DONATIONS

advertisement

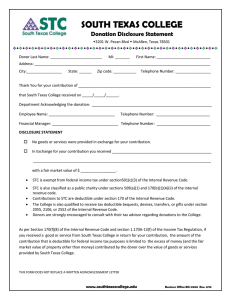

DONATIONS How to Report a Donation When requesting or receiving a donation, such as Cash Land Furniture Equipment, etc., A letter from the donor specifying the restrictions and use of the donated property must be obtained. The Business Office Departmental Accounting Report of Donations form (B.O. 1500) and Donation Disclosure Statement (B.O. 3900) must be completed and approved prior to acceptance of the donated property. POLICY # 5910 Employee requesting or receiving the donation is required to prepare an acknowledgement letter signed by the appropriate authorized signer as per STC’s Acceptance of Gifts and Bequests Policy (5910). Authorized Signers (Policy #5910) •Gifts of land or facilities by the Board of Trustees; •Gifts of money, negotiable instruments or major items of equipment or material by the President; •Gifts of equipment, books or materials, (value up to and including $100,000) by the President; •Larger gifts (value more than $100,000) may be accepted with Board approval. The top left section of the form is required with the donor information. SOUTH TEXAS COLLEGE Departmental Accounting Report of Donations DONOR INFORMATION Name of Donor Donation Date Address EMPLOYEE INFORMATION City, State, Zip Name of South Texas College Employee Telephone Number Campus Name of Donor's Contact Telephone Number Title Program/Dep artment Organization Name and Number Item(s) Contributed Description The middle section (source, purpose, and value of the gift) is required for financial reporting. Goods and services provided in exchange for the contribution: _____ No goods or services were provided by STC in return for the contribution. ______ Descrip tion and good faith estimate of the goods or service that STC p rovided in return for the contribution Description: ________________________________________________________________ Source of Gift (check one): Alumni ______Friend Religious Organization Other Source Faculty/Staff _____ Foundation _____ Fund-Raising or _____ Corporation/Business Purpose of Gift (check one): Cash _____Equipment (Inv.#_____________) ______Supplies _____Research ______Academic _____Faculty & Staff Compensation Public Service & Extension Library _____Operation & Maintenance of Physical Plant Property, Building & Equipment Endowment and Similar Funds - - Unrestricted Income Endowment and Similar Funds - - Restricted Income Loan Funds ______Other Estimated value of donation $ _____________________ Does this gift require operation and maintenance cost? Y N If yes, what organization will cover the cost? NOTE: Please attach an acknowledgement letter for the President's signature. Submit a copy of the letter along with original Departmental Accounting Report of Donations form to the Business Office. Checks must be deposited within 7 days of date of collection. (Texas Education Code § 51.003 (b)) d o n ati o n s Business Office Use Only Fund ______________ Organization_________ Account ____________ Program Employee Signature Title Authorizing Signature (President) Title Authorizing Signature (Board of Trustees) Title Dist ribut ion: Original - Business Of f ice Copy 1 - President Copy 2 - Inventory Control Copy 3 - Department File The top right section of the form is required with the STC employee’s information receiving the donation in case we need to contact donor. Description and specification of the item(s) contributed is required. The bottom section, requires the signature of the employee requesting / receiving gift along with STC’s President and, if applicable, the Board of Trustees. The top section of the form is required with the donor information. Department’s information and employee name acknowledging the donation. This form does not replace a written acknowledgment letter. DONATIONS FOR M Submit to the Business Office the following documentation: Prior to accepting the donation, the Departmental Accounting Report of Donations form, Donation Disclosure Statement and Acknowledgement letter must be approved. YES DONATION P R OCESS Original Departmental Accounting Report of Donations form (BO-1500) Copy of the Donation Disclosure Statement (BO3900) and Acknowledgement letter. Copy of the check received. Copy of the receipt from cashiers. Donated furniture or equipment with an inventory value of $5,000 or greater, (Effective 8/1/04 All books donated are depreciated.) Item is depreciated: Submit donated furniture or equipment to the Shipping and Receiving and Fixed Assets (Inventory Control) department for appropriate tagging. Submit copies to the following departments: President’s Office. Shipping and Receiving and Fixed Assets (Inventory Control). Department receiving the gift. NO LETTER FUNDRAISING Objectives of the Fundraising procedures • To ensure prior approval • To ensure aid in the accomplishment of the mission and further the strategic initiatives of the College • To control duplicate fundraising efforts • To control multiple solicitation of gifts from the same donor • To identify priorities • To ensure proper accounting • To ensure effecting fundraising plan • To ensure compliance with State Comptroller and IRS rules & regulations POLICY # 5910 Employee requesting or receiving the donation is required to prepare an acknowledgement letter signed by the appropriate authorized signer as per STC’s Acceptance of Gifts and Bequests Policy (5910). Authorized Signers (Policy #5910) •Gifts of land or facilities by the Board of Trustees; •Gifts of money, negotiable instruments or major items of equipment or material President; •Gifts of equipment, books or materials, (value up to and including $100,000) by the President. Larger gifts may be accepted with Board approval. by the How to Report a Fundraiser When requesting or receiving a fundraiser, such as Cash Gift Certificates Equipment, etc., The