David Gray Remarks CBOE Update OIC Conference, Miami, Florida

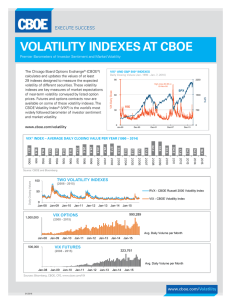

advertisement

David Gray Remarks CBOE Update OIC Conference, Miami, Florida May 6, 2015 INTRODUCTION Good afternoon everyone. I’m glad to be here representing my colleagues within the industry and at CBOE. I also must confess that after this past winter, I am thrilled to be in Miami Beach. But before we get too distracted by the Florida sunshine, I want to take a few minutes to update you on some of CBOE’s recent initiatives. As CBOE strives to grow the industry, we are focused on three key areas: developing new products, broadening access to our marketplace and educating and engaging our customers. DEVELOPING NEW PRODUCTS I’ll start with what’s new on the product front. We are particularly excited about expanding and diversifying our product offerings for customers through recent licensing agreements with two major global index providers -- MSCI and the London Stock Exchange Group, owner of the FTSE and Russell Indexes. The new products will provide customers the opportunity to trade new markets and asset classes. Our December licensing agreement with MSCI made CBOE the sole U.S. exchange to list options on several MSCI indexes. Our April 21st launch of options on MSCI’s EFA and Emerging Markets indexes provides investors 1 with an added global dimension to their index options trading. We plan to launch options on 4 other MSCI indexes in 2015. Our agreement in February with the London Stock Exchange Group will enable us to offer customers cash-settled options on more than two-dozen FTSE and Russell indexes, including the flagship Russell 2000 and FTSE 100. Through the agreement, CBOE and C2 became the sole providers of RUT options on April 1 st. We look forward to bringing FTSE 100 Index options, as well as other Russell and FTSE products, to the marketplace later this year. The addition of MSCI, FTSE and Russell options to a product suite that includes SPX options and VIX options and futures enables investors to hedge and trade global volatility, the global stock market, the broad U.S. stock market, U.S. small caps, European and Asian international equities and the world’s emerging markets at CBOE. These agreements also provide us with the opportunity to create new volatility indexes and bring new volatility products to the marketplace. So stay tuned for news on those future developments. We’ve also expanded our volatility product line into new asset classes. Our new volatility indexes that track the euro, British pound and Japanese yen are the first-ever measures of pure foreign exchange volatility. And the “TYVIX” -- the CBOE/CBOE 10-Year U.S. Treasury Note Volatility Index -is the first exchange-traded volatility benchmark for U.S. Treasuries. Last Friday, we announced the launch of Weekly VIX options and futures at CBOE and CFE. We plan to launch the futures in July, with options to follow, pending regulatory review and approval. Our new VIX Weeklys products will complement VIX futures and options, just as SPX Weeklys complement our standard SPX product. Customers have told us they are looking for volatility exposures that more precisely track our benchmark VIX Index. We think VIX Weeklys will meet that need. The closer VIX futures and options are to expiration, the closer they track the VIX Index. 2 By “filling the gaps” between monthly expirations, we are providing investors with 40 new opportunities to establish short-term VIX positions, and fine-tune the timing of their hedging and trading activities. For the first time, investors will be able to trade expiring VIX and SPX contracts each week, which we believe will create even more trading opportunities. BROADENING ACCESS TO OUR MARKETPLACE As offer customers new products that provide exposure and trading opportunities to the world’s markets, we also are expanding access to our marketplace for a global customer base. Last summer, we implemented near 24-hour trading in VIX futures. Since then, roughly 9 percent of all VIX futures trading takes place outside of regular U.S. trading hours. And we’ve seen that figure rise as high as 20 percent on days with breaking overnight news or global events. In March, we introduced extended trading hours in our SPX and VIX options products with a session that extends from 2:00 a.m. to 8:15 a.m., Chicago time. Our extended trading hours enable overseas customers to access SPX options and VIX options and futures during their local hours, while also meeting the demand from our U.S. customers for additional trading time. We’ve been pleased with response to extended hours to date, and going forward, we’ll explore offering extended hours in other select products as well. We also recently enhanced our PULSE trader workstation. CBOE’s PULSE platform is a multi-asset, front-end trade management system for firms and end-users who wish to have direct exchange-sponsored access to CBOE. The platform offers users access to all of CBOE’s proprietary products, as well as equity options. Now it also offers access to futures at CFE and our extended trading hours sessions. Through PULSE, the upstairs trading community has the ability to streamline workflows and access open-outcry 3 trading efficiently and electronically. I encourage you to stop by our booth to speak with Ted Bilharz about this offering. During our first-quarter earnings call last Friday, we announced that the development of CBOE’s next generation of trading technology is currently underway. The new platform, called CBOE Vector SM, is being designed to provide more efficient access to the most comprehensive array of options and volatility products in the world and to the deep liquid markets in which they trade. Incorporating input from customers, we are developing an advanced architecture that delivers best-in-class functionality, low latency, ease of use, and trading efficiency. The new platform will be engineered to provide greatly increased transaction speeds while handling constantly increasing message traffic and industry demand for additional functionality, such as risk controls. The build out of CBOE Vector projects it will be implemented at CFE first, likely in the second half of 2016, with CBOE and C2 to follow. EDUCATING AND ENGAGING CUSTOMERS Each CBOE innovation and new product development is an opportunity to produce new educational content and form new connections with a growing customer base. The CBOE Options Institute is celebrating its 30th anniversary this year and continues to teach investors around the world through classroom and online programs. In 2014, The Options Institute participated in over 300 events with approximately 40,000 attendees and delivered nearly 30,000 online courses. Over the last several months, The Institute has been hosting delegations of representatives from China’s financial markets, including exchange staff, regulatory personnel and brokers and traders. 4 We’ve been pleased to share with our counterparts in China -- not only our options expertise, but our experience in creating and developing a marketplace -- as they establish their own options markets. Increasingly, we’re also connecting with investors through digital, mobile and social channels. These include our newly redesigned website, our industry-leading social media platforms, and our recently launched education app -- “CBOE Mobile” -- which has been downloaded more than 20,000 times since November. Our Risk Management Conference is the premier industry event for institutional users of equity derivatives and volatility products. Our U.S. conference, the 31st annual, drew record attendance in March. Later this year, we’re looking forward to hosting our 4 th annual RMC Europe in Switzerland in September and our first-ever RMC in Asia by year’s end. CONCLUSION / WHITE PAPER Finally, I want to conclude my update with mention of a white paper on a study of options-based funds that CBOE released in January. The study analyzed investment companies such as mutual funds, exchange-traded funds and closed-end funds that use exchange-listed options for portfolio management. I’d like to share two of the main highlights from the study: 1) The number of funds using options grew sharply over the last fifteen years -- from 10 in 2000 to 119 in 2014. And those 119 funds have an aggregate value of more than $46 billion in assets under management. 2) Options-based funds that focused on using U.S. stock index options and/or equity options had higher riskadjusted returns and lower volatility than the S&P 500. We have received great feedback on the paper from buy-side customers in need of data-driven validation to increase their ability to use equity 5 derivatives to manage funds. If you’d like more information on the study, there are copies available at the CBOE booth outside. In closing, we are energized about the future as we look to grow options trading. We’re expanding our options and volatility product offerings to cover new asset classes and regions around the world. We’re broadening access to our marketplace through extended trading hours and new developments in trading technology. And we’re continuing to educate investors of all levels about options and volatility trading through a variety of engaging channels. Thank you and enjoy the conference. 6