Thomas Jungbauer January 11, 2016 Matching and Price Competition with Multiple Vacancies ∗†

advertisement

Matching and Price Competition with Multiple Vacancies

Thomas Jungbauer∗†

January 11, 2016

Please check for a revised version @

www.kellogg.northwestern.edu/faculty/jungbauer

∗ PhD

candidate of Managerial Economics and Strategy at the Department of Managerial Economics and

Decision Sciences (MEDS) and the Strategy Department, Kellogg School of Management, Northwestern

University.

E-Mail: t-jungbauer@kellogg.northwestern.edu

† First and foremost I would like to express my gratitude to my dissertation committee Peter Klibanoff, Nicola

Persico, James Schummer and Rakesh Vohra for their time, effort and mentoring. I am also thankful

for comments in alphabetical order by Nemanja Antic, Lori Beaman, Nicola Bianchi, Eddie Dekel, David

Dranove, Georgy Egorov, Jeff Ely, George Georgiadis, Soheil Ghili, Thomas Hubbard, Daniel Martin, George

Mailath, Mike Powell, Mark Satterthwaite, Matt Schmitt, Rainer Widmann and everybody I forgot to

mention. Finally, I am grateful to my early advisor at Northwestern University, Dale Mortensen.

Abstract

This paper analyzes the effects of firm-size variation on the performance of central

clearing houses in high-skill labor markets such as the markets for medical interns

in Canada and the US. I find that strategic wage setting in centralized markets

governed by a deferred acceptance algorithm does not result in assortative matching. While firms compete with others of similar quality within market segments,

large firms face additional incentives to diversify their bidding behavior. As a

consequence, large firms tend to offer lower wages in expectation than their smaller

competitors. As for the distribution of surplus, firms gain from the introduction

of a central clearing house compared to a competitive outcome. These additional

profits are bought at the cost of workers, who earn wages well below the competitive

level. Finally, I show that in equilibrium firms do not gain from offering different

wages for different slots. Thus strategic wage setting in the presence of a central

clearing house is compatible with absence of wage variation within firms.

JEL-Classification: C78, D44, I11, J31, J44, K21, L44

1 Introduction

When a decentralized high-skill labor market switches to a central clearing house,

what are the consequences for welfare, profits, and wages? As an example of a central

clearing house, consider the National Resident Matching Program (NRMP), a non-profit

non-governmental organization allocating medical graduates to residency programs in

the United States since 1951. Preferences of hospitals and residents are solicited and

then a match, stable with respect to reported preferences, is found and implemented.1

An antitrust lawsuit filed in 2002 argued that the NRMP adversely affects wages and

working conditions of resident physicians.2 Although the suit was dismissed after heavy

political intervention, and the NRMP eventually granted immunity, questions remained.

What can economic theory tell us about the outcome of this process? Are the gains

from matching actually split in a way that is adverse to the workers?

The matching literature is well-established, of course, but to the extent that the question

of splitting the gains from matching has been addressed, the prices that split the gains

from matching have been primarily determined through a “competitive equilibrium”

type approach. That is to say, after an allocation has been identified, equilibrium prices

(wages) are imposed. Equilibrium prices are those that satisfy some kind of stability

conditions.

To analyze, however, whether a market fosters anti-competitive outcomes, it takes a

model where prices are formed by agent behavior. Bulow and Levin [2006] innovate in

1 The

currently used matching algorithm is described in Roth and Perranson [1999]. For an extensive treatment

of the NRMP and its history see Roth [1984], Roth and Sotomayor [1990], Roth [2002] and Roth [2003].

2 The punch line of the claim reads a follows:“Defendants [hospitals and NRMP] and others have illegally

contracted, combined and conspired among themselves to displace competition in the recruitment, hiring,

employment and compensation of resident physicians, and to impose a scheme of restraints which have

the purpose and effect of fixing, artificially depressing, standardizing and stabilizing resident physician

compensation and other terms of employment.”

1

this sense by featuring strategic wage setting in a clearing house model. Firms and

workers are both characterized by their quality. Each firm can only hire a single worker.