Business Office Fundraising Activity Approval form is to be completed and approved prior to acceptance of the donated property. These procedures can be downloaded from the Business Office web page at: http://www.southtexascollege.edu/businessoffice/pr ocedures.htm Fundraising Authorization FUNDR AIZING AUTHORIZATION •Fundraising Purpose •Period of Fundraising Activity •Type of fundraising activity •Statement as to the College’s need for item (Student Organizations follows the Student Life Department guidelines) Name of Employee responsible for preparation and custody of financial records. Approvals: •Financial Manager •Vice President •President or (Alumni & Fundraising Associate) Once the fundraising proposal has been formally approved, any solicitation must conforms the college policies and procedures SOUTH TEXAS COLLEGE Fundraising Authorization ORGANIZATION: FORMS Name of Department/Organization Fundraising:___________________________________________________ ___________________________________________________________________________________________ FUNDRAISING PURPOSE: Describe the purpose of fundraising:_____________________________________________________________ ___________________________________________________________________________________________ ___________________________________________________________________________________________ PERIOD OF FUNDRAISING ACTIVITY: Begins:___________________ Ends:_________________ Other:______________________________________ TYPE OF FUNDRAISING ACTIVITY: Describe the type of fundraising:________________________________________________________________ ___________________________________________________________________________________________ ___________________________________________________________________________________________ STATEMENT AS TO THE COLLEGE’S NEED FOR THE ITEM: Describe:___________________________________________________________________________________ ___________________________________________________________________________________________ Fundraising request for Approval and acknowledgment of compliance with Fundraising Procedures and Cash Handling Procedures, if applicable, (located at Business Office web page): ___________________________________ Print Name of Fundraiser X________________________________ Signature of Fundraiser ______________ Date Name of Employee responsible for preparation and custody of financial records: ___________________________________ Print Name of Employee X________________________________ Signature of Employee ______________ Date ________ Approved ___________ Disapproved _______________________________________________ Finance Manager _______________ Date ________ Approved ___________ Disapproved _______________________________________________ Vice President of ________________________________ _______________ Date ________ Approved ___________ Disapproved _______________________________________________ Dr. Shirley R. Reed, President _______________ Date Question • Name the two positions that approve a Fundraising Authorization Form (#4000) and the third position if amount is $1,000 and over. Donor Form Donation Purpose Organization Name Donor Information Contribution Goods and Services Provided in Exchange for the Contribution. • Donor Certification • • • • • SOUTH TEXAS COLLEGE DONATION DISC LOSUR E Donation Disclosure Statement 3201 W. Pecan Blvd McAllen, Texas 78501 Donor Last Name: _________________________ MI: _______ First Name: __________________________ Address: _____________________________________________________________________________________ City:_________________ State: ______ Zip code: ___________ Telephone Number: _________________ Thank You for your contribution of ________________________________________________________________ that South Texas College received on _____/_____/______. Department Acknowledging the donation: __________________________________________________________ Employee Name: ________________________________ Telephone Number: __________________________ DISCLOSURE STATEMENT No goods or services were provided in exchange for your contribution. In Exchange for your contribution you received ________________________________________________ ______________________________________________________________________________________ with a fair market value of $ _________________. • STC is exempt from federal income tax under section501(c)(3) of the Internal Revenue Code. • STC is also classified as a public charity under sections 509(a)(1) and 170(b)(1)(A)(ii) of the internal revenue code. Contributions to STC are deductible under section 170 of the Internal Revenue Code. The College is also qualified to receive tax deductible bequests, devises, transfers or gifts under section 2055, 2106, or 2552 of the Internal Revenue Code. • • As per Section 170(f)(8) of the Internal Revenue Code and section 1.170A-13(f) of the Income Tax Regulation, if you received a good or service from South Texas College in return for your contribution, the amount of the contribution that is deductible for federal income tax purposes is limited to the excess of money (and the fair market value of property other than money) contributed by the donor over the value of goods or services provided by South Texas College. THIS FORM DOES NOT REPLACE A WRITTEN ACKNOWLEDGMENT LETTER LETTER March 23, 2006 Name of the Donor Company Address City, State, Zip Dear Ms/Mr..., XXX XXXX: On behalf of South Texas College’s Department or Program, it is my pleasure to extend our appreciation for your generous contribution of the 5 textbooks valued at $300.00. The textbooks will be utilized by our students and will become part of our lending library. Thank you so much for your generosity and for touching the lives of bright but economically disadvantage students. I hope that you will