The Play Spring 2011

advertisement

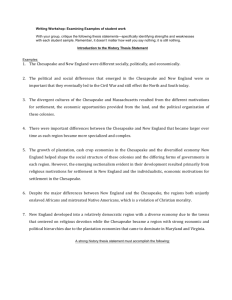

ThePlay The Play Spring 2011 A quarterly publication of Chesapeake Energy Corporation Ready for business, Driller William Fuller works on Nomac Rig #243 in Marshall County, West Virginia. CHK’S RESERVES/PRODUCTION 3.5 Average daily production (Bcfe/day) Reserves in Bcfe 150,000 100,000 50,000 YE’ 2006 YE’ 2007 YE’ 2008 YE’ 2009 YE’ 2010 175 Estimated oil production Estimated natural gas production 3.0 200,000 200 Oil production Natural gas production 150 Average operated rig count Estimated rig count 2.5 125 2.0 100 1.5 75 1.0 50 0.5 25 0 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 11E 12E ’04 2005 2006 2007 2008 2009 2010 0 The Play: Bone Spring Average operated rig count 4.0 Unrisked, unproved reserves Proved reserves 250,000 0 2 PRODUCTION RESERVES 300,000 CONTENTS SPRING 2011 Rigging up for a new play in the legendary Permian Basin 4 Neighbors Great and Small Protecting wildlife at every phase of natural gas and oil development 8 CHK’S OPERATING AREA MAP Powder River Basin Niobrara and Frontier The Play: Marcellus Shale Anadarko Basin Williston Basin Cleveland/Tonkawa and Mississippian DJ Basin Niobrara and Codell Marcellus Shale Dynamic operations supply energy while enlivening local economies 10 What Price Power? Finding better, more cost-effective ways to produce energy 12 Inside Chesapeake A closer look at the company’s people and progress CHESAPEAKE ENERGY CORPORATION is the secondAnadarko Basin Texas Panhandle Granite Wash Anadarko Basin Colony Granite Wash Haynesville Shale Permian Basin Delaware Basin Permian Basin Midland Basin Natural gas plays Liquids plays States with CHK leasehold Printed on recycled paper Barnett Shale South Texas Eagle Ford Shale Bossier Shale largest producer of natural gas, a Top 15 producer of oil and natural gas liquids and the most active driller of new wells in the U.S. Headquartered in Oklahoma City, the company’s operations are focused on discovering and developing unconventional natural gas and oil fields onshore in the U.S. Chesapeake owns leading positions in the Barnett, Fayetteville, Haynesville, Marcellus and Bossier natural gas shale plays and in the Eagle Ford, Granite Wash, Cleveland, Tonkawa, Mississippian, Wolfcamp, Bone Spring, Avalon, Niobrara and Williston Basin unconventional liquids plays. The company has also vertically integrated its operations and owns substantial midstream, compression, drilling and oilfield service assets. ThePlay Play SPRING 2011 THE PLAY: THE ACTIVE EXPLORATION FOR NATURAL GAS, OR THE AREA BEING EXPLORED OR LEASED; SEISMIC ACTIVITY, LEASING, WILDCATTING IN OR ON A TREND. EXECUTIVE PROFILE THE ACCOMPLISHMENTS OF JEFF MOBLEY, CHESAPEAKE’S SENIOR VICE PRESIDENT – INVESTOR RELATIONS AND RESEARCH, REINFORCE THE THEORY THAT EVERYTHING YOU LEARN TODAY CONTRIBUTES TO YOUR FUTURE SUCCESS. Mobley joined Chesapeake in May 2005, excited by Aubrey McClendon’s plans to establish a dedicated Investor Relations and Research “I AM VERY PROUD OF HOW WELL Department in the company. THE COMPANY NAVIGATED SUCH Raised on a farm and ranch in southern New VOLATILE COMMODITY AND Mexico, Mobley received an agriculture business FINANCIAL MARKETS OVER THE degree with honors from New Mexico State PAST FEW YEARS. IT’S TRULY AN University and later became the second-youngest IMPRESSIVE ACCOMPLISHMENT.” MBA student in his class at the Wharton School of Business at the University of Pennsylvania. Mobley’s interest in commodities first led him to trading and marketing agricultural products for Archer Daniels Midland, a major agribusiness conglomerate. Following graduate school, he worked in finance on a variety of private equity investments and capital markets transactions in both corporate and investment banking roles. His analytical and financial market interests led him to an equity research career with Raymond James & Associates where he covered exploration and production Jeff Mobley companies, including Chesapeake. Senior Vice President Investor Relations and Research “I didn’t have intentions of becoming an investor relations (IR) professional,” Mobley said. “But I realized that at Chesapeake – and only at Chesapeake – would I have the ability to combine all the experience I gained earlier in my career and pursue multiple interests. “I had no doubts about joining the company in the spring of 2005,” he said. “As an equity research analyst I had rated CHK shares a ‘strong buy’ at $16 stock and had projected a $34 price over the next year. And it happened in six months! Certainly, I thought very highly of the company and also believed that Aubrey and Steve Dixon were two of the best leaders in the industry. “What I couldn’t appreciate at that time was the velocity of business at Chesapeake – the speed and skill of its operations – and how well its business is orchestrated, particularly for a company of its size. Those characteristics cannot be fully appreciated from outside the company.” Mobley’s charge at Chesapeake was to establish a group to articulate what the company accomplishes in its business and to communicate effectively with the company’s investors. “One of our key objectives is to help achieve better pricing of the company’s debt and equity securities,” Mobley said. The IR and Research Department