Why Do Oil Shocks Matter? The Importance of ∗ Joshua Linn

advertisement

Why Do Oil Shocks Matter? The Importance of

Inter-Industry Linkages in U.S. Manufacturing∗

Joshua Linn

University of Illinois at Chicago

September 2006

Preliminary and Incomplete — Please Do Not Cite Without Permission

Abstract

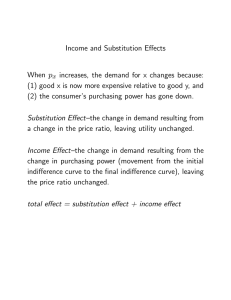

There is considerable empirical evidence that oil prices had a large effect on the U.S. economy

from World War II until the 1980s. This paper argues that linkages between manufacturing

industries play an important role in amplifying oil price shocks. I quantify the importance of

demand and supply linkages by decomposing changes in industry-level value added into three

sources. First is the direct effect: an increase in the price of oil raises costs in energy intensive

industries. Second is the supply effect: an industry that uses energy intensive inputs experiences

a large increase in materials prices after an oil shock. The third effect is the demand effect: an

industry that supplies its output to energy intensive industries will see a large decrease in the

demand for its product.

Using data from the Census of Manufactures from 1963-1982, I find that the supply and

direct effects explain a significant amount of variation in industry-level value added; the demand

effect is relatively weak. The supply effect accounts for more than half the sensitivity of value

added to the price of oil.

Oil shocks appear to primarily affect average production per plant. The direct and supply

effects cause similar changes in value added per plant as in value added per industry. A price

increase causes a small, though precisely estimated, decrease in entry, and has no effect on exit.

Thus, most of the effect of an oil shock is to decrease plants’ production levels.

∗

I thank Nathan Anderson, Bob Kaestner Dan McMillan and Joseph Persky for helpful comments. The

research in this paper was conducted while the author was a Special Sworn Status researcher of the U.S. Census

Bureau at the Chicago Census Research Data Center. Research results and conclusions expressed are those of

the author and do not necessarily reflect the views of the Census Bureau. This paper has been screened to insure

that no confidential data are revealed. Support for this research at the Chicago RDC from NSF (awards no.

SES-0004335 and ITR-0427889) is also gratefully acknowledged. Author’s email address: jlinn@uic.edu

1

1

Introduction

A large body of research has documented a strong correlation between oil prices and economic

activity. Much of the evidence comes from employment and output fluctuations in individual

sectors. Davis and Haltiwanger (2001) find that oil shocks are about twice as important as

monetary shocks in explaining employment variation in U.S. manufacturing. Other studies have

examined the relationship between oil prices and U.S. GDP.1 Using aggregate data from 19491980, Rotemberg and Woodford (1996) find that a one percent increase in the price of oil causes

GDP to decline by 0.25 percent. Although some authors have argued that these elasticities may

be too high (e.g., Bernanke, Gertler and Watson, 1997), and the effect of oil prices may have

diminished since the 1980s, the prevailing view is that oil shocks have played a major role in

most post-World War II business cycles.2

This result constitutes a puzzle. A simple neoclassical model of the U.S. economy would

suggest that oil prices should be much less important (see, e.g., Rotemberg and Woodford). The

elasticity of GDP to the price of oil would be roughly proportional to the cost share of oil, which

was about 0.04 during this time period. But previous research has found a much larger elasticity.

Economists have proposed a number of explanations, but have provided little direct evidence.3

Rotemberg and Woodford argue that a monopolistic competition model can account for the

amplification of an oil shock. Firms charge a markup over marginal cost, and the markup

increases after an oil price increase. The model generates a much larger contraction of GDP

than would occur in a perfectly competitive model. Alternatively, Davis and Haltiwanger focus

on frictions that prevent the reallocation of capital and labor. For example, the 1970s oil

shocks decreased the demand for large automobiles. Manufacturers could not freely adjust their

plants and workforce to produce smaller automobiles, which reduced capital utilization. These

explanations are plausible, and many others have been proposed (e.g., Hamilton, 1988). There

is very little empirical work, however, documenting their importance.

This paper provides an alternative explanation, that demand and supply linkages between

1

Hamilton (1983) was one of the earliest and most influential studies to estimate this relationship. Subsequent

work (e.g., Mork, 1989) argued that the effect is asymmetric; that is, a price increase causes a large decline in

GDP, but a price decrease has little effect. Recent papers (e.g., Hooker, 1996) have documented a decline in the

effect of a price shock on GDP since the 1980s.

2

Some authors have argued that this correlation may be spurious, or that oil prices affected GDP via monetary

policy, particularly in the 1970s and 1980s. For example, Bernanke, Gertler and Watson (1997) arge that after

controlling for changes in monetary policy, oil prices have a very small effect on GDP. Some authors have

questioned the empirical approach used by Bernanke, Gertler and Watson (e.g., Hamilton and Herrera, 2004)

concluding that they understate the effect of a price shock on GDP.

3

Rogoff (2006) summarizes much of this literature. Other proposed explanations include uncertainty

(Bernanke, 1983 and Pindyck and Rotemberg, 1984); irreversable investment (Atketson and Kehoe, 1999); and

the effect of oil prices on monetary policy, noted previously.

1

industries play an important role in the amplification of an oil shock. I present empirical evidence

for this explanation from the manufacturing sector. The argument is similar to Horvath (1998

and 2000), who argues that inter-industry linkages explain much of the variation in value added.

Horvath observes that some industries are important suppliers to other industries. A negative

shock to the supplying industry would cause output in downstream industries to contract. Thus,

if oil intensive industries are important suppliers to other industries, an increase in the price of

oil could have a large effect on the downstream industries.4 It is important to note that for

reasons of data availability discussed below, the analysis focuses on energy costs rather than oil

costs. Thus, for the remainder of the paper I will refer to energy-intensive industries, rather

than oil-intensive industries.5

More specifically, I investigate three channels through which a price shock may affect value

added. A neoclassical production model predicts that industries that use energy as an input

should be sensitive to the price of energy. I refer to the direct effect as the change in value added

due directly to the increase in energy costs; when the price rises, costs increase and production

decreases.

The second and third effects have not been emphasized in the literature. The supply effect

is the change in value added due to the change in materials prices. Industries that use energyintensive inputs (products that are produced with a large amount of energy) experience an

increase in materials prices. For example, paper is a major input for the printing industry.

Printing uses little energy itself, so there is a small direct effect. An energy price increase would

raise the price of paper (which is energy intensive), causing materials prices for printing to rise.

Consequently, the supply effect would cause the printing industry to contract.6

The third effect is the demand effect. If the output of an industry is used by an energy

intensive industry, the demand for its product will fall as the energy intensive industry contracts.

The demand effect is the change in value added caused by a change in the demand for the

industry’s product. For a given industry, the demand effect is large if energy intensive industries

use its output.

The empirical work documents the importance of the three effects. I construct proxies for

the three effects, based on first order approximations, described below. For example, the direct

effect is proportional to the energy cost share. The proxy for the supply effect depends on the

4

Computable general equilibrium models of individual sectors or the entire economy (e.g., Hanson et al., 1993)

also account for such linkages, but they often provide little insight into the sources of amplification.

5

A variety of robustness checks suggest that this distinction does not affect the main conclusions.

6

It is possible that an energy price increase causes industries substitute inputs that require little energy for

energy intensive inputs. The empirical analysis addresses this possibility, and the demand for inputs appears to

be relatively inelastic, at least in the medium term. As a result, a given increase in materials prices would have

a large effect on output.

