Document 11431014

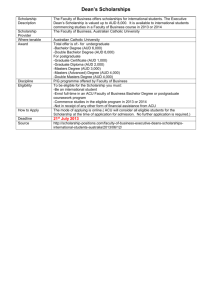

advertisement

\U3Li: U 3)\ \l) l’RRA

fE i\

R\ \ I

\

\V\

Offl4i

,

L

r.

53

ARBITRATION AND PRIVATE INT

ERNATIONAL

LAW

GIUDITTA CORDERO MOSS*

Choice of Iaw; Conflict of Iaws; Internatio

nal commercial

arbitration

Introduction

property, insolvant v law or of anv arm

svht-’re the part

autonotny is restricted b specific

priva

law rules, such as questions ahout the te international

legal

Refiently, the UNCITRAL Working Group

iapacit3 ol

on Arbi

engaged in the inodernisation of the UNCITRAL tration, the parties; (ii) certain rules helonging to laws different

Arhi

from

tra

the Iaw chosen by the parties may be

tion Rules, discussed in the first reading

applicahie

Art33. Articie hecauseoftheir oerridingchar

33 provides, among other things, that the

acter. for example rules of

arbitral trihunal conlpetition law: er (iii) the latv

shall apply the law that was chosen 1w the

chosen by the parties may

parties and, give effect to rules helonging

to a foreign law, for example

feiling any choice made by the parties.

the law desig when illegalitv in the place

nateci by the private international law

of performance renders the

that the trihunal ohl igation ins aud or unen

forr eahle under the law chosen

deems applicable. Arnong the positions

that were clis by the parties.

cussed by the Working Group, was whet

her

to private international law should be elitn reference In these situations

, the parties’ expectati

inated froin

Art. 33

disappointed, as the contract svill be suhj ons niav be

ect to rules that

they had intended to exclude.

This artiale intends to show that priva

te international inav have drafted a contract In particular, the parties

that is enforceahle under

law plays an important role for internatio

nal commer the law rhosen by them, vet

cial arbitration. Disappearauce frem arbit

ration rules of turn out to be unenforceahle some of the terms rnav

because rules helonging to

reference to private international law may

creat

dictable rosults and is not ne essarilv the optii e unpre another lass are applicable. The arbitration clause does not

nal solution necessarilv pres ent the applir

ahi I it of rules helonging to

for husiness transactions.

a law different frem the ene choson by the

parties: sotne of

Lea’ ing asid’ the nbvious situation wliere the

these rules cannot be disrogarded r-’ven

lv, an international

parties have

not uhosen tlie governing law aud it is for th

arhitral trihunal aud. il thev are. the au arcl

will ha int aud

hunal to trid which law is applicahif’, this arbitral tri— er tinenforteable.

artiile will

ha ti’, on situations here the parties has e

madt-’ a hoice It is in these situations that

ilse

ut lan aud it will show that ( on tlict ru les

air’

ar]-’ r’’le ant international liw rules ontri ass arenass ahout

hutes to predii tahilitv for

even theri, Tlie partit’s iw often ons inaed

that the hoice international hosinoss irana

at law laii’o-’ in th

.tions, Rather ihin hting

0 cofitfit i -‘\ llf’ tlia appli(ahi

mv ispa fot thair rolifionship I. tas othai niint lit\ to ignort-’ I ar dittied as an ‘hinent foreiEn to th an ifrnlt\

s lasv:

r

asitirritions ni tvtiisnjti,n:iI lass

att ilitfe sa \ li’n us’-’ cantr

ila-s shonld P1 Ililiri’—

at t contiilN an arhittation

Os I nsihil teol thit prlt]its

lot sa. \rhitrouion i as k noss n hasad on

to iriiIi-rsitn,l md

the ss i Il el the prt’dn i r’sitlis litt atliv, ist

pirtias. tial Ila trihitnal is SflpJJO5I ta

11105 I 0111e ds 00 uttclr sin I

lolh s th iu tir’ sllrjrisf

instim tins. 1Jan a,

onir i t st ith ti ;irhitr[ioii

ar’fltiv rliint -‘s ds’ srti s r’liin

i

n tis’

la 1

t I at tI -5 in- i, fl tlt utiti a i iiil iii

iisr tid I dItt.

( ihrr Iasts

.

,

(

li.t

f tolis

Titti

i

ta

iii iS

f

i

I-ttits in hjsesar, ni Is is’,

il la

lii-\IE 1h

0 rtsolt l’siitI I t. th parti s

5] ll Iiiiiit i

‘I

II- Is I Ila .t i

li’:.l fl ild fl, ilanta li I

I

ass

‘

i

ni

r

i

Fl

i

th

at

ha

iii

i

iii

it

i,

to

i, I

‘FiFa i

fiS

The tribunal gives effect to the partie&

choice: is the award valid and

enforceable even though it violates the

otherwise appllcable Iaw?

I

at]]

)lflplFis

fl

il

‘ss

i

hs iii

s

i

I

Iii

\t,

/1.1(10

\

‘;

14

‘Iii) ‘sI

tJl

I

i,

\l

‘il sst

isI

ro

I ro

)ntF

i

‘i

itit

iii

ti t

fl’s

i

iii,

fl

‘si

iii

i

I

i.

tihtiiI

Isilig

p11 is

155 n

d

ti

i hr’ is lit

aoti

-liii

I ss iihl

I

i

t i litt]] dt.

Il tji I h Iss «at

(FltlslqlIllttl\.

lite ittttjonaj sonits tllid iii

irhitutifii’ii

iiti1ittal jttd’ iii ti ritt iii’, to at iii til]

ille part is i aflui li t nr t’\ ‘I i ilatis P5 I cttttlti

11/ III

og]- eitiani litt til l hat -lit_st’ il 5 iohai s Et i afltpliliilllt

uten ss iii li’-’ to

((3

154

O\ \I) iRI\ AT

3

\ I

I

inso

i a tin i othr n t I nding b€

k t itb st mo t( rm il roqnlrenit nts t ti

I lo in itr itoi s in n r nia nr t di ci

1m

tliv,e rules bnt, as k ng as the losing p mlv

r.snlt t ibe mrbitr mli n, (bore ta iii be n p

to st’ it ilo irbtr mtors ic ts

in i

I\ I RN \ I O\ \I I

lts

the 111

le (3 ai

at epts

ssibilit

ntt

sen

pl

(ho

tor

il

11 (be I siilg pait tions not soluntanily att ept time asvard,

(bom e are, as kness n, two possibilities ot obtaining judit bil

ontrol m an award: (i) time losing party niav t hallenge the

aliditt of in arbitral ass ard hefore the t ourts of time plate

ss bore time ass ard svas rendered; and (ii) the losing partt

niav abstain fronm carr ing out (be ass ard, so induting the

ss inning party to seek €‘nfortement of an arhitral award by

the ourts of the tountr (on ountries) where the losing

partv imas assets,

The validity of an award may be challenged hefore

the rourts of the plate sshere the award was rendered.

Het ause the challenge is regulated by national arhitration

law, and may differ from country to tountrv, it is

impossihie to make an analysis with a general validity.

Suffice here bok at the dist ipline contained in the 1985

UNCITRAL Model Lass on International Commercial

Arhitration, which is atknowbedged as embodving a

general consensus in the matter of arhitration, is adopted

more or less literally in circa 50 countries, and is used

a tonn of reference even in many tountries that have not

formally adopted it)

ial intc rprutations be to eI tili mnities of its spr ifi

n mbt n il s stenm, as stell as (hat it tikes inte c ensidt rafl in

i instrui tion md applit atk n et tlme iimstrunment in otlic’r

c ountnies, is a paraineter for its ett ti intc’rpretation.

Het anse of time identit et the c riteni m for t hallenging

(be s aliditx and rosistirmg the entort t mm’rmt et an award,

iflterpretatien er applit atiorm et Arts .34 and 36 et time

NCITRAL Model, as welI is ef Art,V et the Nt w York

Cons ention, ane relex ant to each other. Theretore, ta’n

will deal svith the grounds for mx alidit and the greunds

for uneniferceability jointly, aud the cc mnments made on

time Model Law ss iii be mpplh able miso to the New York

Cons ention, and vite x ersa,

sps t

It is, lmowever, impertant to bear in mmd that, as

mentioned above, invaliditv of an arbitral award is

regulated by the s anious national lavss. aud ttmat there

may be further greunds for insalidity in time i ountnies

that have not adepted (be UNLITRAL Medel Law.

Enforcement of an arbitrab award is regulated, in the about

150 t ountries that have ratified it, by time 1958 New York

Convention on Rot ognition and Entorcement et Foreign

Arhitral Awards. In Art.V the New York Convention

contains an exhaustive list of time grounds that may be

invoked to prevent enforcement of an award. There is

lange consensus on the opportunity to interpret these

grounds restrictis ely, in, to restnict the scope of judit iai

control.”

