Market Response Measurement using the Multinomial, Multiattribute Choice Model

advertisement

Market Response Measurement

using the

Multinomial, Multiattribute Logit

Choice Model

by

Peter Manning Guadagni

B.S., University of California, Riverside

(1977)

SUBMITTED IN PARTIAL FULFILLMENT

OF THE REQUIREMENTS FOR THE

DEGREE OF

MASTER OF SCIENCE IN MANAGEMENT

at the

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

June 1980

SPeter Manning Guadagni

The author hereby grants M.I.T. permission to reproduce

and distribute copies of this thesis document in whole

or in part.

Signature of Author

'

Alfied'P/

Slban Scho

' of Management

May 15, 1980

Certified by

--

"John D.C. Little

Thesis Supervisor

Accepted by

Michael S. Scott Morton

Chairman, Departmental Graduate Committee

page

2

ABSTRACT

MARKET RESPONSE MEASUREMENT

USING THE MULTINOMIAL, MULTIATTRIBUTE LOGIT

CHOICE MODEL

by

Peter Manning Guadagni

Submitted to the Alfred P. Sloan School of Management on

May 15,

1980,

in partial fulfillment of the requirements

for the degree of Master of Science.

Universal Product Code (UPC) scanning is the key to a

new marketing data source. Unfortunately, most existing

marketing models do not have a structure which can utilize

the richness of UPC data. A new model is proposed which

uses individual purchase choices from members of a UPC

scanner panel to measure consumer response to marketing

variables.

The development and theory of the multinomial logit

(MNL) model as well as goodness of fit measures are

discussed. An adaptation of the MNL is proposed where

multiple purchase choices of a sample of population members

are used to get a disaggregately calibrated measure of

aggregate response. The model is then tested using UPC

panel and sales data from the coffee category. The model

performed well enough in this initial implementation to

indicate

that it may be a useful

analysis

tool.

Specifically, the model was able to measure the impact of

price, promotion, and individual consumer loyalties as well

as the more subtle effect of a promotional purchase's

impact on subsequent buying.

3

page

ACKNOWLEDGEMENTS

I would like to thank Professor John D.C.

all

the

help

he

has

for

given me during the course of this

express

I also would like to

research.

Little

my

gratitude

to

Selling Areas-Marketing Incorpated (SAMI) for supplying the

data used in this project.

people

of

Management

Special recognition goes to the

Decision

Systems,

especially Bob Wallace and Joan Melanson

Inc

who

set

(MDS),

up

and

maintained the database used and Phil Johnson and Bob Klein

who provided innumerable suggestions and comments.

I would

also like to thank Al Silk for serving as my reader and for

all the insights he provided.

Finally, I dedicate this

Harris,

who

may

not

believe

thesis

in

to

my

wife,

Sandy

all of my research but

certainly understands the insanity it inspired.

4

page

CHAPTER 1

INTRODUCTION

Management scientists have

analyze

models

building

been

These models have given

marketing data for years.

managers substantial insight into individual and

consumer behaviour.

to

aggregate

Unfortunately, the ultimate usefulness

of these models has always been inhibited by the quality of

the data used to calibrate them.

Traditionally, marketers have

store

withdrawals,

supply data on

dynamics.

and

audits,

competitive

Warehouse

withdrawal

warehouse

and

purchase

consumer

and store audit data can

(see

Little(1979)).

That

they give management information on total and regional

market shares

as

well

as

seasonalities in sales.

in

upon

consumer diary panels to

sales

answer market status questions

is,

relied

the

compilation

indicate

the

extent

of

However, the extent of aggregation

of this type of data has smoothed out

the peaks and valleys of sales which comprise the effect of

a promotion or price change at the individual store

Use

of

this

data

therefore limited

widespread

and

their usefulness

to

in

market

the

pervasive

here

has

response

analysis

marketing

been

of

level.

measurement

only

the

is

most

activities, and even

debated

(Shoemaker

and

page

5

Pringle (1980)).

The most frequently

have other problems.

but

aggregation

general

bulk

the

keeping discourage

The rigors of diary

accurately.

population

of

represent

to

panel

cited one concerns the ability of the

the

of

effects

the

from

Purchase diaries do not suffer

population

the

from

participating, thereby increasing the likelihood of a bias.

Moreover,

diary

extended

tends

keeping

make

to

panelists extremely aware of prices and therefore

more

sensitive

than

the

possibly

rest of the population to small

price differentials.

Perhaps a more serious

problem

the

.diary panel

it

usual

national

the

is

that

with

gives

indication of the envirDnment in which a purchase is

no

made.

In other words, you learn the price a consumer paid but not

the

prices

of

important since

the

product

purchased

products

other

significance

can

only

the

on

of

shelf.

the

price

This is

of

a

be evaluated if the price of

competing products is also known.

Universal Product Code (UPC) scanner technology may be

the key to an improved data source.

scanner

a

equipped store may be inexpensively monitored on a

weekly, daily, or even hourly basis.

to

Product movement in

observe

the

effects

of

Thus it

is

possible

a temporary price cut or end

aisle display at the individual store level.

In

addition,

page

it

is

the

analyst,

not

6

the

data supplier, who has the

choice of how and where to aggregate,

thereby

making

the

that

many

data much more flexible in its use.

What is perhaps more important is the fact

scanners

have

the

participant in

a

himself/herself

ability

scanner

to

collect

panel

need

panel

data.

only

indentify

as such to the check-out clerk rather than

recording the purchase information by hand.

This advantage

undoubtedly reduces the bias of the data as it

obtrusive

method

and

Futhermore, scanner

movement

data

A

participation

panel

giving

the

data

is

is

so

is

a

less,

much easier.

augmented

by

store

researcher access to the store

environment which may be used in the analysis of individual

purchase behaviour.

Scanner data does have

should

be

aware

of.

A

recorded for purchases made

he/she

is

a

disadvatages

panelist's

in

the

which

the

purchases

scanner

user

are only

store

which

panelist in, and only if he/she remembers to

identify himself/herself as

a

store

recruited

shoppers

have

been

problem has been minimized.

panelist.

as

However, there

As

only

panelists

does

loyal

this

exist

a

problem for categories such as health and beauty aids where

a

substantial

discount stores.

number of purchases may be made in drug and

It is our belief that these problems

are

7

page

relatively

minor

so

long

as

the researcher is aware of

them.

UPC scanners can thus supply

data

which

will

allow

management to understand how consumers respond to marketing

actions

in

a

way

never before possible.

most existing marketing models

which

can

accommodate

data

scientists then

not

have

a

structure

the richness of scanner data.

use of these models means that

scanner

do

Unfortunately,

will

be

lost.

is

to

develop

many

of

the

The

benefits

of

The challenge to marketing

models

which

can

take

advantage of the fertility of UPC data.