2

materials and energy cost shares of an industry’s materials. The demand proxy depends on the

energy cost shares of other industries that demand the product of the particular industry. I

estimate a linear regression to determine whether an industry with a large proxy for the demand

effect experiences a large change in output when the price of energy changes, and similarly for

the supply and demand effects. In other words, I decompose change in industry value added

into the three effects, and compare their relative magnitudes.

The direct effect increases with an industry’s energy cost share, but is small, due to the low

average cost share of energy. The supply effect plays a significant role in explaining variation in

value added. Industries that use large amounts of energy intensive inputs have a large decrease

in output when the price of oil rises. On the other hand, the demand effect is weaker, though

there is some evidence that it is not minimal. A one percent increase in oil prices causes value

added to decline by about 0.07 percent. This elasticity is about four times as large as the cost

share in manufacturing, which is consistent with previous research. The supply effect accounts

for about 60 percent of the response of value added to a price shock.

The results agree with demand and supply patterns in U.S. manufacturing. The average

energy cost share is small, so the direct effect should explain a small fraction of changes in value

added. Prior to the oil shocks in the 1970s, energy intensive industries produced goods that

were important materials for other industries. On the other hand, energy intensive industries

did not have large demands for products of other industries. Based on this pattern, the supply

effect should be larger than the demand effect, and the demand effect may be difficult to detect

in the manufacturing sector.

These results characterize the effect of an oil shock on industry-level value added. I investigate

whether these changes are due to plant entry and exit or to changes in average value added per

plant. It appears that oil shocks primarily affect output per plant. The demand and supply

effects cause similar changes in value added per plant as value added per industry. In comparison,

a price increase causes a small and precisely estimated decrease in entry, and has no effect on

exit.

This paper build on the findings of Lee and Ni (2002). They define an oil-intensive industry

as an industry that uses a lot of oil, or that uses materials with a large oil cost share. For

example, the petroleum refining industry, which uses a lot of oil directly, and the industrial

chemicals industry, which does not, are both considered to be oil intensive. By estimating

a vector autoregression (VAR) for fourteen roughly two digit manufacturing industries, they

find that a positive oil shock causes a contraction of oil-intensive industries (as defined in their

3

paper).7

This paper differs in several respects. First, I distinguish between the direct and indirect

costs of energy, estimating separate direct and supply effects. In comparison, Lee and Ni are not

able to quantify the importance of linkages between industries. Second, instead of estimating

a structural VAR, I use cross sectional variation in input demands across industries and time

series variation in oil prices. Third, I investigate changes in value added at the four digit industry

level, across the entire manufacturing sector. On the other hand, their empirical strategy allows

them to investigate demand effects from industries (and consumers) outside their sample of

industries. In this paper I measure demand effects from industries within the manufacturing

sector, but there is not sufficient data to measure external demand effects. As discussed in the

empirical section, it does not appear that this limitation greatly affects my results.

2

2.1

Model and Estimation

The effect of a price increase on value added

The model highlights the importance of linkages between industries. The economy is composed

of a set of industries, and each industry has a number of identical plants. The plants operate

under perfect competition and there is one time period.

Each plant produces output from a Cobb-Douglas production function. I partition the industries into two groups: the first subset, I, consists of industries that do not use intermediate

materials, but supply their output to other industries. The second set of industries, J, produce

final goods. These plants use the intermediate products from the first set of industries. This

setup reflects the pattern in the manufacturing sector that some industries (generally, energy

intensive industries) are primarily suppliers of intermediate inputs, and use few materials themselves. Other industries mainly produce final products, used in consumption. Horvath makes

similar assumptions and provides evidence that the U.S. economy can be characterized by having

some intermediate products industries and other final goods industries.

Each plant, n, in the intermediate goods industries produces output, Yin , from one unit of

capital, Ein units of energy and Lin units of labor according to the production function:

L

ln Yin = sE

i ln Ein + si ln Lin ,

(1)

L

where sE

i and si are parameters. I assume that all firms in the industry have the same production

7

Lee and Ni find that many industries (e.g., automobiles) experience decreases in the demand for their products. Note that this does not necessarily contradict the lack of a demand effect reported in this paper. I find little

evidence that a reduction in demand by manufacturing industries causes value added to decline. It is possible that

an oil price increase causes demand from outside of the manufacturing sector to fall. For example, consumers’

demand for new automobilies may cause a drop in automobile production. I discuss this concern below.

4

function, and that, after purchasing the unit of capital, the production function is decreasing

L

returns to scale (i.e., sE

i + si < 1). Plants take prices as given and demand energy and labor to

maximize profits:

max Pi Yin − P E Ein − wLin − R,

(2)

Ein ,Lin

where Pi is the output price for industry i (i.e., the price of good i), P E is the price of energy,

w is the wage and R is the cost of capital. The first order conditions for input demands are the

L

standard Cobb-Douglas equations, and the parameters sE

i and si are the cost shares of energy

L

and labor. For convenience, I define the parameter ri = 1 − sE

i − si , which is inversely related

to the returns to scale of the industry. I can use the first order conditions and equation (1) to

obtain the following supply curve for each plant:

sE

Pi

sLi

Pi

i

ln Yin =

ln( E ) +

ln( ) + ki ,

(3)

ri

P

ri

w

where ki is a constant that depends on parameters. Each plant’s supply is increasing in the

output price and decreasing in input prices. The elasticity of output with respect to the real

price of energy is proportional to the (negative of the) cost share of energy, sE

i .

The production function for plants in final good industry j is:

ln Yjn = sE

j ln Ejn +

X

L

sM

ij ln Mijn + sj ln Ljn ,

(4)

i∈I

where Mijn is the quantity of intermediate material i used by plant n in industry j, and sM

ij are

parameters. The supply curve for a final good-producing plant is derived similarly to the supply

curve for intermediate material-producing plant, and is given by:

ln Yjn =

where rj = 1 − sE

j −

P

i∈I

X sM

sE

Pj

Pj

sL

Pj

j

ij

ln( E ) +

ln( ) + i ln( ) + kj ,

rj

P

rj

Pi

rj

w

i∈I

(5)

L

sM

ij − sj . Note that an increase in the real price of material i,

Pi

,

Pj

causes output per plant to decrease. The elasticity of output with respect to the real price of

material i is equal to the (negative of the) cost share of material i.

I now characterize the supply of intermediate goods and final goods, as functions of the input

prices. Free entry and exit in the intermediate goods industries imply that profits must equal

zero. I assume that the wage and price of energy are exogenous. Each plant’s operating profits

must cover the cost of capital. Using the first order conditions for inputs and the expression for

profits in (2), the total revenue of a plant in industry i equals a constant: Pi Yi =

5

R

.

ri

Solving this

equation for Pi , plugging into equation (3) and rearranging yields the supply curve of a plant in

industry i, which is a function of the wage and price of oil:

E

L

ln Yin = −sE

i ln(P ) − si ln(w) + ki .

(6)

Note that the constant has absorbed additional terms and does not depend on input prices. The

output of plants in industry i is decreasing in the price of energy and the wage. The elasticity

of output with respect to the price of energy is equal to the cost share of energy.

Since the price of good i is inversely proportional to the output of each firm in industry i,

the output price is given by:

E

L

ln Pi = sE

i ln(P ) + si ln(w) + ki .

(7)

The elasticity of the output price of industry i to the price of energy is equal to the energy cost

share. If the price of oil rises, the price of energy intensive goods would increase by a relatively

large amount.