also provides research and analysis on oil and natural gas markets for Chesapeake’s highly successful hedging program. Following the departure of Tom Ward, a co-founder and former President of the company, Mobley was added to the company’s hedging committee, and today he is a primary executor of Chesapeake’s hedging transactions, along with McClendon and Nick Dell’Osso, Chesapeake’s CFO. What’s been the biggest source of excitement and pride during his six years with the company? “Far more has happened in Chesapeake than anyone could have predicted,” Mobley said. “I am very proud of how well the company navigated such volatile commodity and financial markets over the past few years. It’s truly an impressive accomplishment.” Over the past six years, Mobley’s IR and Research team has helped execute 26 debt and equity offerings and disseminated more than 250 press releases, and its efforts have gained market recognition and awards from IR Global Rankings, IR Magazine and Institutional Investor Magazine, very significant honors in the national investor relations field. The Play Spring 2011 THE PLAY: BONE SPRING MILESANDMILESOFTEXAS On the surface, not much changes in the Permian Basin of West Texas. The sun shines. The wind blows. The flat, semi-arid landscape stretches from horizon to horizon. For hundreds of miles, there is only silence, broken occasionally by the squeak of a windmill or the thump of a pumpjack. By Cheryl Hudak IT’S RIG UP TIME AGAIN IN THE PERMIAN BASIN Working as a team, Production Superintendent Chip Roemisch, left, and Completion Superintendent Mark Mabe study a field map in the Midland, Texas, office. Below, night lighting on the Monroe 34-205 1 H in Ward County, Texas, enables crews to work around the clock. Far right, a desert panorama of the Blacktip 1-21 2H in Ward County, Texas. 2 The Play Spring 2011 BENEATH THE GROUND HOWEVER, THIS LEGENDARY FIELD HAS MORE PLAYS THAN WILLIAM SHAKESPEARE. AND THE DRAMA OF FINDING AND DEVELOPING THOSE VAST NATURAL GAS AND OIL RESOURCES HAS CONTINUED FOR ALMOST A HUNDRED YEARS. Bringing up oil begins with finding it, land and leasing requirements, reserves, and the complicated geology of the region coordinating well completions and tie-ins presents a challenge. for oil and gas gathering. “The targeted interval of the Bone Spring “This play is completion and technology formation lies about 9,000 to 10,500 feet driven,” said Jay Stratton, Permian District deep, between the Avalon Shale formation Manager. “So cost control and optimizing above and the Wolfcamp below,” said David completions for productivity is the name of Godsey – Geoscience Manager of the Perm- the game. We improve our return on investToday, Chesapeake Energy Corporaian District, Western Division. “Actually, in ment by doing the same numbers of perfotion is opening a new play in the South the Bone Spring there are three sequences of ration clusters, but in fewer frack stages, balPermian’s Bone Spring formation, as part sand interspersed with intervening carbon- ancing the cost of fracking with well output.” of its transition to more liquids-rich asset Walker admits that he is fascinated with bases, which the company is doing to take ates and organic source bed shales. It’s althe fracking process. advantage of the significant and persistent most like a patchwork quilt or a mosaic.” Currently, the com“Fracking is the greatest thing value gap that has developed between pany is primarily active in “THE BONE SPRING I’ve ever done, other than having natural gas and oil prices. the deepest of the three kids,” he said. “It is all about The company’s first Bone Spring well, PLAY IS ONE OF A LONG making the most contact between University 19-14 W 1H, was drilled in Febru- Bone Spring strata. After the wellbore and the reservoir, ary 2007. The game changer, however, was drilling to the appropriate SERIES OF ENERGY BOOMS IN THIS REGION. vertical depth, the welland fracking is how you do it. It’s the Johnson 1-76 1H in Loving County, Texbore kicks off to move pretty cool to think of everything AND MOST PEOPLE as, which opened with initial production horizontally through one you can do in a frack job to get (IP) of 1,000 barrels of oil equivalent per day DIDN’T THINK WE of the more porous sand- COULD STILL DRILL the best results from a well. And (boe/d). The company’s last four wells in stone layers. The well is you see those results in less than a the region had IP exceeding 1,000 boe/d, in1,000-BARREL-PER-DAY week when the frack is complete. cluding the Monroe 1-17 1H in Ward County, completed by hydraulic which IP’d at 2,195 boe/d, including 3.1 mil- fracturing, which creates WELLS DOWN HERE.” We’re really proud of what we do. lion cubic feet (mmcf/d) of natural gas and 1,665 barrels of oil per day (bbs/d). In February 2011, Chesapeake was operating five rigs in Loving, Reeves and Ward counties, Texas, and partnering with Anadarko Petroleum Corporation on another six fissures into the impermeable shale layers Out here we say we work 24/7 to get cheap wells. Chesapeake has identienergy to America.” fied approximately 1,600 poten- that lie above and below it. “This is not as easy as it sounds,” Godsey Success requires an interdisciplinary tial wellsites on 270,000 acres said, explaining that the targeted sandstone team that includes the