Mona Kashiha Department of Geography and Earth Sciences UNC Charlotte

advertisement

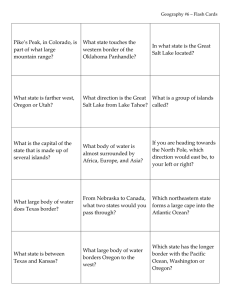

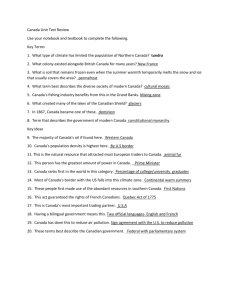

Border Effects in a Free Trade Zone: Evidence from European Wine Shipments Mona Kashiha Department of Geography and Earth Sciences UNC Charlotte Charlotte, NC 28223 mkashiha@uncc.edu Craig A. Depken, II* Department of Economics UNC Charlotte Charlotte, NC 28223 cdepken@uncc.edu Jean-Claude Thill Department of Geography and Earth Sciences UNC Charlotte Charlotte, NC 28223 Jean-Claude.Thill@uncc.edu * Corresponding author Border Effects in a Free Trade Zone: Evidence from European Wine Shipments Abstract This paper examines shipments of wine from European producers to various European ports. The research question focuses on disaggregated decisions on which port to use controlling for port performance, distance, and whether a national border must be crossed to reach the port. Using a mixed logit model we find heterogeneous impacts of distance, performance, and national borders on port choice across shippers of various sizes. Using the estimation results we calculate the distance equivalents of national borders for shippers of various sizes. We show that border effects are non-trivial and asymmetric even within the European free-trade zone. JEL Classifications: F14, L66 Keywords: trade barriers, bilateral trade, distance equivalents, border effects 1. INTRODUCTION Distance and national borders have been the focus of a number of theoretical and empirical studies of international trade patterns. Meanwhile the economics of transportation literature has asked what influences the decision of which port a shipper uses. This paper contributes to both strands of research by focusing on disaggregated shipping decisions of European wine makers that often entail crossing a national border. We first model and discuss influences on shipment-level port decisions allowing for heterogeneity in preferences across shippers of various sizes. We then use the estimation results to calculate distance equivalents of national borders for shippers of various sizes. This study diverges from the extant literature in four ways: first, using a discrete choice framework we simultaneously account for the distances and borders between a particular shipper and several possible destinations; second, we accommodate unobserved heterogeneity in shipper preferences by using a mixed logit estimator; third, our data describe individual shipments rather than aggregated trade volumes at the national or industry level, that is, we investigate individual decisions rather than aggregations of decisions; and fourth, we measure the precise distance between the origin of each shipment and the port chosen by the shipper rather than as between national capitals or centers of economic activity. Studies of aggregated trade volumes combine shipments of many different commodities, implicitly assuming that the shipping decisions for car manufacturers are the same as for those who produce furniture or consumer electronics. Yet, this assumption is not testable using aggregated data. To avoid this problem, we focus on one particular commodity, wine, and we utilize data that describe individual shipments. Wine is a relevant commodity to study because of its regional importance (wine is the most common commodity exported from Europe to the 3 United States), it is relatively homogeneous in its shipping needs, e.g., refrigeration, and wine shipments are divisible, i.e., it is possible to ship several cases up to several containers of wine. We utilize data compiled from the PIERS Trade Intelligence database that describe containerized door-to-door shipments of wine from points of origin within the European freetrade zone to one of sixteen possible ports within the same zone from July 2006 to June 2007. To preview our empirical results, we find statistically and economically meaningful differences in the discrete choice framework for shippers of various sizes. For instance, the impact of port performance on the odds of choosing a particular port increases with shipper size. Further, we find that distance from a shipper to a particular port and crossing a national border both reduce the likelihood that the particular port will be chosen. To connect to the literature on border effects, we use the empirical results to calculate the distance equivalents of national borders. We find non-trivial and asymmetric distance equivalents of national borders within the Euro freetrade zone. 2. LITERATURE REVIEW Quite naturally, geography, and particularly distance, is one of the most well-known barriers against the movement of commodities and people. In most studies distance serves as a proxy for transportation costs and is found to be an important determinant to trade flows. In addition to distance, language, currencies, membership to regional or global trade agreements, sharing a common legal culture, and whether one or both of the trading countries are landlocked, have also been shown to influence trade patterns and flows (see, for example, Anderson and Van Wincoop, 2003; Behar and Venables, 2011; Brun et al., 2005; and Hummels, 1999). The significant negative effect of distance on trade seems obvious, but counter to intuition estimated distance effects have been increasing rather than decreasing over time. This 4 contradicts the perception of the “death of distance” brought about by the current wave of globalization and this distance puzzle has attracted attention in many international trade studies. Several researchers, including Brun et al. (2005) and Coe et al. (2007), find that the impact of distance is falling over time whereas studies reviewed by Leamer and Levinsohn (1995) and Disdier and Head (2008) fail to find a decrease in the impact of distance over time. Disdier and Head conclude that their systematic analysis of 1,467 distance coefficient estimates from 103 separate studies “represent a challenge for those who believe that technological change has revolutionized the world economy causing the impact of spatial separation to decline or disappear.” After long use, the standard gravity model, which models bilateral trade volume as a primarily a function of the national product