consider South Texas College when another opportunity presents itself for a corporate donation. If you ever need assistance from South Texas College, please do not hesitate to call us. We greatly appreciate your support in this very worthy cause. Sincerely, Signature Business Office “Count on Satisfaction” 9. Grants CREATING A GRANT • Fund – Left blank (Business Office will assign fund code) • Organization – Grant Compliance: 143000, Carl Perkins Grant Compliance: 142000, 600010 The Institute for Advanced Manufacturing • • • • Program Financial Manager Principal Investigator Form MUST be completed in full CREATING A GRANT BUDGET • Grant Fund – Left blank (Business Office will assign fund code) • Organization – Grant Compliance: 143000, Carl Perkins Grant Compliance: 142000, 600010 The Institute for Advanced Manufacturing • Program • Revenue Budget – Total budget in corresponding category • Expenditure Budget – In detail by account code • Form MUST be completed in full including ALL required signatures REQUESTING ACCESS TO GRANT FUND • Form BO – 7200 MUST be completed in full and submitted to the Business Office VIEWING A GRANT • FRAGRNT: F – Finance, R – Research A -Accounting, GRNT – Grant FRAGRNT 1. Enter Grant Number 2. Next Block Icon Question Which is the form used to view a grant? Grants Banner System (Non-Student Specific Grants) Financial Manager Inquiry Forms • FRIGITD - Grant Inception To Date Same as FGIBDST– Organization Budget Status (Form in Finance Module) • FRIGTRD - Grant Transaction Detail Form Same as FGITRND- Detail Transaction Activity (Form in Finance Module) FRIGITD 1. Enter Grant number 2. Enter Fund number 3. Next Block Icon FRIGTRD 1. 2. 3. Enter Grant number Enter Fund number Next Block Icon DATA EXTRACT FRIGTRD Enter Grant number Enter Fund code Next Block F8 to execute query – will display all transactions • View selected transactions only (TYPE Field) – INNI: Expenditures – BD01: Budget – PORD: Purchase Orders – JEXX: Journal Entries – E010: Mileage Encumbrance • • • • • Question What are E010 transactions? GRANT REQUISITION APPROVAL PROCESS Authorized personnel completes on-line requisition Purchasing Personnel will approve/disapprove requisition Financial Manager will approve/disapprove requisition Grants Office will approve/disapprove requisition Requisition will follow Purchasing processes GRANT TRAVEL APPROVAL PROCESS • Grant Travel forms and approval follow STC’s general procedures – Federal Limits – State limits Business Office “Count on Satisfaction” 10. Budget Transfers Account Codes Review 710000 Direct Expenditures (Operating) 730000 Travel Expenditures 740000 Capital Expenditures 770000 Construction Procedures for Budget Transfers Go to FGIBAVL form Type Organization & Account Code Click on OK Purpose of budget transfer : - Reallocate budget for future purchases - Cover negative balances Budget transfers are recorded within the same organization or 2 different organizations and different account codes. Review organizations for budget availability Review organizations for budget Availability (Continuation) Steps to prepare a budget transfer Determine organization & account code with sufficient funds (FGIBAVL), to either cover a negative balance or for budget allocation Prepare Budget Transfer form http://www.southtexascollege.edu/businessoffice/forms. html Submit form for approvals Send approved form to Business Office for processing Question Who’s signature(s) does a budget transfer require? Budget Transfer Request Form SOUTH TEXAS COLLEGE REQUEST FOR BUDGET TRANSFER Change No.: BOARD APPROVAL PRESIDENT APPROVAL ______ Increases in E & G Budget ______Reallocations within an organization or account codes of: ______ Changes resulting in increase in number of authorized positions Direct Expenditures Budget ($1,000 or over), ______ Change between fund groups Travel Budget ($1,000 or over), Capital Budget (all decreases and increases of $1,000 or over). 710000 Direct Expenditures 730000 Travel Expenditures ORGANIZATION NAME 740000 Capital Expenditures 770000 Construction ACCOUNT CODE ORGANIZATION CODE INCREASE DECREASE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10 $ - Total Document Amount $ - $ - JUSTIFICATION: Cover ( ) If you would like to be notified on the status of this transaction, please furnish e-mail address and/or phone number. Please check if this budge t transfer will decrease capital budge t. Financial Manager (Budget is being decreased) Date Vice-President Date President Date Entered by - Business Office Business Office Financial Manager's E-mail / Phone Number Board Minute Order Date Revised 06/2007 Budget Change No. BO-3500 Budget transfers approvals review Salaries and Benefits Financial Manager Appropriate Vice President President Increase to Budget Decrease to Budget Not Allowed Not Allowed Not Allowed Not Allowed Not Allowed Not Allowed Direct Exp and Travel Budgets Financial Manager Appropriate Vice President President Required Required Required Required $1,000 or above $1,000 or above Financial Manager Appropriate Vice President President Required Required Required Required $1,000 or above All Increase to Budget Decrease to Budget Capital Budget Increase to Budget Decrease to Budget Note: The above requirements pertain to the following Reallocation within an organization Reallocation within a organization series* Reallocation between organization series* * An organization series represents all the organizations assigned to the same financial manager. Business Office “Count on Satisfaction” 11. Payroll and Position Control Payroll, TimeForce and Position Control Staff Jawaly Coriano jcoriano@southtexascollege.edu Lucia Martinez lmtz@southtexascollege.edu Accountant 872-4674 Payroll Specialist 872-4604 Ana Maria Hodgson Budget/Position Control Specialist amhodgson@southtexascollege.edu 872-4608 Lidia Romo