I can derive the plant-level supply curve for the final goods industries similarly. First, I solve

for the output price in equation (5), Pj , using the fact that zero profits implies that the output

price is inversely proportional to output per plant. Then I use equation (7) to solve for the

intermediate materials prices in equation (5) to obtain the supply curve, as a function of the

wage and the price of oil:

E

ln Yjn = −sE

j ln(P ) −

X

i∈I

E

E

L

sM

ij si ln(P ) − si ln(w) + kj

(8)

The first term in this equation is the direct effect of the price of energy on output. A price

increase causes a large decrease in output for energy intensive industries. I refer to sE

j as the

direct elasticity, because the model predicts that for a given industry the energy cost share is

equal to the output elasticity via the direct effect.

The second term is the supply effect. Equation (7) shows that the price of intermediate

material i rises in proportion to the cost share of oil in that industry. The increase in the price

of material i causes output in industry j to fall in proportion to the importance of that material

E

in production. If the industry uses large amounts of energy intensive inputs (both sM

ij and si are

P

E

large), a price shock causes a large decrease in output. I refer to the inner product, i∈I sM

ij si ,

as the supply elasticity, because it captures how much an oil shock should affect output, via the

supply channel.

6

Equation (8) shows how output per plant varies with the price of energy in the final goods

industries. I now derive the total output of industry j, nj Yj , where nj is the number of plants

in industry j. I assume that consumers have Cobb-Douglas preferences for final goods, so that

total expenditure on good j, nj Pj Yj , is equal to a constant share of total income. Since revenue

per plant, Pj Yj , is also equal to a constant, the log of the number of plants in the industry is

equal to a constant plus the log of total income. This relationship allows me to express total

output in the industry, Yj , as:

E

ln Yj = −sE

j ln(P ) −

X

i∈I

E

E

L

sM

ij si ln(P ) − si ln(w) + kj + k

where k is equal to the log of total income. Thus, the log of total industry output is equal to

output per plant plus a constant that does not vary by industry. Note that the model does not

include all general equilibrium effects; total income may depend on the price of oil, in which case

k = k(P E ). This effect of the price of oil on output would not vary across industries because of

the assumption of Cobb-Douglas consumer preferences.

For the Cobb-Douglas production function, value added is proportional to output. Total

industry value added, Vj , is:

E

ln Vj = −sE

j ln(P ) −

X

i∈I

E

E

L

0

sM

ij si ln(P ) − si ln(w) + kj + k

(9)

The corresponding equation for the intermediate goods industries is similar because the log of

the number of plants in these industries is equal to a (different) constant plus the log of total

income.

As in equation (8), the value added equation, (9), shows the direct and supply effects on

total value added. Returning to the example in the Introduction, the printing industry uses

little energy directly, so the direct effect of an energy price increase should be small. However,

E

printing requires a lot of paper (sM

ij is large) and paper uses a lot of energy (sj is large). The

supply elasticity for printing is large because an increase in the price of energy raises the price of

paper, reducing output in the printing industry. The Cobb-Douglas assumptions for production

and final good consumption, as well as the free entry assumption, imply that there is no demand

effect in this simple model. I relax these assumptions in the empirical work, as described below.

2.2

Estimating the importance of demand and supply linkages

I derive the estimating equation from the model in the previous section and discuss the identification of the three effects. Equation (9) demonstrates the direct and supply effect of a price

7

shock on value added. The equation was derived for final goods industries, but it is valid for

intermediate goods industries, because the cost shares of those industries equal zero. In other

words, equation (9) characterizes value added for any industry. This equation holds for any year

t, where the price of energy is equal to PtE . Since total income may be a function of the price of

oil, or vary over time for other reasons, I replace the second constant term in equation (9) with

a year-specific intercept. Finally, I assume that wages and labor cost shares are uncorrelated

with the other variables in this equation, to obtain:

E

ln Vit = β 1 sE

i ln Pt + β 2

X

E

E

sM

ji si ln Pt + ιi + τ t + εit ,

(10)

i6=j

where β 1 and β 2 are parameters, which equal negative one in the model; ιi is a set of industry

dummies, and τ t is a set of year dummies. The error term, εit , allows for unobserved shocks to

value added or wages that are uncorrelated with the other independent variables. I refer to sE

i as

P

M E

the direct elasticity and to β 1 sE

i as the direct effect. I define the supply elasticity as

i6=j sji si

and the supply effect as β 2 multiplied by the elasticity.8

Due to the assumption that the industry’s production function is stable and Cobb-Douglas,

the cost shares do not change over time. Value added varies because of intertemporal changes

in the price of oil and cross sectional variation in the direct and supply elasticities.

I now address the fact that there is no demand effect in the model used to derive equation

(9). As mentioned in the Introduction, the demand for a given industry’s output may fall if that

output is used by energy intensive industries. If the demand effect is correlated with the other

effects (e.g., energy intensive industries supply their output to other energy intensive industries),

I could obtain spurious or biased estimates. For this reason I add a measure of the demand effect

to equation (10).

P

k

In the empirical analysis, I define the demand elasticity similarly to the supply elasticity:

E

M

sM

ik sk . The parameter sik is the cost share of material i in the production of good k. An

industry that supplies its output to energy intensive industries has a large demand elasticity. I

add the demand elasticity to equation (10):

E

ln Vit = β 1 sE

i ln Pt + β 2

X

E

E

sM

ji si ln Pt + β 3

i6=j

X

E

E

sM

ik sk ln Pt + ιi + τ t + εit ,

(11)

k6=i

where β 3 is a parameter. The demand effect is given by β 3

P

M E

k6=i sik sk ,

similarly to the supply

8

Note that the supply effect for industry i does not include the share of material i in the production of good

i. This is to avoid double counting the supply effect from the same industry. In this equation, the coefficient β 1

includes the supply effect from within the industry. In practice, the materials cost shares, sM

ii , are small, and

this does not have a large effect on β 1 .

8

effect.

Equation (11) is the baseline estimating equation. The dependent variable is log value added

by industry and year. The independent variables decompose the effect of energy prices into

three effects, given by the first three terms on the right hand side: direct, supply and demand.

I compute the elasticities using cost shares and I estimate the parameters β 1 , β 2 and β 3 , which

determine the relative magnitudes of the three effects. The regression is estimated by Ordinary

Least Squares (OLS), and the sample contains a balanced panel of four digit manufacturing

industries from 1963-1982 (the next section discusses the data sources and the construction of

the variables). The year dummies in equation (11) control for aggregate shocks in a given year

and the industry dummies allow for separate industry-specific intercepts.

The regression shows whether industries with large elasticities, as predicted by the model,

actually experience large changes in value added when the price of energy rises. This allows me

to quantify the relative importance of the three effects. The coefficient β 1 determines the direct

effect. A one percent increase in the price of energy causes value added in the average industry

to fall by β 1 · sE percent, where sE is the mean oil cost share across industries. The supply effect

is determined by β 2 and the demand effect by β 3 . Defining sM sE as the mean supply elasticity

across industries, a one percent increase in the price of energy causes value added in the average

industry to fall by β 2 · sM sE percent, via the supply channel. The estimate of β 3 has a similar

interpretation.

Instead of using the price of energy in the empirical work, I define the variable PtE as the log

real price of oil in year t. On the other hand, I use the cost share of energy for sE

i . I use the

price of oil instead of an energy price index because the oil price measure is more likely to be

exogenous over the sample period (1963-1982). I use the energy cost share as opposed to the oil

cost share because of data availability, but this does not appear to affect the results.