A firm’s output is the product of its quality with the quality of the worker it is matched

to.3 Firms prefer higher quality workers over lower ones and workers care exclusively

about their wages. Firms simultaneously announce wages and workers submit their

preferences in response. Then–using the deferred acceptance algorithm–a match is

found.4 Bulow and Levin [2006] find that in equilibrium firms offer wages that are

below their competitive level. In particular, the wage function is more compressed

compared to the wage function in any competitive equilibrium. This compression is

the result of localized competition, an equilibrium phenomenon whereby firms end up

competing with a relatively small subset of similarly-productive firms, as opposed to

competing with the whole set of firms in the market. However, the efficient (assortative)

allocation still obtains.5

I introduce a tractable model of competition among multi-unit firms combining strategic

wage setting with many-to-one matching. Firms post wages for each of their vacancies.

Workers submit their preferences of firms. Then, better workers are matched to firms

offering higher wages. The model yields a rich set of implications regarding the market

structure, conduct and performance. There are two main classes of implications: first,

if the market becomes more concentrated, wages decline. This is a direct consequence

of the lack of wage competition within a firm. Second, the efficiency of the outcome

depends on firm-size6 variation. Welfare loss is more severe–everything else equal–if

3 See

Bulow and Levin [2006] for an argument that the form of the production is innocuous as long as both

arguments exhibit increasing marginal products.

4 The worker- and firm-preferred outcomes coincide when there is perfect complementarity in the market.

5 This is true modulo risk introduced by mixed strategies.

6 As for readability, I refer to firm size as the number of vacancies throughout the paper.

2

there is higher correlation between firm quality and size.

The underlying mechanism at action–not present in the one-to-one setting–is that on

average, smaller firms pay higher wages and therefore hire better workers.7 The force

driving this result is quite robust: when bidding for a vacancy a firm rivals the rest

of its own vacancies. A larger firm is thus more likely to “steal” high quality workers

from itself when compared to a small firm. I call this force internal rivalry. The same

force, by the way, implies that firm mergers tend to lower market wages.

The fact that large firms bid less for workers has far-reaching consequences for efficiency

and for surplus distribution. The asymmetry in bidding behavior causes larger firms

to hire worse workers than smaller firms of similar quality. If the size differential is

substantial, this even holds true when the large firm is of significantly higher quality

than its smaller competitor. As a result, the outcome suffers from local inefficiencies.

While all firms gain from the introduction of a central clearing house when compared

to any competitive equilibrium, welfare loss is entirely born by the workforce.

The model yields a number of additional results. First, despite large firms hiring worse

workers, equilibrium wages are such that profits are increasing in firm size. Second,

although adding a worker to a firm always results in additional profits, the added profit

per worker decreases.8 Third, higher quality firms —holding firm size fixed— accrue

more profits. Since they can produce more with the same input, they outbid their

inferior competitors to hire a better set of workers.

7 This

result about matching markets governed by a clearing house stands in stark contrast to theoretical

and empirical findings concerning large decentralized markets. Numerous contributions in the labor market

literature show that larger firms tend to pay higher wages [see e.g. Krueger and Summers, 1988].

8 This suggests that a model with vacancy posting costs should find an optimal number of workers when

holding the market environment fixed.

3

I identify the entire set of Nash equilibria for the model. Across the equilibrium set,

the average wage within each firm is constant and efficiency is constant as well. An

interesting feature of all the equilibria is that a firm’s best response always contains a

strategy in which the firm offers the same wage to all its workers. This finding relates

to real world concerns about wage inequities. It is generally believed that firms in

high-skill labor markets prefer not to wage-discriminate between their workers at the

entry level. Equal wages avoid tension within the workforce and protect from potential

legal action. Also, firms might find themselves haggling with job candidates once a

discriminatory wage policy becomes common knowledge. By definition, the multitude

of one-to-one matching models can not take on this phenomenon. Within firm wage

variation cannot be analyzed in a model which restricts firms to hire a single worker.

My results suggest that paying equal wages when a central clearing house operates the

market comes as a benefit to the firm without any associated costs. As a consequence,

absence of wage variation is a result of this paper rather than an assumption.

