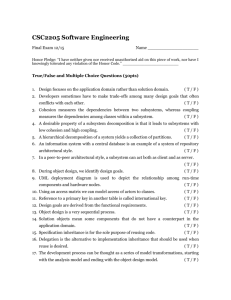

Money

advertisement

How to get the most from an unexpected inheritance – USAT... Money Home Money: News Subscribe http://www.usatoday.com/money/perfi/basics/story/2012-04-06... Join USA TODAY Sign in | Become a member Google USA TODAY stories, photos and more Mobile Travel Money Sports Life Tech Weather Markets | Economy | Personal Finance | Stocks | Mutual Funds | ETFs | Cars | Real Estate | Small Business DJIA 13,065.89 GET A QUOTE: -49.65 NASDAQ 3,038.02 sponsored by See more in this series LIFESTAGES S&P 500 1,386.82 WATCH VIDEOS By Sandra Block, USA TODAY -3.96 as of 10:31 AM Investing at every life stage How to get the most from an unexpected inheritance Recommend -4.80 LIFE STAGE INVESTING ABOUT US Videos you may be interested in Updated 4/9/2012 12:29 PM 78 81 3 Reprints & Permissions Danica Patrick Makes Hearts Race in a Bikini Lifestages: Inheritance Miss Finland's Amazing Bikini Body byTaboola More videos Most Popular Stories Warren Buffett diagnosed with early stage... Citigroup shareholders reject fat executive... Tool and die makers desperately casting for... Study shows how broad pay disparities are... Best Buy announces locations for store... Videos RAW VIDEO: Shuttle Zooms past Washington Monuments Raw video: Discovery lands near Washington Raw Video: Japanese ship rides Tsunami waves Chelsea Logan was a month and a half away from her 21st birthday when her father died suddenly from a heart attack. As her family struggled to cope with the loss, she received another shock: Her father, a longtime federal government worker, had left her $167,000. 1 of 6 Photos Cars in the News The 1100 horsepower Shelby 1000 Food marketers turn to ever weirder flavors 4/18/12 10:32 AM How to get the most from an unexpected inheritance – USAT... http://www.usatoday.com/money/perfi/basics/story/2012-04-06... "To hear that amount at 20 years old is kind of mind-boggling," Logan, now 23, says. Logan, a finance major at George Mason University in Fairfax, Va., used the money to start her own business. "My inheritance has been a huge blessing," she says. "I'm an entrepreneur at heart." VIDEO: Advice on how to manage an unexpected inheritance Joe Brier, for USA TODAY Chelsea Logan, 23, inherited $167,000 when her father passed away suddenly three years ago. She has since invested the money and used some of it to start her own business, Satissimi, selling yoga wear and offering life coaching. Most Popular E-mail Newsletter Sign up to get: Top viewed stories, photo galleries and community posts of the day Most popular right now: 'Dancing' stars face off in elimination duel STORY: How to get on track for saving for retirement STORY: Tips on how to start early managing your money wisely More than $41 trillion will be transferred to heirs over the next 50 years, the largest transfer of wealth in U.S. USATODAYMONEY on Twitter history, according to the Center on Wealth and Sponsored Links Philanthropy at Boston College. Much of that wealth will Woman is 53 But Looks 27 be passed on to people who are already affluent and Doctors are angry with a mom's free facelift secret... presumably schooled in how to manage an inheritance. consumerslifetoday.org But for those who are accustomed to living paycheck to paycheck, even a modest windfall can present daunting 60-Year-Old Mom Looks 25 Mom Reveals $5 Wrinkle Trick That Has Angered Doctors! ConsumerLifestyles.org challenges — and significant risks. USA TODAY asked financial planners and actual heirs for For the latest Money news, follow USATODAYMONEY On Twitter. MONEY advice on how to manage an unexpected inheritance. BlackBerry® Bold™ 9900 Get more of the speed, style and performance you love. Learn more. BlackBerry.com Buy a link here Their suggestions: •Take your time. Don't make any major decisions or purchases until you've consulted with advisers who will help you make sound choices about your money, says Mitch Brill, a financial professional with MassMutual. Some financial planners recommend putting the funds in a money market fund or other low-risk investment for at least a year. You'll probably need a financial planner, a certified public accountant and an attorney, Brill says. Your attorney and accountant can help you navigate tax and legal issues related to the estate. Your financial planner can help you develop long-term strategies for your money, he says. •Don't quit your day job, at least not right away. While the temptation is strong to tell your boss what you think of him, your inheritance will last a lot longer if you continue working, says Mark Bass, a financial planner in Lubbock, Texas. KEY QUESTIONS PROVIDED BY: For example, suppose you inherited $1 million. You could quit your job and try to live on your inheritance. Alternatively, you could keep your job, invest the money and give yourself an annual "raise," Bass says. Under the 4% rule — which not all financial analysts agree with — you can theoretically make an investment portfolio last Whether the sum is large or not, there are important questions you'll want to ask your financial advisor: 1) Where should I invest the money? 