I now discuss the assumption that the cost shares and elasticities are stable over time. In

practice, there are several reasons why they may vary. First, there may be technology adoption

in response to oil prices. Linn (2006) documents considerable adoption in the late 1970s and

early 1980s. I address this possibility by using cost shares from the initial year (to reduce the

likelihood of a spurious correlation) and end the sample in 1982 (because there appears to have

been large changes in cost shares afterwards, which would bias the results).9

A second possibility is that the supply and demand elasticities could be more complicated

functions of the energy and materials cost shares. This would lead to omitted variable bias.

9

It appears that the supply effect diminished in the late 1980s (see Table 3). This is consistent with priceinduced technical change and with previous research (e.g., Hooker), that finds a diminished effect of oil prices in

the last two decades.

9

Below, I show the results of several other measures of the potential supply and demand effects,

which relax the Cobb-Douglas assumption and allow for possible nonlinearities in input demands.

For example, I estimate a similar equation:

E

max

E

max

E

ln Vit = β 1 sE

i ln Pt + β 2 sji ln Pt + β 3 sik ln Pt + ιi + τ t + εit ,

(12)

where smax

is the energy cost share of the supply industry, j, with the largest materials share

ji

max

for industry i (i.e., the largest sM

ji ), and similarly for sik . I estimate similar regressions to

equation (12), using the mean energy cost share of the five most important supply industries,

or the maximum energy cost share of the five most important supply industries (the demand

measures are defined analogously). The main results are similar to estimating equation (11),

which suggests that the Cobb-Douglas assumption is a reasonable approximation.

It is also possible that the changes in cost shares are uncorrelated with the independent

variables. This would create measurement error, biasing the coefficients. In practice, the inner

product measures of the supply and demand elasticities are fairly stable over the sample period

and this does not appear to be a major source of bias.

Even if the cost shares are constant, the estimated coefficients may include higher order

direct or supply effects. For example tire production (SIC 3011) uses synthetic rubber (SIC

2822), which requires petroleum products (SIC 2911). The measure of the supply effect for the

tire industry accounts for the effect of rubber prices on tire production. It does not include the

second order effect of petroleum product prices on tire production. This would cause the βs to

vary from negative one (the value implied by the model). This effect is not in the model from

the previous section because of the assumption that intermediate materials industries do not

require materials from other industries.

The final empirical issue is that equation (11) does not account for external demand shocks,

i.e., changes in demand for an industry’s output by non-manufacturing firms or by consumers.

I cannot address this possibility directly because of a lack of data and a valid identification

strategy. However, as discussed below, it does not appear that omitted demand shocks are

driving the results, and a number of checks for omitted variable bias yield similar results.

2.3

Entry and Exit

Equation (11) characterizes the effect of the price of energy on industry level value added. Value

added is equal to the product of the number of plants in the industry and the average value

added per plant. Consequently, changes in entry and exit, or in plant-level production could

explain changes in total value added.

10

I measure the effect of entry and exit on industry level value added by constructing two

variables for each year and industry. The variable ENit is the sum of the value added in year

t of plants in industry i that entered between the previous and current years. The variable

EXit is the value added of the plants in industry i that exited between the previous and current

years. The entry variable measures the contribution of entry to changes in industry value added

between the two years; the exit variable measures the contribution of exit.

The logs of these two variables are the dependent variables in the following two regressions:

E

ln ENit = δ 1 sE

i ln Pt + δ 2

X

E

E

sM

ji sj ln Pt + δ 3

j6=i

E

ln EXit = γ 1 sE

i ln Pt + γ 2

X

X

E

E

sM

ik sk ln Pt + ιi + τ t + η it ,

(13)

E

E

sM

ik sk ln Pt + ιi + τ t + ν it ,

(14)

k6=i

E

E

sM

ji sj ln Pt + γ 3

j6=i

X

k6=i

where {δ 1 , δ 2 , δ 3 } and {γ 1 , γ 2 , γ 3 } are parameters to be estimated. Equations (13) and (14) have

the same independent variables as equation (11). The three parameters in each equation corre-

spond to the direct, supply and demand effects of the price of oil on entry and exit. Multiplying

the parameters by the appropriate cost shares yields elasticities; for example, a one percent

increase in the price of oil causes the value added of entrants to rise by δ 1 · sE percent, via

the direct channel. However, the elasticities are not directly comparable to those derived from

equation (11). For example, suppose entry accounts for 10 percent of value added in the average

industry. If the estimates of δ1 , δ 2 and δ 3 imply that a one percent increase in the price of oil

causes a 0.1 percent increase in the value added of exiting plants, this would correspond to a

0.01 percent decrease in total value added of the average industry.

2.4

Plant Value Added

An oil price increase would cause industry value added to fall if plant production falls. I estimate

an equation similar to equation (11) at the plant level, where the sample includes a balanced panel

of plants from 1963-1982. The dependent variable is the plant’s value added in the corresponding

year. The independent variables are the energy cost share, supply and demand measures from

equation (11). The regression includes plant fixed-effects and year dummies, as shown below:

E

ln Vnt = λ1 sE

i ln Pt + λ2

X

E

E

sM

ji sj ln Pt + λ3

j6=i

X

E

E

sM

ik sk ln Pt + ν n + τ t + ω nt ,

(15)

k6=i

where n indexes the plant and ν n are plant fixed effects. The coefficients {λ1 , λ2 , λ3 } are the

estimates of the three effects on average value added per plant. The two sets of coefficients,

{β 1 , β 2 , β 3 } and {λ1 , λ2 , λ3 } are directly comparable. Similarity between them would indicate

11

that most of the effect of oil prices on value added occurs at the plant level, rather than due to

plant entry and exit.

3

Data and Variable Construction

The main estimating equations are (11), (13), (14) and (15). The data sources used to construct

the variables are the Census of Manufactures (CM)), 1963-1982, the NBER Manufacturing Productivity Database (MPD) and the refiner acquisition cost of imported oil from 1968-1982,

obtained from the Department of Energy (DOE).

3.1

Industry Value Added Variables

The dependent variable in equation (11) is the log real value added of each industry in each

Census year (1963 and every five years from 1967-1982). A plant’s nominal value added is

defined as total shipments, net of energy and materials expenditure. I take the sum across

plants by four digit industry and year to obtain the industry-level nominal value added.10 I

then compute real value added as the nominal value added divided by an industry specific value

added deflator.11 I estimate equation (11) using a balanced panel of 428 industries.

I restrict the sample to the years 1963-1982. Data is available to extend the analysis through

1997, but I do not use the later years because of the concern that technical change in response

to energy prices may have affected the cost shares (see section 2.2).12

The variable PtE is the real price of oil in year t. The nominal oil price is the refiner acquisition

cost of imported oil, obtained from the DOE.13 The DOE collected the data from refiners in

several different surveys over the time period, and the prices are a national average. I use

the imported price, which is plausibly exogenous to the U.S. economy for this time period

(Rotemberg and Woodford). The real oil price is the nominal oil price divided by an aggregate

value added deflator for the manufacturing sector. The use of the aggregate value added deflator

in constructing the independent variables is justified by the fact that it should be uncorrelated

with industry specific shocks. Furthermore, oil prices have little effect on contemporaneous

output prices.14

10

As is customary in using plant level data from the CM, I omit administrative records plants, for which most

variables are imputed.