romol@southtexascollege.edu Payroll Assistant 872-4606 Nereyda Olivares njolivares@southtexascollege.edu Payroll Assistant 872-4629 Payroll, Timekeeping and Budget/Position Control Responsibilities The Payroll department is responsible for processing accurate and timely payroll functions for the college. Timekeeping staff manage the College’s time and attendance system (TimeForce). The Position Control department is responsible for controlling and monitoring the college’s salary budget. Payroll Process Responsibilities for Payroll Process NOE preparation (STC Departments) NOE review (HR) NOE Budget Control approval (BO-Position Control) Employee information in system (HR) Employee information in TimeForce (BO-Payroll) Employee timecard verification (Employee & Supervisor) Auditing and reviewing timecards & processing payroll (BO-Payroll) Payroll Notice will be emailed to Supervisor/Designee for immediate attention if an error found on timecard. • Timely transfer of funds to ensure availability on pay date (BO) • • • • • • • TimeForce setup The Office of Human Resources sets up all new employee finger templates for use of time clocks. Payroll Office sets up employees in TimeForce based on the “TimeForce Account Request” form submitted by Human Resources. Employees must call Payroll Office for online web access. Access to an STC network computer are necessary for reviewing and verifying timecard online. The department’s supervisor/designee must submit Form BO7710 to Payroll Office for removal of user when employee terminates employment. Question Who gives TF online web access? Employee Responsibilities Clocks in using either a time clock or online web access (https://timeforce.stcc.loc). Hours physically worked will be recorded on the date it actually occurred. Reviews timecard for missing punches causing total work week hours to be less than 40. BO-7700 must be submitted to supervisor/designee for all corrections made to the online timecard. Verifies online timecard. In the event employee cannot verify online timecard a printout of the timecard must be signed by the employee. Ensures supervisor checks off the “Supervisor” verification box. Supervisor Responsibilities All respective employees are set up under their department. Audits, enters missing punches from BO-7700 submitted by employee, enters absences, and verifies the employees online timecard. Time worked must be reported to the nearest quarter hour (1/4, 1/2, & 3/4). When entering a punch, “round punch” must be checked. Verifies that total hours worked by employee are not under 40 for each work week (monthly employees). Ensures all corrected punches have a BO-7700 form on file signed by the employee and supervisor for any changes to the online timecard. The BO-7700 form must be filed by the department and made available for audit purposes. Supervisor Responsibilities (CONT’D) Ensures that timecard verification is made by the due date (2 business days after the end of the pay period). If employee is not available to verify timecard, then the supervisor may print the timecard and verify as “supervisor” without the “employee’s” verification. A written statement explaining the reason the employee did not verify must be kept for audit purposes. Contact the Payroll Department if mass punch in needed. Mass punches are used to create the same punch for a list of employees (i.e. travel or attend special events-conferences, etc. and don’t have access to our clocks or online system). Supervisor Responsibilities (CONT’D) Ensures that overtime/straight time payments by employees has prior written approval from Supervisor, Vice President or Dean and President. Makes sure NOE’s for new hires, changes, and terminations are submitted timely to the Office of Human Resources. How to post an absence in TimeForce 1- Click on Enter Absence 2- Choose the day - click on it 3- Absence window will display - make sure about the date 4- Enter: the total hours a- Total Hours b- Type-use arrow to select sick or vacation c- Notes - write the Note from the form d- Press Enter 5- Always recalculate the employee’s Timecard Example 1 3 2 Example (cont’d) 4 a b c enter d 5 How to post a punch in TimeForce 1- Click on Enter Punch 2- Choose the day - click on it 3- Punch Properties window will display - make sure about the date 4- Enter the punch - always should be rounded a- Notes - write the Note from the form b- Press Submit 5- Always recalculate the employee’s Timecard Example 1 2 Example (cont’d) 4 3 a b 5 BUDGET/ Position Control Introduction • Objectives – Discuss Budget/Position Control Specialist duties related to Notice of Employment (NOE) approval and salary budget transfers – Review the Position Control Transfer Form – Explain how the HR Module affects the Finance Module BUDGET/Position Control Duties • Approve position funding on NOEs • Process Position Control Transfers • Provide position balances – Pools – Salary Savings • Adjust position’s labor distribution – Fund/Organization Effect of overtime on balances • An organization’s available balance is reduced by the amount of overtime earned by staff. • Consider future overtime expenditures when hiring new personnel and transferring funds. NOE fo rm Question An organization’s available balance is reduced by the amount of _________________ earned by staff, which must be considered when hiring new personnel and transferring funds. Funding source information needed • Indicate how position will be funded by providing a position number. – Direct Wage Pool or Salary Savings • If position will be split funded, or funded by a grant, use the “Split Funded” option: – Provide Percent Distribution, Fund Code and Organization Code for each funding source – Provide the Pool or Salary Savings position number(s) • State the total amount of funding needed • Obtain Financial Manager Approval • Incomplete