Plan Enrollments for Covered Workers by Plan Type, 1988-2001 1988 73% 1993 16% 46% 1996 27% 9% 28% 2000 8% 29% 2001 7% 20% 14% 28% 25% 38% 22% 41% 23% 22% 48% 40% Conventional 60% HMO 7% 26% 31% 1999 0% 21% 11% PPO 80% 100% POS Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits: 1999, 2000, 2001; KPMG Survey of Employer-Sponsored Health Benefits: 1988, 1993, 1996 Average Monthly Worker Contribution, 1988-2001 $160 $124 $120 $80 $40 $34 $37 $8 $28 $122 $138 $150 $52 $30 $0 Single Coverage 1988 Sources: Family Coverage 1993 1996 2000 2001 Kaiser/HRET Survey of Employer-Sponsored Health Benefits: 2000, 2001; KPMG Survey of Employer-Sponsored Health Benefits: 1988, 1993, 1996 Percentage of Premium Paid by Covered Workers, 1988-2001 35% 29% 30% 25% 20% 20% 15% 11% 32% 28% 27% 27% 21% 14% 15% 10% 5% 0% Single Coverage 1988 Source: Family Coverage 1993 1996 2000 2001 Kaiser/HRET Survey of Employer-Sponsored Health Benefits: 2000, 2001; KPMG Survey of Employer-Sponsored Health Benefits: 1988, 1993, 1996 Average Annual Deductible for Coverage in Conventional, PPO, and POS Plans, 1988 – 2001 $700 $600 $500 $400 $300 $200 $100 $0 600605 545528 495 407 361* * 315 313 289 375 267 222 245239195 163 170181190187201 106 406 359367 324 177 71 41 79* 84 ^ ^ Conventional Conventional PPO In-Plan Single Family 1988 1993 PPO OutPlan 1996 1999 POS In-Plan 2000 POS OutPlan 2001 Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999, 2000, 2001; KPMG Survey of Employer-Sponsored Health Benefits: 1988, 1993, 1996. * Estimate is statistically different from the previous year for years 1999-2000, 2001-2001.^ Information was not obtained for POS plans in 1988. Percentage 80 Percentage of Covered Workers Facing HMO Co-payments for Physician Visits, 1996 - 2001 54 60 40 20 23 20 25 10 7 4 6 5 0 No copay 61 59 55 50 19* 13 11 24 10 9 10 1 2 0 0 0 1 1 1 3 2 $2 per visit $5 per visit $10 per visit $15 per visit $20 per visit 1996 1998 1999 2000 2 1 2 3 3 5 0 0 0 2 Other Don't know 2001 Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999, 2000, 2001; KPMG Survey of Employer-Sponsored Health Benefits: 1996, 1998. * Estimate is statistically different from the previous year for years 1999-2000, 2000-2001. Frightening Factoids ¾ 51 percent of adults with diabetes did not have an eye exam with pupil dilation in 1997. ¾ 60 percent of Kentucky Medicaid patients diagnosed with a cold filled a prescription for an antibiotic. ¾ Preventable adverse drug events occur in 1.8% of hospital admissions. ¾ One-third of hospitalized elderly patients discharged with an antidepressant were taking a dose below the recommended level. Source: J. Eisenberg and E. Power, JAMA, Oct 25, 2000 The Political Defeat of Managed Care ¾ Caught in the political crossfire, 1993-1995 ¾ The media turns on managed care, 1995 ¾ Backlash continues as evidenced by debate on Patient Bill of Rights ¾ Non-price rationing – Shielded from the cost of care, consumers view plans as limiting necessary services. Consumer-Driven Health Care and Defined Contribution Plans: What is the Difference? ¾ Defined contribution – refers to employer contribution formula ¾ Cash out of health benefits business ¾ Managed competition model of fixed absolute contributions for health insurance ¾ Consumer Driven Health Care – refers to plan design ¾ “Stakeholder empowerment to improve value” Common Elements of ConsumerDriven Products ¾ Increased financial risk for consumers ¾ Increased choice of providers and/or benefit design ¾ Use of e-health insurance medical information products Lessons from the RAND Health Insurance Experiment ¾ Increased coinsurance and deductibles substantially reduce the use of services ¾ Persons with no coinsurance use 23 percent more services than persons with 0 coinsurance. ¾ Out-of-pocket maximums had little effect on use of services ¾ Cost-sharing reduced services by reducing the number of episodes of care. Lessons from RAND Health Insurance Experiment (Continued) ¾Increased cost-sharing had: ¾Little effect on health status for healthy people. ¾High cost-sharing had negative effects on low-income and persons with certain chronic conditions. ¾Cost-sharing had no affect on the percentage of care that was medically necessary. The Case for Consumer Driven-Health Care ¾ Political failure of managed care requires a new strategy. ¾ Without cost-sharing, consumers view cost-control as “taking away my benefits.” ¾ Cost-sharing reduces the use of services. ¾ Cost-sharing does not reduce health status for healthy people. ¾ More choice is associated with higher plan and provider satisfaction. Public equates choice with quality. ¾ Internet provides the tools to improve the knowledge and decision-making ability of consumers. ¾ Some insurer-based plans will increase pooling. The Case Against Consumer-Driven Health Care ¾ Cost-sharing is a blunt instrument. ¾ Impairs access to care for low-income populations. ¾ “Tax” on sick persons. ¾ Does not improve the appropriateness of care. ¾ Impairs health status for some chronic conditions ¾ Plans less able to secure discounts. ¾ Could raise administrative expenses. ¾ Who will hold providers accountable for quality of health care? ¾ Breaks down risk-pools; MSA plans may end up transferring income from sick to healthy. In multi-plan settings, it may raise total outlays. ¾ We need more rather than less co-ordination in health care, particularly for chronic care. Early Experience: Medtronics ¾ Medical technology company with 25,000 employees ¾ Plan design ¾Three options for deductibles ¾Personal health accounts of $1,000 for single coverage and $2,000 for family coverage ¾ 13 percent of employees chose Definity in first year, up 25 percent in second year. ¾ 30 percent of new employees choose Definity Medtronics (Continued) ¾ Greater use of “nurse line” ¾ Increase in use of generic drugs ¾ Three catastrophic cases in first year of plan ¾ About 52 percent of enrollees ‘turned over” their personal savings accounts Early Experience: Highmark BC/BS ¾ BlueChoice product allows businesses to select among 43 configured products ¾ Employer determines funding level and employee buys up or down ¾ 25 accounts with 21,000 members ¾ Employer pool is the risk unit ¾ POS plans are most popular ¾ Renewal increases are similar to remaining book of business. Immediate Future of Employer-Based Health Benefits ¾ Increased patient cost-sharing ¾ Consumer-driven products take-off as new options, not replacement products ¾ Look for tiered network products to gain prominence. ¾ Look for personal spending account products to grab market share. ¾ New products will: ¾ Reduce rate of growth in prescription drug expenses ¾ Have little impact in controlling hospital expenses Conclusion ¾ Plea to policymakers to evaluate these new products in the spirit of problem-solving, not ideology ¾ Key evaluative measures ¾ Use of medical information tools ¾ Risk selection ¾ Enrollment and plan satisfaction ¾ Altered use of health care services ¾Use of services for low-income and sick employees ¾Use of generic drugs ¾ Compliance with clinical guidelines ¾ Total claims costs ¾ Plea to Health Plans – experiment and evaluate ¾ Work with research community to disclose performance of your products