As for the generality of results, the findings in this paper do not only apply to the

NRMP but to centralized high-skill labor markets in general. The crowding out effect

within the firm, which I call internal rivalry is a more general phenomenon. It applies

whenever agents bid strategically for non-unit amounts of items. As a consequence, the

formal results of this paper extend to multi-unit auctions, contests and tournaments.

What follows is a brief characterization of the relevant literature. Section 2 introduces

internal rivalry and its effects by means of a numerical example. Sections 3 and 4

characterize the general problem, its solution and properties of equilibrium. Section

5 deals with the distributional consequences of my findings and section 6 shows that

firms do not prefer to wage discrimination over paying equal wages to the all incoming

4

workers. Section 7 concludes. Proofs not found in the main text are provided in the

appendix.

1.1 Background and related literature

The prominence of centralized matching algorithms stems primarily from their success in

stemming unraveling. Many decentralized high-skill labor markets tend to unravel, that

is, for employment negotiations to take place earlier and earlier relative to hiring date.9

Unraveling may lead to exploding offers and other disorderly hiring behavior which

may hurt efficiency. A central clearing house eliminates the unraveling by replacing

the strategic back and forth with an instantaneous allocation decision based on market

participants’ preferences. The consequences for the distribution of surplus among

market participants, however, are not well understood.

Gale and Shapley [1962] pioneer the study of stable outcomes in two-sided markets

and introduce a mechanism–called deferred acceptance–which always selects a stable

allocation. This early matching literature focuses on stability and efficiency. A second

generation of papers adds a focus on surplus distribution by introducing prices (wages).

Among others see Crawford and Knoer [1981], Kelso and Crawford [1982] and Hatfield

and Milgrom [2005] for a comprehensive treatment.

Kamecke [1998] introduces an early model of the NRMP with endogenous wage formation. In his model, hospitals sequentially set wages. After each round, hospitals

which have already specified their wage are allowed to withdraw from the centralized

mechanism to respond to unexpected offers by competitors. He finds that whereas

9 Unraveling

is also observed in other types of markets. For a detailed discussion of market unraveling and its

driving forces as well as an abundant collection of examples see Roth and Xing [1994].

5

the resulting allocation is efficient, wages fall significantly short of the competitive

level. Crawford [2008] innovates by introducing worker-specific wages and showing that

efficiency and competitive wages can thus be restored. Artemov [2008] analyzes the

effects of reporting errors under such a regime and shows that relatively small errors

may lead to highly distorted wages. Niederle [2007] shows that the low-wage equilibrium

of Bulow and Levin [2006] ceases to exist if firms have an option to personalize offers.

Niederle [2007] also argues that centralization may not be the driving force behind wage

compression. Agarwal [2015] indicates that firms’ capacity constraints, coupled with

medical graduates’ willingness to pay implicit tuition for desirable residency programs,

leads to compressed salaries. Kojima [2007] provides an example which shows that

non-unit and varying capacities of hospitals might not imply all workers to earn lower

wages in the match than in competitive equilibrium.

2 A numerical example

2.1 Equal wages within firms

Firms set wages simultaneously for all of their vacancies and then better workers are

matched with better paying jobs. Consider first a one-to-one setting in which every

firm is restricted to hire a single worker. In the unique wage setting equilibrium firms

compete only with firms of similar quality as opposed to market-wide competition.

Bulow and Levin [2006] provide a baseball analogy to explain the intuition behind this

localized competition: “...the Yankees have an easier schedule than the Tampa Bay

Devil Rays because they face all the same opponents, except that the Yankees get to

play the Devil Rays and the Devil Rays must play the Yankees.” Translated to the

matching model, good firms draw more benefit from competing with any set of firms

6

than weaker firms. Thus, the set of firms they compete with in equilibrium is similar

to themselves. This intuition–ceteris paribus–persists in a world in which firms have

multiple vacancies. However, another dimension, non-existent in the one-to-one setting,

comes into play. Provided below is a stylized numerical example of multi-unit firms. At

first, I will restrict firms to set a single wage for all its vacancies. Then, this restriction

will be lifted. The presentation of the general model follows the same path.