In this paper we shall develop and test such a

The

proposed

model

combines

individual

model.

purchase

observations with the competitive environment in which

purchases

the

were made to produce a disaggregately calibrated

measure of the aggregate response

to

the

marketing

mix.

Both product and individual consumer attributes may be used

in the model to explain purchase decisions.

8

page

CHAPTER 2

THE MULTINOMIAL LOGIT MODEL

A multinomial logit (MNL) model has been suggested

by

several authors (McFadden (1973), Silk and Urban(1978),

and

model

of

and

Gencsh

(1979))

Recker

that

utility.

individual

make

individuals

That is,

will

a

given

reasonable

The derivation of

individual choice behaviour.

assumes

a

as

the

model

choices to maximize their

set

of

S,

alternatives

an

the alternative, k S, which holds

choose

for him the greatest utility.

The utility of an alternative for

assumed to consist of:

can

be

measured

as

and

individual

is

(1) a deterministic component which

a

function

of

the

alternative's

attributes and (2) an unobserved random component.

Utility can thus be written:

u(k) = v(k) + e(k)

(1)

where:

u(k) = the utility of alternative k to the individual

v(k) = the deterministic component, and

e(k) = the random component

Further, the deterministic component,

v(k),

will

be

page

taken

to

be

the

following

9

linear

function of observed

attributes of k:

v(k) =

(2)

c b(i)x(i,k)

il

where:

I = set of observed attributes

b(i) = weight given to attribute i

x(i,k) = value of attribute i, for alternative k.

The probability that an

thus

choose

alternative

individual

will

prefer

and

k, from an alternative set S, is

simply the probability that the individual will derive more

utility from k than from any other alternative in S.

This

may be written mathetically as the following:

P(k:S) = Prob{u(k) > u(j)

for all j

S,j j k}

(3)

where:

P(k:S) = Probability of choosing k, from alternative set S

Breaking (3) into the random and fixed

components

of

utility we get:

P(k:S) = Prob{(v(k)+e(k))

A

> (v(j)+e(j))

for j e S,j

> (e(k)-e(j))

for j e S,j f

k}

(4)

k}

(5)

or

P(k:S) = Prob{(v(k)-v(j))

Finally,

it

has been shown by McFadden(1973)

(I

that

if

10

page

the

random

e(j),

errors,

are independently, identically

distributed with the Weibull distribution

(5)

then

takes

the following form:

P(k:S) = exp(v(k))/

C exp(v(j))

(6)

jeS

This is what is referred to as the

model.

A

more detailed derivation of this type of strict

utility model

and

McFadden(1973)

it

is

logit

multinomial

its

properties

or Theil(1971).

may

be

found

in

The choice theory to which

related may be found in Luce(1959).

The most important

measure

of

output

but

utility

an

of

the

estimate

model

of

is

the

not

relative

importance of various factors in determining utility.

factors

need

The

factors

importance

which

are

difficult

likelihood procedure.

be

estimated

and

is

McFadden(1973)

has

shown

technique

yields

documented

that

estimators

using

a

The particular program used

in this research was developed at M.I.T by C.F.

Moshe Ben-Akiva

to

of each factor, represented by

the b(i) attribute weightings, may

maximum

The

not contribute to utility themselves but may

be surrogates for other

quantify.

a

the

which

in

Manski and

Ben-Akiva(1973).

maximum

are

likelihood

consistent,

asymptotically efficient, and are unique under very general

page

11

conditions.

A property of the MNL model

irrelevant

is

(IIA).

alternatives

the

independence

IIA property states

The

that the relative probability of choosing

over

another

of

one

alternative

should be unaffected by the attributes of or

the presence

or

absence

of

a

third

alternative.

Mathetically this means:

P(a:Sl)/P(b:Sl) = P(a:S2)/P(b:S2)

(7)

..

nere:

Sl = {a,b}

S2 = {a,b,c)

Any significant violation of the

MNL

model

will

Generally, the

assumption

cause

violations

that

independent across

observed

the

the

the

may

be

traced

random

(McFadden,

to

the

squares regression.

or

requirements

to

utility

and

the

in

MNL

component

and

Train,

for

the

independent

Intuitively, the error term requirements

analogous

of

IIA property to fail to hold.

alternatives

attributes

assumptions

of

is

the

Tye(1977)).

the

residuals

MNL

in

If either the error terms in

the

are

least

MNL

the residuals in least squares regression do not behave

properly the estimated coefficients will be biased.

There are two common sources

of

this

problem.

The

page

first

12

is improper specification of the model.

terms are

utility

defined

and

as

the

difference

Since error

between

the

true

utility different specifications of

observed

If

observed utility will result in different error terms.

an

attribute

omitted from the model is not an independent

random variable

independent

the

either.

property to hold or

alternatives

McFadden,

error

will

probably

not

be

Therefore, it is possible for the IIA

fail

depending

Train,

terms

and

to

hold

on

the

same

set

upon the model specification.

Tye(1977)

for

a

in

more

of

See

depth

treatment of this type of problem.

Failure of the IIA property can also be

sufficiently

heterogenous alternative set.

caused

makers

first

choose

between

widely

chosen

group.

See

appendix

A

where

differing

groups of alternatives and then pick an alternative

the

a

This condition

implies choices may be made in a hierarchical manner

decision

by

within

for a more complete

discussion of this type of IIA problem.

The IIA

property

is

necessary

to

attribute weightings as cross elasticities.

MNL

interpret

the

The value of a

model is therefore dependent upon proper specification

of the model and the selection of a homogeneous alternative

set.

13

page

The data requirements for model calibration are a

of

set

choice observations and alternative attributes for each

attribute analyzed.

apply

to

all

The alternative

attributes

choices

observed

The

not

but it is necessary that each

alternatives

alternative apply at least some of the

alternative.

need

to

time

chosen

made by one

be

may

a

individual or by different individuals within a population.

In the

of

case

population

be

the

latter

homogeneous

it

with

is

that

necessary

the

to its members'

respect

attribute weightings.

The MNL model is an extremely flexible model of choice

behaviour.

choice

individual

It is founded on a tested theory of

behaviour

and

has

been

shown

to

be valid in a

The primary use of the model thus far

variety of settings.

has been to forecast demand for new transportation services

(see McFadden(1973)

and Ben-Akiva(1977)).

However, it has been used in a

Silk

and

Urban(1978)

to

marketing

context

by

predict the market share of new

packaged goods, and by Gensch and Recker(1979) to

the relative importance of supermarket attributes.

evaluate

14

page

CHAPTER 3

PROPOSED MODEL

At its most

represents

basic

level

a

product's

market

share

the fact that some proportion of consumers have

chosen that product over its competitors some proportion of

the time.