The grounds that mav be invokeci under Art.34 of the TIme anabysis hebou will show to ss hat extent the rubes on

heice et law may aftect time vaiidity tmn enfort eahility et

UNCITRAL Model Law to make an award invalid are

the same grounds that may be invoked under Art.36 of an arhitrab award.

the Modei Law is defent es against the enforcement of

an award. These are, in turn, the same grounds that are

listed in the 1958 New York Convention en Recognition No review of the application of Iaw

and Enforceinent of Forc’ign Arbitral Awards as the only

possible defences against enforcement of an award. In the The hst of greunds for invabiditv er unenforceahility

is, as mentioned, exhaustis e and nmust be interpreted

intercst of harinonisation, that in a Hold like international

arbitration is extremely important and fully complies restrictixeiy. Nothirmg in the wording of this list suggests

ssith the purposes of hoth the I. NCITRAL Model Law timat time t.ourts have time authenit to rev iexv (be mmmci its ef

md the New York Convontien, hoth instruments shall be the arbitrab decisien, either in respet t et (ho evaluation et

interpreted autonomouslv An autonemous interpretatmon time fatt, er in respet t ef time apphcation et time last’. Judicial

umns at i onstruing and ai plving a rule in a uniform tontrol under (ho UNCITRAL Medel b.mw and under time

ss mx, tomimmon to mli i ountnies tbat bas adoptod on Nest’ York Convention, in ether svortls, mmma not be used

ratilii cl (ho instru nm-nt It asstinies (hat a om t at oids is a s elmit le ter (be ourt to at:t npc mm in ener in litt’

incnnretl by time arhitral tnibummal, mmc irmatter hest es ident

lmt rnc,r i m. TIme irnp

siLiiU tu i imtnul f1mt uri,i(r,,l uts nd

0

iim

tIme

nit’rits,

mi

I uching alse dit’ mpp1ic mtien et time lasv.

i

f i,(

i

Iii im

ta A

I n, i i

is ‘c nerall 0

i knoss iecI.3’ ti bUh in tlmeor mImti in judit i,mi

I I

i

i

I ut II t

I is il I

pr mi (h i

I is i

ti

i

i

I

ta

“

,

i

3

(

i

i

i

ii

i’,t

I

i

i

I

il

t

I.

i

I

‘li

•

ti

,,

I

tI

i

ta i’, ta

i II

( I

,

,.

‘.

/(

i-

i

II

‘i

,

(I.

,h I

I’ii,

I

i

5

Y iI.. I

i

‘

ti,

fri t

li

aooj

liii

‘i

i

i

1

\(

i

ti t

I tI

i

I

\‘

,

‘

t

\

i

I

i

I

t

i

I

I

‘

i

i

i

I

i

i

‘

i

II

‘i

I is I

li

i

i

I

li i

Iii

i

i

‘

i

‘

.

uk

i

3

li

I (i il II

‘I uuli

iilit

Mi,

i i

‘.

ti

i

i

Iii I

k i

lii

i’

I

et.

‘

i

i

i

(

i

nu

kl

itmiin

ii

‘

Y

il

i

ti

i

i

ti’

i

i

I

til

I

3

i

i

i

is

I

I

i nu i.

t

li li’ I I i

ui iii ui (Dm1111 i I talt

Xti\ III ,() III i i I Iii

i

i i

13

I

‘

‘i

i

i I li

t i

tt iii

t

i

I

i

nu

liii

( i,

il i.

XXt I

I

k

ii e

,i

I

i

I

13 ii

i’

t

I

snu’

5

bl uti

o

.s

ur

ii

n tI

r I i

i.

1

nu

be

i

In

I

its

“,

k (‘

i

1

s

I

‘

i

iui iii

i

\‘

i

I i,

i

U ti

li

i

‘

s’

il

ut

i

I ( t

itli

i

ut

ti

‘(‘.3”

i

‘I I

ett

d

(i Ili.

il

‘

‘

i ta

‘,

i i

i

k(’muuui,

i

litt

iii

t

ti

kRBVrRA1 O\ ?\D PRIVA iZ

Legal capacity

Snppose a eontraet i tween a Norweitian and a Russian

partv contains a ehoiue of Iaw elause that designates

Swed ish law to govern the relationship. The Rnssian

party. by its statoles ar the law that governs it, has a

requirensent that certain tvpes ol contraut become binding

on the company oniv il thev have heen signed by two

authorised persons—one signature is not sufficient to

create obligations. Swedish law, (:hosen by the parties

to govern tlie contract. does not contain the same

requirement. li’ the contract is signed only by ane

person, vhich criterion applies to deterinine whether

tiie company is bound—the criterion set by the chosen

Swedish law (one signature, the contract is hinding) or

that set by the Russian lass’ (two signatures, the contract

is not binding)?

There is no uniform conflict rule to identifv which law

governs the legal capacitv of the partv to å contract. In

states of common law, the legal capacity is sometimes

considered a question of contract, ånd is therefore

governed by the law that governs the 7

contract. More

generalIv, however, the capacity to enter into å contrac;t

is regulated by the la’ governing the 8

company.

According to private international law, thus, the choice

of law made by the parties does not cover the question of

legal capacity. What would be the conseqnences for the

award, if the arhitral tribunal n evertheless disregarded

there is a tradition for parinitting s certain control at

error in law in the phase of cha]lenge of the vrilidity of

an 5 ward, ilthaugh it has bom consi ilerably rostrictia i

in modern Iei,’islation (sen, for example, s.69 af thii

Eng]ish Arbitration Act). This. bawever, dms not sffect

the anforciiibil i ty of s fereign asia rd Itnit is governed

by tha New York Cunvantion. See G. Barn, International

Com,nernial ArHtrofion: Coinjnen torv ond Meteriols, 2nd

ei]C. p181. with referonues to lise [S ]octrinu’

af manifest

‘1 isrs’gard at th Lise seL i h nia’ be usa] Ss is ietence

aa inst e nfarcensen 1 of is I award, hut not ut a foreign

-s

sivard.

7. 8. Se,les. P. Havs. P, Be hers aud 8. Symnonihis.

Cnflict uf hans, 4th -‘do, aud L, C-illi;is et el. Dicev.

Morris, CHina: Tb’ CunfiL I et Lsws (200u], i4th ‘in,

8.

I’’r (O’rinOnv, 1. K:’pl::;ll::, !nt, isiti jus ii ‘i’

s tro:ht (201 tO), p.iBl md for Ssvitz.irla ud tho Private

ljiierniti,,iii Lav \t Art, 115(1 Tho 1160 R’me (1,nm

-In

-‘,

.iadi!

1

ti’n ,u tL- Li’ \p

‘et

ntr,i:timd (JIii2itins. ihit

l?uro pian

i)’ jIii sI liv IL: 5Ii, In,

n’presenta thm private i uternationa I law in ti.

(1;niiiItv in’] is ‘JIi ti

li: I’-. ti” i Ila

.ppieiIL th’ ,hi -I av

vreiat.iug ti wta.itlmer 0 ot5n ille i..iind Ei c.impa

i.v. wIich

1-111511060 tInn PleIE th,n is n, l’rl.Is.’i’,n

il th

fl I min ppli

Gi’ I’ IL” i-,pil

1 Ho- fl,uti-’s,

and e:ich sIste Las ila owa nn.flict uis to li•it’rn:im1ii

‘

i:’: :‘I.’-, d

‘i,

I

mv

iii

i

i

i

i,,

i

i

Lii

i

i

j’:,

ii,1,l1

i

i

‘

n

1

il

the Iaw of the legal

parti es?

il

i

ti

I

—,

‘‘

aud follovvad tbe vi11 of the

Arbitrability

An award may be set aside ar refused enforcement if

the suhject matter of the dispute mav not be suhject to

arhitration according to the law of the court of the place

where the award was rendered or, as the case may be,

where the award is sought enforced (see Art.34(2)(h)(i) of

the UNCITRAL Model Lasv and Art.V(2)(a) of the New

York Convention),

National arhitration laws usualiv determine the arhitra

hility of disputes by making reference to concepts such

as the possibility by the parties to freely dispose of

the claims that the dispnte is based on. ar by defin

ing the claims as commercial, contractual ar having the

character at private law. This wouid exclude fram the

scope of cammercial arbitration matters such as taxa

tion. import aud export regulations, cnrrency ar securitv

exchange, concession of rights by administrative author

ities, hankruptcy, the protection of inteliectual property.

etc. These matters are mostiv regulated by mandatorv

rules fram svhich the parties (;annot derogate aud must be

decided upon by courts at justice—unless they are sub

ject to special arbitration, far example hased an treaties ar

special legislation. Disputes concerning the ather aspects

af cammercial transactians, which fall within the scope

at tise freedam ta contract, are nsuallv arbitrahie.

The rationale far restricting arhitrahility is ta reserve

Ille denisian at disputes rmiga.rding p.articularlv insportant

interests aud policies ta courts at law, whh;h are

deemed to be more accurate than nrhitral tribnnals in

lise consideratian aud applicatian of tha relevant risies,

Arhitration lars’s an.! court practice have became more

sild mare liheral in their dnfiuition of vvhat is ,‘srbitrnlde:

lirondiv simmisking. time aiov’

if applii:aIilitv at the ville

on arhitrahiiitv niav be seen to lsrgalv overlap the rule

on piihlii; paliev. bot svill Le v’xaissiised iisiisiediatelv

ii’Iow,”

ILa

i,’

50

i

SS il

i

15

i ti

il i i

0

i

I

i

i

si,,!” ‘viii’ Il. .,nt0i,t oss ‘ni’n-I :rj,

(iioiss i!

‘1’

GiitV WiiS aW:ire ‘if liii iimoii

ic 11v at thit pirtYl il is oen

1

iViiti’’i iii

i!

ei’iide,I li i’ii[-ini

Kopi’llr. p.1

1

5

—

capacilv

155

Articie 34(2)(a)(i) of tbe UNCITRAI, Model 1,aw

and

Art.V(1J(a) uf the New York Conventio n provile

. ss a

ground for setting aside or refusiug enforcesnent of

an

arbitral award, that a party to lise arhitration agreor

nent

svas under same incapacitv under the law applicahie

to il.

