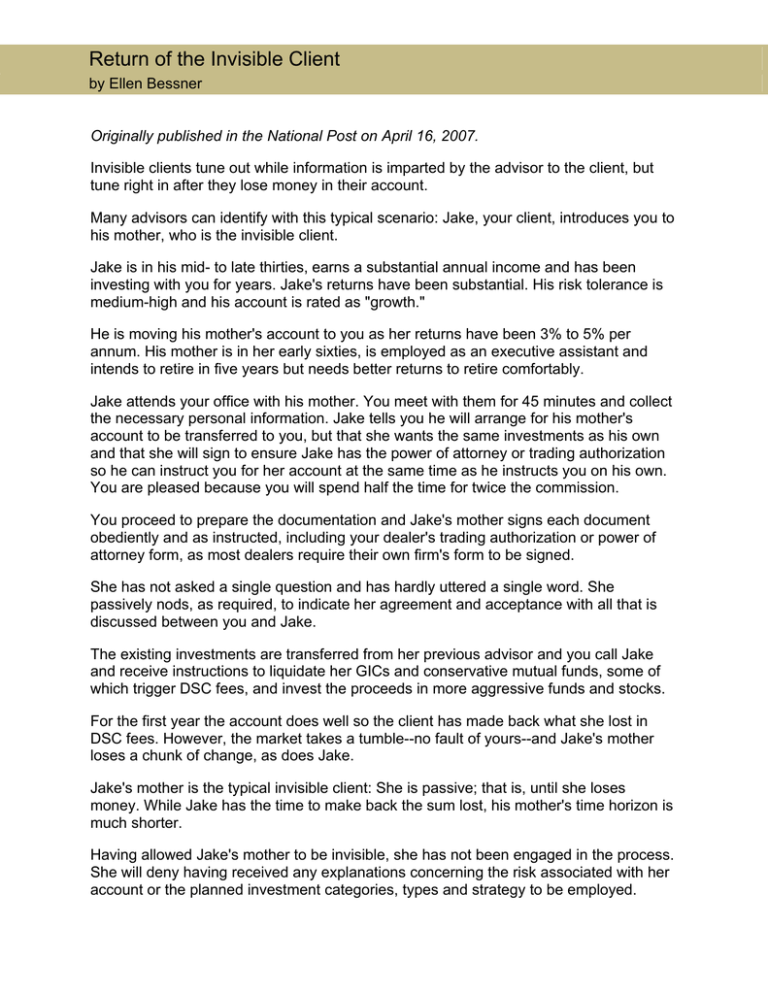

Return of the Invisible Client

advertisement

Return of the Invisible Client by Ellen Bessner Originally published in the National Post on April 16, 2007. Invisible clients tune out while information is imparted by the advisor to the client, but tune right in after they lose money in their account. Many advisors can identify with this typical scenario: Jake, your client, introduces you to his mother, who is the invisible client. Jake is in his mid- to late thirties, earns a substantial annual income and has been investing with you for years. Jake's returns have been substantial. His risk tolerance is medium-high and his account is rated as "growth." He is moving his mother's account to you as her returns have been 3% to 5% per annum. His mother is in her early sixties, is employed as an executive assistant and intends to retire in five years but needs better returns to retire comfortably. Jake attends your office with his mother. You meet with them for 45 minutes and collect the necessary personal information. Jake tells you he will arrange for his mother's account to be transferred to you, but that she wants the same investments as his own and that she will sign to ensure Jake has the power of attorney or trading authorization so he can instruct you for her account at the same time as he instructs you on his own. You are pleased because you will spend half the time for twice the commission. You proceed to prepare the documentation and Jake's mother signs each document obediently and as instructed, including your dealer's trading authorization or power of attorney form, as most dealers require their own firm's form to be signed. She has not asked a single question and has hardly uttered a single word. She passively nods, as required, to indicate her agreement and acceptance with all that is discussed between you and Jake. The existing investments are transferred from her previous advisor and you call Jake and receive instructions to liquidate her GICs and conservative mutual funds, some of which trigger DSC fees, and invest the proceeds in more aggressive funds and stocks. For the first year the account does well so the client has made back what she lost in DSC fees. However, the market takes a tumble--no fault of yours--and Jake's mother loses a chunk of change, as does Jake. Jake's mother is the typical invisible client: She is passive; that is, until she loses money. While Jake has the time to make back the sum lost, his mother's time horizon is much shorter. Having allowed Jake's mother to be invisible, she has not been engaged in the process. She will deny having received any explanations concerning the risk associated with her account or the planned investment categories, types and strategy to be employed. -2- Unless you have taken notes of the fact that explanations were provided and followed up in writing to her, her word that no such explanations were provided will likely be believed, over your attestations that long, detailed explanations were provided. Furthermore, if all communication and instructions came from Jake, how can the advisor prove he explained the investment risks, and that Jake's mother understood them? Even if a letter was delivered, can the advisor prove the investments were suitable? Even if KYC (know-your-client) information is consistent with the investments, does this not automatically protect the advisor, even though it doesn't reflect Jake's mother's profile? With the population growing older, this type of scenario is becoming common. So what are advisors to do? Here are a few suggestions: 1. Do everything possible to engage invisible clients and compel them to be involved in the process. Remind these clients it is their money and responsibility to work with the advisors to develop strategies and pick suitable investments. Power of attorney or trading authorization should be relied on only when invisible clients are incapacitated or otherwise unavailable (when they are travelling, for instance). 2. Manage both Jake's and his mother's expectations. Discuss with Jake up front that you would be pleased to help his mother and she should definitely sign a power of attorney or trading authorization, but that his risk tolerance is likely different from hers. 3. You then want to be certain that his mother is engaged in the process and that you collect evidence of her involvement and understanding of the types of investments and the associated risks. 4. Finally, if she signs a power of attorney or trading authorization in favour of Jake, do not confuse Jake's risk tolerance with that of his mother. You must be committed to serving Jake's mother, regardless of who instructs you, and that means every investment must be consistent with her risk tolerance, time horizon and financial needs. Clear communication and paper trails make a big difference when managing client complaints. Yet with invisible clients, advisors must also engage and involve them in the process. Otherwise, advisors, branch managers or supervisors and dealers risk the inevitable when invisible clients lose money ...they become visible!