Before characterizing the equilibrium of a numerical example with three firms, I lay

out the basic idea of internal rivalry with two firms of equal quality. Firm 1 enters

the market with a single vacancy whereas firm 2 is interested in hiring two workers.

Consider both firms setting a wage w for one of their vacancies. Holding the behavior

of other market participants fixed, every firm faces a distribution over expected worker

quality given its wage offer. If firm 2 sets the same wage for its second vacancy, its

expected profit per vacancy at wage w declines since firm 2 cannot hire the best worker

available at wage w twice. Since larger firms are more likely to steal workers from itself,

in equilibrium they randomize over wider intervals than smaller firms. The maximal

wage offered by a firm, however, is independent of firm size. As a consequence, holding

quality fixed, larger firms pay lower wages than their smaller competitors in equilibrium

and thus, hire lesser qualified workers on average. In other words, if a large firm outbids

its smaller competitor, the former gains a small amount of better human capital but is

forced to up its wages for each of its workers. The latter, however looses relative more

human capital than the large firm gains and only benefits mildly from paying lower

wages to its small workforce. Thus, in equilibrium the small firm might outbid the

large one creating a better outcome for both firms. As a consequence, market efficiency

suffers and the burden is necessarily shouldered by workers.

7

In a two-firm model both firms have a single competitor. Thus, when optimizing, they

have to cover the same interval of wages. While this does not contradict the results of

this paper, it does not reveal the full story. Thus, I introduce a third firm to provide

an insightful numerical example. Let qm be the quality of firm m and sm its size.

Moreover, define a worker’s quality simply by her index and assume the number of

workers in the market to equal the number of total vacancies. Consider a problem

in which the firm’s quality is its index, i.e. qi = i, and assume firms 1 and 2 to have

a single opening whereas firm 3 has three. Firms compete for workers 1 through 5.

Initially, firms announce each a single wage simultaneously. Workers observe the wages

and are then allocated such that if the firm posting the highest wage has l openings

the top l workers will be paired up with this firm and so on and so forth.10

Observe first, that there cannot be a pure strategy equilibrium. Also there is no range

of bids b in equilibrium of the wage setting game at which firm 1 competes with the

other two firms since its required probability density to be indifferent over such an

interval would be negative. Thus, consider a price range over which only firms 2 and 3

are competing. To render each other indifferent, firm 3’s probability distribution over

bids is

1

s3 ·q2

=

1

6

and 2’s

3 has still 1 − 16 · 3 =

1

2

1

s2 ·q3

= 13 . Thus, the length of this segment has to be 3. Firm

of its bidding mass available and thus competes also with firm 1.

This competition has to take place at lower bids since otherwise firm 2 would join and

firm 1 drop out consequently. Firm 3 bids with a density of

the length of this interval is 1.5, leaving firm 1 with

10 As

1

2

1

3

as does firm 1. Thus,

of its bidding mass, which will

a tiebreaker assume workers to be assigned to the best firm bidding a particular wage. This mechanism

satisfies the properties of a deferred acceptance algorithm as discussed earlier. Due to perfect complementarity the worker-preferred and firm-preferred outcomes are identical. In fact the modeling approach is quite

robust. While it was designed to model a deferred acceptance algorithm, it is also compatible with serial

dictatorship by firms when wage-setting is the simultaneous tournament to decide succession and serial

dictatorship by workers when quality determines succession. For an alternative interpretation and way of

modeling wage formation in a centralized matching market see Kamecke [1998].

