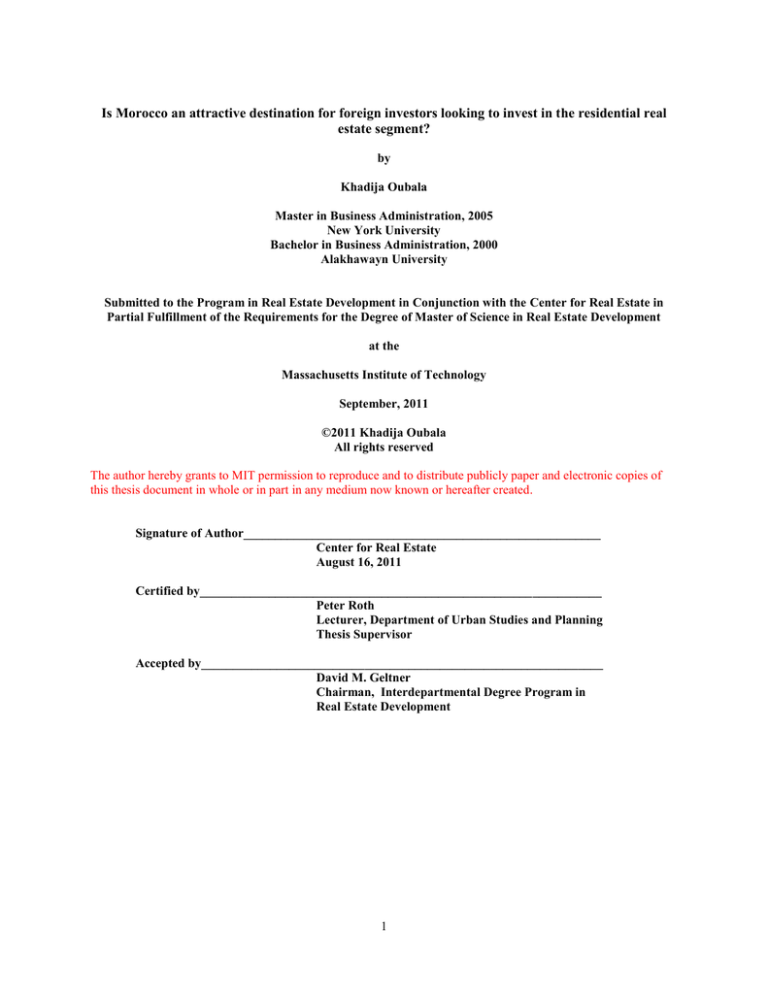

Is Morocco an attractive destination for foreign investors looking to... estate segment?

advertisement