2) Should I alert my CPA? What if I don't have one? 3) Should I use the money to help pay off debt or invest it for the future? indefinitely by withdrawing 4% the first year and adjusting withdrawals by the inflation rate every year after that. On a $1 million inheritance, that's an initial $40,000 bump-up in pay. "Some of my happiest clients invested the money and didn't quit their jobs," Bass says. •Be discreet. It's not unusual for parents to leave different amounts to their children, so revealing the amount you've inherited could lead to family discord, says David Bakke, editor of Money Crashers, a personal finance blog. Discretion will also reduce the number of unwanted tips and investment pitches from friends and family members, says Bakke, who received an 2 of 6 4/18/12 10:32 AM How to get the most from an unexpected inheritance – USAT... http://www.usatoday.com/money/perfi/basics/story/2012-04-06... inheritance from his parents. At the same time, inheriting a large amount of money can lead to isolation, says Anne Ellinger, co-founder of Bolder Giving (boldergiving.org), an organization that helps heirs become philanthropists. "I would encourage people to tell some trusted and intimate friends, especially if it's overwhelming or upsetting," she says. •Address pressing financial needs first. Before you buy a boat or invest in a business, pay off credit card debt, student loans and other high-interest debt, says Joseph Montanaro, financial planner at USAA. Make sure you have a rainy day fund that will cover at least six months of living expenses. You should also review your insurance policies, particularly liability coverage, Montanaro says. A large inheritance makes you "a more lucrative target" for litigious individuals, he says. •Pay attention to taxes. Consider this scenario: You inherit an individual retirement account worth $150,000 and decide to cash it out and pay off your mortgage. You're out of debt, but the additional income pushes you into a higher tax bracket, resulting in a big tax bill. These types of missteps are common when individuals inherit IRAs and other pretax retirement plans, Brill says. Depending on your situation, you may be better off setting up a stretch IRA, a strategy that lets you take annual withdrawals from the IRA based on your life expectancy. This allows the inherited IRA to grow tax-deferred for years. •Be true to your values. In 1981, Christopher Ellinger's CHANGING LIFE STAGES grandmother left him $250,000. He and wife Anne, then in their early 20s, were working as community activists and A look at how personal financial planning is changing in light of social and demographic shifts. FINANCIAL PLANNING: It's less about what age you are; it's what stage you're in made very little money. "He got a call saying, 'Your portfolio's in the mail,' and he said, 'What's a portfolio?' " Anne Ellinger recalls. Christopher and Anne decided to use the money to learn about financial planning, socially responsible investing and philanthropy. That led them to create More Than NOT A PIGGY BANK: The home's changing role in family finances Money, a non-profit education initiative for philanthropists, FORMING A FAMILY: Wide range of households require different types of financial planning died, they asked him to leave Christopher's portion of his PAYING FOR COLLEGE: Older students, part-timers flock to higher education PROTECT YOUR MONEY: Retirement planning mistakes that threaten your income and later, Bolder Giving. Before Christopher's grandfather estate — about $300,000 — to charity. "We knew we already had enough," Anne says. Chelsea Logan realized that she wanted to have more of a say in how her money is invested. She initially invested part of her inheritance with a well-known brokerage firm but felt that her financial adviser wasn't interested in listening to her views. She withdrew the funds and put them into a no-load mutual fund account, where she makes her own decisions. That's not the only change Logan made after she received her inheritance. She initially set out to design luxury travel bags, but after a year and a half was overwhelmed by stress. Conscious of her family's history of heart problems, she took a couple of months off and founded a business that focuses on health. Her company, Satissimi, sells yoga wear and provides life coaching. Logan says her father, who was only 57 when he died, never took a vacation. "He had all of this money, and he never enjoyed it," she says. "I decided I was going to pave my way and do something I really love." For more information about reprints & permissions, visit our FAQ's. To report corrections and clarifications, contact Standards Editor Brent Jones. For publication consideration in the newspaper, send comments to letters@usatoday.com. Include name, phone number, city and state for verification. To view our corrections, go to corrections.usatoday.com. 3 of 6 4/18/12 10:32 AM