COMPARING CAPACITY UTILISATION, ALLOCATIVE EFFICIENCY AND FINANCIAL

advertisement

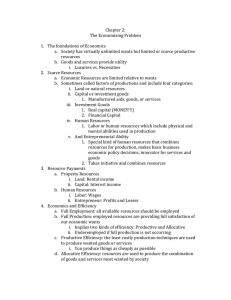

IIFET 2006 Portsmouth Proceedings COMPARING CAPACITY UTILISATION, ALLOCATIVE EFFICIENCY AND FINANCIAL PERFORMANCE IN THE TRAWL FISHERIES OF BRITTANY (1994-2003) Pascal LE FLOC'H, CEDEM, plefloch@univ-brest.fr Simon MARDLE, CEMARE, simon.mardle@port.ac.uk ABSTRACT Overcapacity situations appear regularly in the activity of marine natural resource exploitation. The measure of capacity utilisation and allocative efficiency for fishing vessels is an approach that can determine the details of that overcapacity. On the one hand, DEA (Data Envelopment Analysis) methodology can be used in the case of multi-production to produce individual measures of economic performances, defined through the concept of efficiency. On the other hand, the assessment of financial performance requires the availability of individual data on cost and earnings for the same set of fishing firms. The former method is based on outputs (landings by species) and inputs (fixed and variable) and provides a relative measure for firms (or Decision-making units) being compared, hence at least one firm will lie on the frontier in a DEA analysis. In this context, capacity utilisation, technical efficiency and economic (or revenue) efficiency are main results derived from a linear programming model. Allocative efficiency can be derived from economic and technical efficiency as a final score. The latter approach gives a measure of financial performance from individual bookkeeping data. Gross revenue and gross surplus can then be used to compare financial performance of trawlers with their economic performance computed from DEA model. Both methods are used and compared for the same set of vessels, namely the commercial trawl fisheries of the French region of Brittany. Keywords: Trawl fisheries, Capacity utilization, allocation efficiency, Data envelopment analysis INTRODUCTION Over-capacity is a phenomena that exists in many fisheries around the world. A great deal has been written about how this occurs in open-access and more recently in ‘regulated’ open-access fisheries [1]. In order to address this issue, capacity and capacity utilization must be measured. The preferred approach, as suggested by the Food and Agriculture Organisation of the United Nations [2], is data envelopment analysis (DEA). DEA has been used considerably in recent years in fisheries economics for the measurement of vessel technical efficiency and capacity utilisation [3] and [4]. For the most part, in applications to fisheries, this has been implemented from a physical capacity point of view. That is, capacity utilization is determined by the relationship between physical inputs (such as engine power, vessel length and days at sea) and the production of a set of outputs (i.e. species caught). However, in reality, even amongst vessels with similar physical attributes, the economic performance of those vessels can differ dramatically. In the fisheries literature, there are recent studies that have used DEA models for the measurement of capacity utilization with an added economic dimension. For example, according to the revenue-based approach defined by [5], [6] measure the capacity utilization of Danish North Sea trawlers. In another example, [7] implement a ray economic capacity model [8] using profit as the key measure in order to consider the capacity utilization of a Scottish trawl fleet. In the measurement of capacity utilization and technical and economic efficiency of vessels, it follows [5] that a measure of allocative efficiency can be derived from the measures of technical efficiency and economic efficiency. Other than [6] there are few examples of such an application in marine fisheries. However, [9] also consider technical, economic and allocative efficiencies for Chinese fish farms. 