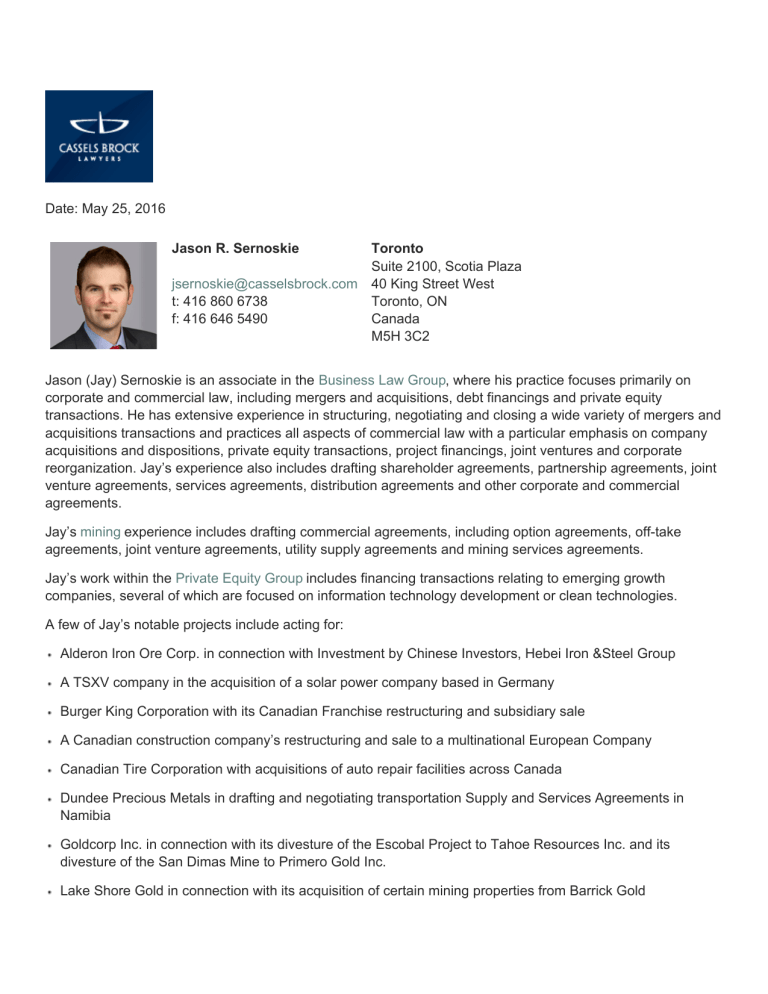

Date: May 25, 2016 Suite 2100, Scotia Plaza 40 King Street West

Date: May 25, 2016

Jason R. Sernoskie jsernoskie@casselsbrock.com

t: 416 860 6738 f: 416 646 5490

Toronto

Suite 2100, Scotia Plaza

40 King Street West

Toronto, ON

Canada

M5H 3C2

Jason (Jay) Sernoskie is an associate in the Business Law Group , where his practice focuses primarily on corporate and commercial law, including mergers and acquisitions, debt financings and private equity transactions. He has extensive experience in structuring, negotiating and closing a wide variety of mergers and acquisitions transactions and practices all aspects of commercial law with a particular emphasis on company acquisitions and dispositions, private equity transactions, project financings, joint ventures and corporate reorganization. Jay’s experience also includes drafting shareholder agreements, partnership agreements, joint venture agreements, services agreements, distribution agreements and other corporate and commercial agreements.

Jay’s mining experience includes drafting commercial agreements, including option agreements, off-take agreements, joint venture agreements, utility supply agreements and mining services agreements.

Jay’s work within the Private Equity Group includes financing transactions relating to emerging growth companies, several of which are focused on information technology development or clean technologies.

A few of Jay’s notable projects include acting for:

Alderon Iron Ore Corp. in connection with Investment by Chinese Investors, Hebei Iron &Steel Group

A TSXV company in the acquisition of a solar power company based in Germany

Burger King Corporation with its Canadian Franchise restructuring and subsidiary sale

A Canadian construction company’s restructuring and sale to a multinational European Company

Canadian Tire Corporation with acquisitions of auto repair facilities across Canada

Dundee Precious Metals in drafting and negotiating transportation Supply and Services Agreements in

Namibia

Goldcorp Inc. in connection with its divesture of the Escobal Project to Tahoe Resources Inc. and its divesture of the San Dimas Mine to Primero Gold Inc.

Lake Shore Gold in connection with its acquisition of certain mining properties from Barrick Gold

A leading electricity company in the negotiation of a power purchase agreement for renewable energy

A leading-edge clean technology fund in the formation of the fund and the structuring of its initial investments in three start-up clean technology companies

A venture capital fund focusing on early-stage technology companies in the formation of its new fund and the negotiation of its investments in underlying investee companies

A Canadian energy company in structuring its carbon offset marketing and sales strategy

A Subsidiary of Sprott Power Corp. in connection with the sale of its indirect partnership interests in a number of Hydro Development Projects in British Columbia

Worldlynx Wireless LP in its purchase of certain Canada-wide retail store locations

Significant Clients Advised (current and historical) (inter alia) – Alderson Iron Ore Corp., Barrick Gold

Corporation, Burger King Corporation, Canadian Tire Corporation, Goldcorp Inc., Extreme Venture Partners

LP, Kinross Gold Corporation, Lakeshore Gold Corporation, Sprott Power Corp., Summitt Energy

Management Inc., WireIE Holdings International Inc., Worldlynx Wireless LP and Yamana Gold Inc.

Call to the bar

Ontario, 2007

Associations

Association for Corporate Growth (ACG)

Canadian Bar Association

Ontario Bar Association

Expertise

Business

Mergers & Acquisitions

Mining

Private Equity