FORD MOTOR CREDIT EARNS $740 MILLION IN THE SECOND QUARTER

advertisement

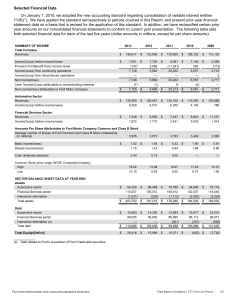

FORD MOTOR CREDIT EARNS $740 MILLION IN THE SECOND QUARTER DEARBORN, Mich., July 19, 2005 – Ford Motor Credit Company reported net income of $740 million in the second quarter of 2005, down $157 million from earnings of $897 million a year earlier. On a pre-tax basis from continuing operations, Ford Motor Credit earned $1.2 billion in the second quarter, compared with $1.4 billion in the previous year. The decrease in earnings primarily reflected higher borrowing costs and the impact of lower receivable levels, offset partially by improved credit loss performance. "This quarter's solid results reflect our ongoing efforts to strengthen our operations," said Mike Bannister, chairman and CEO. "Despite the challenging business environment, Ford Motor Credit continues to generate strong profits." On June 30, 2005, Ford Motor Credit's on-balance sheet net receivables totaled $121 billion, compared with $133 billion on December 31, 2004. Managed receivables were $160 billion on June 30, down from $168 billion on December 31. The lower managed receivables primarily reflected lower retail placement volumes. Ford Motor Credit paid dividends of $1 billion during the quarter. On June 30, managed leverage was 12.8 to 1. Ford Motor Credit Company is one of the world's largest automotive finance companies and has supported the sale of Ford products since 1959. Ford Motor Credit is an indirect, wholly owned subsidiary of Ford Motor Company. It provides automotive financing for Ford, Lincoln, Mercury, Aston Martin, Jaguar, Land Rover, Mazda and Volvo dealers and customers. More information can be found at http://www.fordcredit.com and at Ford Motor Credit's investor center, http://www.fordcredit.com/investorcenter/. ### FORD MOTOR CREDIT COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENT OF INCOME For the Periods Ended June 30, 2005 and 2004 (in millions) Second Quarter 2005 2004 (Unaudited) Financing revenue Operating leases Retail Interest supplements and other support costs earned from affiliated companies Wholesale Other Total financing revenue Depreciation on vehicles subject to operating leases Interest expense Net financing margin Other revenue Investment and other income related to sales of receivables Insurance premiums earned, net Other income Total financing margin and other revenue Expenses Operating expenses Provision for credit losses Insurance expenses Total expenses Income from continuing operations before income taxes Provision for income taxes Income from continuing operations before minority interests Minority interests in net income of subsidiaries Income from continuing operations Income from discontinued operations Gain on disposal of discontinued operations Net income $ 1,339 1,012 $ 1,477 1,081 First Half 2005 2004 (Unaudited) $ 2,697 2,082 $ 3,051 2,152 795 276 55 3,477 (1,095) (1,386) 996 881 193 60 3,692 (1,242) (1,295) 1,155 1,638 527 111 7,055 (2,172) (2,812) 2,071 1,737 382 109 7,431 (2,549) (2,624) 2,258 443 52 143 1,634 542 61 291 2,049 888 104 313 3,376 1,034 121 519 3,932 522 (111) 61 472 1,162 426 736 736 4 $ 740 516 68 74 658 1,391 508 883 1 882 15 $ 897 1,050 6 97 1,153 2,223 813 1,410 1 1,409 37 4 $ 1,450 1,033 350 111 1,494 2,438 891 1,547 1 1,546 39 $ 1,585 FORD MOTOR CREDIT COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET (in millions) ASSETS Cash and cash equivalents Investments in securities Finance receivables, net Net investment in operating leases Retained interest in securitized assets Notes and accounts receivable from affiliated companies Derivative financial instruments Assets of discontinued operations Other assets Total assets LIABILITIES AND STOCKHOLDER'S EQUITY Liabilities Accounts payable Customer deposits, dealer reserves and other Affiliated companies Total accounts payable Debt Deferred income taxes, net Derivative financial instruments Liabilities of discontinued operations Other liabilities and deferred income Total liabilities Minority interests in net assets of subsidiaries Stockholder's equity Capital stock, par value $100 a share, 250,000 shares authorized, issued and outstanding Paid-in surplus (contributions by stockholder) Accumulated other comprehensive income Retained earnings Total stockholder's equity Total liabilities and stockholder's equity June 30, 2005 (Unaudited) December 31, 2004 $ 18,518 706 98,599 21,932 5,287 1,478 4,060 6,087 $ 156,667 $ 12,668 653 110,851 21,866 9,166 1,780 6,930 2,186 6,521 $ 172,621 $ $ 1,604 1,070 2,674 128,935 8,315 711 4,908 145,543 1,645 