11

I compute the value added deflator using industry specific gross shipments and materials deflators and the

Tornqvist approximation. I obtain the deflators from the MPD.

12

The results are qualitatively similar if I extend the sample to 1997 or end the sample in 1977. The estimates

for 1963-1997 are considerably smaller, however, suggesting that technological change reduced the sensitivity of

industries to oil shocks (see Table 3).

13

The data is available from 1968-1997. I assume the nominal price was constant between 1963-1968. Other

measures of oil prices support this assumption; for example, the crude oil domestic first purchase price increased

by less than 2 percent over this time period.

14

Previous research on oil prices and economic activity has used a variety of price indexes constructed from

12

The energy cost shares and materials shares are computed from the 1963 CM. The energy

cost share of each industry is the ratio of energy expenditure to shipments (using the same

sample of plants used to calculate value added).

I use the materials file in the 1963 CM to compute the materials cost shares. For the

plants used to compute value added, the file contains detailed information about the materials

consumed. The file provides each plant’s expenditure on different types of materials, where

materials are coded by six digit product code. I aggregate across plants and materials to calculate

the variable Mji . This variable is the amount of good j purchased by plants in industry i, where

both industries and products are aggregated to the four digit level. I divide Mji by the total

output of industry i in 1963 to obtain the cost share of material j in the output of industry i,

sM

ji .

I compute the supply and demand elasticities in equation (11) by matching the energy cost

share of industry j, sE

j , with the corresponding cost share of material j in the output of industry i,

15

sM

A few industries, such as ready-mix concrete (SIC 3273) primarily use one input (cement,

ji .

SIC 3241), but most four digit industries use materials from many manufacturing industries.16

I check the robustness of the results using several alternative measures of the supply and

demand elasticities. Ideally, I would use oil cost shares instead of energy cost shares in constructing the direct, supply and demand elasticities, because oil shares may more accurately

capture the effect of an oil shock. The necessary data is not available to compute oil cost shares

at the beginning of the sample, however. I am able to compute the oil shares by four digit

industry using the 1977 Annual Survey of Manufacturers Fuel Supplement. I replace the energy

cost shares with the oil shares in equation (11). I prefer the 1963 energy shares because of the

possibility that the oil shares responded endogenously to oil price changes, but I show the results

using oil cost shares for comparison.

To assess the validity of the first order approximations in the model, I use four alternative

oil prices. Barsky and Killian (2002) argue that many changes in the price of oil are due to a mix of demand

and supply factors, and may not be exogenous to the U.S. economy. Killian (2006) proposes an alternative index

designed to isolate oil supply shocks. Future work will study the robustness of the results to relaxing the random

walk assumption implied by using the current price, and and replacing it with alternative measures.

15

E

I match the energy cost share, sE

j , with the materials share of good j. Note that sj is the cost share of

plants in industry j, which is not necessarily equal to the cost share of producing good j. This could introduce

measurement error, if plants in industry j produce multiple goods, and the production of those goods requires

different amounts of energy. However, most plants in a given industry primarily produce products classified in

the same industry, so the energy cost share should accurately reflect the actual importance of energy in producing

good j. I report similar results below when I construct the dependent and independent variables using single

product plants, suggesting this is not a major concern.

16

The coding of the industries and materials are not exactly the same, and in some cases the materials codes do

not have a matching industry code. In that case I cannot obtain the energy cost share of the particular material.

I use the energy cost share of the least aggregated industry that does match. For example, if I can match the

material code to an industry code by the first three digits, I use the average energy cost share of plants in the

corresponding three digit industry.

13

measures of the elasticities. First, I use the energy cost share of the good that is the most

important input to the industry (smax

ji ).

To compute the last three measures for industry i, I obtain the five supply industries that

account for the largest share of materials. For industry i, I take the set {Mji }Ij=1 , and select the

five industries with the largest values of Mji for industry i. I use these industries to compute

three statistics for industry i: the mean energy cost share of the five industries; the mean energy

cost share, weighted by Mji ; and the maximum energy cost share of the five industries. I calculate

the corresponding demand measures similarly.

Table 1 shows the means of the energy cost share, supply and demand measures, with standard deviations in parentheses. In the first column of Panel A, the mean energy cost share is

0.015.

The second and third rows show that energy intensive industries are important input suppliers to other industries, but demand relatively small amounts of goods from other manufacturing

industries. For each industry, I compute the fraction of output used as inputs by other manufacturing industries. The second column reports the correlation between this variable and the

industry’s energy cost share. This correlation is positive, 0.20, meaning that the output of energy

intensive industries is more likely to be used as inputs by other industries; i.e., energy intensive

industries often produce intermediate goods. For the third column I compute the correlation

between an industry’s energy cost share with its materials share. In U.S. manufacturing, energy intensive industries use fewer intermediate materials. Returning to the model in section 2.1,

these patterns suggest that in US manufacturing, intermediate goods tend to be energy intensive

and use few inputs, while final goods tend to use relatively little energy. This suggests that the

supply effect should be larger than the demand effect, which agrees with the empirical results.

Panel B reports the six measures of the supply and demand elasticities. The first row reports

the baseline supply and demand measures, computed using energy cost shares, and the second

row reports the alternative supply measure, computed using oil cost shares. The two supply

measures are considerably larger than the demand measures. The baseline supply measure is

0.0067 with standard deviation of 0.0074, while the baseline demand measure is 0.0027 with

standard deviation 0.0076 (note that the numbers in the table have been multiplied by 10 for

E

clarity). Mechanically, this pattern arises from the fact that sM

ji is positively correlated with sj ,

E

while the correlation between sM

ik and sk is much weaker. In other words, these measures reflect

the correlations reported in Panel A.

The alternative measures of the supply and demand effects in Panel B support this conclusion.

For example, the energy share of the most important supplier is larger than the average energy

14

share reported in Panel A. This means that energy intensive industries are more likely to be

the primary input supplier. In comparison, the energy share of the most important demanding

industry is smaller than the average energy intensity.

3.2

Entry, Exit and Plant Value Added Variables

The entry and exit equations ((13) and (14)) use the same independent variables as equation

(11). I measure the dependent variables, log entry and exit by industry, using plant identifiers

in the CM.17 An entrant is any plant that did not appear in the previous Census, and an exiting

plant is one that appeared in the previous Census but not the current. For each industry and

year I calculate the total value added of plants that entered between the previous and current

Census years. I divide entry by the value added deflator in the current year to obtain the

dependent variable in equation (13), ENit . I calculate EXit as the total value added of plants

that exit between the previous and current Census years, divided by the value added deflator

from the previous Census.18

Finally, the plant level regression, equation (15), is estimated using a balanced panel of

52,474 plants that report positive value added each Census year from 1963-1982. The dependent

variable is log real value added by plant and year, equal to the log of nominal value added divided

by the corresponding industry’s value added deflator.

4

4.1

4.1.1

Results

Effect of a Price Shock on Industry Value Added

Baseline Estimates

Table 2 compares the three effects of an oil price shock on industry-level value added in U.S.

manufacturing. The sample includes a balanced panel of four digit industries, with observations

in each Census year from 1963-1982. The regression is estimated by OLS and all variables are in

first differences.19 The dependent variable is log real value added by four digit industry and year.

The independent variables are a full set of year dummies and measures of the direct, supply and

demand elasticities (taking first differences eliminates the industry dummies in equation (11)).