Tbe law apphcahle to å party, as just seen. is not

the Iaw

that Ilie parties chose to govern the eantract. Il th arbitris

i

award tollows the choice at Iaw made by the parties

aud

considers the contract as hinding in spite of the Russia

n

Iaw requirement. then the award tnay be sel aside

or

refused enforcement because the arbitral agreement bas

not come into existence 9

properiv.

I, ri.SEIit deOsiCu

‘i

i

si t

i

i.

i

‘iLR\Ti(i\L LA ilikJ lei A,LR

i

—

the

So

i

la

i

Li t(e

v

L

i

I

.Si.5’.h jilimi

‘1111 in

0

i

i,,

i

cu:uiitrsct (.iiflflil,” ed ui LiiEiVui’fl ing

‘I1h cv. s!’’,I lÅI’jii’

5’

u.. jul et. ApIeai.l

iaw

clii i.ism’

i

v h

il

i

,Hii

Gi 005 iii

,\.,.sk JIi,iis, :lnA.

Do’,oiuber 17. 218)7, Sv-i lj,,vn,iit,

10. For a no ire, OXtmmflSiViEi s’ubstantiatii.m ei thimi

iin.e

,f t!i,iiebt se (. C’,rl.n, \1’’s, N iil’n,il ilmi’s

,\rbitnilmil is oil li,: Vu,. lit if ‘iii iii ruiiuuu,l ,\rLii ,il

-

136

1511

i:t

iting 1’i- l’ in ii

iriglik r’lti ant gr11Ii1 ar

i oftising its ntori oiiii’nt is that tho a ard iaiates

the iiLilit puliov ut liii’ tortOhl (Artd4(2J(h)(ii) o’ thu

NC11RAL Modei Law md \it\li2)(i) at th Ne oik

tar ozdre

Lam ontion). ‘1 ha cxi “ptlon ot puhlft pcilft

publi ) is. in the cantext af internation il arhitration.

unniniouslv intorpreti-’d x ur\ narrovlv. Its rationale is

not to permit a judge to refuse entori ement or anniml

an international aord on the basis af anv differenri’

hetivi’en tho ri-’sult o t tho uvard and the resu It to ivfliuh

the judge would have roma appl ing his or her own

law. This ou1d run rounter the spirit of the New York

Convention, of the IJNCITRAL Model law, all pratic:e

that is generaliv reuognsed and legal itoctrine in the

international si ale, is si’en heloxv,

\

Res trictive application

Manv rourt decisions in the various states annulling an

award or reftising to enforce it hecause the award is in

contrast with the courts puhlic poiicv. are reported in

the ICCA Yew’hook, C’omrnerciul Arhitrrition. A survev of

these decisions, froni time first volume in the mid—1970s

to our davs, shovs ihat such decisions are not nuinerous.

In some cases there is relative unifornnty of consensus

from state to state: awards that violate rules on bribery

or smuggling, for example, are usually onsidered in the

international legal doctrine as heing against puhiic polk:v.

known, there is no absolute uriterion to cietermine

puhlic poiicv: vhat is fundamental mav varv from state

to stats, and, even vithin the same stats. the conceptions

develop, and what was deerned public policy a decade

1

earlier, may not be it any more)

As

f Di sp tites R gard iq Ri ioi inn

lvi ni: Th’’ Exii niplo

i iii ut

1(mfl I 1 Sto, kic tin .1 rljirztian

R ir I u ro

Tkpcrt 7 et seq.

11 Thr’ x impir’ 1 swap .igri’anwnts and r thor hnanr Pil

1 ti 0: I his kind at

li i i ate i nstr ,iini’iits is q ii to disi ii

II) peii nto a

‘ili li Is iii

of

iii”

0,

I

o1ilra1

I

i,

I’dO,,

tlii:1i01:

irtil

i

s

ni

i

1 ‘O’itS

‘!i

gnisi flnani iii

i

i

tja

0,101’

oi

I,

rm

fl

‘.

i(

tis ds

,,io,iilii”il

I

fl

i

‘,V’

‘l

il)

01)0,11 ii0

1

I

i

r

‘I

‘i:

‘

‘i

- -

I

I!

:1

-

I I 1

.

-

I

III

I 111

I 11

i

liii

II

i

I 1,1 I

1 ,nois ‘i

i

i

I

-

li

i

t

i,

II

i

1

I

Oil

0

I

-1:

I

i

III)

I”

I’

I,1,

il

i iii

Iii’

il

i

i

I’

i

i

-

li

ilO

in

ai

The sar tions below will disr:uss case miv nelating to the

rietermination of public policv in respect of some of

the rules svare private international law designates as

applicabie a iaw different turm the iaw ihosen by the

parties. If the arbitral tribnnal decides to faiiow the ivill

of the parties and disregards time laxv that is applicabie

according to the private international law, is the award

valid and enforceable, or does it run the risk to be set aside

nr refused enforcement for contrast with public policy?

Company Iaw

Suppose that a Norwegian and a Russian company

enter into various agreements regulating a co-operation

ommerc.iai law md iotennational

inspire international

arhitr,ti,in. Th’ aiin uf thi’ th’i’rv unuii’ilviflg the tmuiv

i otemniitiooal public polk v. therefore, is to ‘lisregard the

tundam e nta I pri ni: i p li’s th,i t are prupo r in I u f 000 I og il

svstsm, ‘VI’n If thei- repr’sent th€’ ham values upon

which that socIt’tv is relying. Instead, that iegal system

shoulcl bok at ss hat basic pnini iples are rei ognised rn a

more international les el, ,m,i prr’fer th,ise pnioi.iples to its

‘iii ii It si’ems too imbitiuus to me. hnwes er, to expei

that a sInte ivaives ippiiiati;n ‘‘f its’’w n funci,jrn’’ot,il

prioi i p les in the 11111115- i f an ideal uf harm on i sntiun 111

t1i salilitv at sa

nt”rniti’’!lal (nun,’r’-e.A’ l’ng

,irhitrri i ,is’, aril i’ ri gubati il lii Oati,,flil ,moitr,i ti-,n 1,11V).

o ml the i aIr ni i ab iii ty of ;i fl iwartl is ti gil la ted bi th’’

J’w York (lonVehlt il) fl, the stanil,i ru II i eleN’Oi ss il!

5

e v faii lt haugh iii

be th i’ fii o dam enti I ri oi p li’s nf Ihe 1

Ila n irroxv s”nsi’ deu ribi il ilsiisa’) si’’. ii ni ililatiog tbns

,5j5,•fl\ Si, ppnrl. ihili I’ iii vnI

1

bot i

u,b Stinil i 1:’

i (2

I \rIotiiil ,sianiIs: ab,, li ii0r’ I

12004, I T,ro;vit( 011 Dvijot ‘il i:’;: 0’iit 7

lii l

o

li,

iiihii,

- ‘innhinIllig om ss ak ii 1

li ii,n’ ‘f thi l’at ialt; o I liii \ss ,%ili 0, lo’--rll lO il il

‘

0 Si! itmoI. i ( milil’ om

12. \ 11101)11 010 ap Li! i’n i Lii 1(111 \iin Oil (,a I’) 1(1 I

7 I 0 Oil-il 111)0 iii! Iii Jsiop \‘, Ui’]’’li. 1111 i Se-iif Ii

i, (2iiu,.itl1,l,’i-i,,.i \Xi1 E-;a

l0’Oi I-o/

0

Ro;:1 1:’’ HiOi l,o

-fl 1,11’ in 2!tiini’- LO!

.0105

Oni 5.:011)51 ;:,: j:,,.

J;u,

sI,

i ‘ f ‘-B

I’ ur I ik I) 111101, i il luiit: iti ti \X\

il I i ‘- 1

I

‘I I) stri- I - ut -ittilol I tI I I

i

- I

tI I i , h I

III

I

i - -‘

I i, I nI

2 I

i

In- I I(t

I - iii to

\iil - - ‘i

- Il

(

‘

-‘

I

I ‘

Ila Iti om

-

i

I

fl

ill

—

i

ir il

-,

I

‘I ‘li il I’ III

‘il

i

i-

ii

t

-

‘

text

,

340 “3

I

‘i i

5

‘

0

in

‘.iii1

\! /I

‘1

li

-:

I

-

i I

I

i

I

I

li

i

li

I

I

115

.t iii

i-,

ca.

‘

n’H ;I-ar

-

i’

.,-

‘

I

‘i’

--

1 le imispiring a nmanditor nok’ an le’

nm i

i x or

fnin ij’i’ Not -5 el) \ ni

’alii

ammirl,’re I a pul-’lii- 1

’lo insjiirina an avurritling man.latrrs ml” an I’.’

1

prini i

i onsiiii-’red at [‘ublil: polit v. it is anls tile fimnilanent,il

om’s. those that i oimstitmmte the basis of tiru Ui i’dv, Riiles

that si arild at first sight ccm to e cf iiL lii p lii y, like

embargo, h s e in se t’ral anses not been r onsidered as

sur li. under the onsiileration that, averm if einhangol’s

int af vmew, thu

1

ane imnportant fram a foreign poliav pr

cannot be onsidered uf public pohiv. Moreover. not

nr ter hniialities of a rnle

nov discrepancv ss ith time

hasuii on suah ftindaimn’rmtai prini iple inas ho di-enied a

violation of puhlic policy)

“

01

iii)

i0,i(

liii

liii::

oj:0,t I.