of the two countries and the distance between them, was revolutionized by Anderson and Van Wincoop (2003). Their non-linear gravity model implies that bilateral trade is homogenous of degree zero in trade costs, which they point out, may be a primary reason why gravity model estimations have not found trade becoming less sensitive to distance over time. Borders Another spatial dimension that has caught the attention of economists concerns national borders (for example, Combes et al., 2008). Empirical evidence suggests that crossing a national border, while itself a rather trivial distance, can add considerable effective distance to international trade patterns. Given the worldwide trends in reducing tariff and nontariff barriers to trade due to expanding economic freedom, multilateral and bilateral free trade agreements, and a reduction in logistics and transportation costs, the remaining significant border effect is 5 puzzling and a large empirical literature provides various estimates for the magnitude of national borders on international trade. McCallum (1995) found that the U.S.-Canada border caused Canadian provinces to trade 22 times more with each other than with U.S. states. Further research confirmed a substantial home bias in trade between integrated and culturally homogenous countries, where a free trade agreement is supposed to otherwise enhance international trade. For instance, Helliwell (1996 and 1998) confirms McCallum’s original findings, by analyzing trade between the US and Canada from the post-NAFTA period and shows that international trade fell by a factor of twelve. European Union national borders have been also studied extensively. Chen (2004) estimates that the average EU country trades about six times more with itself than with other EU countries. Nitsch (2000) finds that a border reduces trade by a factor of 6.8 between European countries. Turrini and Ypersele (2010) shows that the absence of borders raises trade by a factor by approximately 9.5 among OECD countries. The frictional effect of national borders on trade has been routinely documented in empirical studies yet there is no consensus on its underlying causes. Turrini and Ypersele (2010) point out that several factors such as exchange rate volatility, non-tariff barriers and regularity differences across countries, informational barriers and the role of commercial networks, weak institutions, and widespread corruption have all been suggested as partial causes of border effects. Using data describing OECD countries, they show that, after controlling for countryspecific factors, distance, the presence of a common border, and sharing a common language, a national border matters most when there are significant differences in legal systems between the two trading partners. They found that trade between two countries with “identical legal 6 procedures to refund an unpaid check” is seventy percent higher than with a “fully differentiated [legal] procedure”. Some studies show a relationship between the magnitude of a border effect and the degree of substitution between domestic and imported goods. For instance, Chen (2004) shows that in the EU bulk commodities like concrete, stone, or mortars experience the largest border effect. Moreover, Wolf (1997) and Hillberry and Hummels (2005) argue that a border effect can arise endogenously as a result of spatial clustering of firms seeking to reduce transportation costs. Border effects have been detected using the dispersion of prices of similar goods between city pairs. Engel and Rogers (1996) show that crossing the US–Canada border is equivalent to traversing a distance of 75,000 miles. Depken and Sonora (2002) found the effect of the Mexico– U.S. border is equivalent to crossing between 3,642 and 44,765 more miles of distance. Parsley and Wei (2001) estimate a remarkably wide border between US and Japan, finding it is equivalent to adding 43,000 trillion miles or 7,314.79 light years. Distance, unit-shipping costs, and exchange rate variability are possible explanations of the observed border effect. Port Performance The data utilized in this study describe individual shipments from wine makers to various ports of departure in Europe. As ports are nodal points of the worldwide maritime network that connect inland distribution networks, port efficiency, infrastructure, accessibility, and connectivity have been recognized as important factors in port choice. Despite the large literature focusing on port characteristics, there are no universal port-level efficiency indicators nor an aggregated index of port performance available to researchers. While the Global Competitiveness Report (GCR) reports port efficiency at the national level, some economists 7 have estimated individual port efficiency through data envelopment analysis, stochastic frontier analysis, multivariate analysis, and regression models (Cullinane and Song 2006; Wanke et al. 2011; Tang et al., 2008; Clark et al., 2004; and Blonigen and Wilson, 2007). We cannot utilize their estimates of port efficiency because their samples are not comprehensive and do not include the ports we use in this study. Acknowledging the difficulty in measuring port efficiency and performance, Malchow and Kanafani (2004) used average capacity of vessels (in TEUs) as a proxy for port attractiveness, Veldman et al. (2003) included liner service frequency, and Tiwari et al. (2003) used vessel size and port throughput in their analysis of port choice. Tongzon (2009) regresses port’s throughput (a port performance indicator) on port efficiency, cargo-handling capacity and reliability, frequency of ship visits, number of containers lifted per crane, number of container berths, and delay time. The high value of the coefficient of determination suggests that port throughput might be a reliable aggregate of a port’s attributes. Therefore, we use port throughput measured as total number of containers loaded as our measure of port performance. 