STRATEGIES FOR TECHNOLOGY-BASED ECONOMIC DEVELOPMENT by B.E.E. Kuwait University (1985)

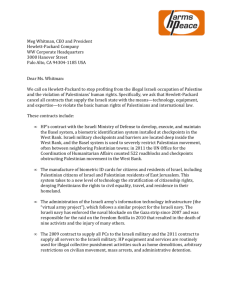

advertisement