Lecture 12: Macro dynamics of the open economy (cont) Ragnar Nymoen

advertisement

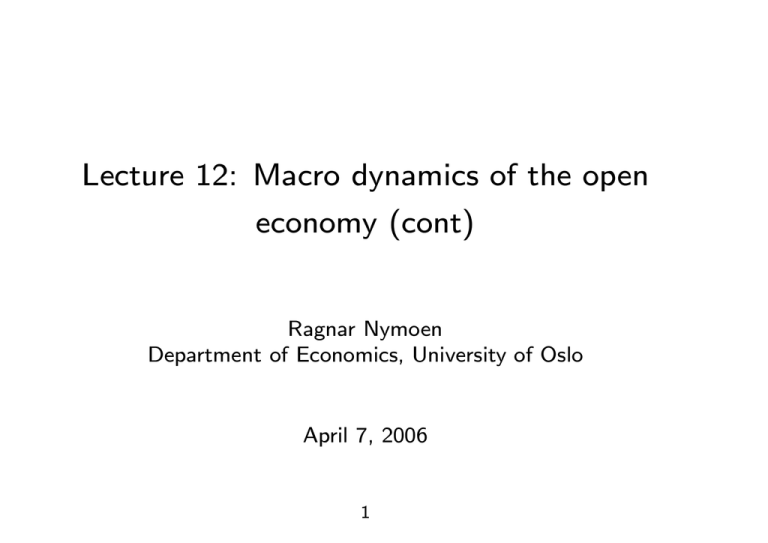

Lecture 12: Macro dynamics of the open economy (cont) Ragnar Nymoen Department of Economics, University of Oslo April 7, 2006 1 Regime dependent macro models (cont) From Lecture 11 we have the following system of equations: f yt = β0 + β1ert − β2rt + β3gt + β4yt e rt = it − πt+1 f ert = ∆et + πt − πt + ert−1 πt = πte + γ(yt − ȳ) + st f it = it + ee + αe(∆et + et−1) mt − pt = m0 − m1it + m2yt, mi > 0, i = 1, 2 (1) (2) (3) (4) (5) (6) (1) is the product marked equilibrium condition. (2) is the definition of the e is the expected rate of inflation, one period ahead. real interest rate. πt+1 (3) is a definition equation for ert , see IAM, p 704 and 711. (4) is the PCM. e /E ) ≡ ee e e (5) is UIP with ln(Et+1 t t+1 − et = e + α (∆et + et−1) inserted. (6) is an equilibrium condition for the money market. Right hand side is a linearization of the demand for money function. 2 Short-run models f f f In the short-run, the following variables are exogenous: gt, yt , st, πt , it , ert−1, et−1 and pt. Note the discussion at the end of Lecture 11 which motivated the classification of pt as predetermined (as a simplification). The two main regimes to consider (because the are robust to perfect capital mobility) are Regime I and Regime VI. They are different in terms of how the interest rate is determined. 3 interest rate Ei-curve i1 i0 Money M0 M1 E0 E1 exchange rate Regime I: The shift in the Ei-curve does not affect i. E depreciates Regme VI: To avoid depreciation, i is inceased. Accommodated in the money market by reduction of the money supply (through market operations) Figure 1: Regime I and VI: FEX market and money market equilibrium 4 Regime VI (fixed ex rate, it as instrument) Regime dependent exogenous variable: ∆et. yt πt it n o f r = β0 + β1 ∆et + πt − πt + et−1 n o f f e e e − β2 it + e + α (∆et + et−1) − πt+1 + β3gt + β4yt = πte + γ(yt − ȳ) + st f = it + ee + αe(∆et + et−1) mt − pt = m0 − m1it + m2yt (7) (8) (9) (10) (7) is the AD curve. Note that the equilibrium condition on the market for e , foreign exchange, (9), is included in this equation. (8) is the AS curve. If πt+1 and πte are exogenous, then (7) and (8) determine yt and πt. it is determined in (9) and mt in (10). 5 Regime I (floating ex rate) Regime dependent exogenous variable: mt Money market and FEX market is now interlocked. Solve (5) and (6) for it and the nominal exchange rate: 1 f e) − e (i − i − e t t−1 t αe −1 m m it = (mt − pt) + 0 + 2 yt m1 m1 m1 ∆et = ( ( ) m m 1 f −1 f (mt − pt) + 0 + 2 yt − e (it + ee) + πt − πt m1 m1 m1 α ( ) m m −1 e − β2 (mt − pt) + 0 + 2 yt − πt+1 m1 m1 m1 yt = β0 + β1 1 αe f + β3gt + β4yt ) (11) πt = πte + γ(yt − ȳ) + st (12) 6 The difference between Regime I and VI is the slope of the AD curves (7) and (11): ¯ 1 ∂πt ¯¯ = <0 (13) ¯ ¯ ∂yt AD,rV I −β1 ¯ m1 2 1 − β1 αm e m + β2 m ∂πt ¯¯ 1 2 = (14) ¯ ¯ ∂yt AD,rI −β1 We noted that (14) hinges on αe 6= 0. The interpretation is that with constant depreciation expectations and perfect capital mobility, it is determined by the UIP condition alone. Hence αe = 0 would introduce an internal inconsistency with the assumption that in this regime, mt is exogenous. We ended Lecture 11 by the following important result about the slopes of the short-run AS curves of the two regimes. ¯ ¯ ¯ ∂πt ¯¯ ∂πt ¯ >− , when αe < 0 − ¯ ¯ ∂yt ¯AD,rI ∂yt ¯AD,rV I (15) meaning that the slope of the short-run AD curve is steeper in Regime I than in Regime VI, at least when αe < 0. 7 Interpretation of slope-difference The interpretation of the difference has to do with how the interest rate is determined in the two regimes: When πt increases, y-demand is reduced in both regimes through the real exchange rate, er . But there are additional effects in RI: Lower demand for money reduces the interest rate in the domestic money market. Hence the eventual reduction in y-demand in RI is lower than in RVI. This is the same as saying that the slope of the AD curve is steeper in RI than in RVI. ¯ ¯ ¯ ∂πt ¯ ∂πt ¯¯ − >− ¯ ¯ ¯ ∂yt AD,rI ∂yt ¯AD,rV I 8 π Regime VI Regime I y e Figure 2: Short-run AD curves, fixed πt+1 in regime I and VI. 9 The short-run solutions for πt and yt is obtained by solving (11) and (12), for Regime I, and (7) and (8) for Regime VI. To learn about the properties of the two regime versions of the model we will consider the response of the endogenous variables yt and πt. For simplicity, and according to custom, we assume that the initial situation is characterized by πt = π e and yt = ȳ, as depicted in figure 3. 