3. EMPIRICAL METHODOLOGY AND DATA Methodology It has been shown that the gravity model can be related to logit-type models (Anderson 2010). However, the standard logit model, which is popular in the port-choice literature, cannot capture heterogeneous preferences and treats repeated choices by the same decision-makers as independent (cross-sectional) observations. Another well-known limitation of the logit model is the Independence of Irrelevant Alternatives (IIA), which imposes restrictions on the relationship between choices. To avoid these limitations and to exploit the richness of our data, we employ a 8 mixed logit framework that matches the economic reality in the shipping industry of unobservable or difficult-to-measure variables. Computational development and ease of simulation allows estimation of more realistic behavioral models using more complicated methods, which were previously unapproachable due to computational complexity (Train 2003). One established solution to the limitations of logit is to allow for variation in preferences across individuals. In other words, to decompose the error term to two components; the first component can be correlated over alternatives and captures unobservable taste heterogeneity by allowing for random preferences, and the remainder is an identically and independently distributed error. Let the utility for person n choosing alternative i be Uni = nxni + ni, where is a vector of preferences for observed attributes that vary across individuals with density ( ), and is an iid extreme value error term. The probability that individual n chooses alternative i is a weighted average of the logit formula evaluated at different values of β, with the weights given by the density f(β); in most applications the density function is specified as normal or lognormal. The mixed logit probability is obtained by the integrals of standard logit probabilities over all possible : The mixed logit accommodates a wide range of behaviors, avoids the aforementioned limitations from the logit (Behrens and Pels, 2012), and has been extensively used in the 9 industrial organization and transportation literature (for example, Hastings et al., 2005; Hensher and Greene, 2002; and Hess and Polak, 2005).1 Data The data used in this study describe 32,097 separate European wine door-to-door shipments to sixteen European ports made by 5,732 distinct shippers from July 2006 through July 2007. Many shippers make repeated choices which we accommodate in our estimation strategy. The data are comprised of information submitted through both the U.S. Customs and Border Protection Automated Manifest System (AMS) and manifests submitted at the various ports. These original documents have been corrected, cross-referenced, and improved by data supplier Port Import Export Reporting Service (PIERS) and distributed to users as the PIERS Trade Intelligence data product (PIERS, 2007). This data include attributes of each shipment including bill of lading, the shipping company’s name and address, a description of the commodity being shipped based on the Harmonized Commodity Description and Coding 2 System , shipment quantity in twenty-foot-equivalent-units (TEU), the shipment's estimated value and weight, the carrier, forwarding port, pre-carrier location, U.S. port of entry, and U.S. consignee and its address (if the shipment is not in transit to a third country). Figure 1 depicts the spatial distribution of European ports and wine shippers in the sample, differentiated by total TEUs. Figure 1a shows that there are three very large ports, four mid-size ports, and several smaller ports used by European wine makers shipping to the United States. Figure 1b depicts the spatial distribution of European wine shippers throughout Europe. 1 The mixed logit specification above can be generalized to accommodate repeated choice situations, by calculating the integral of the product of logit probabilities, one for each time period, instead of only one logit probability. We employ this extension 10 The majority of wine shippers are, as would be expected, in Spain, France, Germany, and Italy (the four countries in the region that produce the most wine). Table 1 reports the countries of origin and their aggregate level of shipments (in TEUs) included in the sample. As can be seen in Figure 1b the size of shippers varies dramatically. Figure 2 shows that the distribution of shipper size, based on total TEUs reported in the data, is skewed toward smaller shippers.3 While the five largest shippers in our data account for 58% of wine shipping in Italy, 40% in France, and 46% in Spain, there are a large number of very small shippers who also export wine to the U.S. Of the 5,732 unique shippers, 3,072 shipped less than one TEU over the year of the sample, which collectively accounts for 0.6% of the total Italian exports to the U.S, 1.3% for France, and 2.5% for Spain. This reflects the fragmented structure of the European wine industry discussed by several researchers (Bardají and Mili, 2009; Chandes et al., 2003; and Garcia et al., 2012). Table 2 reports the number of wine shipments during the sample year and the percentage of all wine shipments that go through each port in the sample. As can be seen, the port of Leghorn was selected most often at 22%, followed by La Spezia (18%), Le Havre (16%), Barcelona (8%), Antwerp (8%), Genoa (7%), Fos (7%), and Rotterdam (5%). No other port was selected more than five percent of total choices. Our empirical analysis aims to explain port choices through a number of possible variables. Unlike a standard logit model in which there is only one observation per choice, in a mixed logit framework there are J observations for each choice, where J is the number of choices available to the decision-maker. Thus, for each decision there are sixteen observations (one for each port), fifteen of which have a dependent variable that takes a value of zero and one that takes a value of one. 3 A single TEU can contain 800 12-bottle cases of 750 ml bottles. 