I ih \tifli tir,t i,11i11 1,i11llill (‘1 ilHi

ti i li 0,) fl tib

[i) J li 117111) i JO ij 5 I lii X mi

Iti

li

5 ‘, 10 I, i III’ I at iii’ 01 (I o I I 10

in i

( t Bind s i i nR! I)

i i n

u’ i 0

I o ‘11 ,1 a l,r. PRIi I

‘lo’ ltd

0 5

5.0,’:-

A

Not

PubIic policy

i

()\\i

\ROI RU1(>\ \\i)1R’\1i\!1 \U

.\

I I

nnI

li

in

i

i

i

i!]

1

1’-

i

‘hi

f

,

,

,iisi

si n in li’’,!!’

.\io,’,,i 0/t ‘i.

iIII

,‘

0 ‘

I

1

I

I

I. o

oil n, Il

SOl’ ‘1)1 I’

‘

‘

li

LiiOiiI 10. R.

I

i

i

‘li

il, I

I

i

III

-

-I

nts 13, ‘i’ni/t 50

kR11

Pen

t10011

.\ fUN \\ i

tilO t 0

tflfl i)dnies SII0d1

.4flJ {J ntI

L it i, w hh h sloiIl have its m in

0

I

i’ios aud jR

aitrai aIiniitratinn in

Russia fo reu1ate iheir cor3erat1on.

ihev ‘ntcr nto

n arphu Iders gr nent: the sharholder

s Igreenient

iitajn,:ii Frnin’2 1

he

h,ne S\d

md an arhitr ticn lause suhma ittiro. ns disp ish iaw

utes riing

mil ut ihe

omilrn t ei arh trutkn bufure time Sto Lholm

n

Chainher d Couunerc.

u

n

i

nipanv

ii

The hiruholilers areemnent montains

arious t:ninmnit—

nments for eaeh of the pamties, u li as Ihe

oblig

to disuluse to third parlies spocitie infermati ation not

on, time obli—

ation to meet periodicaliv to ascertain

tho

progress uf

the co-operation, the obligation to mak

e a’, uIahie funds

under mertain circumstanres, etc.

The ‘hareimolders agri-’ement c ontains

also ome obliga

tions regarding the jointiv uvned com

pany. the operation

or competcnce of its corporate bodies, its

capitalisation.

ett. For exanmple, the shareholciers agre

e to eam h appoint

a certain numher of memhers to the com

pany

of diretors, they specifv tho areas of m:om ’s hoard

petence that

each member of ihe board shall have aud

thev commit to

have the remaining hoard membors vote

in the svav that

tlie competent board mnemher indicated.

The sharehoiders

agreement mav further t:ontain rules asses

sing the value

of the respective contrihutions to the c:api

tai of the c.orn

pany and assigning a peruentage of the

shares in capital

increases that corresponds to the agre

ed assessmnent. The

shareholders agreement mav. finaliv, cont

ain rules on the

transfer of shares to third parties om prc-ernpti

ve rights for

the existing sharehoiders.

VhiIe the comniitmnents bekveen the

parties has e a

contractuai nature and will thus be suhj

ect to the chosen

Svedish iav, the rules ofthe shareholders

atfeet the rolmi aud responsibilit of the agrem’ment that

members of the

hoard of directors, the capitalisation

th-i transfer of shares have ti ditferent of the company ar

nature. Although the

tIarties to ihe shareholdors .igr-’enient have c:on

tractualiv

mommitted themselses to a certain r:onduct

in

the

hoard.

to a m’rtain eval uat on ut the mpitai

contributions aud to

ti certain restriction in

the sale ut sharos. these ‘mbhgatiens

lo not oniv ha e a i ontra ttrml n,mt

ure As

fimme [jun at thm’ imommd ‘mfhre’ tors. time mpitai known. time

in (1 [ho trammsferahiiit ut its sh ar.’s (at hast ola (ompanu

nu d’r -‘rtti in

i iii umstamo es) hmve

i i irgem signitim i ni 0 th

hal.mnm ‘il inti-’r’-sts le-in-i’n the Inn ommfr an th imm mo

.mm ting parti.’s:

tlii-’\ ,mttet i mspe is i liii I’ ,aL 1

merunIiv d ami -ntit

that it is immmpiii itiumib tc nu Is third partim

s, sin h is [ho

‘iii jR’s umipliit-s. is i

r»iit»r trth. .tim’r imar”licl’irs,

,mr’. ti: ni e-’. mm’— u’, t r

‘‘i nth?,! that an

mrt ti i ni fmi’tss’imm In u ei fi’-s (th im.ir

’huiri»ms ‘ti ho

siu’d tim» h mrt-lmci lersmmer’c’mi ‘nt)modiiies thir’

I1

,mtit

sdiii I

ii:iii’aiita th,’e i’ mmiina md1idiii

n rds. ,mtI ,mutuoum h i,iit mo I s tie iv. iii eth’’r

r

ut m1

m ml ml

0

liii ‘mi I ij,mrimes’ mm ii-1s

miot\

mi’ «on fl rs mmi s ml ku

i

I

th

,a “I’,tt;ii”l

il i?’ k ,o

i tI.

miii’

‘

O\ ti.

Asscmnming timat the ,mrbitral an ord

gives e(fi’c,t to

agreement of time parties. thus violn

tmng the apjh

m ,mhle

cmnmmpanv lass: ss iii time aoamd be vahd

aud enforoeahle

time c.uuntrv to ss himh 11w appib

able company an

in

bob mi gs?

The naturo of the puhiic poliov cleth

nce prev

gemmerai assertions as to [be quality as publ erits to make

ic:

whoie area of the Jan’: while some mule policy for a

s of company

lasv may proteci interests that are

deemned to be so

fcmndamneutal that their disregard

may contradict pubhc

pohuv, it svill ch’pend on the circ:ums

tances of the case

to ivhat extemmt time result of a specific

violation actuaily

is in contrast svith such fundamental

general basis. however, il seemmis legit princ:iples. On a

imate to affirm that

the policy mipon which varinus mule

s of

hased mmiav be deemed so strong, that company law are

a serious breach of

those rules mav represent a violation

of puhlic policv.

Timus, an asvard disregarding the appl

icahie company lass’

to give effect to the parties’ agreemen

t

nf heing ineffective, if it is challenged mav run the risk

om sommght enfortecl

14. Sumh ris English l,iw, sce 0. CoH

ins et el, Dicev. M’mrris.

C Ilins: Thi (%inflic:t uf Laws (200B

), l4th eda, partis 30002 (t em.; t S l,mw. s(e th Restat’niemm

t St’ ‘mil. (‘oim likt

nf L ta’s (1071), partis 206

et seq. ,mjiml Scolt’s, [livs t rmL,

imircms 2.1.2 et seiJ.; th’ ,Ssvis Pris

1

sto lni.rnatim’n,ml Law A i

Aril 54: titt’ li mlion Private Immti’rjm mtiona

I i an’ At i Art. 25.

1 5. Som’ I. Kr plmullm’r. lmm[’’rn-iti’m

nrm les Priv,mtr, ht (2001)),

pp.5a ei’ seq. Whr’ri’ 1km’ rami

stil is mi”nmml to ho

is

ti ut n’e- ‘ss,m mils i’ vi cl ‘ut: cv

liii’ ih’ Om ti ‘-se 5 (3 mv nihim ,o

Jnrismlim 1jan imiti Tht Ro, ‘‘muiiomm if

Julti mn’’nfs, is toll

‘is li” ‘mrm!lt1 Lug.mno C’ncenhi

on, l’fi [ho nu ri i (mr

I timining ss km i’’ liii’ s’t sItt ib» I

ss

Brus’m.-i’- Ri d,mti,.r, 44 20(11 il i’- tIupt ,f th. iorwn. Iii,’

t’il i om

1 r ummms”

stiritm, mm km mli pcmro’’s” mi i’t”r’ninim

:7 vh, i’, i i,’, i til IS

i- ‘I’. ‘ad i’ ho. , l’,m’t: ji, mmm,l

1’i”t’ I;’”

si i’ i ,‘.mr’ rvl,’ r ti’ nijis ms

i

mi [ its si m’mjf Is i

il’nOt1 lrn,nstr,” 0’ m li Om

i i.,

li ,sin s

lii \‘ ss i,

0 is tO, 0, stk lii

I I?-,

lI

iff fr,’smo.;,m

ftsth lIt 4

mss’-,’.

m

t.tR

i

11,

t

di, 1cm’

i,,.

-l .

0: Om 0 is

e

li

m’

km is ‘m 1.1

li I ‘1

mci

,

‘

‘,

“

lt

ts” nm’

i

‘i

li

5’

is

,

s

‘i

ur mils

i st ti\ le I

d i mmli

n

.s fimi

at titie-litim ni miii! iii’ 01mb 11juli )t

‘oil

midt’s. 1h’’,m’II a

m’.mkin. ilm’r” mm” live ,liift’i»imt

1

mlmprlt,ml lit’s: th. i urmf!iit mmmii’ 11mai mli’sigim,itm s ihe

Inn ut h

‘

li I”’

il

st

,, I

1

i

I

:‘.j

mm

TA. km

I

I’.

‘i

I

fl

:

tI

‘i

I

!m/

I ,

‘i

.,

‘

t

.