NOEs will be forwarded back to the department Funding Source Examples 841184 8.50 Financial Manager 15 12 1,530.00 10/20/08 841184; 841423 50% 110000 320004 8.50 Financial Manager 10/20/08 50% 15 110000 12 410013 1,530.00 Financial Manager 2 10/20/08 Incorrect Funding Source Example 100% 110000 410013 8.50 Financial Manager 10/20/08 15 12 1,530.00 No e fo rm-partn e rshi p &i n dustri al trai ni n g Revisions to funding source Obtain copy of original NOE and make revisions in red ink. Initial and date revisions Financial Manager Limit number of revisions to original NOE to one or two. Position Control Transfer Form Purpose To transfer only salary funds between positions To clear salary deficits To replenish pools Usage When assignment will be funded differently than stated on the NOE As requested by Financial Managers Completed by Budget/Position Control Specialist and forwarded for approval signatures Position Control Transfer Form HR Module effects on Finance Module • Changes made in the HR Module are reflected in the Finance Module on a monthly basis – Budgeted amounts – Payroll feeds – Encumbrances Business Office “Count on Satisfaction” 12. Student Accounts Receivable Accounts receivable staff Marittza Adame –Accountant mmadame@southtexascollege.edu 872-4612 •Federal & State Financial Aid Maribel Medina– Collection Specialist mmedina@southtexascollege.edu 872-4624 •Uncollectible Accounts •Emergency Loans Norma Ibarra– Accounting Assistant naibarra@southtexascollege.edu 872-4658 •State, Private & Local Accounts •Scholarships •Contract Instruction Ruby Melgoza – Accounting Assistant rmelgoza1@southtexascollege.edu 872-4657 •Federal Accounts •Exemption & Waivers Sonia Elizondo – Accounting Assistant srelizondo@southtexascollege.edu 872-4676 •Continuing and Professional Education •Agency Accounts •Dual Enrollment Office Fax # 872-4647 Accounts Receivable Office Responsibilities Maintains third party contract and scholarship accounts, which consist of academic, workforce training and continuing education students as well as agency accounts. These accounts are categorized based on the funding source: federal, state, local and/or private. •Review – verify that student account complies with contract •Reconcile - Third party account balances •Collect - Bill entity for payment of benefit award Send statements Phone contacts •File originals/pertinent documentation, etc. AR re sp o nsi b il i tie s P ayme n t p ath Payment Types Upon registering, the student should know whether he can pay his student account in full by means of : • • • • • • Cash, check, or credit card Third Party Financial Aid Employee Waivers & Exemptions Emergency Loan Installment Plan What is a Third Party Payment Agreement? 3 r d p arty p ayme n t A third party agreement constitutes a written enforceable agreement between the student and a third party entity. The third party agrees to pay a fixed amount or a percentage of the student’s tuition, fees, and/or other specified items. • There are currently 4 types of third parties. Who are the Third Parties? Federal Agencies Private Agencies State Agencies Local Agencies 3 r d p arti e s For a listing of the most common Third party Assistance Programs See STC 2009-2010 Student Handbook pages(61-75). Question How many third parties do we have? Types of Third Party Payment Agreements Contract An agreement between a student and a third party which states the third party agrees to pay a dollar amount or percentage of the student’s tuition and/or fees. Scholarship Financial aid awarded to a student by a college, agency or special interest group. Waiver An STC agreement to relinquish claim for payment from a student for a specific charge. ) Exemption An STC agreement to free a specific student from an obligation required of others, for example, payment of tuition. Question What is a scholarship? Payment Process (Student) The flowchart below details the steps a student should complete when the Third Party method is chosen. Student goes directly to the entity of his/her choice Student applies with entity representative Entity will provide STUDENT or STC with signed written agreement P ayme n t me th o d If applicant meets the sponsor’s eligibility criteria, A written agreement will be prepared by the corresponding party. ** No verbal agreements are accepted. All agreements require documentation. Payment Process (Financial Aid) Student and/or entity forward written agreement to Financial Aid Office. FINANCIAL AID OFFICE Reviews written agreement specifications Processes benefit award amount Forwards agreements to the Business Office Provides statement of account to student on outstanding charges, if applicable Payment Process (Business Office) Business Office invoices the Third Party Business Office reconciles monthly and follows up on unpaid balances. Business Office receives payment and credits third party account balance. P a y m e n t p r o c e s s The departments that can obtain written agreements are: W ri tte n agre e me nts Business Office Financial Aid Department – Academic enrollment Office of Instruction – Dual enrollment Continuing Professional Education Employee waivers & exemptions ● Employee Waivers cover some tuition costs for qualifying dependents and spouses. ● State Mandated Exemptions cover some or all tuition costs for qualifying student groups & employees. (Veterans Hazelwood Act, Blind-deaf-hearing impaired, TX Dept of Prot & Reg Services, Valedictorian) ● Application and proper documentation must be submitted to Financial Aid to review and award the students. ● Business Office prepare monthly management reports. Dual Enrollment Program for High School Students Du al e n ro l lme nt Dual Enrollment STC allows eligible High School students to enroll in college courses at a discounted rate. College credit earned upon successful completion of a course