11 To capture the importance of proximity and transportation costs, the explanatory variables include the distance from the shipper’s location to the various ports (distance); an indicator that takes a value of one if the port is the closest port and zero otherwise (home port); an indicator that takes a value of one if the border is crossed and zero otherwise (bordercross); throughput as a measure of port performance (performance); the oceanic distance to the U.S. port of destination (oceanic distance).4 We control for shipper heterogeneity in various ways. First, the model is estimated separately for groups of shippers based on size (smaller than 5 TEUs of wine per year, between 5 and 50 TEUs, between 50 and 300 TEUs, between 300 and 600 TEUs).5 We include the interactions between distance and estimated shipment value, between having to cross a national border with estimated shipment value,6 and between distance and crossing a national border. To test if a shipper’s current choice is affected by its past choice a lagged dependent variable is added to the model (lagchoice). Since the mixed logit model assumes that the error terms are independent over time, the lagged dependent variable, Yt-1, is uncorrelated with the error term at time t. In this regard, the lagged dependent variable does not cause inconsistency in the estimation (Train, 2003). One of the advantages of the mixed logit model is that it allows for heterogeneous preferences across individual economic agents. We initially allow the preferences for distance, border, and port performance to be random, and drawn from a Normal distribution.7 This seems 4 The oceanic distance is the great circle distance between two ports and does not reflect the vessels’ actual routes, perhaps consisting of a sequence of scheduled ports. 5 Including the handful of shippers larger than 600 TEUs per year cause the mixed logit model to fail to converge. 6 We specified three different models with interactions of distance and border with shipment value, TEUs and weight, respectively. The results turn out very similar. We report the interaction with shipment value here. 7 In the literature, the distribution of coefficient that are known to have the same sign for every decision maker, such as price (Revelt and Train, 1998) and distance (Hastings et al., 2005) are assumed to follow a lognormal distribution. In this study we do not expect that distance is always negatively perceived, for instance, if the process of port choice 12 advantageous as there are many aspects of shippers and particular shipments that we cannot observe and restricting the impact of distance to be homogeneous across all shippers might introduce specification bias. If the estimated standard deviation of the random coefficients is sufficiently small it would suggest that heterogeneity is not a substantial problem in the data. Table 3 reports the descriptive statistics for the sample of 32,079 shipping decisions. On average wine ships approximately 225 miles to reach the port of departure and approximately twenty-two percent of all decisions entail crossing a national border. The average throughput of a port is approximately 8,777 TEUs per month, the average distance from the port of departure to the port of destination in the United States is approximately 4,400 miles, approximately fortyfour percent of all port decisions correspond to the “home port,” and approximately fifty-two percent of all decisions are a repeat choice. 4. Empirical Results Table 4 reports the estimates of the mixed logit models for the four subsamples of shippers. The coefficient estimates differ significantly across the four groups and within each group the random coefficients have significant variances. Distance The average shipper in each group places a negative value on distance, but the effect is different for each group. Each additional mile of distance reduces the odds of choosing a particular port by approximately 0.50% for the smallest shippers and approximately 0.9% for large shippers. The impact of distance is less important and generally less variant in the first group as reflected in the relatively low value of the standard deviation in estimated heterogeneous preferences. Distance becomes more important for larger shippers. The variation is done under consideration of contractual relationships between shippers and ports. Therefore, we assume that preferences are normally distributed. 13 of the impact of distance increases over groups; it is high relative to the mean in the two groups of largest shippers. The closest port is not significant in the choice of port by the smallest shippers and is negatively related to the choice of port by the next smallest shippers. Only for the larger shippers is homeport positive and statistically significantly related to port choice. These differences might reflect the non-linear impact of distance for shippers of various size. Overall, distance is an important factor in port choice for the average shipper and there is significant heterogeneity across shippers in their valuation of distance, some shippers value distance negatively and five times larger than the average shipper, while some shippers place a positive value on distance. Using the cumulative standard normal distribution, given the mean and standard deviation of the distance coefficients, in the first two groups almost all shippers place a negative value on distance but that nineteen percent of Group 3 and thirty-six percent of Group 4 place a positive value on distance, most likely reflecting infrastructure or idiosyncratic connections between shippers and ports that are unobserved in the data. All groups of shippers place negative weight on oceanic distance, but always smaller than the weight on land distance. This makes sense given lower overseas transportation costs (Hummels, 2001) and that large temperature fluctuations, which can damage wine, are more likely to occur on the land than the water (Marquez, et al., 2012) Performance As discussed by Hess and Polak (2005), the linear specification of the underlying utility function of the mixed logit may not be appropriate for attributes with decreasing marginal returns. Here it is reasonable to assume that improvement at a lower level of performance 14 increases utility more than improvement at a higher level of performance. Hence we use the natural logarithm transformation to introduce a non-linear impact of performance to port choice. A Normal distribution is assumed for the coefficient on performance. The results indicate that the preference for port performance is rather low for smaller shippers but increases with the shipper size.8 The heterogeneity in preference for performance is substantially large, where the standard deviation is