‘‘

i!

r’

:1

.0

:5

I

(i

iii

oil

i

‘

‘m

-

I . : i

fRI i,’

mm

ss

i .o

st

.e

Ritt

-,i,,’,

‘

st

I

‘

-

‘

‘

;.

i

,

sir

‘

I v

.‘

‘

lIt

,

-

,

samt

li ,‘ i ‘i

[‘1

Jt,,mt tit’; s.i’it-It (mmi)

Il ( 1.;

i

i

Is

‘:

I

I

,‘.

‘t

.‘

mi I

‘,i

,1

i1’ i

I

a

‘5

i

‘,ir,’t

ti ‘1 I 5

‘

0 I’

10

r;

‘

ci

157

,

‘,

i

\ .

si ate u lier» the I,’ ml entit’.

flt

r ‘ritt i w r- isiered,

in i tlm’

‘mmliii i rult litt ,i sisnai.-s

0

1,155 ut the st mie

svlmere tIme legai entits hms

tts i mmim,ti m,imimrisim miim’mm ni

mmm,mimi l mc e el hmin ss (ihe so-m

illid

il s -uk In liii

:mse desc rihed liere, ilmeretbre.

lii” i(!O ,I’!

inn om mmld be [hat

f laR ia (jmiece af rm’gi’-irati’ mml

t ur ut

Rcmssia (real s’,mt) depenmbmig

on time pi li il is ris ,ile

i

intc-’rnationai lmmw,

‘

tO

oa :o

tit

i

I

!

\ .m’li

Jtl

(,jd,

..

i’n

‘

I

ti; 2(iH t(OJ

ni

m

t

Il’

0

Ii i,.,

21(101 koR

I ‘;‘O’

mitt kunl», mitt I. ‘‘j li ialt I ‘o

I ml.,,’ f’ mm i “i

,lai “i-imot i lro ut’ In iti

i, (tlOlJ 2001! 11 R

1 Jul 1.

158

PU;

c I

i

.

:0

1

t

i

Li s h

\!<3 i. R\ ïiUN \\i) Ri \ IE iN RN\ aiNAi. \tV

p

i

hel iL

t

d

ii

I ency

Supp

ti it tho

i

\orsi oti

n ti

t i i 0 i

o cl r -ep r ticu. th it i r t

irieus nutu il

ment

iiiiaticns. 1h

lOePt iros ids that oac fl uartvs

i m nr chi ig.it ien shill r .t- l iiainst the ither

p irt s pa 1nnt ehhiation. se Ihat oiik tho not aniount

shall ho ille. 11 ene ol the parties hei omes inspl ut.

si iii its oreilitor’, ho ahie to claim trein tlii-’ othr parts

iii vuent in fi il ot tho eiit’tanding eL] igations. er ss 111 tlio

s t-ult .igrer ment ho respet ed Se that onh Ihe n-t dnlOunt

e\L eedi

thi othor partvs (.laim’, ss iii have to be paid

In

Rue.i

Suppo th t the agreem nt i ontains i 5o-( all d cio e ont

o tting rrangement. a ( ordine to xvhb h all ohligitionL,

ofth dehtorbecoine imm diatel du aud paable (even

prior to tli i

latu it ) upon the d fault by ti t partv of

one of its obligations, a ‘cariation of this arrangen ent

is the 50 call d a ccl ration, particulark uide spr ad

for loan agreerrients, accordin to sshich th loan shall

be tcrminated and the whole outstanding amount shall

hel ome immediatelv pa’. aLle if the borrower “Lhreatens

to het rune insolvent’’. The reason for these mot hanisrns

is ovidont: the oreditor wishes to ensure that ihe debtor

Las sufficient means to coniplv with its obligations: if the

fl nancial sitnation of the deblor is such that there is an

imminent risk that it ber omes insols ent. the repas ment

of the loan mav Le atfei ted Moreovor, if the borrou er

heromes insols ent, the insols encv pro eeding u iii aim

at rcde mine all the horrower’s liahilities, and there mav

not be suffi ient means to r pa’. the loan in t tot lit’.

To as oid this situation, the close-out nettin airns at

obt ining p m ut of Il outstanding obligations prior to

in fin ni h 1 difficulti s that rna anse s a consequence

of the d fa ut and pos. uble ubsequ ut (ros defaults in

olher contrac ts, aud th ba ag e ment Las a mci hanism

that proi. id

for repas ment of the outstnndung mount

prior to the initidtion el il insolvenev pu o cedung, se

fLat the leniler loes not hu’.e to li’. ide the horr’ss er’s

ussIs 55 Oil tbe tli.r ,reItors. Manv L gal svstenis

iuoi e iliSol’. Ciii.’. regulation’, that nm ut preventiug tliese

il— hanisni’,. uuu1 tliO pornut to res ers

p15 nlents tliat

Li ‘l’ fli.idL’ ss ithin i

rtaun poiiud rrie to ilie ii’ititioii

th. jui-el’. in s p1

‘dip Can th- I’n ler is d iii—

(I I l ru 1 th-se

li’. ‘,lhflLitfJ ii

( il

ti

‘

11

‘i:

I

r

I

1

si

i

IL

h

Li. li

i

in

ir

‘-

iitt

lii

i,ilits

1

1 tni

f iaduunen Il I

i i(l’iil

ut ane

ti

fl

q

I

et

‘Il thi

ass

th

n

I

1110

sios

di

ls i

i

in

rs,

regulations, would be considerahiv sveakened, aud the

ereditors would not be aLle to assess ihe assets ihat ane

availahle, This is not a reconimendabie situation, and for

this reason tbe uhoii:e of law contained in the agreement.

svhile fully effeiti’. e for the contractual aspects of tbo

legal relatiouship. hav uot have full emthi.t for the part

ihat Iias impliiatiouus on tlw svincling lip ur iusolvoucv

pro eeediug.

As a general approacli, th clissolution el a company is

governed Lv the company law that is applicable to that

company. In rase of :ornpanies having activitv in more

tlian one state. this raises the question of hosv to ensure

a just aud equal troatuuent of all creditors in respect of

assets that mav be located in varions countries. The two

opposite approai:hes ane the ternitorial aud the universal:

acconding to tbe former, a state’s law aud junisdiction

extends only to the assets that are located in the state’s

territorv. According to the latter, the competent state’s law

aud jurisdiction is to be recognised by foreign states,

To harmorose this area, the Eunopoan Union issued

Regulation 1346/2000° which determnines that for a

company with cross-border activities insolvencv is

governed by lasv of tlw place ‘.vhere tbe main proceeding

is carnied out. In tuurn. the main proceeding is to be

conducted in the rountry svhere the company bas the

centre of its main interests (‘COMI”). The nebuttable

presumption is that tbe COMI is ivhere the company is

° The insolvency regulation, hosvever. carves

2

registered.

orut froni the application of this connecting factor a senies

of situations that involve vested nights by thincl panties,

sucb as propenty aud secunity rights, set-off aud netention

of title, and confirins tor them the applicahility of the

govenning law determined according to the nespective

conflict rule (which is not necessanily the law chosen by

the panties, as will be seen hebow). To ‘.vhat extent this

svill be sufficient to provent applicahiiitv ofthe insolvencv

rule neversing payments on traosactious made in the last

moutbs on years(s) pnion to tbe insolvcnrv. depends on

ss’lui’tjier 11w rule is iIoonied to ovorrido the proper Iasv ur

21

not.

Do the same roasons for i:onsidening niattens relatiug to

insolvenev is not suhjct to the lasv u;hosouu Lv the parties

ionstitnte a stutfiriont basis for invoking tlio clefeni:e of

puiiL: poliov to sol aside er retuse euiforieuuoiut of iii

:Isv;lrcl ihat gives If,’ t to iL- ja rties’ igreInent aud tLLIs

ielatos the appliulile illSUlVtnCV ILISVt

ilie. cjuestion svas :lnsivered afiïniuatis ei v in ibe United

States in a rase regard ing the on forreluellt of an arhitral

asvard rendered in London that ordored

i

i

i

iii

li

i

i

(

L

I

‘

1’

i

() (i I

.\.I \

(i

i

I

i

il

I

I

i.

.

i

I

,\

I

offie;t i

S’.ved ish partv

i

certain pavment, The debtor svas sohjert to

n

i

I

i

to

01

li

I

i

‘,

18. Sto ScoI:.s Hiivs et el. por:i20IJ7: CIiIn, paris :101)10 et 50/.: Ki:ihir. PI•002 et .scsJ.: d: SuOs. On

iii: nn.ith::I

v 1 I

1

ci

is

i.

di

011)110 (il 1:.ti• 0

I’

(

i

‘i,

i,

liii

i

‘

,

i.

I

i

‘

I

IL

i

i

Li

Li

‘.

