Document 11590534

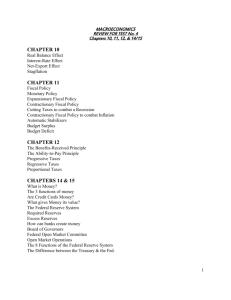

advertisement