asset manager, of leasehold in the Bone Spring intervals are only about 12 feet thick. geologist, reservoir engineer, landman, and adjacent Avalon Shale, How do they fi nd those slim targets, drilldrilling engineer, petrophysicist and which extends into New Mexico. ing down as far as two miles beneath the sur- representative from Chesapeake Energy The liquids-rich aspect of Marketing Inc. (CEMI). Drilling, production the play is particularly attractive face of the earth? “It is a deductive process,” Godsey said. and transportation groups also meet every to Chesapeake, with oil repre“We do a lot of mapping and analyzing of two weeks with their Anadarko counterparts senting approximately 75% of existing wells and how they produce. It’s to plan development for the Chesapeakethe Bone Spring reserves. The Anadarko partnership wells. company is targeting 350 thou- similar to zooming in on a city map with a computer mapping system – each map is There is a long way to go in the Bone sand barrels of oil (mbo) and an estimated 890 million cubic feet progressively more detailed – until we arrive Spring Play. Its full extent has yet to be deterat a map of the ‘sweet spot,’ showing sand mined, so drilling crews are moving north (mmcf) of natural gas per well in the play. within the Bone Spring and finally, oil in and northwest to evaluate its boundaries. “The Permian is more drilled up than place in the particular strata.” Currently, oil is being trucked out of the area any oil play in the U.S., except maybe OklaThe enormous volume of data means and gas is transported by pipelines with an homa,” said Josh Walker – Asset Manager, expanded infrastructure under construction Permian Basin. “Midland, Texas, is the hub computers are the indispensible tools of geologists and geophysicists. But they still to accommodate new oil and gas production. of the Permian, and almost everyone in town “How are we going to take this play from is involved in the natural gas and oil industry. rely on their own knowledge, experience and common sense, which are critical two rigs to the rig count we have in ChesaTwo years ago, when most cities in America peake’s other successful plays?” Walker had double-digit unemployment, Midland as they interpret and analyze the data provided by well logs and complex mapping asked. “Well, there’s not a doubt in anyone’s had a negative unemployment rate! systems. The process involves a wide range mind that it will get done. No one out here “The Bone Spring Play is one of a long series of energy booms in this region,” Walk- of high-tech disciplines, as well as fracture says, ‘We can’t do that.’ Our field guys are gung ho. We all are.” er added, “and most people didn’t think we stimulation models to determine how to provide each well maximum contact with That gung ho attitude may be one more could still drill 1,000-barrel-per-day wells the surrounding rock. thing that never changes in West Texas. down here.” Ultimately, wellsite selection depends on even broader factors than geology, such as 3 The Play Spring 2011 THE ENVIRONMENT: SPECIES PROTECTION NEIGHBORS AREN’T ALWAYS THE PEOPLE YOU PASS ON THE STREET, SIT NEXT TO IN CHURCH OR SEE IN THE LOCAL GROCERY STORE. THEY ARE ALSO THE FURRY, FEATHERED AND SCALY CREATURES THAT SHARE OUR WORLD EVERY DAY. While these neighbors do not have voices of their own, Chesapeake continues to look out for their well-being throughout our operations. As an environmentally friendly Dunes sagebrush lizard operator and good neighbor, the company strives at every phase of development, from wellsite selection to restoration, to protect all creatures, including vulnerable species and their habitats. “When we begin looking at potential wellsite locations in areas identified as habitats of endangered As a proactive measure for site planning, Chesapeake reviews both federal and state Threatened and Endangered Species lists (T&E lists) and their locations so that these areas can be evaluated as soon as possible. There are currently more than 1,240 wildlife species listed by the U.S. Fish and Wildlife Service, as well as 796 plant varieties on these lists. Some of these species have unique habitat and life cycle requirements, and a number of special techniques are required to avoid impacting them. For example, when working within a two-mile radius of areas known to be home to the endangered American burying beetle, Chesapeake hires a consultant to trap and relocate or bait-away the insects before beginning work on any construction projects. The company also recognizes local creatures that are not listed on the T&E lists, but are protected by separate regulations. Animals chicken in Colorado, Kansas, New Mexico, Oklahoma and Texas,” said Miller. “We have to be familiar with the unique ecosystem in their areas to ensure that all of these species are continuously protected throughout our operations.” In addition to these efforts, Chesapeake also implements a number of best management practices (BMPs) at its locations, lease roads and rights-of-way to control erosion and sediment run-off that might have a negative impact on lakes, streams or rivers. The company’s BMPs can be as simple as preserving as many healthy trees near a location as possible, or constructing sites with natural contour lines to flow with the land. More intensive