1 IIFET 2006 Portsmouth Proceedings The approach used in this paper to measure capacity incorporates an economic measure of inputs (i.e. fuel costs) and a revenue based measure to compare performance of vessels. Here, in addition to capacity utilization, we also consider technical, allocative and economic efficiency, and we use individual vessel accounts in order to compare economic performance obtained from DEA model to actual financial performance of the vessels. It is rarely possible in fisheries to have access to such data, and as such provides for an innovative analysis. In this study, data for French trawlers operating in Southern Brittany is used. METHODS Capacity utilisation The origins for the current measurement of efficiency of production is typically regarded to be the work of Farrell [10]. Since, several techniques for measurement have been developed. One such technique is that of data envelopment analysis (DEA) which can be used to estimate technical, allocative and economic efficiencies [11] and [12]. DEA is deterministic and as a result does not require prespecification of the frontier technology. It provides a relative measure for those firms i being compared, hence at least one firm will lie on the frontier in a DEA analysis. The technical efficiency (TE) measure can by obtained by solving the following DEA modelii: Max i subject to i y im j y jm m j j x jn xin n (Eq. 1) j j 0 where i is a scalar outcome denoting how much the production or outputs, ym, of each firm, i, can increase by using inputs, xn, (both fixed and variable) in a technically efficient configuration. In this case, both variable and fixed inputs are constrained to their current level. In this case, i represents the extent to which output can increase through using all inputs efficiently, and is therefore output-based. The * technically efficient level of output ( yTE ) is defined as i multiplied by observed output (y). As defined, this model represents a constant returns to scale (CRS) assumption. In order to model variable returns to 1 or scale (VRS) or non-increasing returns to scale (NIRS), the constraints 1 j j j j respectively are required. The level of technical efficiency is estimated as: TEi 1 i . (Eq. 2) Following [13], a measure of capacity output can be found using: Max i' subject to 2 IIFET 2006 Portsmouth Proceedings i' y im j y jm m j j x jn xin n (Eq. 3) j j 0 where i' is a scalar denoting the multiplier that describes by how much the output of firm i can be expanded. In the estimation of capacity, only fixed factors are considered where inputs are separated into fixed factors (i.e. set ) and variable factors (i.e. set ̂ ). Capacity utilisation (CU) for firm i is defined as: CU i 1 i' . (Eq. 4) An unbiased estimate of capacity utilisation (CU*) for firm i is estimated by removing the effects of technical efficiency from the capacity utilisation measure (i.e. equation 7 divided by equation 2), and is achieved by the following equation: 1 CU i i CU i* 1 TEi i' i' i (Eq. 5) Allocative efficiency An economic efficiency (EE) measure can be obtained by solving the following revenue-maximising DEA model [5]: m Max Pik yik* k 1 subject to * y im j y jm 0 m j xin j x jn 0 n (Eq. 6) j j 0 where y ik* is the revenue maximising or economically efficient production of the kth output of the ith firm and Pik is the observed price of that output. The economic efficiency index is then calculated as the ratio between actual revenue and potential revenue using: 3 IIFET 2006 Portsmouth Proceedings m EE i P y ki P * ki k 1 m k 1 ki ki (Eq. 7) y The output-based measure of allocative efficiency for the ith firm can be obtained using [10] and [13]: AE i EE i (Eq. 8) TEi Main efficiencies measures are represented in figure 1. Technical efficiency (TE) is given by the distance 0A/0B. Only pure technical efficiency is calculated as the restriction, 1 , is included in the j j analysis. Economic efficiency (EE) is depicted by 0A/0D and refers to a revenue maximisation principle. Finally, allocative efficiency (AE) is illustrated through 0B/0D, which is an optimal combination of fish landings taking into account theirs ex-vessel prices. This description corresponds to an output orientation model (a given level of inputs). Y2 B Y*2 0 D A C Y*1 Y1 Figure 1. Output orientation Financial performance In this paper, we retain the distinction between economic performance and financial performance [14]. Here, economic performance is related to the concept of efficiency, which can be measured in term of technical efficiency and economic efficiency, as defined above to measure allocative efficiency either in the input direction (cost minimisation) or in the output direction (profit maximisation). Financial performance is based on the concept of revenue or income and is described through indicators as gross revenue and gross surplus. The analysis of financial performance can be undertaken from economic information of fishing boats, defined as individual firms, collected either through skipper-owner’s surveys or from bookkeeping. The