Market and non-market policies for renewable energy diffusion: a

advertisement

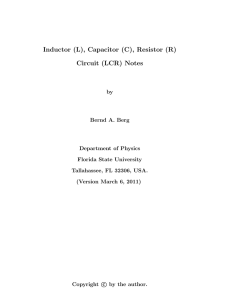

Market and non-market policies for renewable energy diffusion: a unifying framework and empirical evidence from China’s wind power sector Authors: Yang LIU and Taoyuan WEI Published in Energy Journal Annex 1. Proof of Eq. 4. Since lim Qt−h → Qt , Eq. 3 can be expressed by ℎ→0 𝑄 𝑡 𝐷𝑖𝑓𝑡 = γ · 𝑄𝑡 (1 − Qmax ) (A1) as ℎ → 0. Notice that Eq. 2 can be rewritten as 𝑎𝑡 − 𝑎𝑡−ℎ = 𝑎𝑡−ℎ 𝐷𝑖𝑓𝑡−ℎ 𝑄𝑡−ℎ which is equivalent to 𝑑𝑎𝑡 1 𝑑𝑙𝑛𝑎𝑡 𝐷𝑖𝑓𝑡 = = 𝑑𝑡 𝑎𝑡 𝑑𝑡 𝑄𝑡 when ℎ → 0. By inserting Eq. A1, the above equation becomes 𝑑𝑙𝑛𝑎𝑡 𝑑𝑡 = 𝐷𝑖𝑓𝑡 𝑄𝑡 𝑄 𝑡 = γ · (1 − Qmax )= 𝑑[γ·𝑡] 𝑑𝑡 𝑡 γ − Qmax 𝑑(∫0 𝑄𝑣 𝑑𝑣) 𝑑𝑡 = 𝑑[γ·𝑡] 𝑑𝑡 γ − Qmax 𝑑(𝑄𝑆𝑡 ) 𝑑𝑡 , 𝑡 𝑄𝑆𝑡 = ∫0 𝑄𝑣 𝑑𝑣 is the cumulative capacity at time t1. Hence, 𝑎𝑡 = 𝑒 𝑄𝑆 𝑡 ) γ·(𝑡− max Q 𝑏𝑦 𝑎𝑠𝑠𝑢𝑚𝑖𝑛𝑔 𝑎0 = 1 and 𝑡 ≥ 0. (A2) By inserting Eq. A1 into Eq. 1 and rearranging terms, we have γ Qmax 𝑄𝑡 2 + (1 − γ)𝑄𝑡 − 1 1 1 1 +( − 𝑚𝑎𝑥 )·𝑒 −𝑏·𝑁𝑃𝑉𝑡 𝑄𝑚𝑎𝑥 𝑎𝑡 𝑄 =0 (A3) A lagged cumulative stock 𝑄𝑆𝑡−1 at time t is used in our empirical estimation. However, due to a continuous time framework, we cannot state t-1 in our theoretical model. 1 1 where If 𝑄 𝑚𝑎𝑥 is large, then γ 1 Qmax < 𝑄𝑚𝑎𝑥 ≅ 0. At the earlier stage, we would expect 𝑄𝑡 is trivial compared to Qmax 2. Hence, the squared term of 𝑄𝑡 can be ignored and the above Eq. A3 can be simplified as (1 − γ)𝑄𝑡 − 𝑎𝑡 · 𝑒 𝑏·𝑁𝑃𝑉𝑡 ≅ 0 (A4) By inserting Eq. A2 to Eq. A4, we obtain Eq. 4. Annex 2. Calculation of customer benefits for numerical simulation in Section 6 The customer benefits are calculated by 𝐼𝑛𝑣𝑒𝑠𝑡 (𝑛𝑜 𝑝𝑜𝑙𝑖𝑐𝑦) 𝐶𝐵𝑡 = [𝐶𝑡 − 𝐶𝑡𝐼𝑛𝑣𝑒𝑠𝑡 ] + ∑20 𝑛=1 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑜𝑛 (𝑛𝑜 𝑝𝑜𝑙𝑖𝑐𝑦) 𝐶𝑡 (1+𝑟)𝑙 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑜𝑛 −𝐶𝑡 (A5) where 𝑙 is the average lifetime period of the wind farm; 𝐶𝑡𝐼𝑛𝑣𝑒𝑠𝑡 is capital costs and 𝐶𝑡𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑜𝑛 is the O&M costs. With the common learning curve, we specify the investment and O&M costs as following: QS 𝐶𝑡𝐼𝑛𝑣𝑒𝑠𝑡 = 𝐶0𝐼𝑛𝑣𝑒𝑠𝑡 · ( QS t )−𝛽 0 𝐶𝑡𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑜𝑛 = 𝐶𝑡𝐼𝑛𝑣𝑒𝑠𝑡 · α where 𝐶0𝐼𝑛𝑣𝑒𝑠𝑡 and QS0 are, respectively, capital costs and cumulated installed capacity at the starting point; 𝛽 is the learning-by-doing coefficient; α is a parameter determining average annual O&M costs as a percentage of capital costs of a wind farm. In the case of China’s wind power 2004-2011, the maximum Q t is only 8.5 MW (Table 1) while the estimated Qmax is 0.45/0.00009=5000 MW for a province based on the estimated coefficients of 𝑡 and QSt in Model A (Table 2). Hence, the squared term in Eq. A3 is estimated to be only 0.45/5000*8.5 2=0.0065 even for the maximum Q t . 2 2 Annex 3: Evolution of different components of social welfare Fig. A1. Environmental benefits, customer benefits and subsidy costs (γ =0.38, Unit=billion RMB) 500 450 400 350 300 250 200 150 100 50 0 -50 201020112012201320142015201620172018201920202021202220232024202520262027202820292030 -100 Environmental benefits Customer benefits Subsidy cost Fig. A2. Environmental benefits, customer benefits and subsidy costs (γ =0.05, Unit=billion RMB) 300 250 200 150 100 50 0 -50 -100 Environmental benefits Customer benefits 3 Subsidy cost

![[1] A FIXED POINT THEOREM FOR GENERALIZED METRIC SPACES Let](http://s2.studylib.net/store/data/010447303_1-830d1dca013385b68e967636daaf4a32-300x300.png)