If we can understand

how

and

why

individuals

choose one product over another we should gain insight into

the

reasons

for

considering each

composed

us a

a

products

product

as

relative

an

success.

alternative

in

By

a

set

of it and its competitors the MNL model will give

structure

suitable

for

the

analysis

of

consumer

purchase choices.

Silk and Urban(20) recognized this

logit

model

to

predict

and

have

used

the market share of new packaged

goods prior to test market using consumer preference

Jones

and

Zufryden(1978) and

based model

Customer

for

analysis

characteristics,

characteristics and the

used

in

the

model

of

aggregation

usefulness.

and

data.

(1979) have proposed a logit

consumer

marketing

competitive

purchase

data.

mix variables, store

environment

are

to explain purchase behaviour.

their model is a step in the right direction,

of

a

a

shortage

of

data

the

all

While

effects

restrict

its

page

15

to

In order to use the MNL model effectively

the

effects

of

various

marketing

analyze

variables on consumer

behaviour extensive data are needed.

The

model

requires

information on the decision maker, the chosen products, all

of

the

competing products, and on the current environment

of the market.

With the emergence of UPC scanner data

the

data requirements for effective use of the MNL can often be

Thus perhaps for the first time it is possible to use

met.

a

dissagregate

MNL

model to evaluate several elements of

the marketing mix in an adequate way.

However, some ground

work must be laid first.

is

The first step in the modeling process

parameters

the

whether

individual or across

the

will

is freedom from the assumption of

for

each

advantage

of

population

homogeneity.

implementation of the MNL requires the population be

homogeneous with respect to

members

run on

The

population.

decide

the model on an individual by individual basis

calibrating

Valid

estimated

be

to

the

relative

give to the various attributes.

individual's

one

satisfied

trivially.

The

individual analysis is the

importance

of

each

aggregate response.

theoretically

honest

choices

requirement

this

difficulty

analysis

model

which

its

When the model is

disadvantage

individual's

Such

importance

is

of individual by

in

evaluating

the

attribute weightings to

might

is

so

result

in

a

difficult

to

page

16

interpret as to be managerially useless.

A model

individual

which

utilizes

population

the

members

assumption of homogeneity.

separate

does

It also

decisions

necessitate

carries

with

the

it

The advantage is that the model will give a

c-librated

measure

mix variables.

disaggregately

of the aggregate response to marketing

Futhermore, problems of

cross-sectional

effects

may

be

heterogeneity

handled

each

segment.

This

may

increase

interpreting the results but will help

are meaningful.

and

by dividing the

population into homogeneous segments and running the

results

the

of cross-sectional effects confounding the results.

danger

on

of

model

the difficulty of

insure

that

those

Ultimately, the data requirements

of the model usually rule out calibration by individual.

A

general rule of thumb for

a

minimum

of

100

been

modeling

states

that

observations are needed to yield unbiased

results (Mcfadden(1973)).

observations

logit

Seldom

collected

for

have

one

enough

purchase

individual to meet

these suggested minimums.

Once the decision is made on whether to calibrate

the

model by individual or by population the model builder must

next define an alternative set.

minor

While this may seem like a

task it may prove to be the most difficult.

or not the model violates its

underlying

Whether

assumptions

and

17

page

thus

the

ultimate

utility

of

the

model

depend

on

a

satisfactory selection of an alternative set.

The most obvious choice is the various products within

a category.

However, the IIA property

alternatives

do

not

compete

level (see Appendix A).

this

may

be

as

category

pre-sweetened

an

example.

cereal

half

pre-sweetened

vary depending

on

if

the

categories

all

time

where

to eat cereal

ready

eats

individual

an

If

and bran cereal the

probability

other half then his predicted

particular

some

the

Take

case.

fail

with each other on the same

There are

the

will

of

choosing

a

cereal

over

a bran cereal will

one,

two,

three,

whether

or

more

pre-sweetened cereals are available.

to

Bran and pre-sweetened cereals would seem

separate

A

subcategories.

been proposed to handle

hierarchical

logit

hierarchical

sort

this

two

logit model has

problem.

of

be

In

the

a probability would be assigned to the

choice between bran and

pre-sweetened

probabilities

to

assigned

each

and

member

then

of

purchase

the bran and

pre-sweetened categories.

Given a

compete

category

in

which

all

products

directly

with each other, the various brands may seem to be

an appropriate alternative set.

In this case a problem can

page

18

arise if there are multiple sizes.

to define an alternative's

The concern here is how

attributes.

For

example,

if

price is an attribute, which price should be used the price

of the size with the cheapest unit cost or the price of the

most

popular size?

In categories where there is high size

loyalty either specification is likely to

In general, the problems of defining

set

will

vary

with

cause

problems.

alternative

the

the product class being studied.

We

would propose a simple but pragmatic rule which

may

useful

Define the

in

a

variety

of

product categories.

alternative set in accordance with the supermarket

pricing policies.

unit

price

and

sizes

trade's

If all sizes of each brand have the same

are

always promoted together, define the

alternatives at the brand level.

different

prove

If, on

the

other

hand,

of a brand have different unit prices and

are usually

not

promoted

together.

alternative

to be a brand and size combination.

then

define

the

This sort

of policy is an indication that a brand's various sizes are

being treated as separate products and thus are

be

perceived

as such by the consumer.

exhibit definite loyalties to particular

but

this

likely

to

Some customers may

sizes

or

brands

does not necessarily indicate that the resulting

alternaLive set is so heterogeneous as to result in failure

of the IIA property.

the

effects

of

Proper modeling can

usually

capture

differing loyalties well enough to insure

page

19

that the mo'el's assumptions are not violated.

Some researchers may wish to limit the alternatives to

each customers evoked set.

products

to.

which

the

By evoked

to

have

considerable

experience that proper

yield

choice

we

mean

and

appeal.

specification

probabilities

one

which

However,

of

the

that are small,

outside each individual's evoked set.

of

purchase

implied

model

a

will

for products

Actually,

by

does

it is our

a purchase

probability close to 0 is more plausible than the

impossibility

those

individual confines his/her purchases

This is a possible modification

seem

set

apparent

0 probability.

Restriction of alternatives to each individual's evoked set

also complicates the modeling of a product's migration into

or out of an evoked set.

The analyst may specify attributes in a MNL model much

the same way

important

he

to

would

in

the

model's

basic

in

attributes.

It

is

turn

is

a

utility

function

imposed

of purchase probability

of

of

the

an

alternative

alternative's

Characteristics of the decision maker must

modeled so as to apply to the alternatives.

loyalty

model.