OIL’

-s.

ni

imizu, i-i! ftiif::!nri ed i]:. 01s1 lv

Inn (tortli ILL:iitJ ‘i I

01

fl. ldJdi

1/1’

0k HUN k\H HV

\

IN FR\\HON\i

\\V

?oOaI I

ino R

v pro ctlin

Appa1 tumid that: os in Su c 1n, nid lht (:ourt ‘f

i 0

159

Vbi li of 111cm I I

lilits pi nil

s. 15 iii hInt..! fl 55

ilEtiler

tnaleri:il .1 tualis

llln light ut SaIns ba

n’s’-r s

1u

1j;

5 in

ss

iii

1c

tom. tin.

nkrupt

..n

I

nu

titt’ last govertl

11w 1IfLr uincn

m Id contlict v ith the

ing tbe pne.age ut til

public pob v d

le

Thu ass ga’ ..rtïing

u

u

1

itab

t

h md ud rk Jisti ihu

ill

e

ius

sag

tin

..

n ut i al asts at

ab

tit

le

tim

is

e

lnrin 13.(nkrupt.

las

no

s

t

ne

tbat the parti

i essarii

a

r-u1ating tha transfer s’s Innse to go ciii lIw i omitraot

.

lh

cl

t(ice ut Iasv nide

The (otLrt lalanc d

ontras t has ettti:ts

nii nst uuch utlwr

in tba

for [ho

. n on hand the toss ards

intarest in unsurin

eac li utlier, litt it du obligitions of tIme parties

g enfor einent to inte

i-s

rn

not nsu tssdrj1 hav

and. on the otlwr ha

at

nd. [be interut in en ional aw ards, abihity to atfect vssted rights

s’ 11w

su

ar

treatment to the (re

d itors hen an i nsolv ring an oqual by third partis’s. For tite s’tfect legitinmate expw tations

uncv procdttre tite applica

s toss ards third

has been opuned. Th

hie lasv is not lite

parlies,

ltw

avard, thus preventi e ourt resolved not to entorce the contract, bo

t the law at lite pla chosen to gos cm the

ng that ane creditor

the detrinient of the

ba preferred to located, so-ca

e where tite good

others.

s are

lied Iex rei 4

situe.

Other court decision

Su

pp

os

e

ihat [ha parties agree

s have enforced award

that the debtor shall

panding bankruptuv

s in spite at ds obligation

sec

proceedings. hecaus

stances of the

e the circum the English s by pledging in favour of the ara ure

ases ware not making

ditor

pa

rti

’.

all

fut

ure prodtiats at

enforr ement

patible with

incom.

manufactiirin

the dehto

the prin:iple

s underlying

proreedings.

tbe hankruptc that the Ru g piant in Russia, nr the future pro r’s

ssian part wiIl have

ceed

for the sale of its fut s

products. The parti

ure

es choose to suhmit

lasv [hat permits the

the contraot to a

Property and encu

mbrances

pledge of future (hu

lk) things or, as

the case maybe. of fut

Suppose that an En

glish company transfer

ure income. Arethe

in

parties justified

s

company the posse

rel

to

vin

a

Ru

g

siminpiv on

ssian

ssion of certain ra

v material. for Russian iaw on ple the chosen law and disregarding

example alumina,

dge? If [be pledge

sa

of bulk things ar

pracess it and produ that the Russian company may the pledge of future

thi

ce

for so making it avail aluminium of a certain quality, Russian law, is the chngs ar claims is not allowed under

ahle again to the En

oice of law made

glish company suflicient to render

against pavment of

in the pledge

a fee—a so-called tol

the

ling agreement. and effective tosvards piedge valid between the parties

The toihng agreeme

nt

third parties?

does not pass at anv specifies that title to the material

time and that the En

glish company A further method to (:reate a securitv

remains the owner

of

interest is to assign

located in tho Russian the material even when this is to tbe creditor a claim that [be dehtor

has towards another

partys premises. Supp

Russian partv, while

ose that [be party (for exampie, the manufacturer

in

assigns to its maw

hankrupt. Suppose tha possession of the materiai, goes mnaterial supplier, as pavinent of the

uarious parties in res t the trustee receives iiaims from c.laims [hat the rnanufacturer uilI raw materials, the

pw t ofthis material

have in [be future

against the purchase

: fram

parti, that ac( ording

to tbe tolling agreente the English consider [be assign rs of the manufacturer’s products). To

lille to the material

nt alwavs had

mn

ent valid in respent

; fram a Russian bank

time during whicli

, tbat in the (tite manufacturer’s clients ar the mn of third partis’s

the rnaterial vas in

anufacturer’s otbar

cre

dit

ors) is il suffh:ient to

at the Russian party

tbe possession

comply svith [be

bad granted a loan

by

[be

Iaw i.haseri

pa

rti

eS

. ar is the lasv govemn

uhtainad i first pri

to this party and

oritv

ing lite assigned cia

int

and front a trader. tha pledge on the niaterial dS swuritv: also relevant?

t bad enter-’d into

lite pu rchase of tha

a

(:u

ntr

An

ac

oti

t

for

tar mnetbod to i reate

ina

s€n,uritl interests is

Ruian partv vas the tarial on tbu assuinpt ion that tha 11w i reditor.

to dalis er

os fler and bad 11w

right l dispose cash ar sec as so-cal led coliateral, certimin assuts (us to

ut it. Thui a ar’. this pE

ua i1

uri

ICO

tis

s),

tiO

lIE

pro

viding tbat 11w ,:r

bor Iaints on the san

\JlifliW f tttitri

ntitl.d to rs’tain

editar svill be

w

il: (i) l,\ be oriin

lit

en

ip

un

Ila

\vi

t1

tmlt by lite delibur

Ihi tallilg

t.i’. 1 uus

uten oblig

go ment

i I 11w

bank. hw lusu il r’gist iti ur ir9n.trrrrd titlo: iii) 1 the nisfl1rii)ility .ition. Bs’ ass’ th i ri ditor nltn,nls ha ti

urud i Igal pludo

ni [ho .issetS, tius arr

iii) 1, tlw

liaser, ha 1,1w it nter.ue on 11w niaterial: risk at iuss in use ut latault. angement iiiinimnisss lite

VihI th

antr ut I

uhh’it»r’il mi’’d i

ham: md Ii I l lit l ml ii 1iidittg i. r.cignmseI Is se is lier

e

thc hus ni [ha

Russiiti part\ s rIit,

ne

ril

ity

ut

lii’

i’e

tlw

uts

r... 1. ni iii ,nat

tra lu util, r is lit

pI mi ss ber’

.rial is n lit

e lo ,)gimtiun

il ut iii

ti In the

i\ lite 1155

i 11 r.

i tie sutti

i.. ttt

titlo to lite

..,

.

\ii -lE umnl,m,um

‘:,

i

nI

‘

X\ 1i1r

in, (

mi

I

i

/

I

I

I

I’

‘

i

i

I Iii

,.fnrn XXIN ((0

n,

111111?

i

‘

1.

.

i

‘I i

.

.

I

\

I ‘10 i

I \;

I

1?

ti

‘

l

11 r\

i

.‘

i

i

is trumi

‘ho

,Oi.

.‘

..-i

-

0 (

10 Il I,’

uIrr k ( I!?? (‘i

1 t ti.

il

I?) I i

01,r Ila;. li

10(11

‘rj.

0

I,! .0

i

I,!.

‘

‘

i!

,

l

1

-

I

I

1.1,,!

Jon ,

f’.

V\

1

li!

I

‘

;

il

I

((0

‘0

,

(Il nilS 1.’.)

‘ltslllE’ 1111 in

u,Iir h(fs tI,’t

i

lit IssEt ss iii L ‘im

nilISi5 Is iii???,

f I.

;tl”i1il’.illi5. tis’ ‘mii

tIti is iiiihihils

lim

1 th il ,.nonl tur tIm cn ti l’ll1tI itii, Is

)I,t i tt’,iit ris is li”

dl ie dI’! t( (1(1 to

15

ti.., f

10

I 0

I

nI 1 ho IS ot 5 iii

hts

tIi 0 fl-oil iinii, ti, I

r

h

i ‘H ,ij’ Iii

ni

l ml i

i

I

1110

111

I el

in

il

r li

I

i

(1!

‘‘‘‘00’

1))) ‘.1

i

104 II

S\.

I.

\ i (JrI il

1,1 I’ il, (

Il tI i/

(ni li II

ris), 11(0/nr kr

‘uiiit,itnii 111? (Il

P,entr, lit. 2 i nnl

li 101)

I 1410”) r’, 140 .1

mo in 1.1 [31

s s4tE

I 11,

3 iiIk: 1! iii jr)

I,

I

ti .11 ‘)i .1

.111:,.,

o’ :4 (IL) ‘i er/.

1n

0

i.’

i

v

-«

1tO

.050

R

0031

ON \\1) eRI\.\ 1. \ fl. N \

\

rditors is th it tiie ‘-,liall e tr itid e ju ilIv. md the

riorito-s thot ir ids mi id plod es or oth r n mai r m s

ii

ni xitp(i’n riiIit-i hs mandat r ribs

t iasi

oml onr iII s hi- t to pihi dv md r-istr itin. 11 i

I i k is uiii den ng gi v ing o tom to a partv in d requ ires

m units, it must ho ilb ssed to rei n tin i ros slities iid

In lir ‘0 ih s nth iil losv ssti ii s niftiu si ht1mr

th li’htor’s assnts lrn at radv ‘ati joc.t tu mi si mbraiis ei

in tivotir sf jth-r i roditurs. If it svos possible for a

debtur to avnid thnsn roquirnnients by t.huusing n furnign

lasv for a r ontran t ioutainirig an -ncunihrance. the bank

ss ould have to vnnifv the status of the asmts in all the

world’s junisdii tions in orden to satisty itselt tliat the

assets are free form encumhnanc es. This is obviouslv not

o reconimendable situation, ann this is the reason svhv

tlin ornation uf encuinhrantes or olher seuuritv rights [hat

niav atte(t the position of third parties is not suhject to

the choice of law made by (be parties in the agreement.