may be applied towards an Associate’s degree at STC or may transfer to another college/university. STC provides workforce development instruction to High School students through the Contract Training Dual Enrollment Program. This program allows students the opportunity to enroll in technical courses also at a discounted rate. Contract Instruction Dual Enrollment Emergency Loan Program The Emergency Tuition & Fee Loan Program is a short term - loan in which students are attesting to financial need and are loaned money to pay for a portion of their tuition and applicable fees. Therefore, this loan must be repaid. What does the student need to qualify for an Emergency Loan? • Be at least 18 years of age. • Be able to demonstrate ability to repay loan. • Be currently enrolled at least 3 credit hours. Proof of upcoming financial aid disbursement. Employer information Other source of payment • Must not be in default on any student loans. • Must not have an outstanding balance owed to STC. • Must provide 3 references. Name Address Telephone Number Emergency loans What does the student need to do to apply for the Emergency Loan? After registering for the current semester Lo an s (co n ti n ued ) Report to the Emergency loan Station (Financial Aid Office) to complete loan application. Verify account statement (receipt) to ensure loan award (payment) has been applied to the student’s account. Report to cashier station to pay the 50% initial down payment. Report back to emergency loan station (Financial Aid Office) to complete a promissory note for loan processing. Frequently Asked Questions Faq’s What should the student do if enrollment status changes? • Student must contact the Financial Aid Office to renew their promissory note due to an increase in credit hours. • If the student decides not to attend STC or wants to cancel the loan, he/she must submit a written request for cancellation to the Financial Aid Office prior to the first class day. • The student must follow Admissions withdrawal policies to ensure he/she is officially dropped from his/her classes. • If the student does not follow Admissions withdrawal policies, he/she will remain enrolled and will consequently incur a debt due to STC. • Class drops or withdrawals also affect students under Financial Aid. Student must contact the Financial Aid Office. Frequently Asked Questions Faq ’s (co n ti n u ed) When is the emergency loan due? The emergency loan must be paid back within the same semester. For example: The Spring 2010 Semester’s emergency loan due date is April 14, 2010. What if the student does not pay the emergency loan by the due date? •A $30.00 late fee will be assessed. •Also, registration and transcript holds will be placed on the students account. What if the student does not pay the emergency loan back? •He/she will not be able to register for any future semesters. •He/she may not receive credit for the semesters coursework and will not be able to obtain a transcript. •The student’s account will be sent to an outside collection agency and reported to the credit bureau. Continuing and Professional Education students and/or entity goes to CPE Department CPE W ri tte n agre e me nt (conti n ued ) Forwards Request For Student Award Form and agreement to Cashier’s Office Prepares and/or reviews written agreement specifications Prepares Request For Student Award Form, BO 5600 Cashier processes benefit award amount and forwards all documentation to the Business Office Agency Accounts Funds collected from students that must be paid to vendors for services. ● Voluntary Health Insurance- Columbian Life Insurance Company (Students may print out enrollment form available at STC website & pay at cashiers or make payment directly through insurance company website www.sas-mn.com) ● Low Risk Insurance ● Testing Fees (Nursing) ● Other Certification fees Business Office “Count on Satisfaction” 13. S.P.I.R.I.T. OFFICE STUDENT -PAYMENT INQUIRY, -RESOLUTION AND INFORMATION TEAM Pop Question? What does the acronym S.P.I.R.I.T. stand for? Student-Payment-Inquiry-Resolution-Team Staff Maribel Medina Collection Specialist Connie Lira Accounting Assistant Contact Information tra En Financial Aid Location Student Services Pecan Campus Bldg K1.912 e nc Hours o Do rs Monday-Friday: 8:00 a.m. – 5:00 p.m. Wednesday: 8:00 a.m. – 7:00 p.m. Stairs Walk-Ins Welcome Appointment (upon request) Contacts Cashiers Connie Lira Phone: (956) 872-2565 E-mail: clira@southtexascollege.edu Maribel Medina Phone: (956) 872-4615 E-mail: metrevin@southtexascollege.edu S.P.I.R.I.T. Office The S.P.I.R.I.T. Office, was by the Business Office on July 24, 2007. The intent of creating this office is to help ease frustrations on students who are experiencing billing and other related difficulties. We offer the necessary assistance to meet student’s need(s). The office is decorated with European Architecture in which it’s theme portrays a welcoming, peaceful, and private setting to help ease frustrations. Business Office Cashiers SPIRIT Office July 24, 2007 Accounts Receivable A Look Inside the Office Office Plan To facilitate students who feel like they have been given the “Run-Around.” • Ease their frustration by letting the student vent. • Offer solutions/options to help meet their need(s). To aid students who have billing issues/concerns and other related questions. Serve as a liaison and communicate with other departments in attempt to fix the issue. • Resolving the issue may require the involvement of one or more departments. • Immediate contact and communication with the appropriate personnel in each department is essential to ensure the proper action(s) is taken to resolve the issue in a timely manner. Follow-up with the student when the issue cannot be fixed “on-the-spot” and we monitor the account until the matter is resolved. Referrals Courtesy call BEFORE referring the student • Provide us the Student ID, and details of the situation Sometimes the problem can be resolved instantly • Saves the student time/frustration. • Allows us a chance to review the student account before meeting with the student. • We can prepare in advance to offer solutions/options to resolve the issue promptly. If the issue is not able to be resolved “on-the-spot,” we will request for the student to be referred to our office. • Student is to wait their turn outside the office if we are currently busy assisting another student. • Appointments are available upon request. Appointments work best for students who don’t have time to wait their turn and need to come back again. Question What is the first step taken before referring a student to our office? 