commercial fishing fleet of the French region of Brittany is well informed by the Regional Economic Observatory of Fisheries which is a NGO created by a professional fishermen organisation. This Observatory collects bookkeeping and landings data by individual units. Accounting database gives information on costs and earnings. Variable costs are collected for fuel, crew share and gears. Fixed costs 4 IIFET 2006 Portsmouth Proceedings are represented through maintenance and repairs. The item “other costs” associates other variables and fixed expenses, that are usually less sensitive with respect to variations in landings (ex-vessel prices, volume, abundance) and costs. Table I: Costs and Earnings taken into account in the different parameters Parameter Costs/Income included Income Value of landings = fish Other = subsidies, compensations, hire of vessel, rescue, etc. Fuel cost Fuel Lubricant Crew share Crew share Crew premium, owner premium Social insurance Gears Fishing gear expenses Maintenance Maintenance and repair for the vessel Others costs Landings costs, Port taxes, Ice, food, Leasing, Insurance, Miscelleaneous costs Source: Thébaud et al., (2005) [15] The collection of data to measure economic and financial performance of fishing fleets in the European Union is now ruled by the Council Regulation No 1543/2000 and the Commission Regulation No 1639/2001. According to Member States, economic information is provided by bookkeeping or field survey methods. A comparison of economic and financial indicators estimated from these two collection methods was made in the French case [16] and [17]. DATA A comparative approach between financial and economic performances makes sense if individual information is delivered for a constant sample of units. Through the Regional Economic Observatory, landings and bookkeeping data are available from 1994 to 2003 by individual units. Hence, a constant sample of fishing vessels was constituted. These fishing boats belong to three segments of trawlers located in South Brittany. As constant samples are required to study economic and financial performance on several years, size of samples is consequently low for each segment (13 units for 12-16 meters, 5 units for 16-20 meters, 11 units for 20-25 meters). Table II: Technical parameters (mean value) for constant samples Age Length Tonnage Engine power in 2003 (meter) (GRT) (kw) 12-16 m 23.3 14.8 31.2 214.8 16-20 m 23.4 18.0 38.6 305.4 20-25 m 16.7 21.4 78.8 410.9 From Observatoire Economique Régional des Pêches de Bretagne In a short-term analysis between 1999-2003, [18] considered the definition of fleets and fisheries for South Brittany trawlers. The above fleet categories were accepted. As a further part of the analysis, it was shown that different vessel strategies are used by different classes of vesslels. For example, large South Brittany otter trawlers were indicated to have six different strategies based on landing profiles. The smallest group is composed of vessels of 12-16 meters exploiting resources mainly in inshore fisheries (VIIIa area). The second segment characterises trawlers of 16 to 20 meters. Most of the time, vessels belonging to this segment produce fish in offshore fisheries (WIIIa, VIIh areas), but a few of them 5 IIFET 2006 Portsmouth Proceedings spend fishing time in the same grounds as the first segment units. The biggest trawlers compose the third segment, with a length of 20-25 meters. These largest fishing units produce fish essentially in offshore fisheries (VIIh-g areas). Figure 2. Fisheries In terms of average landings, different trends can be observed for the three fleets. Average annual landings per vessel vary in quantities between 46 tons and 65 tons for the [12-16m[ sample, between 101 and 139 tons for the [16-20m[ sample, and between 192 and 250 tons for the largest trawlers. Annual gross revenues are comprised between 242 and 279 k€ (in constant euro 2003) for the smallest units, between 389 and 436 k€ for the intermediate segment, and between 627 and 725 k€ for the [20-25m[ sample. Average landings in value have known strong overall increases from 1994 to 2003 for the [2025m[, excepted in 2000. Conversely, trend was declining from 1997 to 2002 for the [12-16m[ and [1620m[ segments, in value and volume for the former and mainly in volume for the latter. The set of target species varies considerably according to the segment fleet observed. The smallest units, so called 12-16 meters, exploit simultaneously and mainly five stocks (nephrops, anglerfish, megrim, hake and sole). Cod and whiting stocks have to be added to the above list in the case of the intermediate segment, 16-20 meters. The biggest trawlers produce a larger panel of fish in offshore fisheries, including those cited previously. Eventually, three species have been selected as outputs in DEA analysis (nephrops, anglerfish, megrim) because they are considered as the main valuable products for all three segments. Others species, targeted fishes and by-products, are gathered in a fourth category. Landing values have been inflated to 2003 values using a Fisher price index. 