Consumer response to public reporting: Changes in market share in skilled nursing facilities

advertisement

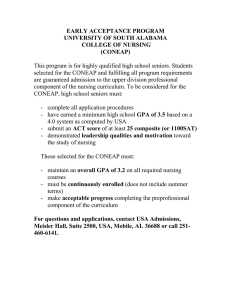

Consumer response to public reporting: Changes in market share in skilled nursing facilities Rachel Werner Tamara Konetzka Edward Norton Dan Polsky Funded by AHRQ Public reporting and quality improvement • Poor quality in part due to asymmetric information – Difficult for consumers to judge quality – Little incentive for providers to deliver high‐quality care • Public reporting of quality information is intended to improve quality by: – Giving consumers information needed to shop on quality – Giving providers incentive to compete on quality • Mixed evidence whether there is a consumer response to public reporting – Without a consumer response quality improvement under public reporting may not be sustainable Setting: Nursing Home Compare • Persistently low quality in nursing homes • Nursing Home Compare – CMS began publicly rating nursing homes in 2002 • Clinical quality measures • Staffing • Inspections – All Medicare‐ and Medicaid‐certified NHs • 17,000 nursing homes Research objectives • To examine whether consumers (or their agents) use publicly reported information when choosing a nursing home • To examine heterogeneity in the effect of information across markets, facilities, and consumers Conceptually… • In absence of report cards, demand for nursing homes may be affected by – Out‐of‐pocket costs – Service offerings – Location/availability – Observable NH quality – Unobservable characteristics (“belief” about NH quality) • Once report cards become available, they may change demand for nursing home care Empirical approach • Test for changes in NH market share as a function of report card scores • Pre‐post design – Pre period: 2000 to 2002 – Post period: 2003 • Falsification tests and sensitivity analyses Post‐acute care • Post‐acute care is transition between hospital and home – Skilled nursing facilities (SNFs) – 43% – Home health care – 40% – Inpatient rehab/LTACs – 11% • Empirically – Higher turn over in short‐stay vs. long‐stay residents – Less cognitive impairment – Medicare FFS beneficiaries face same out‐of‐ pocket costs Data • Minimum Data Set (2000‐2003) – – – – All Medicare‐ and Medicaid‐certified nursing homes Includes all nursing home admissions Detailed clinical data Source to calculate quality score for Nursing Home Compare • OSCAR – Facility characteristics Study sample • All U.S. nursing homes included in public reporting for post‐acute care – 8,137 nursing homes included in public reporting – 4,437,746 post‐acute care admissions • Fee‐for‐service beneficiaries • Age 65 or older Dependent variable: market share • Definition of market – Hospital Service Area – 2,254 markets • Market share – # admissions j,qtr # admissions m,qtr – 23% Key independent variable: Report card score • Facility‐level report card score • • • • Follow CMS specifications to calculate • • • • • • No pain No delirium Improved walking 14‐day assessment Use CMS risk adjustment Exclude small facilities (<20 cases/6 months) Based on data collected 3 to 9 months prior to the score’s calculation Updated quarterly Calculate before and after public reporting Key independent variable: Report card score Measure Definition Mean (SD) No pain % of residents without moderate or severe pain No delirium % of residents without delirium 96 (5) Improved walking % of residents whose walking improved or who remained independent in walking 28 (14) 75 (15) Nursing home markets # NH # markets # NH/market, mean (SD) 8,137 2,254 12 (13) # NH in public reporting/market, mean (SD) Occupancy rate, mean (SD) Range of reported scores within markets, mean (SD) No pain No delirium Improved walking 10 (11) .84 (.17) .31 (.19) .10 (.08) .30 (.19) Covariates • Facility characteristics – Profit status, size, chain, hospital based – % post‐acute care – Occupancy rate • Unobservable quality (“belief” about NH quality) – Demand that is not attributable to observable characteristics or distance from a facility – First‐stage demand prediction during pre‐reporting period based on factors that exogenously determine demand – Residual demand = Observed demand – Predicted demand – Includes prior, subjective beliefs Specification MktSharej,m,t = β1Scorej,t‐1 + β2postNHC + β3Scorej,t‐1*postNHC + Xj + Mktm – – – – – MktShare: Quarterly measures of facility market share Score: Report card score postNHC: pre‐post public reporting indicator variable X: facility covariates Mkt: Market fixed effects – β3: marginal change in market share related to report card score after public reporting Effect of publicly reported quality on market share Pain score* post Improved No pain No delirium walking All 3 scores 0.018*** 0.014*** 0.033** Delirium score* post Walking score* post Observations R‐squared *** p<0.01, ** p<0.05, * p<0.1 123,174 0.37 123,159 0.37 0.029* ‐0.010** ‐0.006 123,156 0.30 123,144 0.37 Falsification tests • Nursing homes without public reporting – Public reporting excludes small SNFs with fewer than 20 cases during target 6‐month period – ~20% of SNFs always excluded • 2,942 nursing homes • 442,952 post‐acute care admissions • False implementation date – Redefine pre period as 2000 – Redefine post period as 2001‐2002 – Exclude post‐NHC period (2003) Effect of public reporting on market share: Falsification tests Pain score* post Public reporting 0.014*** No public reporting False date ‐0.005 0.005 Delirium score* post 0.029* 0.002 ‐0.002 Walking score* post ‐0.006 ‐0.006 0.007 123,144 0.37 29,961 0.07 70,043 0.43 Observations R‐squared *** p<0.01, ** p<0.05, * p<0.1 Effect of public reporting on market share: Stratified analyses • Occupancy – Facilities that are not fully occupied at the initiation of public reporting will have the largest response • Choice of facilities – Markets with only 1 facility included in public reporting will have smaller response Effect of public reporting on market share: Stratified analyses Occupancy Choice of facilities High Low 1 > 1 Pain * post .001 .021*** ‐.000 .015*** Delirium * post ‐.000 .030 .037 .026* Walking * post ‐.012* .001 ‐.009 ‐.006 Observations R‐squared 60,820 0.30 62,324 0.39 12,296 0.01 110,848 0.41 *** p<0.01, ** p<0.05, * p<0.1 Does consumer education affect response to information? • Consumers with low education may be less responsive to report card information – Available online – Complex information • May not be a strong response if consumer is not decision maker – Role of family, discharge planners Effect of public reporting on market share: Role of education Less than college degree College degree or above .021*** .036*** Delirium * post .027* .042* Walking * post ‐.013* ‐.003 123,143 0.34 119,849 0.16 Pain * post Observations R‐squared *** p<0.01, ** p<0.05, * p<0.1 Summary • Nursing homes with higher report card scores gain market share • Effect size: – 1 pct point increase in pain score – Associated with 1.4 pct point increase market share • For the average nursing home: – Has 2 pct point improvement in pain score – Associated with 80 more patients/year Implications • Sustainability of public reporting – Demand‐side changes necessary to sustain provider response – Long‐run effects are unknown • Business case for public reporting – Direct financial consequences through market share – High‐scoring nursing homes have better financial performance under public reporting • Effects are heterogeneous – Less effective policy tool in concentrated markets – Less effective policy tool to improve quality for low‐SES consumers