819 2,464 144,274 7,593 911 93 5,802 161,137 14 13 25 5,117 502 5,466 11,110 $ 156,667 25 5,117 855 5,474 11,471 $ 172,621 FORD MOTOR CREDIT COMPANY AND SUBSIDIARIES OPERATING HIGHLIGHTS* Financing Shares United States Financing share – Ford, Lincoln and Mercury Retail installment and lease Wholesale Europe Financing share – Ford Retail installment and lease Wholesale Second Quarter 2005 2004 2005 First Half 2004 40% 81 39% 84 41% 81 38% 84 29% 97 29% 97 28% 97 28% 97 Contract Volume – New and used retail/lease (in thousands) North America segment United States Canada Total North America segment 424 51 475 440 52 492 834 82 916 838 88 926 International segment Europe Other international Total International segment Total contract volume 206 65 271 746 208 62 270 762 392 138 530 1,446 410 136 546 1,472 Borrowing Cost Rate** Charge-offs (in millions) On-Balance Sheet Retail installment & lease Wholesale Other Total on-balance sheet charge-offs Total loss-to-receivables ratio Managed*** Retail installment & lease Wholesale Other Total managed charge-offs Total loss-to-receivables ratio ————— * Continuing operations ** Includes the effect of interest rate swap agreements *** See appendix for additional information 4.4% $ 140 (1) (2) $ 137 0.44% $ 172 (1) (2) $ 169 0.41% 3.7% $ 285 6 0 $ 291 0.91% $ 362 6 0 $ 368 0.85% 4.2% $ 307 16 (5) $ 318 0.50% $ 387 16 (5) $ 398 0.48% 3.7% $ 598 9 (1) $ 606 0.94% $ 789 9 (1) $ 797 0.91% FORD MOTOR CREDIT COMPANY AND SUBSIDIARIES APPENDIX In evaluating Ford Motor Credit's financial performance, Ford Motor Credit management uses financial statements and other financial measures in accordance with Generally Accepted Accounting Principles (GAAP). Included below are brief definitions of key terms, information about the impact of on-balance sheet securitization and a reconciliation of other measures. KEY TERMS: • Managed receivables: receivables reported on Ford Motor Credit's balance sheet and receivables Ford Motor Credit sold in off-balance sheet securitizations and continues to service. • Charge-offs on managed receivables: charge-offs associated with receivables reported on Ford Motor Credit's balance sheet and charge-offs associated with receivables that Ford Motor Credit sold in off-balance sheet securitizations and continues to service. IMPACT OF ON-BALANCE SHEET SECURITIZATION: finance receivables (retail and wholesale) and investments in operating leases reported on Ford Motor Credit's balance sheet include assets transferred in securitizations that do not qualify for accounting sale treatment. These assets have been legally transferred to Ford Motor Credit sponsored special purpose entities and are available only to pay the obligations of the special purpose entities and are not available to pay the other obligations of Ford Motor Credit or the claims of Ford Motor Credit's other creditors. Debt reported on Ford Motor Credit's balance sheet includes debt issued by these special purpose entities to securitization investors which is payable out of collections on the assets supporting the securitizations and is not the legal obligation of Ford Motor Credit or its other subsidiaries. RECONCILIATION OF MEASURES: Managed Leverage Calculation June 30, 2005 Total debt Securitized off-balance sheet receivables outstanding Retained interest in securitized off-balance sheet receivables Adjustments for cash and cash equivalents Adjustments for SFAS No. 133 Total adjusted debt December 31, 2004 (in billions) $ 128.9 $ 144.3 39.2 37.7* (5.3) (9.5)** (18.5) (12.7) (2.6) (3.2) $ 141.7 $ 156.6 Total stockholder's equity (including minority interest) Adjustments for SFAS No. 133 Total adjusted equity $ 11.1 (0.0) $ 11.1 Managed leverage (to 1) = adjusted debt / adjusted equity Memo: Financial statement leverage (to 1) = total debt / stockholder's equity Net Finance Receivables and Operating Leases June 30, 2005 Retail installment Wholesale Other finance receivables Net investment in operating leases Total net finance receivables and operating leases On-Balance Sheet December 31, 2004 Retail installment Wholesale Other finance receivables Net investment in operating leases Total net finance receivables and operating leases ————— * Includes securitized funding from discontinued operations ** Includes retained interest in securitized receivables from discontinued operations $ 69.9 23.5 5.2 21.9 $ 120.5 $ 81.7 23.8 5.3 21.9 $ 132.7 12.8 11.6 Managed Receivables Off-Balance Sheet (in billions) $ 20.4 18.8 0.0 0.0 $ 39.2 $ 16.7 18.9 0.0 0.0 $ 35.6 $ 11.5 (0.1) $ 11.4 13.7 12.6 Total $ 90.3 42.3 5.2 21.9 $ 159.7 $ 98.4 42.7 5.3 21.9 $ 168.3