6 Quantity (tons) Value (k€2003) Quantity (tons) 12-16 m Average landings per vessel (kE2003) 360 2003 370 0 2002 380 20 1994 390 40 2003 2002 2001 2000 220 1999 0 1998 230 1997 10 1996 240 1995 20 400 60 2001 250 2000 30 410 80 1999 260 420 100 1998 40 430 120 1997 270 440 140 1996 50 160 1995 280 Average landings per vessel (tons) 290 60 Average landings per vessel (kE2003) 70 1994 Average landings per vessel (tons) IIFET 2006 Portsmouth Proceedings Value (k€2003) 16-20 m 720 250 700 200 680 660 150 640 100 620 600 50 580 2003 2002 2001 2000 1999 1998 1997 1996 560 1995 0 Average landings per vessel (kE2003) 740 1994 Average landings per vessel (tons) 300 Value (k€2003) Quantity (tons) 20-25 m Figure 3. Average annual landings per vessel From Observatoire Economique Régional des Pêches de Bretagne Fixed inputs are represented by length, engine power and catch per unit of fuel consumption. As abundance index is not available on a monthly basis, a proxy has been built as a catch per unit of fuel consumption from landings by selected species (kg) divided by fuel consumption (litres). In empirical applications of DEA, abundance index is considered as fixed inputiii or more precisely “…DEA model also included biomass levels…as additional fixed environmental parameters…”[19]. Variable input is included through fuel consumption (litres). In this paper, all units were considered in the same linear programming analysis. Consequently, the constant sample include all 29 fishing boats for which information on inputs and outputs is available on a monthly basis during ten years (from 1994 to 2003). Fifty-one months during which boats had no fishing activity have been removed from the analysis to avoid a bias in capacity utilisation and efficiency scores. 13 observations were moved for 12-16 meters boats, 12 observations for 16-20 meters boats, and 26 observations for 20-25 meters boats. If the model is specified on a monthly basis, scores are averaged from individual data based on monthly production by boat and by year. Hence, number of data is 3429 (1547 for the 12-16 meters, 588 for the 16-20 meters sample, and 1294 for the 20-25 meters). Boats 1 to 13 belong to the smallest group (12-16 meters class), boats 14 to 18 are the 16-20 meters units, and boats 19 to 29 are the 20-25 meters vesselsiv. Table III: Description of number of observations used in the DEA analysis 12-25 meters Boats (constant sample) 29 Available observations 3429 (boat x month x year) Moved observations from the analysis 51 7 IIFET 2006 Portsmouth Proceedings RESULTS In the literature on DEA models, allocative efficiency can be often presented as a final score to identify the best practise in term of economic performance of the individual fishing companies [9] and [20]. The availability of individual bookkeeping data for the constant sample gives the opportunity to check financial performance, computed through gross revenue per meter and gross surplus per meterv, against allocative efficiency. Moreover, it appears interesting to rely allocative efficiency scores to unbiased capacity utilisation (CU*). This comparative approach is an innovative analysis, providing several indicators on individual fishing firm’s performance during the decade 1994-2003. Big trawlers used in average 76% of their capacity utilisation under a CRS assumption and 79% under a VRS assumption. Mixed trawlers (16-20 meters) used respectively 63% (CRS) and 82% (VRS) of their CU. The inshore fleet reached a mean value by 53% with CRS and 87% with VRS. Allocative efficiency reaches respectively under CRS (constant return to scale) and VRS (variable return to scale) a mean value by 0.89 and 0.9 for the 20-25 meters class (table IV). The intermediate segment, 16-20 meters, obtain a mean value by 0.88 under CRS and by 0.93 under VRS. The smallest segment produces a