methods include using silt fences to intercept sediment and creating temporary berms or ridges similar to pond dams to channel water appropriately. After construction on any project is complete, Chesapeake uses sod, mulch, seeding and vegetation buffer strips at the top and bottom of slopes H GREAT&SMALL By Brandi Wessel PROTECTING OUR NEIGHBORS 4 or sensitive species, a survey is conducted to determine the potential impact of our operations,” said Dewayne Miller, Regulatory Affairs Environmental Specialist, who has a master’s degree in Wildlife and Fisheries Ecology and is a certified wildlife biologist and wetland scientist. “If we determine that a location could impact animals, habitat or specific vegetation in an area, we look for ways to move the location or, if possible, conduct our operations during natural migratory or hibernation periods when the species are not present.” The Play Spring 2011 such as the bald and golden eagle are protected under the Bald and Golden Eagle Protection Act of 1940 and the Migratory Bird Treaty Act of 1918. Chesapeake must also consider candidate species – animals that have sufficient data to support their inclusion on the T&E lists, but have been left off due to the higher priority of other species. “There are a number of candidate species that are not listed on the T&E lists in the areas where we operate, like the dunes sagebrush lizard in New Mexico, the yellowcheek darter in Arkansas and the lesser prairie and critical locations to stabilize soil and eliminate erosion. Local vegetation is also replanted around the site. “Through recent years we have developed a number of BMPs to help minimize our impact on local habitats,” said Miller. “These practices are continually evaluated and added to as we expand our technologies and operating knowledge. We also work with state organizations and nonprofits to protect the environment for future generations.” Platanthera leucophaea Eastern prairie fringed orchid 5 A few of our protected neighbors Haliaeetus leucocephalus Bald eagle L “IF WE DETERMINE THAT A LOCATION COULD IMPACT ANIMALS, HABITAT OR SPECIFIC VEGETATION IN AN AREA, WE LOOK FOR WAYS TO MOVE THE LOCATION OR, IF POSSIBLE, CONDUCT OUR OPERATIONS DURING NATURAL MIGRATORY OR HIBERNATION PERIODS WHEN THE SPECIES ARE NOT PRESENT.” Lesser prairie chicken Tympanuchus pallidicinctus Nicrophorus americanus American burying beetle ■ AMERICAN BURYING BEETLE – Listed as an endangered species by the U.S. Fish and Wildlife Service, the American burying beetle distribution encompasses eight states, including Arkansas, Kansas, Massachusetts, Nebraska, Oklahoma, Rhode Island, South Dakota and Texas. ■ BALD EAGLE – Standing as the symbol of our nation, the bald eagle is protected under the Bald and Golden Eagle Protection Act of 1940 and the Migratory Bird Treaty Act of 1918. ■ DUNES SAGEBRUSH LIZARD – The dunes sagebrush lizard calls the deserts of New Mexico and four western counties in Texas (Andrews, Gaines, Ward and Winkler) home and was petitioned for listing as a threatened or endangered species under the U.S. Endangered Species Act in 2002. The dunes sagebrush lizard is currently a candidate species. ■ EASTERN PRAIRIE FRINGED ORCHID – Found throughout the Midwest, the native perennial plant was listed as a threatened species in 1989. ■ GRAY BAT – The gray bat lives year-round in caves in the southern U.S. and was listed as an endangered species in 1976. ■ LESSER PRAIRIE CHICKEN – Once abundant across the American prairie, the lesser prairie chicken can now only be seen in sandhills and prairies of western Oklahoma, the Texas Panhandle, the Llano Estacado of Texas and eastern New Mexico, as well as rarely in southeastern Colorado and western Kansas. The lesser prairie chicken was petitioned for listing in 1995 and is currently a level two candidate species, which is the level just prior to being listed. ■ SPECKLED POCKETBOOK – Only found in a sixmile stretch of the Middle Fork of the Little Red River in Arkansas, the speckled pocketbook is a freshwater mussel that was listed as an endangered species in 1989. ■ YELLOWCHEEK DARTER – The yellowcheek darter calls four tributaries of the upper Little Red River in Arkansas home and is currently a candidate for listing. The Play Spring 2011 Keeping the lights on in Wyalusing Borough Wyalusing Borough, located in the southeast corner of Bradford County, Pennsylvania, sits serenely on the Susquehanna River. Covering approximately one and a half square miles, the borough is home to approximately 570 residents. The borough owns property in Wyalusing Township and recently signed a lease to drill with Chesapeake. Funds from the lease bonus will enable the borough to move forward on several community projects. One of the potential projects is repairing and upgrading storm drains. Being so close to a river and sitting only 750 feet above sea level, flooding can be a real problem in the Wyalusing Borough, according to Secretary and Treasurer Stacy Hart. “We haven’t finalized how we will spend the funds, but repairing water drains is on the list,” Hart explained. Also slated for repair are the street lights on Main Street, which only work intermittently. “The lease bonus means a lot to our small community. It gives us the financial boost to expedite many of these projects,” she added. 