The nights aud obligations of the parties hetsveen each

nth’n are regulated by th

0 law that tliev have ohusen. hut

the nntorceabilitv of seizuritv rights that rnay affect third

partins is not. Shauld the nncumhranm:e turn not not to be

effective under its proper law, the consequences hetween

the parties wilI be determined by the lasv chosen hx them:

svhile in sorne svstems the clebtor 1nov be (leemed to be in

hreach ofits contractual commitnient towards the creditor

even though the perferrnance nfthe obligation is illegal nr

ineftective under its proper lasv, under other svstemns the

invaliditv of noe obligation mav affect (be validitv of the

whole contract, [hus rendering the encumhrance a nullitv

even between the parties.

The law governing encumhrances on tangible gnods is

generally determined hy [be same cnnflict rute as [be law

‘f property seen above, i.e. the connectiog factor is the

state where the goods are lot ated.

25

I

ON Si. LU

in

oil’ m is te imitennaticuol lisss. In nIlsen ss Opnss,

thn i noe ti og ii tor duter inmnm iU ‘be appli Ist lass is

tts» plai.i-’ -1 mli’-’ i ns-’ditun.-” Tu Imirmunise tin’, orua. lise

L NCI’I RAL hos pn-’pared the 2001 Cunv-’ntion n thu

signnsent f Rei eis iisies imm International ‘I’ade, bot tise

nstr miss’ ut Isas so far nut umsterod mIn fon u,

For ilst -‘s-entimoiitv timat thse Si-i mmlv uterust nr i ilIaten’ml

oneatid with seimsritiu’, ur sther bnantial iuslrumuumsts.

spe ifin rules mnav be rei ommendable: tberefone, the Euno’

peao Union bas issued two direitis es,’ ‘md i aninus ullser

initiatives ane ht’ing pursum’d by international organisa—

tions sum:h as lise Hogun Conference, time UNGITRAL aud

tlse UNIDROIT.

is

Would an asvard that disregards these conflict rules and

applies instnad [be law husen hx’ [be parties ise valid

and enfnrceahle? Lacking any specific case lass’ on time

effectiveness nf arhitral awards that give effect to (be

parties’ agreement and vinlate applicable lasv on propnrtv.

encumnbrances nr sen.uritv interests, il seems advisable to

refer to 11w reasoniog made above in respect ni cnrnpany

law and insnlvencv prnceedings, that respnnd tn the same

logic.

Competition Iaw

Suppose that twn cnmpe[ing manufacturers enter intn a

cnntract for the licensing of certain technnlogv, ann tisat

the transfer of technolngv is accnnmpaoied by a system for

sharinmg the nsarket between the twn cnmnpetitors, which

violates Eurnpean cnrnpetition law. The cnntract i ontains

o chnice uf law ciause. accordiog to which the governing

ass’ is a foreigo law. If a dispute orises hetsveen [be (syn

parties, and une nf the tsvn parties alleges [hat [be cnntract

is null and vninl hi’cause it violates Lurnpean rompm’tition

iaw, the otber pantv will ailn’ge [hat EC nonspetition law

is not apphcalsle to tise cnntract. [hat Ihe chuice of the

fnreign gnverning lasv svas useant ‘,pecificallv to avoid

appikahility of EC law and [hat the svill of the parties

sball be respem.ted.

Time lass’ govurning assignahilitv of iaims nr rem;eivahles

md tbe effect of (be assignment tnsvards third parties

and betsseen the assigned debtnr and the ssignen is,

gi-niraliv, Ihe iosv govsrnilmg the i lains hat is heing

sssignnd. svheneas tbe utfeut ut the assignment hntsveen Time purpose of the EC rules on inmpi’titinn is to ensmmr

thi’ ossignor aud 11w assignee snu governud by the law that isusirmess parties du not disturt the market by, k r

gos erning tbe i ontrit of assignnleot, sne for exampie ex’mmple, sharing it hetsi nen themoseives, Pru tices sm h

Art. 12 if dii’ Risnmu Ccns untion. I {oss i’v”r, (li’ osv ut th as umankit shsmning 1mai, i’ negative i’ltuit on ila’ offer aud

pin.e svh’nu tlmp iti-’htor is ni ati’d is min is i

‘n lite p’ is, mmai this ni--gmtivi’ls slR’i2s t1s’ tsui “is.

sii ahl’

1

0 liii parti’s iTimid as oid iipj lii ahilili ut tis,c’ mli s

I

“it’joi t0 thc

mitrm I to

thlrd Imss, ‘bru liiim ti

‘i

-

si

1:

\ i I

•.

i

I>.

1

ii.

iii

-

i ‘i

.

I

Il i i

i

Is

3

3(

‘-‘

[li

.

Iii

I

4

si.)

i

,

1i:1ii

0 iS ut

tI i II. 5

‘4

-i

I

.

i

i

‘Il,’

‘

1

til,)

li’

•s

1

i’

‘i

i

51

‘5 5

I

u

\iI,,2 I

14 Si /14 102 ,7:

5

imot)

[lo i

55

il [i

i”

i

‘;

4

li

. js..

‘i i

i

J(

‘‘i

4’

Iistif;ii’i .11.11

11,1 i’

s 54 0

iti

«i

il

i .

s

il

1

I

‘

i’

iii

i

“5

iO

Si niii

oir

4

i,,-,

i

ei

ei

il

le

i

,

,

i

3’’’

i

is 111

et

‘.

,i

!‘‘Iiiiitt

“

‘

i

i?

5

,,

:.--

.

,i0’

, I

li

ii

‘

‘seil? .

i

5!

14 il

111

5 ‘i

“:1-;

‘‘

—«‘:

n

‘et

iii,

i)’

1’

5 ‘4-

[Si,’

C

“-

lOt’s

‘

i

i

‘

i,

[“‘il

“

‘‘4

5,

I? aO

«i il

is

i;

S’,O..

:

.°

li

‘ii

‘,‘

Ii

1

1)1’

(

,i

iii

5 fl

-‘

(

i,.

5i

i i

I’

\i ‘(i’m

I

3 om’s

i

5 ,Sii(IioIj:n

00.,

iii i Si ‘i

0

24. ‘4,-

i’.!:’-s’

i

to,,

l:”u

5.

‘

.

I)

Ii

i

,

is

‘

i

‘

i

.

til, iSi i

:?ii

iii.

1.1

\.

,

hi,’!it

t-r’;

1/ii:

-‘

4

i

I

s 4

i

i

j l•

i

_

i

‘is

1

i. i

-I’

).

5

(

...

‘.

0,

I’

01

iit

.<‘s

‘SI

ss, I, I’ns,

i 11

i’’

5

til

‘i

i-i, ii

i

5

3 i, i

i

S.i.-

i

‘“‘

li

i

N

iii

I

il

I

i/i

s,,’t-

t[

i ‘i

Iitlp

i

,

0)5

5

‘I,

li i’iiif’[

!Iui”riiI

,,l,

fl

i

.ii(if

i,

il

iii

ei!t,iii

ii

il TO

ei

5’

il

‘ei’,

li

uke I I

I,,

‘

il

ti’.

ii iii i

o /1

il

iii

;iki

5

,

.,

i

\iT

‘

\ iO\ \\D “V \ i i:

i\

\ \ IO\ T.

.\

r.

(S)i

\ R.

t1

utun Ifl 0 niild itto t th ptsi

tifuI ot th hu rs. ind

i ontlad.t tII,it

his is mi lsirihio, lisni o. uI1

tIi» agrei- roii,,i

1piitin rulos s iii ipplx

in torinin 1

ti-d at 11w

lit o-tir fl if th /r dii

r ‘monts dod nldrLnt fra tI( s

er ml tliat ti-i dinifehi-,

I

hat

hav

e

elle

,t

ull

the

ti li

shill be paid to 11w agi- nt

reies ant terrltc rv, irrespot Ii e

ti Inn sw li tnj mi nul

f tlw Lov that

-rte, the

l n (ho

rutrai I 011111115 i i bob

(mtrd( i (impetitim IJW is on

e I law ilin (Itirminitig

ut th- fleljs vith n los lasv

thr

t)oit v»rri

cl \ew V- rL Is

he r - I

I mfliiig. i ni

t ho thero is a

aos’ tins r’gnliti

n

ihie

la w.

pI

of tliu piitios’ i nterests

ii

is il full ud unds r that

Ru enth the EuriJean Cou

lasv,

rt uf Jiistire liasJotrmined ( ruter Nos ‘gi-in Iasv. hun ove

r (is well as uniler

that European Competition rule

s have to ho ionsidered Italian law). 11w agent is i-ntitledf

to

conipon—ation

part ni piiblic polit.

ii poti

t-m

niinatinn nf tlie relationship.

The Europa

Is the i hoice of law laus

upon a rt’ferenoo made liv the Dut n Court xas acting sufficient

e

to exclude application ofthe

oh Suprenie Court in a

Norwegian rule Oil

caso for the annulmont ni an arh

ompensation?

itral award, The aard

bad given ofte I to the agreement

het

iolated the provision on competi een the parties, that ‘(be rute on compensation is part of

a sel of rirles designed

tion of tlie EC Treatv, to pro

then Art.85. The Dutch Sup

tect 11w agent. which is deo

reme Court bad affirmed that

med

to be tlw sveaker

partv in the relationship. An

ni avard violating Dutzh com

agencv assumes that the

petition rules oiild not age

be cienmed against Dutch pub

nt exercises its activitv for

11w

lic policy, and requested a

on terminatjon of the rolation benefit of the principal:

decision of the European Cou

slnp, the rmsults of tlie

rt as to hether European

agent’s activitv fall to the

tonipetition poliev i hold b’ trea

principal ‘s hendt, that

ted in Ili same vav or enj

svill

o the market aud the goo

not. The ECJ ruled that the rule

dwill developed for il

on conipetition contained lite

by

agent. The agent, on 11w con

in Ihe Ihen Art85 of the EC

Tre

trar

provision which is ossential for atv is a fundamental benefit from the artivitv carried y, svill not havn any

not for the principal.

the accomplishrnent of Henne.

the tasks entrusted to the Com

the i-ornpensation upon term

munit} and, in particular, bala

for the function ing of the interna

nce the parties’ interests. Tho ination is meant to

l n]arket. Based on this, dee

protection regime is

med to regard all i ommercial

the Court o»plicitly affirmed:

agents oarridng out their

ti- tivity svithin

the territory, aud the cimcum

stance that

tire parties i hose a different

‘The provisions of articie 85 of

law to govern the contrant

the

Tre

aty rnay be should not

regarded as a mattor of puhlic

exclude its 1

application)

policy within the

nieaning of the New York Con

venlion.”