lower optimal allocation of fish products compared to others classes under CRS, with a mean value by 0.82. On the other hand, small trawlers record a better result than big trawlers under VRS, with a mean score by 0.92. Table IV: Mean comparison of CU (unbiased capacity utilisation) and AE (allocative efficiency) scores 12-16 meters 16-20 meters 20-25 meters All units CUCRS 0.53 0.63 0.76 0.63 CUVRS 0.87 0.82 0.79 0.83 AECRS 0.82 0.88 0.89 0.86 AEVRS 0.92 0.93 0.90 0.91 Subscripts CRS and VRS for constant return to scale and variable return to scale, respectively. The best allocation of outputs (nephrops, anglerfish, megrim and others species), given their landings prices, is obtained by the biggest units if the CRS assumption is retained (figure 4). Boat 8 is the only one, belonging to the smallest segment, amongst the best units with a score by 0.93 in term of allocative efficiency. If the VRS assumption is used, 9 boats out of the first ten are small trawlers. As a result of the adoption of VRS, fishing vessel size cannot be considered as an argument to explain allocative (in)efficiency. Best combinations of prices and quantities to maximise gross revenue have been attributed to smallest trawlers (specifically boats 2, 3 and 11). These three vessels perform both in term of CU (with no excess capacity situation) and AE. The coefficient of correlation is higher with VRS (R²=49%) than with CRS (R²=34%). 1,00 1,00 0,98 B27 y = 0,1927x + 0,7351 R2 = 0,3363 B8 B16 B14 0,90 B22 B20 B18 B1 B15 0,85 B2 0,80 B25 B24 B3 0,96 B29 B19 B23 B26 Allocative efficiency Allocative efficiency 0,95 B21 B17 B28 B11 B4 B6 B12 B10 B5 B9 B3 y = 0,287x + 0,6759 R2 = 0,4944 B2 B27 B11 B14 B16 B8 B18 0,94 0,88 B26 B4 B25 B5 B23 B17 B19 B10 B12 B6 B28 B22 B13 B20 0,86 B9 B21 B15 0,90 B1 B29 B24 0,92 0,84 0,75 B13 0,82 B7 B7 0,70 0,30 0,40 0,50 0,60 0,70 0,80 Unbiased capacity utilisation 0,90 0,80 0,60 1,00 0,65 0,70 0,75 0,80 0,85 Unbiased capacity utilisation CRS VRS Figure 4. Allocative efficiency and Unbiased Capacity Utilisation 8 0,90 0,95 1,00 IIFET 2006 Portsmouth Proceedings Comparing economic performance (scores providing by DEA model) with financial results proves to be an innovative analysis. Figures 5 and 6 depict individual location of trawlers both through allocative efficiency, gross revenue per meter of length and gross surplus per meter of length. It can be noted a relationship between allocative efficiency and gross revenue per meter (R² is equal to 25% under CRS and 20% under VRS). 40000 40000 B29 B25 B10 B9 B21 B22 30000 25000 B23 B19 B14 B24 B17 B18 B13 20000 B16 B15 B8 B4 B7 15000 B1 B5 B6 B2 10000 B27 B26 B02 B28 B11 B12 Gross Revenue per meter (€2003) Gross Revenue per meter (€2003) B29 y = 73627x - 38804 R2 = 0,2463 35000 B3 5000 0 0,70 0,75 0,80 0,85 0,90 0,95 B22 30000 B26 B24 B12 B11 B9 B18 B17 B13 20000 B14 B10 B28 25000 B27 B21 B19 B20 B16 B15 B8 B7 15000 B4 B6 B5 B2 B1 10000 B3 y = -1E+06x 2 + 3E+06x - 1E+06 R2 = 0,1971 5000 0 0,80 1,00 B23 B25 35000 0,85 0,90 Allocative Efficiency Allocative Efficiency 0,95 1,00 VRS CRS Figure 5. Allocative efficiency and average Gross Revenue per meter (€2003) As allocative efficiency is based on economic efficiency weighted by technical efficiency, figure 5 shows for each vessel its maximised revenue in relation to average gross revenue. Gross revenue is very close for biggest trawlers, average landings value by boat and per meter for the 20-25 meters class during the period 1994-2003 was 32063 €, with a t-value by 10.7. Situation is more contrasted for the 12-16 meters class. Average gross revenue is estimated to 18118 € with a t-value by 2.8. In the case of VRS model, a polynomial curve is needed to generate a trend between AE and gross revenue per meter. Most of small units are located below or near the curve, excepted boat 11. In figure 6, allocative efficiency is relied on short term profit, gross surplus per meter (figure 6). Gross surplus is computed as the difference between total revenue (gross revenue and compensation, see table I) and operational total costs (wages, fuel, gear, maintenance, others operational costs). Allocative efficiency indice explain only 7% of gross surplus with VRS model (5% with CRS model). 