6 The Play Spring 2011 BOO THE PLAY: MARCELLUS SHALE OOMING ING OOM By Laura Bauer Business is Marcellus Shale operations continue to provide growing supplies of natural gas FOR 200 YEARS, THE APPALACHIAN MOUNTAINS HAVE PROVIDED ENERGY FOR AMERICA IN THE FORM OF COAL. SINCE TECHNOLOGICAL ADVANCES RECENTLY UNLOCKED THE MYSTERIES OF SHALE GAS DEVELOPMENT, THE AREA NOW PRODUCES A MUCH CLEANER ENERGY SOURCE, NATURAL GAS. AND CHESAPEAKE IS HELPING PAVE THE WAY. With an estimated 500 trillion cubic feet (tcf) of technically recoverable reserves, the Marcellus Shale is likely to become one of the two largest natural gas fields in the U.S. Chesapeake has a number-one position in the play, with more than 1.7 million acres of leasehold and 90 tcf equivalent of net unrisked, unproved potential. The company currently has 33 drilling rigs producing natural gas and oil, with plans to drill approximately 300 wells in 2011. 7 The Play Spring 2011 (Continued from page 7) Chesapeake first put down roots in the Appalachian Basin in late 2005 with the $2.2 billion acquisition of Columbia Natural Resources, a West Virginia-based natural gas producer. Aggressive by nature, Chesapeake didn’t waste any time finding a local drilling company to expedite drilling operations. In 2006, the company purchased a local drilling company, Gene D. Yost & Son, Inc. (Yost). As a Chesapeake subsidiary, Yost’s first priority was servicing Chesapeake’s Eastern Division operations. Yost was founded in 1960 by Gene Yost and over the years had earned a solid repu- 8 sidiaries often traded rigs, information and training, so it made sense when Yost came under the Nomac umbrella in January 2009. “By blending Yost into Nomac, we tation in the community. When it was acquired by Chesapeake, Yost was operated were able to better align Chesapeake’s drilling services programs by having a central by Gene’s son, Duane Yost. The company had 15 drilling rigs, trucks to move the rigs drilling entity, rather than two separate and a variety of ground-based equipment. groups,” explained Dave Fisher, Chesapeake Vice President - Drilling Services. At that time, the company primarily proThe result has improved knowledge vided excavation services, and the coal intransfer across Nomac’s operations and dustry was an important part of Yost’s busistreamlined training and safety processes. ness for many years. Its drilling activities centered around dewatering wells, shallow Nomac currently has 107 rigs operating in seven states. gas wells and degasifier wells to bleed off the methane released when miners cut into coal. Once acquired by Chesapeake, the company’s focus shifted to natural gas drilling operations. Chesapeake continued acquiring leases and spud its first vertical Marcellus Shale test well, the Altman 1, in September 2006. It was drilled by Yost rig #290. For a couple of years, Yost continued to operate as Chesapeake’s Eastern Division drilling company, while Nomac Drilling serviced the rest of the company’s Dennis and Brett Boyanowski operating areas. The two Chesapeake sub- The Play Spring 2011 Nomac’s Eastern Division Training Center and Housing Facility opened in November and trains locals to work in the region. Saving the family farm Dennis and Sherre Boyanowski met in 1965 when Sherre’s family bought 400-plus acres next to Dennis’ family farm on Dolittle Hill in Wyoming County, Pennsylvania. Dennis’ family had lived there since 1925. Several years later, Dennis and Sherre married, combining both their lives and their acreage. They used their 565 acres to maintain a herd of 35 dairy cows and provide for their four children. As with many farmers, keeping the farm afloat has been difficult and paying the tax bill a struggle. The surface disturbance payments they received from Chesapeake for two padsites planned for their property came at just the right moment, covering the tax bill at a time when they had no other solution. The Boyanowskis’ partnership with Chesapeake allowed them to keep the property and preserve the family farm. The first two wells, the Franclaire E 6H and Franclaire W 4H, started drilling earlier this year. 9 “BY INVESTING IN THIS TRAINING CENTER, WE ARE PREPPING FOR AN INCREASE IN WORKER KNOWLEDGE AND EXPERTISE IN THIS PART OF THE COUNTRY.” “Now that we have the same drillworkers. To help develop a local skilled laing company from the Eagle Ford Shale in bor force, Nomac built a training center and South Texas to the Marcellus Shale in Penn- housing facility in Sayre, Pennsylvania. The sylvania, we are able to share efficiencies company’s Eastern Training Center and and improve overall operaHousing Facility is a nearly tions,” Fisher added. 