8

Gi

1

.5

G1

G3

G2

1.5

4.5

b

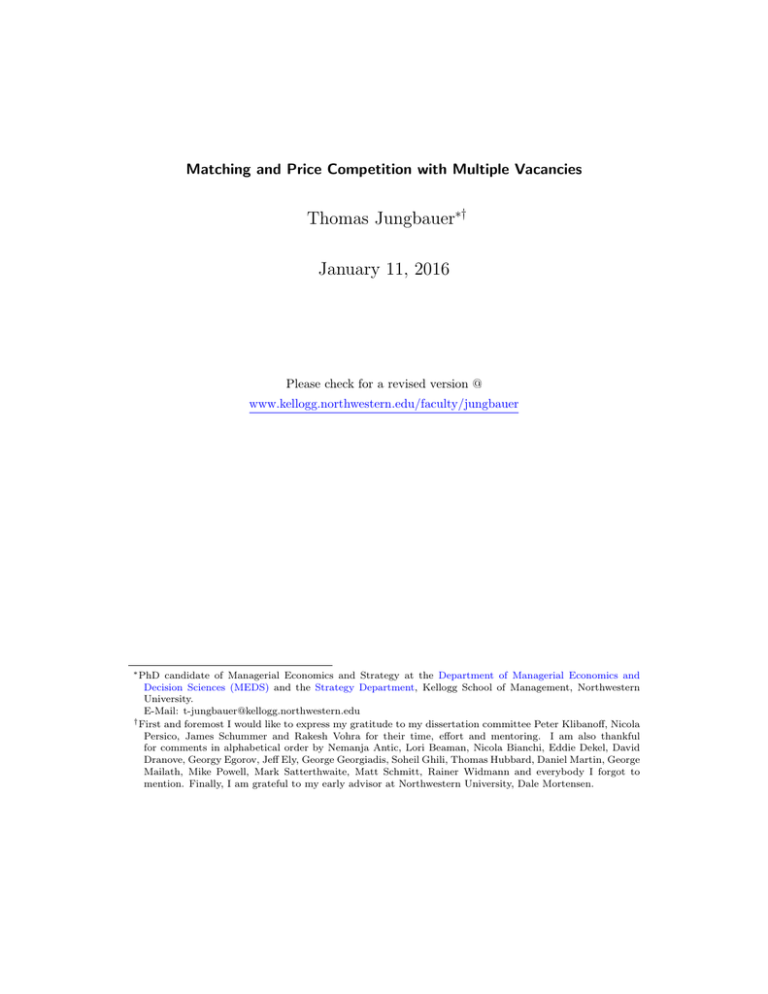

Figure 1: Cumulative densities over bids in the numerical example

be its atom at the worker outside option of 0. The graph below shows this strategies in

terms of cumulative densities of bids in equilibrium.

A brief glance at Figure 1 reveals that firm 2 outbids 3 in expectation and expects

to hire worker 5 whereas firm 3 hires workers 2, 3 and 4. Thus, the equilibrium

does not only introduce inefficiency by randomness due to mixed strategies but is

truly inefficient in expectation. Expected wages of workers can be calculated to be

be (w1 , ..., w5 ) = (.31, 1.62, 1.88, 1.94, 3.25) The lowest wages that support the unique

(assortative) competitive equilibrium allocation are (w1C , ..., w5C ) = (0, 1, 3, 5, 7).11 While

worker 1’s wage increases in the match when compared to competitive equilibrium all

other wages decrease. In fact, the average wage decreases by approximately 44%12

whereas at the same time average firm profit increases by 16%.13 Figure 2 below again

11 Section

5 discusses why firm 3 does not offer equal wages in competitive equilibrium.

the single worker replica of a model with multiple vacancies as the one-to-one matching model where

each vacancy keeps its quality but every firm demerges into single entities. When looking at the single

worker replica of this model and comparing it to competitive equilibrium the average wage only decreases

by around 33%.

13 In terms of efficiency an interesting benchmark –in particular in small markets– can be derived from a

random allocation model, consider a draft which calls upon vacancies in random order. Let W Fi be the

expected welfare for i = (M E, CE, RA), where ME=matching equilibrium, CE=competitive equilibrium

M E −∆RA

and RA=random allocation. Then ∆RA = ∆

indicates the fraction of potential welfare possible

∆CE −∆RA

over a random allocation realized in the match. For the numerical example above ∆RA = .4 whereas

for its single worker replica ∆RA = .95. This indicates the potentially significant differences in expected

12 Define

9

Firm 3

Firm 2

Firm 1

0

1.5

4.5

b

Figure 2: Bidding supports in the numerical example

visualizes that the expected allocation is inefficient (not assortative).