This requirement is

structure

being related to the observed

which

regression

remember that attributes in a MNL must apply

directly to the alternatives.

by

a

variable

may

be

For example, a

change with the decision maker, but

20

page

the changing loyalty is expressed as

an

attribute

of

an

alternative for the decision maker.

The use of dummy variables as attributes for

one

all

of the alternatives is has an important advantage.

other words for each

attribute

alternative

attribute

but

one

we

0

captures

define

for

any

all

others.

uniqueness

Such

a

observations.

model

with

an

average

choice

dummy

un an alternative not

captured by other explanatory attributes, at least

describing

In

has a value of 1 at every observation for

which

that alternative and

as

but

behaviour

A maximum likelihood

insofar

over

estimate

of

all

the

the

only the dummy variables as attributes insures

that the predicted probabilities

alternative's

market

share

will

for

be

equal

to

each

the entire sample.

This

turns out to give the model some desirable properties which

will be discussed later.

dummy

variable

for

singularity

which

impossible,

hence

It should be noted that

all

of

makes

the

the

the

dummy

using

a

alternatives

causes

a

estimation

procedure

for one of the alternatives

should be excluded from the attribute set.

whose dummy is excluded may be

attribute

weighting

of

population's

is

the

product's

underlying

of

having

as

zero for the excluded dummy.

managerial interpretation of the

variables

thought

The alternative

coefficicients

franchise.

preference

for

That

a

of

an

The

these

is,

the

product

page

independent

of

price,

consumer loyalties,

21

promotion, advertising, individual

and

other

explanatory

attributes

included in the model.

The proposed model then takes the following form:

P(k:S) = exp(v(k))/

(8)

7 exp (v(j))

j sS

where:

P(k:S) = the probability that a consumer will choose

product, k, out of a set of products S, given the

observed product atributes, x(i,k)

v(j) =

iEI b(i)x(i,j)

181i

+ b(0,j)

(9)

b(i) = attribute weight for attribute i

x(i,j) = value of attribute i for product j

b(0,j) = weight of dummy attribute for product j, b(O,j) is

defined to be 0 for

one and only one alternative

Where the b(i)'s and b(0,j)'s are estimated using

the

decisions

of members of a homogeneous population.

should be noted that an observation subscript

in

all

the

notation.

is

the

It

implicit

That is, the attribute values and

therefore the v(j)'s and choice

probabilities

may

change

with each different observation.

In choosing attributes to

add

to

the

model

it

is

important to remember that the model is based on the theory

page

of

utility

maximization.

22

All

attributes

should

contribute to utility in some way, or should be

of

unquantifiable

attributes

which

are

then

surrogates

surmised

to

contribute to utility.

The proposed model is thus a versatile

the consideration of diverse attributes.

be

indm-endent

of

the

decision

model will

importance

maker,

yield

of

such

as

maker,

loyalty.

accurate

various

measures

marketing

d-'ermining consumer purchase choices.

allowing

The variables may

promotion, or they may take on different

decision

tool

as

values

price

for

and

each

A carefully specified

of

mix

the

relative

variables

in

These measures will

give an indication of how the market responds to changes in

price, promotion, or advertising.

page

23

CHAPTER 4

GOODNESS OF FIT MEASURES

Essential to the construction of any model is an index

of how well that model performs.

A goodness of fit measure

will tell the model builder how successful he has

explaining

the

observations.

been

in

It may be interpreted as an

indication of the reliablity of

the

estimated

parameters

and may be used to compare the quality of different models.

The log likelihood value, a standard

logit

output

of

could be used as such a measure.

programs,

most

The log

likelihood value is the log of the estimated probability of

the given

observations

coefficients.

occuring

with the

the

estimated

The closer that value is to zero the better

we have done in explaining

likelihood

given

value

number

the

data.

However,

the

log

has no lower bound and tends to decrease

of

observations.

This

makes

its

use

d'fficult in determining whether a model has a good or poor

fit.

What

is

needed is a bounded measure of fit where a

particular value will indicate a particular quality of

regardless

of

the

number

of

observations.

A familiar

measure of fit which is bounded is the R squared in

regression.

The

fit

linear

R squared uses the relative magnitude of

the residuals to formulate a measure which has a range from

24

page

one.

zero to

Unfortunately,

and

probabilities,

predicts

predict

makes the calculation of residuals

so

A

inappropriate.

squared

R

a

and hence

models

logit

which

model

requires a measure which indicates

probabilities

how reasonable those predictions are as

the

of

estimates

actual but unknown probabilities.

A measure

'batting

of

the

has

highest

been

suggested

useful

useful in

in

choice

probability

This index does provide an

judging

explaing

non-quantitative

a

a

was

the

quality

manager.

intuitive

model's performance and can be

of

model

a

to

a

Its structure, however, belies

the probabalistic nature of the MNL model and

not

is

measure is also known as the first

this

chosen,

preference recovery.

aid

which

average' where we find the proportion of time the

alternative with

actually

fit

thus

should

Indeed, one would wonder what to

be used exclusively.

think of a model which gave a maximum predicted probability

of .5 but yielded a perfect first preference recovery.

One way recognize

model

in

a

goodness

probabilities for

each

the

probabilistic

nature

of

the

of fit measure is to sum the choice

alternative

across

observations.

The result will be a prediction of the number of times each

alternative

will

be chosen, which can be converted into a

market share prediction by dividing each prediction by

the

page

By comparing the actual with the

observations.

of

number

25

measure

predicted market shares we should have a resonable

of

the

quality

of

model.

the

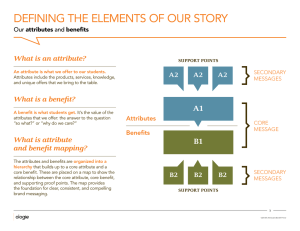

Unfortunately, if dummy

variables are used for all but on of the

is

model

Even if this were not the

perfectly accurately.

would

not

reasnonable fits.

4-1.

table

dummy

more

cases yield

cases

the

consider

in

variables

were

used

as

alternative

complete

perfect

Note that both

set of attributes.

predictions

of

the

actual

market

Case 2, however, gives us a much better indication

shares.

of

example

As an

between

distinguish

to

the

The second case might be the result of a model

attributes.

a

able

be

case

The first case would be the result of a model

where only

with

the

to predict the actual market shares

constrained

measure

alternatives

when each alternative will be chosen.

The second model

gives us more information.

In order

developed

to

capture

this

Hauser(1978)

difference

a set of statistics based on information theory.

These statistics use our prior knowledge and the

gained

from

knowledge

the tested model to give a bounded measure of

fit and an indication of the

significance

of

the

tested

model.