10000 10000 y = -179169x 2 + 323411x - 141789 R2 = 0,0719 9000 y = 7398x - 2501,5 R2 = 0,0528 8000 Gross Surplus per meter (€2003) Gross Surplus per meter (€2003) 9000 B29 7000 B25 B27 B23 6000 B12 5000 B22 B9 B10 B13 4000 B11 B28 B24 B21 B20 3000 B7 B4 B5 2000 1000 0 0,70 B19 B14 B18 B15 B3 B2 B26 B16 B1 B17 B8 B6 0,75 0,80 0,85 0,90 0,95 8000 1,00 B25 6000 B23 B27 B28 B12 B22 5000 B26 B19 B20 3000 B5 B7 B4 B9 B24 B11 B10 B13 4000 B21 B15 B14 B18 B16 B3 2000 B1 B6 1000 0 0,80 Allocative Efficiency B29 7000 0,85 B17 0,90 B2 B8 0,95 1,00 Allocative Efficiency CRS VRS Figure 6. Allocative efficiency and Gross Surplus per meter (€2003) Optimal allocation of fish outputs, given ex-vessel prices, is poorly correlated with short term profit. In the case of trawlers under 16 meters, linear regression is characterised by a decreasing slope (with both 9 IIFET 2006 Portsmouth Proceedings models CRS and VRS) whereas boats above 16 meters display increasing gross surplus per meter with a better allocative efficiency score. DISCUSSION In our study, only the biggest trawlers, with an overall length up to 16 meters, can be defined as units in large scale fisheries. The smallest units, less of 16 meters, spend their fishing time exclusively in coastal areas. Consequently, their labour input is more significant than capital input compared to the over 16 meters trawlers. In certain circumstances, financial results can be considered as irrelevant to measure performance of fishing boats. This is particularly the case for small scale fisheries, where “non-wage labour is a major input” [21]. Conversely, financial performance, based on bookkeeping data, becomes a more significant indicator for large scale fisheries, where capital component is high compared to labour input. In the case of trawl fisheries of Brittany, the smallest units display heterogeneous economic and financial performance compared to 16-20 and 20-25 meters segments. Non-wage labour is potentially an explanation to this difference. Boats 9, 10, 11, 12 and 13, belonging to the 12-16 meters class, display gross surplus per meter as high as than big vessels (between 4000 and 5000 € per meter) but with a greater scale of allocative efficiency. Potentially, skipper-owners can be rewarded exclusively from his entrepreneur profit, explaining a decreasing relationships between economic and financial performance on small boats. In this paper, we have shown that there is some correlation between economic performance measured by DEA and via accounting (gross revenue and gross surplus per meter). However, there are significant differences that could impede the successful implementation of a policy designed to deal with the issue of over-capacity. Particularly, capital value should be assessed for fishing boats to be included in this type of analysis. Here, financial performance was estimated only from gross revenue and gross surplus. Consequently, these results were affected exclusively by the cost of capital in the short run (gears, repairs and maintenance). A comparison between economic performance, from DEA model, and net profit (taking into account the full component of capital, depreciation and opportunity cost) could be a next outcome of this analysis. REFERENCES 1. Homans, F.R., Wilen J. 1997. A model of regulated open access resource use. Journal of Environmental Economics and Management 32(1): 1-21. 2. FAO, 2000. Report of the Technical Consultation on the Measurement of Fishing Capacity. FAO Fisheries Report No.615. FAO, Rome. 3. Tingley D., Pascoe S., Mardle S., 2003. Estimating capacity utilisation in multi-purpose, multi-metiers fisheries, Fisheries Research, 63, pp121-134. 4. Kirkley J.E., Squires D.E., 1999. Measuring capacity and capacity utilization in fisheries. In Greboval D. (ed.), Managing fishing capacity: Selected papers on underlying concepts and issues. FAO Fisheries Technical Paper 386, FAO, Rome 5. Färe R., Grosskopf S., Kirkley J., 2000. Multi-output capacity measures and their relevance for productivity. Bulletin of Economic Research, 52 (2), pp.101-112. 6. Lindebo E., Hoff A., Vestergaard N. 2006. Revenue-based capacity utilisation measures and decomposition: The case of Danish North Sea trawlers. European Journal of Operational Research In press. 7. Pascoe S., Tingley D. 2006. Economic capacity estimation in fisheries: A non-parametric ray approach. Resource and Energy Economics 28: 124-138. 10 IIFET 2006 Portsmouth Proceedings 8. Coelli T., Grifell-Tatje, E., Perelman, S. 2002. Capacity utilisation and profitability: A decomposition of short run profit efficiency. Internation Journal of Production Economics 79(3): 261-278. 