911 Referrals Highly-Irritated Students • Are students who feel like they have been given the “run-around” and have attempted to fix the problem. Their attempt(s) in resolving the issue caused them to stress and become difficult students to handle. • Immediate Attention (Required)!! Contact the S.P.I.R.I.T. Office • We give the student our full attention and some privacy to discuss the issue. • We walk the student over to our office if student is in person and nearby. • Meet with the student on-the-spot so that we may offer solutions to resolve the issue. Privacy • Our office offers the adequate amount of privacy needed to handle the situation. • Calling us in advance is very important because we may already have a student in the office. If so, • We will make note of the students data, • Provide student with a waiting period time frame, and • Seat the student outside our office to wait and be called on for assistance immediately after the student who is currently being helped. Appointments (Available upon request) • If the student cannot wait, we will offer to set up an appointment for a later time/date. • Most highly irritated students want the problem solved right away and will not request an appointment for a later date. Common Inquiries Billing: • Balance • Disputes • Payment Options Payment: • Payment Arrangements • Payments over-the-phone Other Issues: • Dropped (for non-payment) • Higher-One • Given the “run-around” • Complaints • Prospect Students Holds Collections Students usually have more than one issue affecting their student account which requires the involvement of more than one department. Collection Specialist Statements of Account • Mails out reminder notices of outstanding balances • Contacts students with the intent to collect. • Research accounts whose mail was returned. Payment Arrangements • Offered to students who are at risk of being sent to collections. • Payment Arrangements are closely monitored for compliance • Students are contacted when they are not in compliance. Refers students to outside collection agencies • Provides agency contact information. Maintains billing history of uncollectible accounts. Collections Daily communication with external collection agencies to report adjustments and/or direct payments: • NCO • NRI • S&S Reports unpaid (uncollectible) balances to external collection agency. Reviews collection accounts being disputed. • An appeal may submit an appeal to the Conflict Resolution Center. • The Appeals Committee will vote and determine the final outcome. Department Goals SPIRIT Office Provide a direct reliable resource which students may utilize to expeditiously resolve his/her issues. Payment discrepancies, alternative payment arrangements, or specific financial concerns are addressed. Commit the availability of professional skilled personnel to research and analyze student account inquiries. The issues are resolved through the collaboration of various interrelated campus departments (primarily Cashiers, Financial Aid, Admissions, or Ombudsperson). Student information is gathered from different areas as required. The team cooperatively assists in resolving and/or thoroughly explaining the student issue while reducing student “run around”. Business Office “Count on Satisfaction” 14. Conference Procedures Procedures for Revenue Generating Conferences and Other Events Where can I find these procedures? …on the Business Office Website. • http://finance.southtexascollege.edu/businessoffice/procedures.html Purpose • To establish proper steps that a College department must follow for a department held conference or other event. • When an auxiliary fund organization unit and associated budget will be created and revenue will be generated. Conference Coordinator • The department must identify one employee who will be designated as the department conference coordinator for purposes of these procedures. • The Coordinator must plan for each component necessary for hosting a conference or event. Items to be addressed by Conference Coordinator • Request and gain approval of conference • Coordinate Conference-related activities and identify the Conference location • Prepare budget and request for a general ledger organization unit • Purchase goods and services for the Conference • Execute contracts and service agreements • Processing registration • Cash handling and deposits • Recordkeeping and Reconciliations • Create a Conference website for registration and payment Question • Question: • Answer: Who is responsible Conference Coordinator for organizing and coordinating conference efforts? Request and gain approval of conference. • The department conference coordinator should gain approval from appropriate personnel. • Each division should develop guidelines on types of conferences beneficial to the College. • The purpose of the conference should be related to the College’s educational mission. Identify the conference location and develop guidelines. • Contact Operations and Maintenance Office to identify and reserve suitable location. • Develop conference