The direct effect is the interaction of the real price of imported oil with the industry’s energy cost

share in 1963. The supply measure for industry i is the interaction of the log price of oil with

17

More precisely, the plant identifiers are in the Longitudinal Research Database, which links the Census of

Manufactures and the Annual Survey of Manufactures, for 1963, 1967 and 1972-1997.

18

The results are similar using the current value added deflator in the exit regressions.

19

The results are qualitatively similar using industry fixed effects instead of taking first differences. The

magnitudes are somewhat different, which suggests there may be some drift in the industry-specific constant

term. I focus on the first difference estimates which are more robust.

15

the supply elasticity. The supply elasticity is the inner product of the cost share of material j for

E

industry i (sM

ji ) with the energy cost share of industry j (sj ). The demand measure is defined

similarly. The estimated supply effect captures the importance of supply side shocks on value

added and the demand measure captures demand shocks from other manufacturing industries.

Column 1 shows the results of estimating equation (11). The estimate of β 1 , for the direct

effect, is -1.60 with standard error 0.62, significant at the 1 percent level. The mean cost share

is 0.015, so a one percent increase in the price of oil causes value added to decrease by 0.024

percent in the average industry, holding constant materials supply and output demand.20

The estimate for the supply effect, β 2 , is -6.07 with standard error 2.33. The demand estimate,

β 3 , is much smaller, -0.06, and is insignificant. The next two rows quantify the importance of

the supply effect. I calculate the total effect of the price of oil on value added using the reported

coefficients and the sample means of the corresponding variables. A one percent increase in the

price of oil causes value added to fall by -0.07 percent, which is about five times larger than the

average energy cost share. This elasticity is comparable to the results of Lee and Ni for some of

their industries, and to some of the macroeconomic studies (e.g., Hamilton, 2005). As noted in

the introduction, other studies (e.g., Bohi, 1991) has found a smaller effect.

The last row shows that the magnitude of the supply effect, -0.04, is a large fraction of

the total effect. The relative importance of the supply effect agrees with the fact that energy

intensive industries are important suppliers.21

The baseline regression may misspecify the effect of an oil shock on value added because it

uses energy cost shares instead of oil cost shares. Recall that I use the energy cost shares in

1963 because of data limitations. An alternative is to use oil cost shares in 1977, computed

from the 1977 Annual Survey of Manufactures Fuel Supplement. In column 2, the direct effect

is close to the estimate in column 1. The estimated supply effect at the bottom of the table

(which accounts for the different normalizations of the energy and oil supply elasticities, shown

in Table 1) is similar in columns 1 and 2, though it is more precisely estimated using the oil cost

shares. The demand effect is much larger in column 2, and is marginally significant (at about

the 10 percent level). This suggests that measurement error in column 1 may bias the demand

effect estimate towards zero. However, there are two things to note. First, because oil shares are

computed after the first oil shock, these estimates may be biased. Second, the demand effect is

20

The supply and demand effects for industry i are computed by taking the inner product over all other

industries. Some industries contain plants that use products from within the same industry. Consequently, β 1

measures the direct effect, plus the supply and demand effects from within the industry. However, these materials

cost shares are typically small, and this should not greatly affect the estimate of β 1 . Note that I compute the

inner products in this manner to avoid double-counting the effects from within the industry. Table 3 reports

similar results using the industry’s cost share of materials from the same industry as a separate control.

21

Recall that the demand measure is a second order effect, while the other variables are first order. Omitting

this variable does not affect the estimates.

16

much smaller than the supply effect in column 2; this specification supports the conclusion that

the supply effect is more important than the demand effect in U.S. manufacturing.

As discussed in section 2.2, the elasticities computed in equation (11) are first order approximations. The approximations may lead to biased results, so I consider a number of alternative

measures in place of the inner products used in column 1. Column 3 uses the energy cost share

of the industry that is the largest supplier of intermediate materials or the largest demander of

M

the industry’s output (the industry with the largest sM

ji or sik for industry i in equation (11)).

Column 4 uses the mean energy cost share of the five most important suppliers and demanders

(the five industries with the largest Mji and Mik for industry i). Column 5 weights these five

cost shares by the corresponding Mji or Mik . In column 6 the supply effect is measured by the

largest energy cost share of the five most important industries, and similarly for the demand

effect.

The estimates of β 1 in columns 3-6 are close to negative one, though the estimate is insignificant in column 4 (which uses the raw man of the five industries). The supply effects are similar

to the baseline, though again column 4 is an exception. Note that the demand side estimates are

positive, though small and insignificant. For this reason, the measures of the demand elasticity

in columns 1 and 2 are probably more accurate. Nonetheless, these specifications show a similar

pattern to the baseline, that the supply effect plays an important role in explaining volatility of

industry level value added. I conclude that the results are fairly robust to alternative measures

of the supply and demand elasticities.22

4.1.2

Interpretation of the Baseline Estimates

The parameter β 2 is related to the supply side effect of an oil shock. Table 2 shows that supply

effect is much stronger than the demand effect. In comparison, Lee and Ni conclude that the

demand effect is important for some industries. A possible explanation for this discrepancy is

that I do not measure the total demand effect for each industry. I only have sufficient data to

estimate the demand effect from other industries within manufacturing; there may be important

demand effects from other industries or from consumers. In other words, I may be unable to

detect a strong demand effect because of insufficient data.

The main concern is that the omitted demand effect may be causing a spurious supply

22

An issue related to the measurement of the supply and demand elasticities is that many plants produce

products of other industries. For example, many sausage plants (SIC 2013) produce products of the meat packing

industry (SIC 2011). In such cases, the direct, supply and demand elasticities may be mismeasured; these sausage

plants may use different materials than the averge sausage plant. As a specification check I compute value added

by four digit industry using plants that produce mainly one product (i.e., plants for which at least 95 percent of

output includes a product in the same four digit industry). I compute the direct, supply and demand measures

using plants that produce one product. I obtain similar results to the baseline, though the estimates are smaller.

17

estimate. To address this, I estimate the following regression:

E

ln Pit = φ1 sE

i ln Pt + φ2

X

E

E

sM

ji sj ln Pt + φ3

j6=i

X

E

E

sM

ik sk ln Pt + ιi + τ t + εit ,

(16)

k6=i

where the dependent variable, ln Pit , is the log output price of industry i in year t. This equation

has the same independent variables as equation (11), and the only difference is the dependent

variable. If the estimate of β 2 were not spurious, I would obtain a positive estimate of φ2

because the decrease in the output of the industry would cause the price to rise, holding demand

constant. On the other hand, if unobserved demand shocks were correlated with the calculated

supply elasticity, I would obtain a negative estimate of φ2 . In practice, the estimates of equation

(16) suggest that the results are not driven by an omitted demand variable. The estimate of φ2

is 3.47 (standard error, 0.77). The estimate of φ3 is positive, though small and insignificant.

This results is further indication that the measurement of the full demand effect is inaccurate.

It is, of course, possible that external demand shocks cause the baseline estimates to be biased,

but these results support the claim that the supply estimate is not spurious.

I further investigate this concern by re-estimating equation (16), using the average log materials price for industry i in year t as the dependent variable. If the interpretation of β 2 is

correct, then industries with a large supply effect should also experience a large increase in the

average price of their materials. This would not likely be the case if an omitted variable correlated with the supply effect were driving the results. The estimate of the supply effect with

this specification is positive and significant, supporting the interpretation of β 2 as capturing the

supply effect, which arises from changes in materials prices.[This estimate has not yet been

disclosed.]