Does this affect the validitv and

enforceahu1it ofan award

that gives effent to the will

Tbe ECJ docision in Ein Swiss

of tbe parties and disregamd

means, therefore, that the tlie applica

s

ble mule on compensation upo

arhitral trihunal risks to ren

n tumnunation?

dor an award that will be

deemed invalid aud refu

sed enforcement by Europoan Applving the rationale of Enn Sw

iss China Time Ltd

courts il the avard gives effe

ut to the rhoic’ if law rnade v Benetton International NV (C126197) might bad

hv tho parties in the contraet, and

to

cor

isidering also the European

this leacis to violating

rules protecting

tlie uthorwise applicable Eur

opan competition law: 11w vonunercial agunts as puhuic pol

icv. This is bec,ause

award 111 be deemed to con

flict u-ith Europeari puhlic Ilie European Court uf Justice alfi

rmed in Iii,giirar OB

policv. This, in tom, is a gro

imd for setting aside the Ltd v Euton Li-’onoi’d Technologies

inn (C-38 1/98) that

award il the award was rendered

thes

o

rule

s have as a purpose to

in a European country

pmotm t freedoni

and xvas i hallenged lwfore

11w conri of that pla:e. rii1 a ot estahlishment and the protect

ion of undistorted

ground tor refusing unforocine

nt it this is sought hefore a colupetition in the intemnal markot

”

European iourt.

‘I’his renunds of

the formula ot Enn Srviss, that

defined as public polh.v oil

‘‘ssuntia

l

for

the un i-oniplishinent of the

That 11w Furoptan (nrt of Justit i-’

tasks entriistel to

hos defined Eniopan ute Communitv’ini

i 0 ni pi-ti tion Li iv is piih

l. in parmicular. for lite fu

li pol io iloes not ni-an thiit nth

ni mioning i il

tlie

intimna

-r

l

market,

ss stns culs ide ut (urope svi li

lo Ihe same In the (niteil

t il s, ti r ixim

iilt. i fort ni

-il -n Ir el i 015 ml

Labour /aw. insurance

iliat 201 ofte i ti i til irk-t iIli

ition gri—enh-it on tlw

basis Iliat liii ompaIiLilit u ith

Uthem mm-ris ss bore Fl in Li-i

n il inn I ivis pr ov ide for

Cli ionipntition lasv iiil rira

nuintirv mIles Iliat Irot

dr-il

In ‘-i il I II- I In- liiiert n enkir i ontrattial

irhitra I trihiinal anl liii

lamli’s

ml thmofrm’ mm l’un’l

niirt ni ild rot riS in ii li el

to us irrile tlie othm’rxs ise

al iititiin.

liu il le lov, ar li

1

ip

tros i insurim e md liii

om

lasv

bor ssant nI

Agency

ist’ lisv on li-si mli s,

5 ‘i itii

il

iii’i\ li

u’l

ul

to

‘Iii

i

50 Iliiit in it.iI i in

mo mlii nationaL’ o[ 11w ohio

I Li

md i f i-ut’ 5 i om

i inhi a

iti i 11usd hun

151111 a \iii\iiiiin

Sriiss md fiignioi lii isions:

C’hiI hr tur’ [- nr tin of

ti; Ihi- i-’\I ut

tlo’ Ilimt iii ulil,ihrl

dii i-f S fi lii is td mh I

lot mmm t 0 mi km mas I d ‘ou’l muli--s ‘i I ml,nmr in til ni instnibli i’ li’s

i mlii- \‘i’- ihi vrri’

t le

st-rmial lor tlu- luiii ti(nihi

r\ 1 ho arti’s im stil ti tii

I ml;‘

-

-

- -

i

-

i—

s

/

/

sb.i

bil

i

Y’

i

‘i

‘-l

;

I

/‘s?

i Ii

/

:1

(‘i.

iii

i

i

/

P

i

i;

i

-i

-

oil

i

.,1,i

5,

i

I

i

i:.

/1

1

ni

i

Ii? Om

i- i

i

i,

i

i

‘

Il

\X\ III

1

ju

/-

J(i il)

li

ii

—

-

i

i

I

i

il

ti-

i

4. J!i;tui

i

‘1

i

-,-.

i

i i

/

—

I’

-

‘

I

li

I

2

‘

ti

‘

I

i

‘i

li i i

i’, I 15 0

i 11 i

J

i

—

i

1

i

i

-r

‘

i

-

1

i

0111 1(0 I ‘oil il

ail

lit-ru ut

tl

ti

ti

I

i

i

r ut—

i

i

jul

1,i

iS

jriti i,.

-,

; i il

s.22

iii

162

2Ot5

iii.

i,, I.:

\Ri31

<.\I!U\ ANE) i’RIV\ FE iNïER\A i( )\r\L LA\V

nvirkot tintluding frpdom of estohi ishiuont and

award that aivs ffeot to tho narties

,iOroinent ancl thiis violates thostr’ rtIlos nigJit ren th risk

to h jueffetlive if it is presented to a tomt within the

Enropean Coniinunitv er tbe EFTA,

ntrnaI

fliOVOfl1r’Ut), ,fl

Good

faith

and fa,r dealing

Sorne legal sxstems, particularly those inspired by

German law, base their contrat:t laws on the prineiple of

good faith and fair dealing This principle may be used to

guide the interpretation of the contract, its perforrnance,

to ereate anciliarv obligations for the parties in spite of

ibeir not heing expressly provided for in the contract er

t?vttn to correet the reculation (.:ofltaifled in the contract.

Contract olauses that expresslv perrnit an interpretation

er a perfornimce that violate the princ:iple of good faith

and fair dealing, for example exeinpting froin ]iahilitv

uten in case of gross neghgence or wilful rnisconduct

er permitting terniination of the contrac;t for capricious

reasons, might be deemed to violate the prim:iple of good

hith and fair dealing. If the contract is suhject to, for

exarnple, English law, which has no general principle of

good faith for comrnercial contracts, there are no ohstacles

to a literal impleinentation of the contract’s provisions,

as long as thev are sufficientiv clear.

36

\Vould the literal implementation of these clauses be

affected by an overriding principle of good faith and fair

dealing in the law that would have heen applicable if

the parties bad not chosen English law to govern the

:ontract? The principle of good faith and fair dealing

is considered to be central in the contract laws of

thus rt’main applit ahie in spite efa ‘I itferent

hoPe of iav ntade by the pnrti7s.

i:iitiracterand

The printiple ef goed faith aud tair dealinp is nise the

basis for many provisions of Diret t:tive 93/i 7.’ In Icistozt1

v Cpntu \IotiI \filitnittn, SL (C—ltiH:tt3j.

’’ Ihe

t

Etiropean Ccturt of justiite rttled en thu qiiestielt tvhether

Art.6 ef the Dirtative represents public policv iiii thus

van be a basis for setting aside an arhitral award. Articie 6

of the Directive provides that contract terms that are

defined as unfair under the Directive shall not be binding

on the consunler.

The ECJ found that:

“lAls the airn of the Diretitive is to strengthen

consurner protection. it constitutes. according to

Articie 3(1 )(t) EG. a measure tvhich is essential to

the accomplisbrnent of the tasks entrusted to the

Comrnunitv and. in particular. to reising the standard

of living and the quality of life in its territory. ‘41

The ECJ concluded thus that the rule on unfair contract

terms is to be deerned ofpublic policy.

The CIoz’o decision was rendered in a case involving

a consurner, and its rationale is hased on consumer

protection. It is. therefore, quite douhtful. ‘.vhether

corresponding rules mav be deetned to be puhlic policv

when the award regards a comrnercial dispute.

42

There is a certain case law in support of the restrictive

approach recommended here,

45

:ivil law svsterns, and it has been transferred from

there into various restaternents of principles of contract

law that have the ambition of being applicahie to

international contracts, such as the UNIDROIT Principles

of International Comrnercia] Contracts aud the Principles

of European (Zontract Law. Jt has even heen proposed

il.

ii

til,

ti

I

[i

to extend to coininercial contract the overriding rules

base d on good faith that have so tar bet-in applicahie to

:onsumer protection. 0 There are sorne indications that

rttIts ‘spressing th is priliti ple in ight have an overriding

lit

i

Per

iO,

1,Oiiitiotjofl 2

tii

(Zordero EI

0

i ui’

fl.

‘i

liii’

a,

‘

et ‘n

hi’ n:

i

‘.1,,]’.

‘

‘‘

i

..tirtt (rettt

I

li

tiitti’

:

t

1

t

7

I)

i,

..

‘.

tt’It