– Business Annual Questionnaire

advertisement

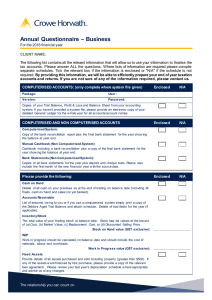

Annual Questionnaire – Business For the 2016 financial year CLIENT NAME: The following list contains all the relevant information that will allow us to use your information to finalise the tax accounts. Please answer ALL the questions. Where lists of information are required please compile separate schedules. Please file information in a folder with an A-Z index as noted on the Financial Statements Schedules attached. Tick the relevant box if the information is enclosed or "N/A" if the schedule is not required. By providing this information, we will be able to efficiently prepare your end of year taxation accounts and returns. If you are not sure of any of the information required, please contact us. Folder Ref Com puterised Accounts: (only com plete w here system file given) Package: User: Version: Passw ord: Enclosed N/A Enclosed N/A System Files: CD/Disk enclosed E-mailed to Crow e Horw ath Advisor A Copies of your Trial Balance, Profit & Loss and Balance Sheet from your accounting system. E If you haven't provided a system file, please provide an electronic copy of your detailed General Ledger for the w hole year for all accounts/account names. Folder Ref Com puterised Accounts and Non Com puterised Accounts: G Com puterised System Please provide a copy of the bank reconciliation report plus the final bank statement for the year show ing the balance at year end. G Manual Cashbook (Non Com puterised System ) Please provide your cashbook including a bank reconciliation plus a copy of the final bank statement for the year show ing the balance at year end. Please also include the first month of the new financial year w ith the source data. G Bank Statem ents (Non Com puterised System ) Please provide copies of all bank statements for the year plus deposit and cheque butts. Please include the first month of the new financial year w ith the source data. G Please provide the follow ing inform ation as at year end: H Cash on hand $ Till float $ Layby sales $ Sales up to balance date but deposited after balance date $ Accounts Receivable List (over page) or if you use the sales module of a computerised system simply print a copy of the Debtors Aged Trial Balance (attach schedule). Please review for any bad debts and mark as necessary . Folder Ref Enclosed / Yes Com puterised Accounts and Non Com puterised Accounts: Nam e Particulars N/A Am ount (inc GST) Note: If Bad Debts are to be a deductible expense in the current year they must be w ritten out of your Debtors Ledger before the end of your financial year. I Inventory / Stock What is the total value of your "trading stock" at balance date? Stock may be valued at the low est of (a) Cost, (b) Market Value, (c) Replacement Cost, or (d) Discounted Selling Price. Please indicate w hich method used. □ A □ □ □ B Exclusive of GST? □ □ C Yes $ D No Stock on Hand report I Work in Progress WIP Value $ □ Exclusive of GST? □ Yes No WIP report J Date Fixed Assets Details of cost, selling price and trade-in value of plant, vehicles, property etc bought, sold or traded in for the period w ith copies of invoices. Purchased (greater than $500): New / Used Price (inc GST) Description Asset traded (if any) Value (inc GST) $ $ $ $ $ $ Sold (excluding trade -ins included above): Date Price (inc GST) Description Scrapped? $ $ $ L Details of any business investments, plus investments bought and sold during the year, plus any income received from them e.g. dividends and interest. L Overseas investments – provide details of any investments, including life insurance policies, land, shares, trusts or superannuation. M Accounts Payable List (below ) w here not included in company file provided or please print a copy of your Accounts Payable ledger and attach. Nam e Particulars Am ount (inc GST) $ $ $ Folder Ref N Com puterised Accounts and Non Com puterised Accounts: Enclosed / Yes N/A Copies of GST w orkpapers and GST returns. Did you process prior year GST adjustments as provided by your Crow e Horw ath advisor? Q Loans List below details of bank loans, including closing loan balances, interest rate and details of securities in place (w here applicable). Interest Rate Loan Q % $ % $ % $ Interest Rate Security Balance % $ % $ % $ OTHER INCOME R Details of dividends/bonuses/insurance payments/interest income/partnership income or any other sundry income received during the period (attach documentation including RWT and dividend slips). R Details of Sales receipts used directly, ie sales not banked. Folder Ref Balance Hire Purchase Agreem ents List below details of Hire Purchase Agreements, including closing loan balances, interest rate and details of securities in place (w here applicable). Hire Purchase Folder Ref Security EXPENSES S Bad Debts w ritten off prior to balance date, but invoiced during the period. S Details of any legal expenses (including copies of invoices). S Details of any insurance and ACC payments (including copies of invoices). S Details of any donations made. S Details of any expenses paid personally, i.e. paid out of a non-business bank account or from a personal credit card (please provide invoices). S Details of motor vehicle expenses i.e. business related versus personal. Please provide log book or mileage details, including date, distance and purpose. S Entertainment – You can only claim 50% of most entertainment expenses. How ever, there are exceptions and exemptions. Please list all entertainment expenses and give a brief explanation of each. S Resident Withholding Tax (RWT)/Non Resident Withholding Tax (NRWT) . Please provide copies (if any) of w orksheets and returns, and annual reconciliation. S FBT – Copies of w orksheets and returns. S Please provide details of any benefits supplied to employees e.g. cash or noncash benefits, including motor vehicles available for private use. Enclosed / Yes N/A Enclosed / Yes N/A Folder Ref Enclosed / Yes EXPENSES S Holiday pay paid w ithin 63 days after your balance date. S Home Office Expenses - If part of your home is used for business purposes, please advise expenses below . This includes a home office, w orkshop or storage area. Please provide details of the purchase price and a copy of the rates demand if this is the first year you have made a home office claim. Area of home for office Total area of home sq m sq m Expense Private use % Insurance % $ Mortgage interest % $ Rates % $ Repairs % $ Pow er % $ Gas % $ Other: % $ S Goods for ow n use – please provide details. S Repairs & Maintenance – Details of significant repairs and maintenance, alterations and modifications over $500. Folder Ref U Am ount (inc GST) Enclosed / Yes OTHER Contingent Liabilities / Commitments: Are there any contingent liabilities, law suits, guarantees? Any commitments for capital expenditure at or since balance date? Any commitment under a lease for plant or vehicles? OTHER Details of any other major transactions or changes undertaken during the period. OTHER Please provide details of any associated entities that are not clients of this firm. OTHER If this is a Trust, please fill in the “Annual Questionnaire – Trust” OTHER Do you require a copy of the accounts to be forw arded to a third party? If Yes, please provide details: GENERAL COMMENTS N/A N/A