2.2 Wage discrimination within firms

Consider the above described problem and now lift the restriction of equal wages within

firms. Since a pure strategy equilibrium is still infeasible, we would expect negligible

inefficiency due to randomness of equilibrium but better firms to hire —on average—

better workers due to their dominant value creation process. This intuition, however,

is flawed. Suppose firms 1 and 2 to stick to their strategies and consider firm 3’s best

response. Since firm 3 does not compete with itself, consider it to offer the maximal

market wage of 4.5 for each of its vacancies. Its resulting payoff is

3 · (3 + 4 + 5) − 3 ∗ 4.5 = 36 − 13.5 = 22.5,

(1)

which doesn’t come as a surprise since this is exactly the payoff achieved by setting

any wage between 0 and 4.5 for all its vacancies. It is straightforward to verify that

firm 3 earns the same profit for any combination of bids within 0 and 4.5. As a result

the non-discriminating matching equilibrium presented above persists when firm 3 is

performance when one considers firms with multiple vacancies.

10

allowed to set different wages for its vacancies. Since the intuition presented under equal

wages within firms does not apply here, this finding has to be put into perspective.

The reason why firm 3 does not do better with differentiated prices is as follows. If

firm 3 bids for all its vacancies above 1.5, it appears that all three of its vacancies have

a shot at hiring the top worker. This intuition, however, is deceiving. Upon relabeling,

firm 3’s second and third vacancy do only compete for the second respectively third

best worker due to rivalry within the firm. In equilibrium, firm 3 has to be necessarily

indifferent between bidding in the top bracket and bidding below for all of its openings.

Additionally, firm 3 is equally well off when splitting the bidding of its vacancies over

the entire interval. One can observe that there are multiple discriminating equilibria.

In order to keep firm 2 indifferent over the interval [1.5, 4.5] firm 3 bids with a total

density of

1

2

over this interval, whether it does so with two vacancies and densities of

over disjoint intervals or with all three of them and a density of

1

6

1

2

for each of them. An

analogous condition has to hold for competition of firms 3 and 1 over [0, 1.5]. Firms 1

and 2 randomize as before. Whereas the expected allocation might vary depending on

equilibrium selection, efficiency, profits and the average wage offered by each and every

firm do not.

3 The model

3.1 The multiple vacancy problem

The agents in a multiple vacancy model are M firms and N workers. Every firm m is

characterized by a pair (qm , sm ), qm denoting its quality and sm its number of vacancies

11

(firm size). Worker n’s quality is simply defined by her index n.14 The total number of

job-seeking workers is assumed to equal the total number of vacancies in the market.

This assumption has no bearing on the interpretation of results and is purely employed

to increase the transparency of the model.15 Since rearrangement is always possible,

firms are ordered according to their quality, i.e. m > l ⇒ qm ≥ ql . Throughout the

paper production of a worker n at firm m will be the product of their qualities qm · n

16

and total firm production is additive.

Definition 1. A multiple vacancy problem is how to allocate N workers, defined

by their index, to M firms, each defined by its quality qm and size sm (number of

vacancies) when production of firms and workers is multiplicative and the market of

vacancies and workers is balanced.

Due to increasing marginal products of both firms and workers, the efficient allocation

of a multiple vacancy problem necessarily results in assortative matching. Allocation

14 Both

magnitude and distribution of worker qualities are inessential for qualitative results as long as no

consecutive pair of workers exhibits a significant relative quality differential. The exact crucial differential

is hard to pin down due to the number of possible permutations of firm size but the restriction becomes

negligible when the number of firm grows. Without this restriction, results as presented in Kojima [2007] are

possible. Kojima [2007] was the first to introduce the multiple vacancy idea into this literature. He shows

that wage compression does not necessarily persist in general if firms hire a different number of workers.

This is true if there is a pair of consecutively ranked workers exhibiting a significant difference in quality.