estimated to be three times larger than the mean in Group 2. We assume that this variation in preference for port performance arises due to other port characteristics that are not observed in this study. In the next section we control for port country fixed-effects that control for all the fixed (during the sample period) port characteristics in terms of performance, costs, and wine handling facilities. Border A large body of literature investigates trade-barrier effects caused by borders and the puzzle that border effects are found even in integrated and free trade regimes, such as the European Union and NAFTA. The results in Table 4 indicate that an average European wine shipper perceives a border crossing as a negative regardless of shipper size, but that the impact of a border crossing decreases with shipper size. For a shipment with average value, a border is a strong barrier for the smallest group but the borders impact decreases with shipment value. Although the border is a smaller barrier to larger shippers, its negative impact increases with the value of the shipment. There is considerable heterogeneity across shippers in their sensitivity to crossing a border. 8 We also interacted performance and shipment value to test whether a higher value of a shipment increases the preference for more efficient ports. However, this variable turns out to be insignificant across the four groups, and was removed from the reported results. 15 Variation of Border Effects across Countries To explain the negative and heterogeneous effect of a border crossing in the free trade zone of Europe we include interactions of bordercross and country fixed effects to control for the local business culture, local regulations and norms, and local business climate. These interactions identify movement across one of the four country borders from within the country. For example, From_Italy_border equals one if an Italian shipper chooses a port outside of Italy and zero otherwise. We also create indicator variables for the countries hosting the most popular ports (Italy, Spain, France, Belgium, and the Netherlands) and interact them with bordercross. These new interactions allow for asymmetric border effects depending on whether a domestic shipper is leaving a particular country or a non-domestic shipper is coming into a particular country. For example, To_Italy_Border takes a value of one if a non-Italian shipper were to choose an Italian port. The main bordercross variable is replaced by four from-within interactions and five to-outside interactions. In both cases, countries such as Portugal, Netherlands, and Greece comprise the “omitted category.” For the landlocked countries a border crossing is required and therefore the bordercross interactions have zero variation and are therefore not included. The results are reported in Table 5. In Table 5 only distance has a randomly distributed coefficient. The large variation of the preference for border and performance observed in Table 4 is captured by the interactions of bordercross and country fixed effects. The results show that the border effects from within vary across countries: Spanish shippers are least reluctant to crossing their own border, as reflected in the lowest distance equivalents of the border, whereas the Italians are the most reluctant, as reflected in the highest distance equivalents of the border. Furthermore, the border effect from outside a country varies: the borders of the Netherlands, Spain, and Belgium are perceived to be 16 the least costly followed by France, and Italy. As can be seen, the impact of a port’s national border is almost always positive, reflected in the negative distance equivalents of the border crossing, suggesting that the country attracts more shipments relative to the omitted countries. Only for the largest shippers do the borders of France and Italy dissuade shipments from other countries. Next, we specifically test if shippers differentiate between equidistant ports but one port requires a border crossing. To do so, we interacted distance and border effects in Table 5. Groups 1, 2, and 4 evaluate distance more negatively when there is a border to cross. In other words, a port that is located across a border is treated as farther than its actual physical distance. Trade-off between Proximity, Port Performance and Border While the results from the mixed logit models provide some insight about how borders influence decision making, it is of interest to see how decision makers weigh different port characteristics on the margin. When using the mixed logit, the trade-off between distance and port performance is simply the ratio of the two parameter estimates; the result is the amount port performance must increase to offset a given distance increase and keep the decision maker indifferent about changing their port decision. The estimated trade-offs between proximity and port performance (evaluated at each parameter's mean) is presented in Table 6.9 The first row lists the increase in performance that would compensate an average shipper to travel 100 more miles to reach the port. For the average shipper in the smallest group, the port has to increase its performance by 1.2 percent to compensate traveling 100 more miles. The tradeoff between distance and port performance is 9 We follow Hastings, et al. (2006) for computing trade-off between attributes in the context of mixed logit model; where proximity equivalent to border is calculated by . 