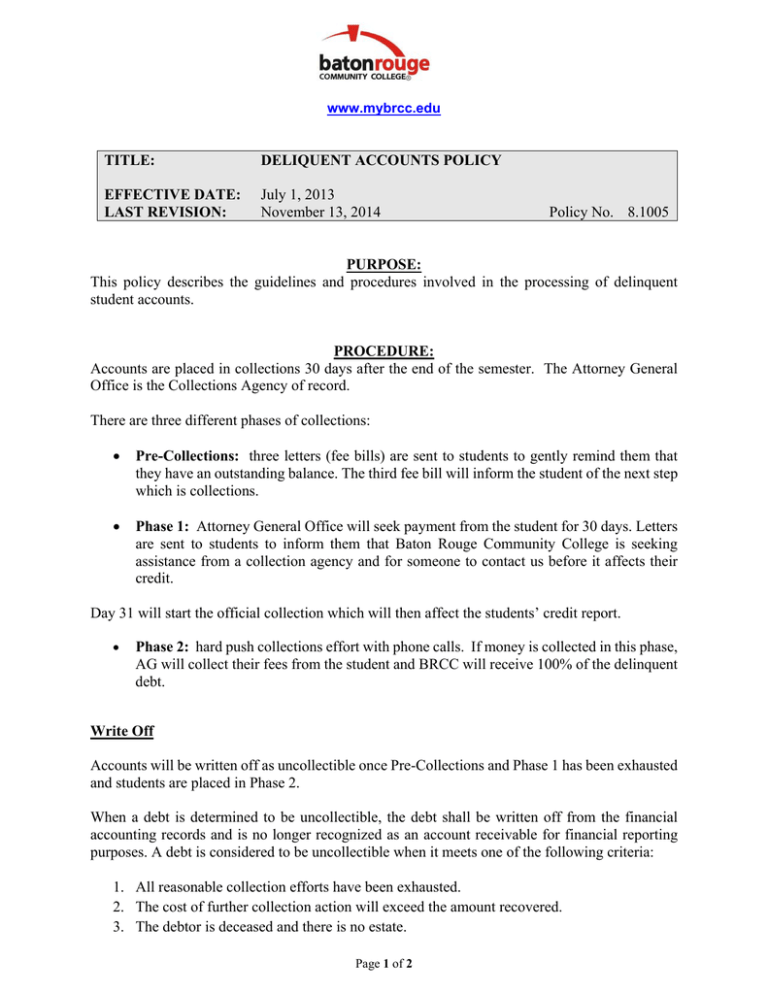

July 1, 2013 November 13, 2014 Policy No. 8.1005

advertisement

www.mybrcc.edu TITLE: DELIQUENT ACCOUNTS POLICY EFFECTIVE DATE: LAST REVISION: July 1, 2013 November 13, 2014 Policy No. 8.1005 PURPOSE: This policy describes the guidelines and procedures involved in the processing of delinquent student accounts. PROCEDURE: Accounts are placed in collections 30 days after the end of the semester. The Attorney General Office is the Collections Agency of record. There are three different phases of collections: Pre-Collections: three letters (fee bills) are sent to students to gently remind them that they have an outstanding balance. The third fee bill will inform the student of the next step which is collections. Phase 1: Attorney General Office will seek payment from the student for 30 days. Letters are sent to students to inform them that Baton Rouge Community College is seeking assistance from a collection agency and for someone to contact us before it affects their credit. Day 31 will start the official collection which will then affect the students’ credit report. Phase 2: hard push collections effort with phone calls. If money is collected in this phase, AG will collect their fees from the student and BRCC will receive 100% of the delinquent debt. Write Off Accounts will be written off as uncollectible once Pre-Collections and Phase 1 has been exhausted and students are placed in Phase 2. When a debt is determined to be uncollectible, the debt shall be written off from the financial accounting records and is no longer recognized as an account receivable for financial reporting purposes. A debt is considered to be uncollectible when it meets one of the following criteria: 1. All reasonable collection efforts have been exhausted. 2. The cost of further collection action will exceed the amount recovered. 3. The debtor is deceased and there is no estate. Page 1 of 2 www.mybrcc.edu 4. The debtor cannot be located. 5. The debt was discharged in bankruptcy. 6. The applicable statute of limitations for collection of the debt has expired (3 years). Writing off an accounts receivable is sensitive and should therefore be subject to strong internal accounting controls. All write-offs of uncollectible accounts receivable require the approval of the Vice Chancellor of Finance or designee. Holds Holds will be placed on student accounts once the account reach Phase 1. This will prevent the student from registering in future courses. (Holds will only be removed by Finance staff.) Holds are removed once accounts have been satisfied. Students with write-offs on their account will keep a hold until the debt is satisfied. Students who are expecting to receive financial aid in future semesters will be reviewed on a case-by-case basis. Source of Policy: Finance Related Policy: Approved by: Chancellor Andrea Lewis Miller Responsible Administrator: VC for Finance LCTCS Policy Reference: 5.008 LCTCS Guideline Reference: Date: 11/13/2014 Page 2 of 2