This potentially causes some workers to earn wages in excess of the competitive level in the match, in

particular if the market is very small. I rule out large gaps in quality between consecutively ranked workers

to circumvent this problem which becomes quickly negligible, even in fair sized markets. It is noteworthy

that this assumption exclusively affects results about surplus distribution.

15 Restriction of the number of workers to equal the number of open seats in the market simplifies analysis. It

rules out both excess demand and excess supply of workers. All allocation mechanisms analyzed in this

paper would be affected by a relaxation thereof in the same way. In expectation, excess demand leads to

the lowest ranked firms not filling their vacancies whereas excess supply causes the lowest ranked workers

to remain unemployed. While the first case causes a general increase in wages throughout the second case

implies the opposite. None of the qualitative results to follow are altered by relaxing this assumption.

16 Results are independent of this assumption as long as the production of a worker at a firm exhibits strictly

increasing marginal products in both arguments and the the firm’s total production is the sum of its

production with workers. The assumption of separability of the production function in workers is essential

for the result. The existence of non zero cross partial derivatives of production in workers’ qualities would

contradict the optimality of a deferred acceptance algorithm even in the absence of prices. For a matching

theory with non-separable production in the absence of a central clearing house see the O-Ring literature

around Kremer [1993]. I am thankful to Tom Hubbard for pointing this out to me.

12

of workers among firms with equal quality does not affect efficiency.

Remark 1. The efficient allocation of a multiple vacancy problem is assortative

and unique up to firms of equal quality.17

3.2 Matching equilibrium

As outlined in the introduction, this paper introduces a model of a centralized matching

mechanism with strategic wage formation. At first, I restrict firms to pay a single wage

to its incoming workforce. Workers’ preferences are independent of a firm’s quality and

are solely based on wages. Following Bulow and Levin [2006] the time line of events

is:

1. Firms engage in a simultaneous auction each posting a single wage which it

commits to pay to all incoming workers.

2. Better workers are matched with firms setting higher wages by a central clearing

house.

Firms’ actions in the simultaneous wage setting game are referred to as bids b to

preserve the notion of wages for realized outcomes. A strategy for firm m is a probability

distribution gm over bids b. Let Vm (·) be firm m’s expected payoff in the match.

Definition 2. A (non-discriminatory) matching equilibrium of a multiple vacancy

problem is a firm strategy gm for every firm m such that gm maximizes Vm (gm , g−m )

given the other M − 1 firms’ strategies g−m = (g1 , ..., gm−1 , gm+1 , ..., gM ).

Before matching equilibrium can be characterized, some of its features are established

ex ante:

17 See

the assignment game in Shapley and Shubik [1971].

13

Proposition 1 (Features of matching equilibrium). (a) There is no matching

equilibrium in pure strategies. (b) No bid b is offered by a only a single firm18 and (c)

P

some firm always bids arbitrarily close to 0. (d) Aggregate offering

sm · gm (b) is

m≤M

non-increasing in b. (e) There are no gaps in the support of a firm’s strategy and (f )

or, in the aggregate support of all firms. (g) No firm’s strategy can assign atoms except

at 0.19

If firm m bids b in equilibrium, b has to be an optimal choice, i.e.

dVm (b, g−m )

= 0.

db

(2)

Firm m’s expected profit from bidding b depends on the magnitude of b and its expected

rank among all firms’ bids. Let Gm (b) be the probability of firm m bidding below b

and Sm be the total vacancies of all firms i ≤ m. Then,

P

SM

Y

Vm (b, g−m ) =

Gi (b) · qm ·

j

SM −sm +1

Fi ∈F \Fm

Y

+

X

Gi (b)(1 − GM (b)) · qm ·

SM

−sM

X

SM −sM −sm +1

Fi ∈F \{Fm ,FM }

j

(3)

+ ...

+

Y

(1 − Gi (b)) · qm ·

sm

X

j

1

Fi ∈F \Fm

− sm b.

18 excluding

irrelevant measure zero cases;

of those properties are inherent to auctions with heterogeneous valuations and full information in

general or generalize their counterparts of the special case presented in Bulow and Levin [2006]. Thus, no

originality of their proofs in the appendix is claimed.