17 fairly steady across the three remaining groups although Group 2 requires a somewhat larger increase in port performance to compensate for additional distance. The amount a port needs to improve its performance to compensate a shipper for crossing a border is summarized in the second row of Table 6. The trade-off decreases as shippers become larger. Finally, the distance equivalents of a generic border crossing in the shipping market for wine is reported in the third row of Table 6. On average, the smallest shippers are willing to travel approximately 625 more miles to avoid a border; this value decreases with the size of the shippers. The final row of Table 6 reports the trade-off for an average shipper with shipment values one standard deviation above average.10 An increase in the value of a shipment decreases the trade-off between distance and border in the smallest group and increases this value in the largest group. Trade-off between Distance and Border across the Countries Table 7 reports the distance equivalents estimated from the mixed logit results when border effects are allowed to by asymmetric (Table 5). Overall, borders dissuade outbound shipments but encourage inbound shipments, precisely because these shipments are heading to a port (as reflected in the negative sign of the calculated trade-offs). For all but the largest shippers leaving the home country for a port in another country is costly, as reflected in the positive distance equivalents. This might reflect other non-formal trade barriers such as language, customs, or social connections. For example, the average Italian shipper with less than 5 TEU considers crossing the Italian border to reach a port in another country as the equivalent of 836 miles in land transportation. This pattern is the same for all domestic movements regardless of the size of the shipper. 10 The trade-off at one standard deviation above the mean is calculated by 18 . On the other hand, shippers outside of Italy, France, and Spain consider crossing into any of those countries as the equivalent of fewer land transport miles as reflected in the negative distance equivalents. The results suggest that the ports in our sample are strong draws for domestic and foreign shippers. This might be caused by port-specific infrastructure to handle wine shipments. Another explanation is that those outside a country are slightly less concerned into that particular because they have options, that is, an Austrian shipper can go to Italy, Germany, or France, and therefore any particular country’s border is less of an issue. 4. CONCLUSIONS As pointed out by Disdier and Head (2008), the large literature that investigates the impact of distance and national borders on bilateral trade flows has yielded a wide range of estimated impacts. They attribute the increasing variance in estimated effects to three issues: sampling error, structural heterogeneity, and methodological differences. This paper offers an estimate of distance and national borders on the flow of a single commodity in the early stages of the supply chain using unique data characterized by structural heterogeneity and a methodology that accommodates that heterogeneity. We empirically model the choice of European wine shippers on what port to use when shipping wine to the United States. Our data describe the nature of the shipment, i.e., its size and value, the shipper's location, the port's location, and port characteristics. Furthermore, we know the distance and characteristics of the other ports in Europe that weren't selected. Therefore, the transactions we investigate can be domestic or international and therefore distance and national borders might be expected to influence port choice. The data used here have several advantages but most importantly being able to precisely measure actual and potential distance travelled. 19 Focusing on a relatively homogeneous product reduces the potential for attributing the same distance and border effects across very different types of decision makers. Using a mixed logit that accommodates heterogeneous preferences, we first investigate how distance, port performance, and crossing a national border influence port choice across shippers of different size assuming a common border effect across all countries and that border effects are symmetric on both sides of the border. We find that port performance is an important influence on port choice but so too is distance and crossing national borders. We then estimate the implied tradeoff between performance and distance, performance and crossing a border, and distance and crossing a border, the latter often referred to as the distance equivalents of a border. We find that the border effect varies from approximately 90 miles to 560 miles of equivalent land travel depending on the size of the shipper. We next relax the assumption that all border effects are the same and that border effects are symmetric by identifying particular borders that have to be crossed to reach a port and whether one is leaving or entering a particular country. We find that the border effects are not the same across countries nor are they the same when you are entering or leaving a country. Measured in distance equivalents, it is expensive to leave Italy, France, and Spain but it is cheap to enter the Netherlands, Spain, and Belgium. We find that estimated border effects never exceed a thousand miles although the vast majority of the estimated border effects are statistically significant. Thus, even within the free-trade Euro zone, non-trivial border effects still exist. We do not have the data to speculate as to why this is the case but this is an obvious direction of possible future inquiry. While the border effects we estimate are substantially smaller than those estimated in aggregated gravity models, we appeal to the taxonomy of Disdier and Head (2008) and point out 20 that our study is focused on a structurally heterogeneous group of decision makers (wine shippers) and we use a different methodology (mixed logit) than would be used in a traditional gravity model of bilateral trade. Furthermore, we point out that the wine shipments included in this sample are only on the first stage of the overall shipment process from producer to endconsumer. Therefore, it is not surprising that our estimated border effects are substantially smaller than those obtained using aggregated trade that includes the entire shipping journey from producer to end-user. 21 REFERENCES Anderson, James E. 2010. “The Gravity Model.” Working paper National Bureau of Economic Research Working paper 16576. Anderson, James E, and Eric van Wincoop. 2003. “Gravity with Gravitas: A Solution to the Border Puzzle.” American Economic Review 93(1): 170–192. Bardají, Isabel, and Samir Mili. 2009. “Prospective Trends in Wine Export Markets – Expert Views from Spain Prospective Trends in Wine Export Markets – Expert Views from Spain.” International Association of Agricultural Economists: 16–22. Behar, Alberto, and Anthony J Venables. 