Efficiency and Distributional Trade-Offs in Recycling Carbon Cap-and-Trade Revenues Ian Parry

advertisement

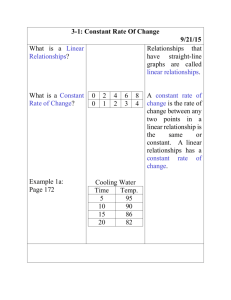

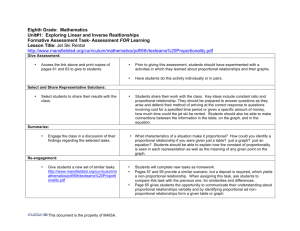

Efficiency and Distributional Trade-Offs in Recycling Carbon Cap-and-Trade Revenues Ian Parry Resources For the Future Roberton C. Williams III University of Maryland, University of Texas, Resources For the Future, and NBER Distributional Aspects of Energy and Climate Policy Conference January 20, 2010 • Carbon tax or cap-and-trade could raise large amounts of revenue (e.g., $33/ton by 2020 raises approximately $180 billion/year) • The use of that potential revenue greatly affects both the overall cost of the policy and the distribution of that cost Overview • Model Structure • Uses of carbon policy revenue to consider • Decomposition of overall policy costs under each option for revenue use • Decomposition of distributional effects under each option • Key results and conclusions Model Structure • Very simple static general-equilibrium model • Five representative households, one for each income quintile • Each household divides time between labor and leisure, and divides spending between energy-intensive and non-energy-intensive consumption • Constant returns to scale production with labor as the only primary factor of production, and all markets are perfectly competitive • Two ways to reduce carbon emissions: reduce households’ consumption of energy-intensive good, or reduce emissions per unit of that good produced Model Structure (cont.) • Government tax and transfer system: net tax paid by a household is piecewiselinear function of income, with five segments (tax brackets) – Transfer and tax bracket cutoffs automatically adjust based on price level • Spending on public goods is exogenously fixed • Government budget balance achieved through proportional change in taxes (tax increase/decrease for each income group is proportional to income) Uses of Carbon Policy Revenue/Rents 1) Proportional income tax cut: all carbon policy revenue used to finance a proportional cut in income taxes 2) Cap-and-dividend: all carbon policy revenue returned lump-sum, divided equally among households 3) Free permit allocation (grandfathering): all carbon permits allocated lumpsum to firms 4) Distribution-neutral: carbon policy revenue used to finance changes in taxand-transfer system that offset distributional effects of carbon policy itself Model Parameterization • Model intended to represent year 2020, but expressed in 2008 dollars • Household consumption and income patterns based on Consumer Expenditure Survey • Production, consumption, and labor supply elasticities based on estimates in the literature • Household quintiles defined by current-year income – Using quintiles based on current-year consumption or lifetime income would give smaller distribution effects Components of Overall Policy Cost • “Harberger triangle” or partial-equilibrium cost of policy: cost of substitution away from energy in production or away from energy-intensive consumption • Revenue-recycling effect: efficiency effect of changes in marginal income tax rates • Tax-interaction effect: welfare loss from interaction between income tax distortions and changes in labor supply caused by increased consumer prices • Income effect on labor supply: similar to tax-interaction effect, but caused by income effect from changes in government transfers or firm profits !"#$%&'()' *+,-+.&./0'+1'234"&.45'*+0/'+1'6+7"4"&0 (##$# '#$# "#$# 8'9"77"+. %#$# &#$# #$# )*+,+*-+./012/31452 6/,17189:98;.8 !&#$# !%#$# !"#$# ?/*@;*A;*12*9/.A0; E/3!9.2;*/4-+.1;D;42 E+2/01;D;42 B;:;.5;1*;4C409.A1;D;42 F.4+=;1;D;421+.10/@+*1>5,,0C <*;;1,;*=92> Components of Household Burden • “Carbon tax” term: burden from increased prices of energy-intensive consumer goods • Inflation-indexing term: gain from automatic adjustments in tax-and-transfer system in response to higher consumer prices • Income tax rate change term: gain or loss from policy-induced changes in income tax rates • Policy dividend term: policy dividend received under cap-and-dividend option • Permit rents: share of firm profits resulting from free permit allocation !"#$%&'()*' +,-.,/&/01',2'3&0'4$%5&/'67'8/9,-&':$"/;<&=' +)%6,/'>)?'@"0A'B%,.,%;,/)<'>)?'+$0 )#$% (#$% C',2'"/9,-& '#$% "#$% &#$% $#$% & " ' ( ) !&#$% !"#$% 0.-12345.6 738.9234:3;,6:3/ 73<2=,45.64-.5,4<>.3/,? @,541A-;,3 *+,-./, !"#$%&'()*' +,-.,/&/01',2'3&0'4$%5&/')6'7/8,-&'9$"/:;&<' +=%),/'>=?'@"0A'+=.'B'C"D"5&/5 )$%& #$%& '$%& E',2'"/8,-& %$%& !'$%& " ' * # !#$%& !)$%& !($%& !"%$%& !"'$%& !"#$%& 20/3456708 >4?<@A6=<-<=.5= E.763F/=.5 95:0;456<5=.8<51 95@4B.67086/07.6@C051.D + ,-./01. !"#$%&'()* +,-.,/&/01',2'3&0'4$%5&/'67'8/),-&'9$"/:;&<' +=%6,/'>=?'@"0A'!%&&'B&%-"01 )#$% (#$% "#$% C',2'"/),-& &#$% '#$% $#$% ' & " ( !'#$% !&#$% !"#$% 0.-12345.6 <,-=:54-,35> A,541B-;,3 738.9234:3;,6:3/ 73?2=,45.64-.5,4?@.3/,> ) *+,-./, Key Results • Overall cost much lower under proportional income tax cut than under capand-dividend or free permit allocation • Regressive distribution of costs from carbon policy itself • Inflation-indexing of tax-and-transfer system offsets part of cost to households, and makes distribution somewhat less regressive • Cap-and-dividend makes distribution much more progressive – Bottom three quintiles better off than under proportional tax cut – Bottom two quintiles better off than with no policy at all (even ignoring benefits from reduced carbon emissions) • Free permit allocation has high cost and regressive distribution – All five quintiles are worse off than under proportional income tax cut Conclusions • Use of revenue has potentially huge effects on both efficiency and distributional effects of carbon policy • Comparison of cap-and-dividend and income tax cut cases shows efficiencydistribution tradeoff – Choice between these two policies depends on how much we care about income distribution • Some free permit allocation may be politically necessary, but it comes at a high cost in terms of both efficiency and distribution