10 π AS πe RVI RI y y e . Regime I and VI. Figure 3: Initial situation with πt = πt+1 11 Short run effects of fiscal policy in regime I and VI Consider the immediate (short-run) effect of an increase in gt. From (11) and (7), note that for a given yt, the derivative of πt with respect to gt is identical in the two regimes ¯ ¯ ¯ dπt ¯¯ β dπt ¯ = = 3>0 ¯ ¯ dgt ¯yt=ȳ,rI dgt ¯yt=ȳ,rI β1 The graphical analysis of short-run effects of fiscal policy is therefore represented by identical vertical shifts in the AD curve of the two regimes. Hence, the impact effect of increased gt is larger in Regime VI (fixed exchange rate) than in Regime I (float), see figure 4. The explanation is that higher GDP output increases the demand for money, which in Regime I increases the interest rate, in regime VI the interest rate stays constant. 12 π AS RVI πe RI y y e Figure 4: Short-run effects of fiscal policy, regime Regime I and VI, fixed πt+1 and πte . 13 Long-run models We still consider Regime I and VI, and repeat the equations of the model: f yt = β0 + β1ert − β2rt + β3gt + β4yt e rt = it − πt+1 f ert = ∆et + πt − πt + ert−1 πt = πte + γ(yt − ȳ) + st f it = it + ee + αe(∆et + et−1) mt − pt = m0 − m1it + m2yt, mi > 0, i = 1, 2 14 (16) (17) (18) (19) (20) (21) The models’ steady-state is defined by the following, see IAM p. 717-719. πte = π̄ f , expectation equal to the world inflation rate yt = ȳ, ert = ert−1 = er , stationarity of rex, gt = ḡ, gov exp on trend, f yt = ȳ f , world GDP on trend ı̄f = constant world interest rate st = 0, no supply shocks Since ert = ert−1 = er and πt = π̄ f it follows from (18) that ∆et = 0 in e /E ) so we add steady-state. It is logical that in a steady-state ∆et = ln(Et+1 t e /E ) = ∆e = 0 ln(Et+1 t t to the list of steady-state conditions. 15 Hence, from the UIP condition (20): i = ı̄f (22) m − p = m0 − m1ı̄f + m2ȳ (23) ȳ = β0 + β1er − β2(ı̄f − π̄ f ) + β3ḡ + β4ȳ f , from AD π = π f , from AS (24) (25) and from (21) e = π̄ f in (16) gives Using i = ı̄f and πt+1 The equations of the long-run model are thus: (24),(25), (22) and (23). The endogenous variables of the long-run model are: er , π, i, m or e, and p. Even though pt is predetermined in the short-run model it is endogenous in the long-run. Hence there is one missing equation in our long-run model. However, note that ert = ert−1 = er is actually the hypothesis of PPP, as a long-run property. Hence, from the definition of er p = e + pf − er 16 (26) which determines p (noting that er is determined in the (24) and pf is exogenous. The PPP condition (26) determines p in the Regime VI, and e in Regime 1, treating m as exogenous. Regime independency of the long-run solution (IAM figure 23.7) (24) is the same in both regimes (I and VI). The long-run AS schedule is also identical across the two regimes. Hence the steady-state solutions for er and π are independent of the two regimes. ¯ r −β3 de ¯¯ = <0 ¯ ¯ dḡ rI,rV I β1 Hence, if the increase in g is permanent, the model predicts a long-run there real appreciation. In Regime VI, this happends trough increased P , from (26). In Regime I there is a nominal appreciation. 17 e r LR AS LRAD er r e0 y y Figure 5: Long-run effect of fiscal policy, regime Regime I and VI . 18 Short-summary of our analysis of the AD-AS model so far. Float/fix Target (exogenous) Instrument short-run effects of g long-run effects of g RI R VI float M i yt and πt ↑, er ↓ er ↓, fix E i larger on yt and πt same as RI Next we need to consider • Role of endogenous expectations • Sketch the dynamic analysis of for example fiscal policy • Other regimes! 19

![Understanding barriers to transition in the MLP [PPT 1.19MB]](http://s2.studylib.net/store/data/005544558_1-6334f4f216c9ca191524b6f6ed43b6e2-300x300.png)