4.1.3

Alternative Specifications

This section discusses a number of checks of the baseline estimates. I first consider whether

random fluctuations of the cost shares bias the estimates. Energy and materials prices were

relatively stable between 1963 and 1972. Consequently, changes in energy or materials cost

shares during this period would likely be due to measurement error or other sources of variation,

uncorrelated with the independent variables.

Figures 1 shows that such fluctuations were relatively small. In Figure 1 I plot the percent

change of each industry’s energy cost share between 1963 and 1972 versus the initial value in

1963.23 The figure shows that there was little change in the energy cost share, and that the

23

Due to confidentiality concerns, I cannot plot the data points for all 428 industries in the sample. Figures

1-4 include industries with at least 25 firms, and include 164 industries. The sample of industries meeting the

18

changes were not strongly correlated with the initial levels (the mean change is seven percent).

There is a slight negative correlation, but the coefficient in a univariate regression of the percent

change on the initial cost share is not significant.24

The results in column 1 of Table 3 support this conclusion. If random variation in the cost

shares were biasing the results, I would obtain different estimates by omitting the years 1963 and

1967 from the estimation model. I restrict the sample to the years 1972-1982 and use the 1972

energy and materials cost shares to compute the independent variables. As in all specifications

in Table 3, I use the calculated elasticities from column 1 of Table 2. The estimates of equation

(11) are similar to the baseline.25

I next focus on changes in cost shares that may have been caused by energy prices. For

example, price-induced technical change could cause industries to reduce their average energy

cost shares. Correlation between technical change and the independent variables could lead to

spurious or biased estimates of the different effects.

Figures 2 and 3 suggest that such changes may have occurred in the 1980s. Figure 2 plots the

percent change in each industry’s energy cost share against its initial level for 1963-1982. Figure

3 shows the percent change in cost share from 1982-1997 versus the 1982 cost share. The change

in cost share between 1963 and 1982 was much larger than between 1963 and 1972, though the

percent change is not correlated with the initial value. This suggests there was little price-induced

technical change. On the other hand, the change in cost share was negatively correlated with the

initial cost share between 1982 and 1997. This correlation may reflect underlying endogenous

technical change, and supports restricting the baseline regression to the years 1963-1982.

Column 2 of Table 3 provides further justification for ending the estimation in 1982. This

specification shows the results from estimating equation (11) between 1963-1997.[This estimate

has not yet been disclosed.] The estimates of the direct and supply effects are considerably

smaller than in Table 2. This pattern is consistent with industries adopting technology that reduces their sensitivity to price shocks, and is consistent with other research that has documented

a decline in the importance of price shocks since the 1980s (e.g., Hooker, 1996).

Transportation costs represent another possible source of bias. Manufacturing industries rely

on a variety of energy intensive forms of transportation. If industries with a high measure of

the supply elasticity also have high transportation costs (either for materials they consume or

for their output), the estimates could be biased.

disclosure criteria is fairly representative; the patterns in the figures with the full samples of industries are quite

similar.

24

The supply and demand elasticities show a similar pattern.

25

If measurement error were important, I would obtain different results using the 1963 cost shares in place of

the 1972 cost shares in column 1 of Table 3, which is not the case.

19

I use the 1993 Commodity Flow Survey to construct two measures of transportation costs.26

First, I obtain a demand measure of transportation costs. Industries that ship a large share of

their output great distances have a relatively large average shipping cost. An oil price increase

would raise these shipping costs and reduce the demand for the industry’s output. I compute

the number of ton-miles of goods shipped by each industry, divided by the industry’s output.

This variable proxies the average shipping cost of the industry’s output. I interact this measure

with the log real price of oil.

The second measure is the supply effect of transportation costs. Industries that rely on

shipments of a large share of intermediate materials would experience a large change in the price

of those materials. For a given industry, I compute the weighted average shipping cost of its

inputs, using the corresponding input cost shares (sM

ji ) as weights. I interact this variable with

the log real price of oil.

Column 2 in Table 3 shows that including these measures of transportation costs does not

affect the results.27 The coefficients on the transportation variables (not reported) are negative,

indicating that a price increase reduces value added because of the increase in transportation

costs.28 The results in Table 3 suggest that the independent variables are not highly correlated

with transportation costs.

Column 4 uses a less parametric, and more demanding, approach to check for omitted variable bias. Persistent shocks correlated with the independent variables could bias the estimates

or cause a spurious correlation. Controlling for industry-specific trends reduces the estimates

considerably.

To first order, value added is proportional to gross output. The approximation may not be

very accurate for a non Cobb-Douglas production function, in which case the estimates would be

biased. In column 5 the dependent variable is log real gross output, computed using an industry

specific output deflator. The results are similar to the baseline, suggesting this is not a major

concern.

Columns 6-8 control for other industry-specific characteristics, none of which affect the results. Column 6 includes the interaction of the industry’s materials cost share in 1963 with the

26

Ideally I would use transportation cost data from the beginning of the sample, or at least before the

major oil price shocks. However, the necessary data is not available. In addition, the data is only

available at the three digit level of aggregation. The 1993 Commodity Flow Survey can be found at:

www.census.gov/prod/2/trans/93comflo/.

27

The Survey includes sufficient data to construct more detailed measures of transportation costs. For example,

I can distinguish shipments by mode of travel. The results are similar using a variety of other measures of

transportation costs, such as the share of materials shipped by trucking.

28

I do not emphasize those estimates because the variables are probably measured with error; nonetheless, they

should be correlated with actual transportation costs, and be sufficient for addressing concerns about omitted

variable bias.

20

real price of oil. Column 7 includes the 1963 labor cost share and column 8 includes the share

in materials of products made by plants in the same industry.

4.2

Effect of a Price Shock on Entry and Exit

Changes in industry-level value added could be due to entry and exit or to changes in value added

per plant. Tables 4 and 5 show the estimates of equations (13) and (14), which characterize the

direct, supply and demand effects on entry and exit. The dependent variables are the log total

real value added of plants entering or exiting between the previous and current Census years.

The regressions use the same supply and demand measures as the corresponding columns in

Table 2.

The coefficients capture the importance of the three effects on entry and exit. Multiplying

the coefficients by the appropriate cost shares yields the elasticities of value added from entry or

exit with respect to the price of oil. For example, multiplying the coefficient on the direct effect

by the average energy cost share in the sample gives the effect of a one percent price increase

on entrants’ value added, holding fixed the supply and demand effects.

Note that the magnitudes do not correspond exactly to the estimates in Table 2. The value

added of entrants accounts for about 10 percent of total value added in the sample, and similarly

for exiting plants. Thus, if the entire effect of oil prices on value added was due to entry and

exit, the coefficients in Table 4 would be about 10 (1/0.1) times larger than the coefficients in

Table 2.

With these considerations in mind, Table 4 shows that entry does not explain much of the

effect of oil prices on value added. The direct and supply estimates are negative and precisely

estimated. The total elasticity in the baseline specification is -0.12. Accounting for the fact

that 10 percent of value added is from entrants, this elasticity implies that a one percent price

increase causes total value added to fall by 0.01 percent due to the reduction in entry. This is

about 20 percent of the total effect on value added, reported in Table 2. The other columns

imply a similarly small effect of entry. The precision of the estimates in Table 4 allows me to

reject the hypothesis of large entry effects.

By comparison, there is no evidence in Table 5 that a price increase causes an increase in

exit. As the last two rows show, I can reject the hypothesis of a large effect of exit on total value

added.

21

4.3

Effect of a Price Shock on Plant Value Added

Table 6 reports the estimates of equation (15). The results suggest that oil shocks have large

effects on average output per plant.