40,000-square-foot campus SINCE JANUARY 2008, But there’s nothing quite CHESAPEAKE HAS PAID that serves as both housing like operating in the East. and training grounds for 266 NEARLY $1.2 BILLION With mountainous terrain, workers at a time. The center TO LANDOWNERS IN winding roads, steep cliffs opened in November 2010. LEASE-BONUS PAYMENTS and icy weather, operating in “By investing in this the Marcellus Shale poses its AND ROYALTIES IN training center, we are prepown sets of challenges. PENNSYLVANIA ALONE. ping for an increase in work“There was definitely a er knowledge and expertise learning curve in the Marcellus Shale. Safe- in this part of the country,” said Fisher. “We ty is always a priority, and ensuring we had currently have to fly crews from other opthe proper training and equipment is a big erating areas here to help man the rigs, but deal,” said Fisher. now we can accelerate recruitment and Another challenge was finding quali- train people from the communities where fied workers to man the rigs. In all its opera- we are drilling.” tions, Chesapeake hires locally whenever The last six years have proved fruitful possible. Since drilling was new to the refor both Chesapeake and local communigion, there wasn’t a large pool of qualified ties boosted by Marcellus Shale operations. While many states struggle economically, those with drilling operations are experiencing an economic stimulus through direct lease bonuses and tax payments. In addition, many businesses are thriving due to the additional work in the region. Since January 2008, Chesapeake has paid nearly $1.2 billion to landowners in lease-bonus payments and royalties in Pennsylvania alone. It also awarded more than $350 million in contracts to vendors and provided more than $1.5 million in support to local hospitals, service groups, libraries, economic development and other community organizations in the state. Other states with Marcellus Shale operations are also reaping the benefits. With a more than 200-year supply of natural gas in the U.S., the boom is here to stay as the Appalachian region continues providing clean energy for America. The Play Spring 2011 THE TECHNOLOGY: HIGH-TECH ENERGY SAVINGS Solar-powered battery unit HOW FAR WOULD YOUR ELECTRIC PAYMENT GO IN THE ENERGY BUSINESS? 10 REDUCINGTHE REDUCING THE PRICE OF POW PRICE OF PO By Laura Bauer Considering that an average home uses 1,300 kilowatt hours of electricity per month at a cost of $130, your electric payment would pay for: ■ 150 Supervisory Control and Data Acquisition (SCADA) wellsite reporting systems. These solar/battery-powered systems collect well production data and automatically report it on an ongoing basis. ■ One 1,800-watt Cathode Protection System, which controls pipeline and well casing corrosion by applying a small electric current to the metal pipe, allowing another “sacrificial” piece of metal in the system to corrode, instead of the pipe. Or, 10 average homes would run one 25horsepower gas compressor for one month. Or, 80 homes would run one 200-horsepower electrical submersible pump, which pumps large amounts of fluid up the well casing for processing. New programs help Chesapeake manage the energy required to produce energy The Play Spring 2011 as through the use of controls, variable speed drives and higher efficiency motors. An example is optimizing electrical power line design. “In our Pennsylvania frack water pumping project, we changed the type of water transRigs have to turn, gas has to be compressed, fer pipe so we can have a single pump station at the river instead of multiple pump sites along the pumps have to move liquids from storage tanks transfer line. This reduces the length of the utility to collection points, production data has to be transmitted and well casings and pipelines have power line,” Chapman explained. “We saved more to be electrically charged to protect against corro- than $1 million for every 10 miles we reduced the sion. If that’s not enough, offices have to be lit and power line length.” Chesapeake is also changing the structurcooled, computer systems have to be powered al way we obtain electrical energy. In some areas, and cell phones have to be charged. such as our Niobrara Play in WyoAll this energy comes at a hefty price; Chesapeake pays “IN NORTHERN OKLAHOMA ming, we are aggregating loads to get a rate reduction. With aggre$21.5 million a year for electric WE REDUCED POWER COSTS gated loads, one meter is used for power. More than $17 million of that total is used in operations and ABOUT $8,000 PER MONTH all wellsites in an area, which results in lower prices. about $4.5 million in corporate FROM ALFALFA ELECTRIC COOPERATIVE BY USING THE “In northern Oklahoma,” and field offices. To help Chesapeake manage AGGREGATED LOAD CONCEPT Chapman said, “we reduced power costs about $8,000 per energy costs, electrical engineer IN SUPPLYING POWER month from Alfalfa Electric CoTerry Chapman recently joined the TO OUR ELECTRICAL operative by using the aggregated company’s Engineering Technolload concept in supplying power ogy Group (ETG) as Engineering SUBMERSIBLE PUMPS.” Advisor – Power and Special Projects. He is tasked to our electrical submersible pumps.” In some locations the company is able to with setting new standards and guidelines on everything related to power: procurement, proto- generate its own electricity by using natural gaspowered generators or other alternative energy cols and safety. It is a daunting – and growing – challenge that sources. Natural gas generators avoid the high cost involves rethinking how we use energy, as well as of running utility lines at the company’s Millers dealing with 120 different utility companies located and Pleasants compression facilities in West in states throughout Chesapeake’s operating areas. Virginia and at vapor recovery units in western Oklahoma. On the Pauline 1-9 well in Kingfisher, LIKE MOST COMMERCIAL POWER USERS, CHESAPEAKE IS BILLED DIFFERENTLY Oklahoma, a