In order to use these goodness of fit measures we must

first define the following:

page 26

TABLE 4-1

POSSIBLE PROBABILITIES OF CHOICE

CASE 1:

PREDICTED PROBABLITIES OF CHOICE

ALTERNATIVE

OBSERVATION

1

2

3

4

5

6

7

8

9

10

A

0.20

0.20

0.20

0.20

0.20

0.20

0.20

0.20

0.20

0.20

B

0.80

0.80

0.80

0.80

0.80

0.80

0.80

0.80

0.80

0.80

TOTAL:

PREDICTED

MARKET SHARE:

2.00

8.00

80%

20%

CASE 2:

PREDICTED FROBABILITIES OF CHOICE

ALTERNATIVE

OBSERVATION

1

2

3

4

5

6

7

8

9

10

A

0.025

0.025

0.900

0.025

0.025

0.025

0.025

0.900

0.025

0.025

B

0.975

0.975

0.100

0.975

0.975

0.975

0.975

0.100

0.975

0.975

TOTAL:

2.00

8.00

20%

80%

PREDICTED

MARKET SHARE:

NOTE: ALTERNATIVE A WAS CHOSEN ON THE 3RD AN4D 9TH OBSERVATION,

B WAS CHOSEN ON ALL OTHER OCCASIONS.

SHARES IS 20% AND 80%

THE RESPECTIVE ACTUAL MARKET

page

27

PRIOR ENTROPY (H)

H = -1/N

N

I

i=1

M(i)

z

p(i,k)ln(p(ik))

k=1

(11)

EXPECTED INFORMATION (EI)

El = 1/N

N

Z

i=1

M(i)

z P(i,k)ln(P(i,k)/p(i,k))

OBSERVED INFORMATION

OI = 1/N

(12)

k=1

N

M(i)

i=1

k=1

z

(01)

d(i,k)n (P(i,k)/p (i,k))

(13)

where:

H = the uncertainty relative to the null model

El = expected information from the tested model relative

to the null model

N = number of observations

M(i) = Number of alternatives for the ith observation

p(i,k) = probability of choosing alternative k.

on observation i, under the null model

P(i,k) = probability of choosing thb alternative, k

on observation i, under the tested model

d(i,k) = 1 if alternative k,

0 otherwise

on observation i,

is chosen

Hauser uses these three statistics to develop measures

of usefulness, accuracy, and significance.

The

usefulness

D~aae

measures

are constructed by comparing the expected and. the

observed information with the prior entropy:

G = EI/H

(14)

USQRD = OI/H

(15)

G is said to be the expected proportion of uncertainty

explained by the tested model, while

squared)

is

the

observed

USQRD

proportion

explained by the tested model.

(pronounced

of

U

uncertainty

The statistics are measures

of usefulness in that they show how useful the tested model

is

in explaining

model.

Both

the

of

residual

these

uncertainty

of

the

null

statistics are analogous to the R

squared of regression in that they have a range of 0 to

They

will

take

on

a

value

of zero if

the tested model

yields predicted probabilities identical to

null

model.

If

1.

those

of

the

the tested model makes perfect predictions

(probability of 1

that

the

chosen

alternative

will

be

ratio

of

chosen) both measures will be 1.

The accuracy measure is defined to

be

the

observed information to expected information.

ACCURACY = OI/EI or USQRD/G

The

interpretation

probabilistic model

observations.

of

is

(16)

accuracy

able

to

is

how

well

the

explain

real

world

page

29

Finally, the significance measure uses the

OI

is

fact

that

the log likelihood ratio of the tested model to the

null model

divided

by

the

number

of

observations.

Therefore by defining, S, as follows:

S = 2*N*OI

we

have

(17)

a

statistic which Wilkes(22) has shown to have a

chi squared distribution if the null model is a restriction

of the tested model.

the tested

and

null

of

calibration

result in

the

predicted

Therefore,

shares.

models.

model

As

earlier

model.

Similarly,

the

with only dummy variables will

probabilities

the

stated

proposed

equal

to

since

the

market

model will always meet

Wilkes' requirement when the market shares are

null

statistic

to the difference in degrees of freedom between

equal

are

Degrees of freedom for the

used

as

a

a logit model run with no

attributes will result in predicted probabilities equal for

all alternatives, Wilkes' result will hold

model

for

any

when the equally likely null model is used.

chi squared statistic indicates that the

significantly better than the null model.

tested

logit

A large

model

is

Figure 4-2 shows

the value of each of these measures for the model in case 2

of

table

4-1.

The null models used are the market share

model (case 1) and the equally likely model.

Part of the appeal of these measures is the fact

any

null

model

may

be

used.

that

This makes it possible to

page

30

measure the impact of each added

model

attribute

by

using

without that attribute as the null model.

measures in this way will tell the

model

the

Using the

builder

whether

the addition of a variable significantly improves the model

as well as indicating how much of the remaining uncertainty

was

explained

by

the variable.

that the magnitude of

quality

of

the

It should be pointed out

measures

the null model.

will

depend

on

the

The more naive the null model

is, the larger the magnitude of prior entropy and thus

easier

it

is

uncertainty.

to

explain

a

substantial

An example of this is

seen

the

portion of the

in

4-2,

figure

where

the USQRD is larger when the equally likely model is

used.

A possible problem in using these

difficulty

is

the

in knowing the maximum value we can expect G or

USQRD to be.

highest

measures

A theoretical maximum of

achievable

value

is

1

exists

dependent

randomness in the behaviour we observe.

but

the

on the degree of

This

in

fact

is

also true of the R squared, but it is an attribute so often

forgotten

we

felt

it

warranted

mention

here.

It

is

difficult to know at this time how random consumer purchase

behaviour is.

in

the

However, repeated application of

future

should

help

establish

the

model

guidelines on the

magnitude of values which should be expected from

a

fully

specified model.

A problem with these measures for

our

uses

is

that

page 31

FIGURE 4-2

EXAtPLES OF HAFUSER'S GOODNESS OF FIT rESURES

CASE A: MARKET SHPRE USED AS NLLL MOCEL

i.e. p(i,k) = ms(k), where ms(k) is market

share of alternative_ k

01 = 0.12

EI = 0.12

USORD

2

0.87

G = 0.87

S = 2.46

H - 0.06

CASE B: EOUALLY LIKELY MODEL USED AS NULL MODEL

i.e. p(i,k) = 1/(number of alternatives)

01 = 0.65

El = 0.65

USQRD = .94

G = .94

S = 13.00

H = 0.69

page

they

32

require choice probabilities for each alternative and

observation.

Calculation of these probablities can be time

consuming on even a powerful computer and

thus

expensive.

Fortunately, Hauser(1978) shows that under conditions which

hold

on

our proposed model all of these statistics may be

calculated from the log likelihood values of the

tested

models.

part of

the

As

null

and

the log likelihood values are usually

standard

output

of

logit

programs

this

represents a great advantage.