guidelines regarding such issues as substitute attendees, refunds, cancellations, payment deadlines, etc. Prepare budget and request for a general ledger organization unit. • Use form BO-2610 to budget for anticipated revenue and expenses. • Determine that fee amounts, per Board of Trustee approved fee schedule, should be set to recover costs. A processing fee may be charged. • The fees should not be set to generate excess revenues to be used for other purposes. • All revenues generated are earmarked solely for the conference. • At the end of the fiscal year, unless the conference activities cross fiscal years, any revenue over expenses will be added to the auxiliary fund balance. Prepare budget and request for a general ledger organization unit. Continued • Obtain cost estimates for any goods and services. • Consideration should be made for facility/meeting space rental, meals and hospitality coffee breaks, audio visual equipment, supplies, promotional items, advertising, printing, postage, copying, transportation, food purchases, equipment rental, vehicle use, speakers’ honoraria and expenses, etc. • All expenses directly associated with the conference must be charged to the conference organization unit. Prepare budget and request for a general ledger organization unit. Continued • Form BO-2600 • Used to setup Conference auxiliary fund and organization code • All approvals must be complete • Submitted with form BO-2610 Question • Question: What form is submitted to the Business Office after the event? • Answer: Form BO-2620 Conference Financial Report. To be submitted no later than 30 days after the end of the conference. Prepare budget and request for a general ledger organization unit. Continued • Form BO-2610 • Used to setup budget • Plan or project revenue & expenses • Identify additional funding sources Prepare budget and request for a general ledger organization unit. Continued • • • • The budget must be developed and submitted to the Business Office along with the Request to Create a Conference Organization Unit (Form BO-2600). The accounts in the auxiliary fund are selfsustaining. The conference should generate sufficient funds to cover all its expenses. The budget and the request for an organization unit forms must be submitted to the Business Office at least 45 days prior to the conference/event. Purchase goods and services for the Conference. • Pre-planning for purchase of goods is key. • Please take into consideration the amount of time that is needed to prepare the requisition and place the order. • Some purchases or services require prepayment. In these cases, additional time is required since checks are processed only once a week. • The check cycle is available on-line under the Business Office Accounts Payable webpage. • Goods and services acquired must comply with College’s policies and procedures. Execute contracts and service agreements. • All contracts and agreements must be prepared and executed in accordance with College policies and procedures. • The Purchasing Office must be consulted from the onset regarding any contracts or agreements. Processing Registration • Procedures for the registration process must be developed by the department conference coordinator and reviewed by the Business Office. • The registration forms must include the organization unit of the event. Cash Handling and Deposits • The department conference coordinator must read and understand the Business Office cash handling procedures. • These procedures are available at the Business Office procedures webpage. • The department conference coordinator and other responsible parties must attend the cash handling training course conducted by the Business Office. Recordkeeping and Reconciliation • • • • • The department conference coordinator is responsible for maintaining a record of all revenues and expenses and for reconciling all activities with the Business Office at the end of the event. The department conference coordinator is responsible for submitting a conference financial report (Form BO-2620) at the end of the event to their immediate supervisor and to the Business Office. The report is due no later than 30 days after the end of the conference. The department conference coordinator is also responsible for establishing a budget for the next fiscal year if the Conference is recurring. Conference accounts may be audited in the same manner as all other accounts are audited at the College by internal or external auditors. Create a Conference website for registration and payment. • A website may be created to announce the Conference’s activities, including registration and payment. • A shopping cart styled Market Place site or Upay feature can be integrated into existing conference websites. • Site may be configured to capture payments and registration information. Recap of Coordinator Responsibilities • • • • • • • • • • Department conference coordinator Obtain approval from appropriate immediate supervisor, financial manager and Vice President to hold the Conference. Request an organization unit from the Business Office (Form BO2600) Prepare a budget and submit to the Business Office so that the budget may be posted on the organization unit (Form BO-2610). Prepare a conference financial report after the Conference (Form BO-2620). Reconcile the financial activities with the Business Office. Read and understand the Conferences and Other Event Procedures. Attend the cash handling course, if applicable. Read and understand the Fundraising Procedures, if applicable. Read and understand the Donation Procedures, if applicable.

![Career Center 5 English [005] .indd](http://s3.studylib.net/store/data/008252861_1-a505cad1ddf780a5cb1005da866a969e-300x300.png)

![[PowerPoint 2007] presentation file](http://s2.studylib.net/store/data/005406460_1-7834316c409f9802f7aec3d8538324fb-300x300.png)