portable power unit uses wind energy with battery storage to power a pumpjack. THAN A RESIDENTIAL CUSTOMER. Solar-powered batteries are used to transmit Its power bills are comprised of three parts: production data at many wellsites. an energy charge based on the amount of total CHESAPEAKE ALSO REDUCES TOTAL electricity consumed, a demand charge based on the company’s maximum usage for any 15-minute ENERGY COSTS BY SWITCHING TO ELECTRIC period during the previous 12 months, and POWERED DRILLING RIGS. Most of its drilling miscellaneous items such as fuel charges, taxes rigs are diesel fueled, the cost of which is not and special assessments. included in the $21.5 million electric bill. In the “We use monthly utility reports to review Barnett Shale of North Texas, where large volumes how much energy we use and how we are of electricity are available, five rigs are powered charged,” Chapman said. “The reports are closely directly through the urban electric grid. monitored to evaluate rates and recover billing “Electric grid drilling uses more electricity, errors. We stay abreast of energy market dynamics but it reduces Chesapeake’s overall energy as we deal with power producers, whether they costs because electric drilling, when you have are rural cooperatives, regulated monopolies or access to it, is less expensive than diesel drilling,” deregulated entities.” Chapman noted. Andrew McCalmont, Manager – Gas STAR, Regardless of its source, Chesapeake is Power and Projects, said, “We understand that as finding better, more cost-effective ways to produce Chesapeake grows its oil and gas production, energy, and employees like Chapman and we need better interaction among the staff, our McCalmont are helping. field personnel and power providers. Through “We’re catalysts,” Chapman said. “But the Terry Chapman’s efforts, we are addressing some larger value of the Engineering Technology Group very important issues which translate directly is that when we do our jobs really well, someone to the bottom line.” else’s projects go better, too.” Chapman also focuses on cost reductions through engineering design and planning, as well IT TAKES MORE THAN BRILLIANT SCIENTISTS AND HARDWORKING FIELDHANDS TO BRING UP NATURAL GAS AND OIL IN TODAY’S HIGH-TECH ENERGY INDUSTRY. Wind energy portable power unit 11 Use of solar and wind power adds up to savings on the Pauline 1-9 well in Kingfisher, Oklahoma. WER OWER The Play Spring 2011 INSIDECHK INSIDE CHK 12 A closer look at Chesapeake’s people and progress CHESAPEAKE CLIMBS IN FORTUNE RANKINGS AS A GREAT PLACE TO WORK For the fourth consecutive year, Chesapeake Energy Corporation was named to FORTUNE magazine’s 100 Best Companies to Work For® list. The company was listed as number 32, up from number 34 in 2009, and is the highest ranking company in Oklahoma and the highest ranking energy producer. “We are honored and excited to have been selected again this year as one of America’s best places to work,” CEO Aubrey McClendon said. “We have long recognized that our employees are our most valuable asset and we continue to look for innovative ways to enhance their professional and personal experience at our company. Chesapeake’s unique corporate culture of achievement and innovation, along with cutting-edge benefits, have enabled us to attract and retain what we believe is the best talent in the industry.” To determine the rankings, FORTUNE partners with the Great Place To Work Institute®, which conducts random surveys, asking employees about leadership, communication, programs and policies. Entrants also submit a culture audit, explaining the company’s benefits, incentive programs and other perks available to employees. Some of Chesapeake’s culture audit highlights included its outstanding 401(k), in which the company matches contributions up to 15% of salary; a $1,500 annual Living Well bonus, which employees can earn by participating in healthy activities; a generous sense of community service, wherein employees gave more than 30,000 hours in volunteer time to community programs; and a work atmosphere that facilitates personal achievement and innovation. ThePlay is designed and published each quarter by the Corporate Communications Department of Chesapeake Energy Corporation, P.O. Box 18128, Oklahoma City, OK 73154-0128. Telephone 405-935-4761 Email the editor, Cheryl Hudak, at publications@chk.com. “The Play” is online at www.chk.com under Media Resources. This publication includes “forward-looking statements” that give our current expectations or forecasts of future events, including estimates of oil and natural gas reserves, projected production and future development plans. Factors that could cause actual results to differ materially from expected results are described in “Risk Factors” in the Prospectus Supplement we filed with the U.S. Securities and Exchange Commission on July 10, 2008. These risk factors include the volatility of natural gas and oil prices; the limitations our level of indebtedness may have on our financial flexibility; our ability to compete effectively against strong independent natural gas and oil companies and majors; the availability of capital on an economic basis, including planned asset monetization transactions, to fund reserve replacement costs; our ability to replace reserves and sustain