2011. “Transport Costs and Costs and International Trade.” In A Handbook Of Transport Economics, eds. André de Palma, Robin Lindsey, Emile Quinet, and Roger Vickerman. Cheltenham: Edward Elgar, p. 97–115. Behrens, Christiaan, and Eric Pels. 2012. “Intermodal competition in the London–Paris passenger market: High-Speed Rail and air transport.” Journal of Urban Economics 71(3): 278–288. Beugelsdijk, Sjoerd, and Ram Mudambi. 2013. “MNEs as border-crossing multi-location enterprises: The role of discontinuities in geographic space.” Journal of International Business Studies 44(5): 413–426. Blonigen, Bruce A, and Wesley W. Wilson. 2007. “Port Efficiency and Trade Flows.” Review of International Economics 16(1): 21–36. Brun, Jean-Francois, Carrere Celine, Patrik Guillaumont, and Jaime De Melo. 2005. “Has Distance Died? Evidence from a Panel Gravity Model.” The World Bank Economic Review 19(1): 99–120. Chandes, Jérôme, Dominique Estampe, Dean Isli, Romain Berthomier, Laure-anne Courrié, Lingli Han, and Sylvain Marquevielle. 2003. “of Actors in the Wine Supply Chain.” Supply Chain Forum: An International Journal 4(1): 12–27. Chen, Natalie. 2004. “Intra-national versus international trade in the European Union: why do national borders matter?” Journal of International Economics 63(1): 93–118. Clark, X, D Dollar, and a Micco. 2004. “Port efficiency, maritime transport costs, and bilateral trade.” Journal of Development Economics 75(2): 417–450. Coe, David T, Arvind Subramanian, and Natalia T Tamirisa. 2007. “The Missing Globalization Puzzle: Evidence of the Declining Importance of Distance.” IMF Staff Papers 54(1): 34–58. 22 Combes, Pierre-Philippe, Thierry Mayer, and Jacques-François Thisse. 2008. Economic geography: The integration of regions and nations. Princeton. Cullinane, Kevin, and Dong-Wook Song. 2006. “Estimating the Relative Efficiency of European Container Ports: A Stochastic Frontier Analysis.” Research in Transportation Economics 16(06): 85–115. Depken, Craig A., and Robert J. Sonora. 2002. “International price volatility: Evidence from U.S. and Mexican cities.” The North American Journal of Economics and Finance 13(2): 179–193. Disdier, Anne-Célia, and Keith Head. 2008. “The Puzzling Persistence of the Distance Effect on Bilateral Trade.” Review of Economics and Statistics 90(1): 37–48. Engel, Charles, and John Rogers. 1996. “How Wide is the border.” American Economic Review 86(5): 1112–1125. Fotheringham, A.S., and M.E. O’Kelly. 1989. Spatial Interaction Models: Formulations and Applications. Dordrecht, The Netherland: Kluwer Academic Publishers. Garcia, Fernanda a., Martin G. Marchetta, Mauricio Camargo, Laure Morel, and Raymundo Q. Forradellas. 2012. “A framework for measuring logistics performance in the wine industry.” International Journal of Production Economics 135(1): 284–298. Hastings, Justine S, Thomas J Kane, Douglas O Staiger, Steven Berry, Philip Haile, Fabian Lange, Sharon Oster, Miguel Villas-boas, and Sofia Villas-boas. 2005. “Parental Preferences and School Competition: Evidence From A Public School Choice Program.” Working paper National Bureau of Economic Research Working paper 11805. Helliwell, John F. 1996. “Do National Borders Matter for Quebec’s Trade?” Working paper National Bureau of Economic Research Working paper 5215. ———. 1998. How much do national borders matter? Brookings Institution Press. Hensher, David A, and William H Greene. 2002. “The Mixed Logit Model: The State of Practice.” 2002(June): 1–49. Hess, Stephane, and John W. Polak. 2005. “Mixed logit modelling of airport choice in multiairport regions.” Journal of Air Transport Management 11(2): 59–68. Hillberry, Russell, and David Hummels. 2005. “Trade Responses to Geographic Frictions : A Decomposition Using Micro-Data.” Russell The Journal Of The Bertrand Russell Archives. Hummels, David. 1999. “Have international transportation costs declined?” University of Chicago 23 ———. 2001. “Toward a Geography of Trade Costs.” Purdue University Leamer, Edward E., and James Levinsohn. 1995. “International trade theory: the evidence.” In Handbook of international economics, eds. GM Grossman and K Rogoff. New York: Elsevier. Malchow, Matthew B, and Adib Kanafani. 2004. “A disaggregate analysis of port selection.” Transportation Research Part E: Logistics and Transportation Review 40(4): 317–337. Marquez, Leorey, Simon Dunstall, John Bartholdi, and Alejandro Maccawley. 2012. “‘ Cool or Hot ’: A Study of Container Temperatures in Australian Wine Shipments.” Australasian Journal of Regional Studies 18(3): 420–443. Mccallum, John. 1995. “National Borders Matter : Canada-U . S . Regional Trade Patterns.” McCallum J 85(3): 615–623. Nitsch, Volker. 2000. “National borders and international trade: evidence from the European Union.” Canadian Journal of Economics/Revue Canadienne d`Economique 33(4): 1091– 1105. Parsley, David C., and Shang-Jin Wei. 2001. “Explaining the border effect: the role of exchange rate variability, shipping costs, and geography.” Journal of International Economics 55(1): 87–105. PIERS. 2007. July 1, 2006 - June 30, 2007- PIERS TI U.S. Waterborne Imports Dataset [Data file]. UBM Global Trade, Newark, NJ. Revelt, David, and Kenneth Train. 1998. “Mixed Logit with Repeated Choices: Households’ Choices of Appliance Efficiency Level.” Review of Economics and Statistics 80(4): 647– 657. Tang, Loon Ching, Joyce M. W. Low, and Shao Wei Lam. 2008. “Understanding Port Choice Behavior—A Network Perspective.” Networks and Spatial Economics 11(1): 65–82. Tiwari, Piyush, Hidekazu Itoh, and Masayuki Doi. 2003. “Shippers’ Port and Carrier Selection Behaviour in China: A Discrete Choice Analysis.” Maritime Economics & Logistics 5(1): 23–39. Tongzon, Jose L. 2009. “Port choice and freight forwarders.” Transportation Research Part E: Logistics and Transportation Review 45(1): 186–195. Train, Kenneth E. 2003. Discrete Choice Methods with Simulation. Cambridge: Cambridge University Press. Turrini, Alessandro, and Tanguy van Ypersele. 2010. “Traders, courts, and the border effect puzzle.” Regional Science and Urban Economics 40(2-3): 81–91. 24 Veldman, Simme, Lorena Garcia-Alonso, and José Ángel Vallejo-Pinto. 2011. “Determinants of container port choice in Spain.” Maritime Policy & Management 38(5): 509–522. Wanke, Peter F., Rafael Garcia Barbastefano, and Maria Fernanda Hijjar. 