DRAFT

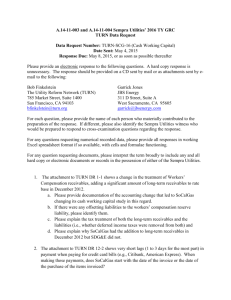

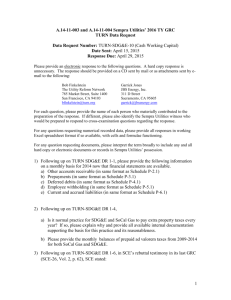

advertisement