Hauser has shown that:

USQRD = 1-

L(t)/L(n)

(18)

where:

L(t) = log likelihood of the tested model

L(n) = log likelihood of the null model

Which implies:

OI = H(1 - L(t)/L(n))

choice

(19)

probabilities

are

constant

across

observations for the market share and equally likely models

their

H and L(n) values may be calculated easily.

the OI,

one

of

USQRD, and S statistics is thus

fairly

easy

those two models is used as a null hypothesis.

should be noted that the formulation of USQRD

(17)

Finding

shows

that

it

is

equivalent

to

the

in

when

It

equation

rho squared

page

recommended for

McFadden().

use

To

as

further

a

33

fit

index

simplify

by

things

Domencich

and

we can use the

following results from Hauser(1978).

OI(t2:tl) = OI(t2:n) - OI(tl:n)

(20)

H(tl) = H(n) - OI(tl:n)

(21)

USQRD(t2:tl)

= OI(t2:tl)/H(ti)

(22)

where:

OI(a:b) = observed information of model a relative to model

b

H(a)

=

entropy under model a

USQRD(a:b) = observed propertion of uncertainty explained

by model a relative to model b

n --simple null model

tl,t2 = complex tested models

Therfore, we can find the OI,

for

any

USQRD, and S

statistics

complex model relative to any other complex model

if we first find those statistics for those models relative

to a simple model such as the market share model.

We now need a simple formula for the calculation of EI

and ACCURACY.

We do this by using Hauser's result that:

OI(t2:n) - OI(tl:n)

if the model is

= EI(t2:n) - EI(tl:n)

constrained

to

predict

(23)

accurate

market

shares.

Since this is the case under the proposed model EI

and

must always differ by an additive constant for any

OI

page

tested and null models.

for

34

Therefore, if we can show OI =

any tested and null models then OI = EI for all tested

and null models.

market

share

This is

model

as

guaranteed

perfect

done

the

likely model as the null.

in

appendix

b

using

Under the proposed model we

accuracy

in

the

have a method of calculating all of

statistics

without

the

tested model and the equally

sense

of

Hauser's

are

Hauser's

measure, making the EI and G statistics redundant.

rit

EI

We thus

goodness

of

having to calculate the predicted

probabilities of choice for the tested model.

Although, these measures give a good indication of how

well the

model

diagnosing

fits

problems.

the

data

they

be useful as a diagnostic tool.

based

not

help

in

The model builder may know he has a

bad fit but not why the fit is bad.

into segments,

may

on

Contingency tables may

By breaking the population

demographics

or

some

other

criteria,

we

can see how well the model is doing in these

segments.

If

the

predicts

in

some

variables which

segments.

model

groups

help

Another

systematically

the

analyst

explain

solution

the

to

the

over

may

or

under

want

to add

difference

between

problem would be to

break the population up into those segments

and

then

the model on each of these subpopulations separately.

run

page

35

CHAPTER 5

DATA DESCRIPTION

The data used

ground

coffee

in

sales

this

and

research

panel

consists

of

regular

data from four Kansas City

scanner equipped supermarkets.

It was collected

by

Areas-Marketing

(SAMI)

on-line

Incorporated

and

put

Selling

Management Decision Systems, Inc (MDS) using EXPRESS

level

information

analysis

a

language developed by MDS.

data collected covers the time period from June

6,

by

high

The

1978

to

March 12, 1980.

The sales data contains weekly

products

in

item

movement

for

all

the ground coffee category as well as the shelf

price for each item each week.

The panel

transactions

consists

were

of

colleted

2,000

and

members

whose

purchase

separated into categories.

Each member identifies himself/herself as a panelist

check

out

clerk

to

the

before his/her purchases are scanned.

The

clerk then keys in a code specific to that panelist

each

that

product he/she buys will be recorded with its price and

attributed to him/her.

made

so

by

There is a problem in that

purchases

the panelist outside the store in which he/she is

scanner panelist in will not be

recorded.

This

a

difficulty

page

has

been

minimized

by

shoppers as panelists.

forgetting

to

the recruitment of only loyal store

There is also a problem in

identify themselves.

the extent of this problem.

have

an

36

effect

It is difficult to know

Missed transactions should

members

a

total

Out of

1978

to

the

2,000

of 1,000 members were both category

users and actively participating in the panel

12,

only

on the analysis in so far as they may cause

our loyalty attribute to be misspecified.

panel

panelists

from

December

February 13, 1980, the researched time period.

Eighty-five panelists

were

randomly

selected

from

the

population of active panelists to serve as a test group.

The major

brand

regular

ground

caffinated

coffee

purchases of the test group were used to develop and test the

model.

This represented 1,470 purchase transactions.

In addition

newspaper

to

advertising

the

UPC

data,

information

on

local

by the four stores has been collected

and was used to identify individual store

feature

activity.

page

37

CHAPTER 6

MODEL SPECIFICATION AND ANALYSIS

The first

step

the

implementing

model

to

alternatives

the

This choice was based on research

structure

of

Brudnick(1979).

between

choose

caffeinated and

and

and

ground

decaffeinated

the

first

consumers

Their findings were that

instant

on

done

Urban, Johnson, and

by

market

coffee

by

caffeinated

ground

products.

the

the

began

We

this process is relatively straight forward.

restricting

is

In the coffee category

an alternative set.

of

definition

in

products.

between

then

Next

it

was

observed that switching between brands and between sizes in

this

data is frequent enough to indicate that consumers do

not make

consumers

their

first

in

choices

chose

a

a

hierarchical

and then a size or first

brand

choose a size and then a brand we would not expect to

the

find

the

Therefore,

behaviour.

switching

observed

If

manner.

alternative set was constructed so that the primary choices

The small size of

would be brand and size combinations.

a

brand

is considered a different alternative from the large

size.

Although some customers may display a strong loyalty

to a particular size

characteristics

procedure in

a

or

could

way

brand

be

which

it

modeled

would

was

felt

into

not

the

violate

that

these

estimation

the

IIA

page

38

property.

This selection of an

with

the

way

alternative

set

is

consistent

in which grocers treat the coffee category.

Sizes within a brand of coffee are rarely promoted together

and similarly price per ounce levels for the various

within brand are not necessarily at parity.

alternative

set

selection

avoids

specification of attribute values.

definition

results

in

a

consisting of ten products.

group

Therefore, our

ambiguities

This

of

number

possible

first

the

set

choices

As the data is proprietary the

disguised.

of times each alternative was purchased by the

test group and its disguised name is listed in

The

in

alternative

names of the specific brands involved have been

The

sizes

nine

alternatives

6-1.

table

in the list were assigned a

dummy variable attribute.