production; uncertainties inherent in estimating quantities of natural gas and oil reserves and projecting future rates of production and the amount and timing of development expenditures; uncertainties in evaluating natural gas and oil reserves of acquired properties and associated potential liabilities; our ability to effectively consolidate and integrate acquired properties and operations; unsuccessful exploration and development drilling; declines in the values of our natural gas and oil properties resulting in ceiling test write-downs; risks associated with our oil and natural gas hedging program, including realizations on hedged natural gas and oil sales that are lower than market prices, collateral required to secure hedging liabilities and losses resulting from counterparty failure; the negative impact lower natural gas and oil prices could have on our ability to borrow; drilling and operating risks, including potential environmental liabilities; production interruptions that could adversely affect our cash flow; and pending or future litigation. Although we believe the expectations and forecasts reflected in our forward-looking statements are reasonable, we can give no assurance they will prove to have been correct. The Play Spring 2011 Chesapeake recently sold its Fayetteville Shale assets to BHP Billiton Petroleum, a wholly owned subsidiary of BHP Billiton Limited (NYSE:BHP; ASX:BHP), for approximately $4.75 billion. The transaction included existing net production of approximately 415 million cubic feet of natural gas equivalent per day and midstream assets with approximately 420 miles of pipeline. As part “THIS TRANSACTION ALLOWS of the transaction, ChesaCHESAPEAKE TO ACHIEVE peake has agreed to provide SUBSTANTIAL PROGRESS IN essential services for up to IMPLEMENTING THE DEBT one year for BHP Billiton’s REDUCTION TARGETS OF OUR Fayetteville properties for an PREVIOUSLY ANNOUNCED agreed-upon fee. 25/25 PLAN.” Aubrey McClendon, Chesapeake’s CEO, commented, “We are pleased to complete the sale of our Fayetteville Shale assets to BHP Billiton. I would also like to personally thank all of the Chesapeake employees who throughout the past six years helped build this field into a world-class natural gas asset. This transaction allows Chesapeake to achieve substantial progress in implementing the debt reduction targets of our previously announced 25/25 Plan. We look forward to replacing the Fayetteville production through substantial growth from our other world-class natural gas plays and also from our rapidly growing higher margin liquids-rich plays in the year ahead.” SALE OF ARKANSAS ASSETS IS COMPLETED Goodwill employees take a few minutes off the job to celebrate the opening of the Chesapeake Energy Environmental Recycling Center. 13 Recycling center reduces strain on landfills while creating “green” jobs Goodwill Industries of Central Oklahoma recently opened the Chesapeake Energy Environmental Recycling Center. The 40,000-squarefoot, state-of-the-art recycling center will enable Goodwill to increase its capacity to divert materials from Oklahoma landfills from 6 to10 million “GOODWILL IS PROUD pounds per year, which equates to one-third of all goods that would have TO PARTNER WITH been destined for Oklahoma City-area CHESAPEAKE TO landfills, while creating approximately 80 INCREASE AWARENESS “green” jobs for disabled Oklahomans. OF THE POSITIVE In 2010, Goodwill received 8.5 milENVIRONMENTAL lion pounds of donated goods and recyclables. With Chesapeake’s support, IMPACT ON THE STATE the organization was able to recycle 95% OF OKLAHOMA FROM of that material, keeping all but 392,000 DONATED HOUSEHOLD pounds from Oklahoma landfills. GOODS AND CON“Goodwill is proud to partner with SUMER RECYCLABLES Chesapeake to increase awareness of the positive environmental impact on the TO GOODWILL.” state of Oklahoma from donated household goods and consumer recyclables to Goodwill,” said Heather Rennebohm, CEO of Goodwill Industries of Central Oklahoma. “Their gift not only has created this center, but has supported our aspirations to create more sustainable eco-friendly jobs for disadvantaged individuals” Martha Burger, Chesapeake’s Senior Vice President – Human & Corporate Resources, said, “We applaud Goodwill Industries of Central Oklahoma’s proactive efforts to reduce our state’s environmental footprint; and we are proud to help them accomplish this goal with the establishment of the Chesapeake Energy Environmental Recycling Center.” The Play Spring 2011 PROUDLY ENERGIZING AMERICA’S ECONOMY At a time when America is still seeking an economic lift, Chesapeake Energy Corporation is stimulating business and industry of all kinds, making a remarkable difference everywhere we operate. We proudly stand as the number one driller and second-largest producer of clean, affordable, abundant, American natural gas. We’re helping create millions of dollars in unprecedented revenue for state and local governments, giving landowners and leaseholders welcome new income and putting thousands of skilled workers back on the job. And we’re doing all of this while helping move our country toward energy freedom. Today, more than ever, Chesapeake is Fueling America’s Future®. chk.com TWITTER.COM/CHESAPEAKE FACEBOOK.COM/CHESAPEAKE YOUTUBE.COM/CHESAPEAKEENERGY NYSE: CHK T