9. Sharma K., Leung P., Chen H., Peterson A., 1999. Economic efficiency and optimum stocking densities in fish polyculture: an application of data envelopment analysis (DEA) to Chinese fish farms. Aquaculture, 180, pp207-221 10. Farrell M.J., 1957. The measurement of productive efficiency. Journal of the Royal Statistical Society Series A 120 (3), pp253-281 11. Charnes A., Cooper W.W., Rhodes E., 1978. Measuring the efficiency of decision making units. European Journal of Operational Research, 2, pp429-444 12. Banker R.D., Charnes A. and Cooper W.W., 1984, Some models for estimating technical and scale efficiencies in data envelopment analysis, Management Science, 30, pp1078-1092. 13. Färe R., Grosskopf S., Lovell C.A.K., 1994. Production frontiers. Cambridge University Press, UK 14. Whitmarsh D., James C., Pickering H., Neiland A., 2000, The profitability of marine commercial fisheries: a review of economic information needs with particular reference to the UK, Marine Policy, 24, pp257-263 15. Thébaud O., Guyader O., Le Floc’h P., Steinmetz F., 2006. Analysis of contributions to changes in the revenue of selected European fleets. South-Brittany trawler fleets (France) 1990-2003, European Union Project, Q5RS-2002-01291. 16. Boncoeur J., Daurès F., Guyader O., Martin A., Le Floc’h P., Thébaud O., 2004. Comparing bookkeeping and field survey methods for assessing fishing fleets economic performance. A case study of Brittany fishing fleet (France), IIFET 2004 Japan Proceedings 17. Le Floc’h., Bihel J., Daurès F., Guyader O., Thébaud O., Boncoeur J., 2006. Assessing economic performance and capital productivity in the fisheries sector – The case of fishing vessels in Brittany (France), IIFET 2006 Portsmouth Proceedings 18. Marchal, P. 2006. Technological developments and tactical adaptations of important EU fleets. European Union Project, Q5RS-2002-01291. 19. Dupont D.P., Grafton R.Q., Kirkley J., Squires D., 2002. Capacity utilization measures and excess capacity in multi-product privatized fisheries, Resource and Energy Economics, 24, pp193-210. 20. Pascoe S., Mardle S., 2003. Efficiency analysis in EU fisheries: Stochastic Production Frontiers and Data Envelopment Analysis. Cemare. Report n°60 21. Boncoeur J., Coglan L., Le Gallic B., Pascoe S., 2000, On the (ir)relevance of rates of return measures of economic performance to small boats, Fisheries Research, 49, pp105-115 i In the original DEA literature, the generalised term decision making unit (DMU) is used. However, in economic application, the firm is the common concept. ii This model is in fact a linear programming model, and in this case for ease of solution is denoted in the dual-form (see for example Färe et al (1994), Charnes et al (2001) and Coelli (2000) for a complete derivation). iii Separate proxies for biomass abundance, estimated from landings and fuel consumption, have been computed according to length class of trawlers. If target outputs (anglerfish, nephrops, megrim) are exploited in offshore fisheries by big trawlers (20-25 meters), these species are caught in inshore marine area by small vessels (12-16 meters). Mixed trawlers (16-20 meters) share their fishing time between offshore and inshore fisheries. iv According to a rule of thumb suggested by Cooper et al. (Cooper et al., 2000), number of observations should be equal to or greater than max [(outputs x inputs) ; 3x(ouputs + inputs)]. In this empirical work, number of outputs is equal to 4 (anglerfish, nephrops, megrim, others species) and inputs are 7 (length, engine power, fuel consumption and four different proxies for biomass abundance). Consequently, number of observations should be equal to or greater than 33. Here, the size of constant sample is 29 boats but individual data are given by month and by year. Finally, 3459 available observations have been used in DEA model. v Length (meter) and engine power (Kw) are fixed inputs in DEA model to represent technical characteristics of trawlers. Gross revenue and gross surplus are weighted by length for two reasons. Firstly, as individual units belong to three segments of trawlers in term of length (12-16 meters, 16-20 meters, and 20-25 meters), the comparative approach between DEA scores and financial performance requires to use weighting factors. In DEA model, parameters j j 1 represent weighting factors. Secondly, fishing vessel’s length appears more significant than 11 IIFET 2006 Portsmouth Proceedings engine power (Kw) in regression analysis between financial scores (gross revenue or gross surplus) and allocative efficiency. 12