2011. “Determinants of Efficiency at Major Brazilian Port Terminals.” Transport Reviews 31(5): 653–677. Wolf, Holger C. 1997. “Patterns of Intra- and Inter-state trade.” National Bureau of Economic Research 5939. 25 Table 1: Country of origins included in the analysis Country of Origin ITALY FRANCE SPAIN GERMANY PORTUGAL NETHERLANDS IRELAND TEUs 38,266 18,713 6,567 3,204 1,236 648 237 Country of Origin GREECE AUSTRIA SLOVENIA BELGIUM SWITZERLAND ROMANIA HUNGARY 26 TEUs 223 216 205 114 93 84 78 Table 2: Sample Ports and Wine Shipments. Port Name (Country) Leghorn (Italy) La Spezia (Italy) Le Havre (France) Barcelona (Spain) Antwerp (Belgium) Genoa (Italy) Fos (France) Rotterdam (Netherlands) Valencia (Spain) Naples (Italy) Algeciras (Spain) Bremerhaven (Germany) Lisbon (Portugal) Sines (Portugal) Piraeus (Greece) Gioia Tauro (Italy) Number of wine shipments (Percentage of Total Shipments) 10,200 (22%) 8,523 (18%) 7,619 (16%) 3,965 (8%) 3,902 (8%) 3,559 (7%) 3,348 (7%) 2,587 (5%) 1,117 (2%) 528 (1%) 414 (0.8%) 344 (0.7%) 326 (0.7%) 271 (0.6%) 186 (0.4%) 181 (0.4%) 27 Table 3: Descriptive Statistics of the Sample Mean Std. Dev. Min Max Distance 226.30 194.63 0 1453.82 Border cross (1=Yes) 0.22 0.42 0 1 Performance (log of port TEUs) 9.08 0.76 6.60 10.63 Distance of European port of origin to US port of destination 4414.09 775.03 3224.12 6905.23 Home port (1=Yes) 0.44 0.50 0 1 Lagchoice (1=Yes) 0.52 0.50 0 1 Value x distance 14.22 284.90 -994.56 8359.68 Valuex border 0.03 0.55 -1.03 28.80 Notes: Sample includes 32,079 observations. Shipment value normalized to have a mean of zero and a standard deviation of one. 28 Table 4: Mixed Logit Estimation Results Assuming Symmetric Border Effects Group 1 Group 2 Group 3 Group 4 TEUs<5 5=<TEUs<50 50<=TEUs<300 300<TEUs<600 Distance Mean SD -0.005 (0.0002) 0.002 (0.0002) -0.013 (0.000) 0.007 (0.0003) -0.014 (0.0005) 0.016 (0.0007) -0.009 (0.0005) 0.14 (0.001) Border cross Mean SD -3.134 (0.12) 2.339 (0.14) -2.151 (0.15) 3.220 (0.15) -1.263 (0.09) 3.490 (0.12) -1.635 (0.12) 2.854 (0.18) Performance (log) Mean SD 0.421 (0.02) 0.500 (0.05) 0.579 (0.06) 1.496 (0.08) 1.097 (0.05) 2.926 (0.10) 0.662 (0.06) 0.760 (0.05) Distance port to US port -0.001 -0.002 -0.003 -0.004 (0.000) (0.0001) (0.0001) (0.0002) -0.006 -0.259 0.427 0.811 (0.03) (0.05) (0.05) (0.06) Lagchoice 1.489 1.138 0.689 0.535 (0.05) (0.03) (0.03) (0.05) Val * distance -0.00004 -0.0003 -0.0002 0.002 (0.0001) (0.0002) (0.0001) (0.0003) Val * border -0.042 0.221 0.164 -1.039 (0.06) (0.05) (0.06) (0.12) Number of observations 162048 149104 140656 61456 Number of shippers 3072 2479 147 34 Notes: Numbers in parentheses are standard errors. All parameters in bold are statistically significant at the 5% level. Home port 29 Table 5: Mixed Logit Results Allowing for Asymmetric Border Effects. Group 1 Group 2 Group 3 Group 4 TEUs<5 5<TEUs<50 50<TEUs<300 300<TEUs<600 -0.0045 (.0002) -0.0084 (.0004) -0.021 (.001) -0.006 (.001) 0.003 (.0002) 0.006 (.0004) 0.018 (.001) 0.012 (.001) Home port -0.048 (.033) -0.034 (.038) -0.046 (.044) 1.012 (.068) Performance (log) 0.380 (.029) 0.258 (.034) 0.124 (.039) 1.014 (.064) From Italy border -3.780 (.184) -2.810 (.220) -2.813 (.301) -4.355 (.595) From Spain border -0.912 (.130) -0.784 (.163) -0.569 (.188) 2.006 (.424) From France border -3.107 (.111) -2.425 (.135) -3.227 (.164) -1.552 (.315) From Germany border -1.278 (.199) -0.476 (.307) -2.254 (.541) 3.264 (.713) To Italy border 0.460 (0.126) 0.967 (.147) 1.156 (.184) -2.022 (.613) To Spain border 1.604 (.113) 1.845 (.118) 2.176 (.140) 1.451 (.336) To France border 1.500 (.104) 1.271 (.116) 1.583 (.164) -0.490 (.263) To Belgium border 1.296 (.117) 1.864 (.128) 2.298 (.154) 0.719 (.176) To Netherlands border 1.588 (.119) 2.032 (.131) 2.793 (.163) 0.989 (.170) -0.0002 (.0001) -.00008 (.0001) -0.0001 (.0002) 0.001 (.0003) 0.104 (.030) 0.111 (.035) -0.058 (.044) -0.952 (.128) -0.001 (.0001) -0.002 (.0001) -0.003 (.0002) -0.004 (.0003) 1.624 (.051) 1.54 (.028) 1.167 (.028) 0.600 (.052) -0.002 (.0003) -0.002 (.0002) 0.0002 (.0003) -0.006 (.009) Distance Mean SD Val x distance Val x border Distance port to US port Lagchoice Distance x border Notes: Numbers in parentheses are standard errors. All parameters in bold are statistically significant at 5%. 30 Table 6 Trade-offs between Performance, Distance, and Border Crossing Shipment value above average Between performance and distance (percentage) NO Between performance and border (percentage) NO NO Group 1 Group 2 Group 3 Group 4 1.2 (0.000) -7.44 (0.48) 626.47 (36.90) 2.3 (0.002) -3.71 (0.42) 161.50 (14.20) 1.2 (0.000) -1.15 (0.09) 92.31 (7.59) 1.4 (0.001) -2.47 (0.26) 172.81 (68.46) 557.64 (35.50) 148.62 (14.28) 93.44 (8.50) 359.95 (39.65) Between distance and border (miles) YES Notes: Values in parentheses represent standard errors. All values in bold significant at the 5% level. Shipment values are standardized to have zero mean and standard deviation of one. 31 Table 7: Distance Equivalents of Entering and Exiting EU Countries for Wine Shipments From Italy border From France border From Spain border From Germany border To Italy border To France border To Spain border To Belgium To Netherlands Group 1 Group 2 Group 3 Group 4 836.40 (52.56) 201.88 (28.40) 687.36 (33.99) 282.67 (44.08) -101. 71 (28.08) -331.70 (26.21) -354.81 (28.64) -286.77 (27.99) -351.39 (29.82) 336.21 (31.81) 93.85 (19.31) 290.09 (21.07) 59.98 (36.63) -115.66 (18.68) -152.04 (15.76) -220.69 (18.38) -222.96 (19.55) -243.146 (20.51) 134.92 (16.01) 27.32 (8.75) 154.78 (11.19) 108.08 (24.97) -55.46 (9.02) -75.94 (7.74) -104.38 (9.18) -110.21 (9.68) -133.96 (10.59) 748.99 (210.55) -345.08 (119.58) 267.09 (80.05) -561.48 (194.02) 347.88 (138.02) 84.34 (49.74) -249.61 (85.87) -123.61 (43.64) -169.91 (52.14) Note: Values in parentheses are standard errors. All values in bold significant at the 5% level. 32 Figure 1: Spatial Distribution of European Ports of Origin and Wine Shippers 1a) U.S.-bound containerized wine traffic of major European ports (TEUs) 1b) Spatial distribution of shippers, weighted by the size of wine shipment between 7/2006 and 6/2007 33 Figure 2: Distribution of Wine Shippers by Annual TEUs Shipped 34