To make interpretation

possible

the

of

the

results

decision

easy

as

decision was made to do the estimations with

all of the purchases of all 85 members of the

This

as

was

supported

by

our

population is homogeneous with respect to

test

belief

their

group.

that

the

attribute

weightings in a fully specified model.

The most obvious product attribute which might

affect

page 39

TAfBLE 6-1

PLTERIATIYE FlSES

TOTAL:

BRRAD

BMID

BORPtiD

E241D

BPRID

BRPV'D

BRIP

BRAND

RKET

S*ikES

RUJ1ER OF PU; KHASES

ALTERTATIVE

Sr'IP-LL

LAPGE

9iM4LL

SMA~LL

LAPGE

St4PLL

LARGE

SMA1LL

LARGE

SMALL

D

PA

A,

BA

0C

0C

D:

D,

E

ERR4FD E:

BRAND F

MARnKET SHPRE

17.7%

260

105

23

516

149

52

5

255

97

8

1.6%

35.1%

10.1%

3.5%

0.3%

17.3%

6.6%

0.5%

1,470

100.0%

7.1%

* DENOTES BRAND IS REPRESENTED WITH A DUMMY VARIABLE ATTRIBUTE

NOTE: BRAND B PNtD F ARE OCLY CARRIED IN SMALL SIZES

page

the

purchase

40

decision is price.

Other things being equal

consumers are thought to prefer the item

price.

with

the

lowest

The price variable used is the product's depromoted

price

per

ounce

at the time of purchase.

necessary to avoid the

those

of

confusion

of

price

effects

with

display and advertising during a promotion.

depromoting is done by adding the depth of

d ring

Depromotion is

a

the

price

promotion to the observed shelf price.

The

cut

If there

was no promotion in effect at the time of purchase then the

observed shelf price

was

used.

See

appendix

C

for

a

listing and definition of this and all other variables used

in

the

analysis.

The results of the model with the price

variable are given in figure 6-1.

The negative

confirms

our

the

better

However,

is

than

model

the market share model the low

new

information.

occurring

parity

at

with

times

the

only

of promotion.

significant

This means

there will be little variation between alternatives in

depromoted

is

probably due to the fact that major coffee brands

are usually priced at

deviations

attribute

while the new

USQRD value indicates it gives us little

This

price

intuition that a reduced price increases the

probability of purchase.

significantly

of

coefficient

price

our

variable, making it difficult to explain

the observed choice behaviour.

page 41

FIG.RE 6-1

NUMER OCrATTEIEUTES: 10

ALTEF ATIYES: 10

tIUEER OF O•.~,TIATIOEiS: 1,470

I4U·iE,•R OF~

LOG LIKELIHOOD: -2,649.19

ATTRIBUTE

COEF EST

STD ERR

T STAT

NOF~RM

RArGE

PRICE

SMALL.A*R

LARGE. *

SM•LU. B*

SMALL.C*

LARGE.C*

SMALL. D*

LARGE.D*

SMILL. E*

LARGE.E*

-9.53

3.64

2.71

1.42

4.44

3.19

2.35

-0.03

3.70

2.67

2.16

0.36

0.37

0.42

0.36

0.37

0.40

0.59

0.36

-4.73

10.39

7.36

3.40

12.25

9.67

5.94

-0.0,5

10.17

7.20

03.19

0.37

MEASLUES OF FIT WITH MfRKET SHF;RES USED AS

UtLL MODEL:

OI = 0.01

USORD = 0.00

S = 18.97

* DENOTES DUMY VAPRIABLE ATTRIBUITES

NOTE: BY •CiM WE MEAN THE tM'DAL Vj- LE FOR THAT

ATTRIE1TE'S VYLLES ACFOSS AL.L osEEVfATICOiNS AND

PLTERýtTIVES. R~iGE IS T-E RA'NE OF VYLUES THE

THE ATTRIBUTE NMY TWKE ON.

.12-.22

-

page

42

stimulating

As deals are important in

the

dealt

brand,

addition

the

the data.

there

We do have

advertising,

though.

explain

by the

or

information

on

sales,

price,

and

Because it is reasonable to expect a

heavy

item

advertising we may infer a deal is in effect

presence

occurences

behaviour.

is no direct measure of promotion in

promotion to be accompanied by a price change,

movement,

for

of a promotion attribute

should increase the model's ability to

Unfortunately,

purchases

one

of

these.

Since

of

any

these

may not be a reliable indication alone, we will

identify a product as being on promotion

only

if

two

of

The promotion attribute is

these three things are present.

implemented as a dummy variable which indicates whether the

product

was

identified

the purchase.

to be on promotion at the time of

promotion

The results of the model with the

variable added are in figure 6-2.

The coefficient of the added attribute shows that

the

presence of promotions greatly increases the probability of

purchase.

Furthermore,

the

addition

of

the

variable yields a model which is significantly

one

promotion

better

and

which explains a substantial amount of the uncertainty

of the price only model.

Both of these facts indicate

importance of deals in consumer purchase choices.

the

page 43

FIGURE 6-2

NJMBER OF ATTPP•IUTES: 11

NJIBER OF PLTER APTIVES: 10

NUMBER OF OBSERVATIONS: 1,470

LOG LIKELIHOOD: -2,216.03

ATTRIBUTE

COEF EST

STD ERR

T STAT

PRICE

PROMOTION

SMALL.A*F

LARGE.A*

SMALL. B

SMALL.C*

LAPGE.C*,

SMtLL. D*

LARGE. D*

-6.27

2.23

-2.81

1.92

28.43

1.96

1.30

3.86

2.62

0.07

0.36

0.37

0.42

0.36

0.37

1.98

0.40

-0.27

2.94

1.97

0.58

0.37

0.37

4.93

-0.460

8.02

SM~LL.E*

LARGE.E*

2.81

NORM

0.18

7.73

5.28

3.10

10.62

7.09

5.28

RANGE

.12-.22

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

MEASURES OF FIT WITH MARKET S-HFES USED AS [tLL MODEL:

01 = 0.30

USORD = 0.17

S = 885.30

MEASURSLES OF FIT WITH PREVICLUS

SPECIFICATION USED AS [ULL MODEL:

01 = 0.29

USQRD = 0.11

S = 866.33

* DEN)OTES DULMMY VARIABLE ATTRIBUTES

page

44

By using a dummy variable to indicate promotion we are

implicitly assuming that promotion has only one effect, say

due to special display

or

advertising.

research (see Little et al.

promotion

with

no

There

that

the

price

change

associated with it will

Quite likely

promotion has two components.

does

not

the

response

to

a

A fixed component due to the

of special display and advertising, and a variable

component dependent on the depth of

dummy

This

effect of promotion is independent of the

depth of the price cut.

effects

been

(1977)) which indicates that a

never the less result in increased sales.

imply

has

variable

should

component, but we need

capture

between

the

and during it.

promotion

in

price

cut.