The independent variables are the same as those used in the regressions in Table 2, but

observations are at the plant level. The sample includes a balanced panel of plants that appear

in every Census from 1963-1982. The dependent variable is log real value added, computed using

the plant’s reported shipments, materials and energy costs, and the industry-level value added

deflator. The coefficients are directly comparable to Table 2. A close similarity would suggest

that much of the effect of oil prices occurs at the plant level.

The estimates are, in fact, fairly similar to the results in Table 2. In column 1 the direct effect

is significant and precisely estimated, as is the supply effect. The total elasticity of plant-level

value added to the price of oil is about -0.05, and the supply elasticity is -0.04. The corresponding

numbers in Table 2 were -0.07 and -0.04, suggesting that much of the effect of a price shock on

total value added is due to changes in plant-level production.29

Column 2 yields slightly different conclusions, using oil cost shares. This specification suggests that changes in average plant output have an important effect on total industry value

added, though their importance is smaller than in column 1. There is also evidence of a large

demand effect at the plant level.

It appears that an increase in the price of oil causes output at plants to contract because

of the direct and supply-side effects. In contrast, oil shocks have little effect on entry and exit.

This result is consistent with the views of other researchers (e.g., Davis and Haltiwanger), who

argue that oil shocks affect capital utilization.30

5

Conclusion

This paper investigates the importance of demand and supply linkages between industries. In

U.S. manufacturing, energy intensive industries are major input suppliers to other industries.

A price increase causes the supply of output from the energy intensive industries to decrease,

which causes other industries to contract. This supply effect is economically and statistically

important in explaining variation in value added in U.S. manufacturing. In contrast, I find little

29

It is possible to measure the variables for the direct and supply effect for many of the plants in the sample in

Table 5. For the direct effect, I use the plant’s energy cost share in 1963. I measure the supply variable similarly

to equation (11), except that I use the plant’s materials cost shares in 1963, instead of the cost shares of the

corresponding industry. I obtain smaller estimates, though the suplly effect explains a comparable fraction of the

total variation of value added.

30

There is little direct evidence in support of the capital utilization argument, due to data limitations. Barsky

and Killian (2002) argue that the existing evidence does not support the argument, because rental rates do not

fall when oil prices rise. Thus, the question of the effect of oil prices on capital utilization remains open.

22

evidence that demand shocks from within the U.S. manufacturing sector play an important role.

Oil shocks primarily affect average production per plant, rather than entry and exit. The

demand and supply effects cause similar changes in value added per plant as value added per

industry. There is no evidence that entry and exit respond by economically significant amounts

to a price shock. A price increase causes a small (and precisely estimated) decrease in entry, and

has no effect on exit.

An open question is how strong are external demand shocks, in particular, changes in consumer demand. Lee and Ni show that these effects are important for some industries, but there

is not much evidence for large sectors of the US economy.

6

References

Atkeson, Andrew and Patrick J. Kehoe, 1999. "Models of Energy Use: Putty-Putty Versus

Putty-Clay," American Economic Review, v89, 1028-1043.

Barsky, Robert and Lutz Killian, 2002. "Do We Really Know that Oil Caused the Great

Stagflation? A Monetary Alternative," in Ben S. Bernanke and Kenneth Rogoff (eds.) NBER

Macroeconomics Annual 2001, Cambridge, MA (MIT Press).

Bernanke, Ben S., 1983. "Irreversibility, Uncertainty and Cyclical Investment," Quarterly

Journal of Economics, v98, 85-106.

Bohi, Douglas R., 1991. "On the Macroeconomic Effects of Energy Price Shocks," Resources

and Energy, v13, 145-162.

Davis, Steven J. and John Haltiwanger, 2001. "Sectoral Job Creation and Destruction Responses to Oil Price Changes," Journal of Monetary Economics, v48, 465-512.

Hamilton, James D., 1983. "Oil and the Macroeconomy Since World War II," Journal of

Political Economy, v91, 228-248.

Hamilton, James D., 1988. "A Neoclassical Model of Unemployment and the Business Cycle,"

Journal of Political Economy, v96, 593-617.

Hamilton, James D. and Ana Maria Herrara, 2004. "Oil Shocks and Aggregate Macroeconomic Behavior: The Role of Monetary Policy," Journal of Money, Credit and Banking, v36,

265-286.

Hamilton, James D, 2006. "Oil and the Macroeconomy," in Palgrave Dictionary of Economics, Steven J. Durlauf (ed.).

Hanson, Kenneth, Sherman Robinson and Geral Schluter, 1993. "Sectoral Effects of a World

Oil Price Shock: Economy-wide Linkages to the Agricultural Sector," Journal of Agricultural

and Resource Economics, v18, 96-116.

23

Hooker, Mark A., 1996. "What Happened to the Oil Price-Macroeconomy Relationship?"

Journal of Monetary Economics, v38, 195-213.

Horvath, Michael, 1998. "Cyclicality and Sectoral Linkages: Aggregate Fluctuations from

Sectoral Shocks," Review of Economic Dynamics, v1, 781-808.

Horvath, Michael, 2000. "Sectoral Shocks and Aggregate Fluctuations," Journal of Monetary

Economics, v45, 69-106.

Killian, Lutz, 2006. "Exogenous Oil Supply Shocks: How Big Are They and How Much Do

They Matter for the U.S. Economy?" mimeo, University of Michigan Department of Economics.

Lee, Kiseok and Shawn Ni, 2002. "On the Dynamic Effects of Oil Price Shocks: A Study

Using Industry Level Data," Journal of Monetary Economics, v49, 823-852.

Linn, Joshua, 2006. "Energy Prices and the Adoption of Energy-Saving Technology."

Mork, Knut A., 1989. "Oil and the Macroeconomy When Prices Go Up and Down: An

Extension of Hamilton’s Results," Journal of Political Economy, v92, 740-744.

Pindyck, Robert S. and Julio J. Rotemberg, 1984. "Energy Shocks and the Macroeconomy."

Published in A. L. Alm and R.J. Weimer (eds.), Oil Shock: Policy Response and Implementation,

Harper & Row Ballinger, Cambridge, MA.

Rogoff, Kenneth, 2006. "Oil and the Global Economy."

Rotemberg, Julio J. and Michael Woodford, 1996. "Imperfect Competition and the Effects

of Energy Price Increases," Journal of Money, Credit and Banking, v28, 549-577.

24

Table 1:

Energy Cost Shares and Correlations with Materials Shares

Panel A

Energy Cost Share

0.015

(0.020)

Correlation of Energy Share with

Use as Material

Correlation of Energy Share with

Materials Share

0.20

-0.18

Panel B

Supply Side

Demand Side

Inner Product Using

Energy Share (x 10)

0.067

(0.074)

0.027

(0.076)

Inner Product Using

Oil Share (x 10)

0.026

(0.055)

0.017

(0.054)

Energy Share of

Primary Industry

0.035

(0.026)

0.012

(0.015)

Mean Energy Share

0.031

(0.014)

0.014

(0.013)

Weighted Mean

Energy Share

0.034

(0.021)

0.013

(0.012)

Maximum Energy

Share

0.060

(0.031)

0.029

(0.033)

Notes: All variables are computed from the 1963 Census of Manufactures, except as noted. Energy share is the

ratio of total energy expenditure divided by total shipments for each four digit industry. Panel A reports the mean

energy share across industries, with standard deviations in parentheses. Use as material is the share of an