The

have captured much of the constant

to

add

the variable effect.

price cut variable

the

which

an

attribute

which

will

For this purpose we define a

represents

the

the

difference

observed price per ounce before the promotion

It takes on a value of zero if there is

effect.

The

no

results of the model with the

price cut variable added are given in figure 6-3.

Again, the result of a positive

new

coefficient

the

attribute agrees with our expectations that the larger

the price cut the greater the probablity of

far

for

purchase.

As

as the magnitude of the effect is concerned we can see

page 45

FIGURE 6-3

NUIPER COF

ATTRIBUTES: 12

?JYBER OFT

ALTEPRi'ATIVES: 10

NUMBER OF OBSERVATIOfNS: 1,470

LOG LIKELIHOOD: -2,194.44

ATTRIBUTE

COEF EST

PRICE

PROMOTION

PRICE CUT

SMALL.A,

LARGE.A *

SrALL.B*

SMALL. C*

LARGE. C*

SMALL. D*

LAR~GE. D*

SMALL.E*

LARGE.E*

-14.77

1.39

18.72

3.01

2.13

1.62

4.07

2.87

2.41

0.14

3.05

2.15

STD ERR

2.60

0.10

2.90

0.37

0.37

0.42

0.37

0.37

0.40

0.58

0.37

0.37

T STAiT NORiMRR GE

-5.68

13.27

6.46

8.25

5.71

3.83

11.13

7.70

5.98

0.24

8.23

5.76

0.18

.12-.22

0.03

.00-.06

-

-

MEASURES OF FIT WITH MARKET SHARES USED AS NULL MODEL:

01 = 0.32

USORD = 0.17

S = 928.48

MEASURES OF FIT WITH PREVICOUS

SPECIFICATION USED AS NULL MODEL:

01 = 0.01

USORD = 0.00

S = 43.17

* DENOTES DUMiMY VARIABLE ATTRIBUTES

46

page

that it is relatively minor as a price

cut

equal

to

the

total price will not even match the contribution to utility

of a promotion with no price cut.

the

What is especially interesting about

is

results

the difference in the magnitudes of the price and price cut

While

weightings.

attribute

difference may not be

this

statistically significant, it does appear that reducing the

price while the product is on promotion will

greater

response

accompanied by

than

a

an

promotion.

equal

price

An

result

in

reduction

explanation

a

not

this

for

difference in elasticities is that consumers are more aware

thus

and

to

sensitive

receiving some

special

prices

of

treatment

which

are

advertising

or

products

like

display.

Thus far we

though

each

the various

assumption.

have

been

products.

Each

Certainly

consumer

this

will

is

not

as

We

a

valid

differing

display

capture

this

with the use of a loyalty variable which is assumed

to be a reasonable surrogate for preference.

this

population

member had the same underlying preference for

preferences for the different products.

effect

the

treating

To

construct

variable we first calculate each alternative's market

share for each customer in the 20 week period prior to

the

page

These market shares are used as each

period.

calibration

47

customer's loyalty value for each alternative at

of

first

his/her

purchase

of

the

This loyalty measure is then

smoothed

each

subsequent

time

period the model was

calibrated on.

with

the

exponentially

purchase in the following

manner:

L(i,j,k)

=

.75*L(i,j-l,k) + .25*d(i,j-l,k)

L(i,l,k) = customer i's market share of product k during the

20 weeks prior to the model calibration period

L(i,j,k) = customer i's loyalty value for product k

on observation j

d(i,j,k) = 1, if customer i chose product k on observation j

0, otherwise

Loyalty is thus an attribute

which

is

dependent

on

of

an

alternative

but

one

the particular decision maker and

his/her past behaviour.

Exponential smoothing with a constant of .25

to

used

loyalty measure because it is felt that

the

construct

is

loyalties can change faster than a market share might imply

but not as fast as a larger

results

of

are given in

the

would

imply.

The

model with the loyalty attribute included

figure 6-4.

As might be

variable

smoothing

gives

expected

a

the

addition

much better fit.

of

the

loyalty

Not only is the model

significantly better with the loyalty measure than

without

page 48

FIGURE 6-4

tU0BER OF ATT-IFUTES: 13

rUM:ER OF SLTERATIES1:

471

NUBSER OF

LOG LIKELIHOOD: -1,441.28

ATTRIBUTE

COEF EST

FPRICE

PROYCOT IC9

PRICE CUT

LOYALTY

SMFLL. Af

LARGE. A*

SMALL.B

-16.26

1.84

24.17

4.37

1.71

1.42

1.47

2.27

1.61

1.38

0.23

1.66

1.29

LAPIGE. C,

SMALL. D*

LARGE. D*

SARLL.E*

LARGE.E*

STD ERP

3.20

0.12

3.43

0.14

0.37

0.33

0.43

0.38

0.393

0.44

0.593

0.330.33

PORýM

R4iCTE-

T STAT

-5.09

14.76

7.05

32.01

4.55

3.75

3.39

5.988

4.15

3.16

0.18

.12-.22

0.03

.00-1.00

0.39

4.37

3.63

MEASURES OF FIT WITH MPXKET SHARES USED AS ULL MODEL:

01 = 0.83

USORD = 0. 46

S = 2,434.79

MEASURES OF FIT WITH PRVIOUS

SPECIFICATIOG

01 = 0.51

USLPD = 0.25

S = 1,506.32

* DENOTES DDUflY VARIABLE ATTRIBUTES

USED •S ~JLL MODEI:

49

page

it,

the

current

specification

explains

nearly half the

uncertainty of the market share model.

A similar concept to loyalty is

sat.

the consumer confines his/her purchasing

activity

to.

A

must therefore contain the products

set

evoked

consumers

evoked

set is composed of those products which

evoked

The

the

of

that

he/she is most familiar with.

A less familiar product, one

outside the evoked set,

likely

we

To investigate this possibility

for

variables

attribute

be

as

perceived

a

and accordingly have different elasticities.

risk

greater

will

products

in

the evoked set and

Evoked set promotion will

products not in it.

different

define

may

be

defined

to be the same as the current promotion variable for evoked

products

but

will

always

be zero for unevoked products.

Similarly, promotion for unevoked products will be the same

as the current promotion variable if the product is not

The price and

the customers evoked set and zero otherwise.

attributes are similarly defined for evoked and

cut

price

unevoked products.

evoked

set

if

in

A product

is

defined

it

has

to

be

not

been

purchased

in

within

the

not

been

the

purchased

in

evoked

the past 13

purchase occasions and probabably will not be in it

has

in

this study if its loyalty value is greater

This means a product can not be

than .02.

set