19 Many

14

Derivation of Equation (3) with respect to b reveals the following optimality condition:

Proposition 2 (Optimality condition). For all b in the support of firm m’s equilibrium strategy

X

si gi (b) =

Fi ∈F \Fm

1

.

qm

Proof of Proposition (2). If b is an optimal bid for firm m in equilibrium

(4)

dVm (b,g−m )

db

=

0. Thus,

dVm (b, g−m )

= qm s m

db

X

si gi (b) − sm

(5)

Fi ∈F \Fm

and as a result

X

si gi (b) =

Fi ∈F \Fm

1

.

qm

(6)

Propositions 1 and 2 imply that in a matching equilibrium every firm is randomizing

over an interval of bids:

Corollary 1 (Interval support). In equilibrium, supports are intervals, that is there

are bids bm and bm for all firms m ≤ M such that firm m randomizes over [bm , bm ].

As a consequence, firm m’s equilibrium behavior over [bm , bm ] is characterized by

X 1

1

1

1

−

,

gm (b) =

sm

|K(b)| − 1

qi

qm

(7)

i∈K(b)

which is the only solution to the system of equations defined by Proposition (2), where

K(b) denotes the set of firms competing at b. The expression within the square brackets

determines whether firm m is good enough to compete with the remainder of K(b).

15

Thus, the highest bid of a firm in equilibrium is independent of its size. After firm m

sterns this test, sm scales its bidding strategy, its probability density at b. This implies

that –ceteris paribus– bigger firms will randomize over wider intervals than smaller

firms. This confirms our intuition from the numerical example. To retrospectively

legitimize the matching equilibrium in the numerical example of section 2.1 observe

the following implication of Equation (7):

Corollary 2. If only two firms m and l are competing over an interval [b, b] in a

matching equilibrium, their respective strategies over this interval are gm (b) =

gl (b) =

1

sl qm

1

sm ql

and

for all b ∈ [b, b].

Thus, a firms strategy decreases locally in its opponents quality and its own size.

Smaller firms will therefore –ceteris paribus– on average, offer higher wages than larger

firms and expect better worker quality. The maximal bid offer of firm is independent

of firm size and increasing in quality:

Proposition 3 (Maximal bids). In any matching equilibrium firms of higher quality

bid up to weakly higher amounts, i.e. qm > ql ⇒ bm ≥ bl .

Based on these results an algorithm to identify matching equilibrium can be presented.

In general, one assumes a maximal bid b in the simultaneous wage setting game and

determines the set of firms willing to compete. This set is uniquely determined.20

Thereafter, the first firm to exit bidding can be determined. Keeping track of probability

offer mass this step is repeated until there is a single firm with positive probability

mass left. This is the probability with which this firm offer the workers’ outside option

of 0.21 Since this algorithm satisfies all features of matching equilibrium and each

20 As

long as low-quality firms are willing to compete, so are firms of higher quality. The cutoff must be unique.

detailed algorithm is provided in the appendix.

21 The

16

of its steps has a unique solution, matching equilibrium satisfies both existence and

uniqueness in the class of all multiple vacancy problems:

Theorem 1 (Matching equilibrium). Every multiple vacancy problem has a unique

matching equilibrium in which every firm m randomizes over an interval of bids

[bm , bm ]. Bidding strategies (probability densities) over bids are characterized by:

gm (p) =

"

s1m

#

!

1

|K(b)|−1

P

i∈K(b)

1

qi

−

1

qm

0

if b ∈ [bm , bm ],

(8)

else,

where K(b) indicates the set of firms competing at b.

On top of the intuition about effects due to firm quality and size, two observations

are noteworthy. First, firm m’s strategy at b is independent of the magnitude of the

bid itself. It rather depends on the quality of firms competing at b as well as firm m’s

characteristics. Secondly, small changes in firm quality will only cause small changes of

equilibrium strategies:

Remark 2. Strategies in a matching equilibrium are piecewise continuous in firm

quality. Thus, small changes in firm qualities do not alter competing sets of firms.

4 Properties of matching equilibrium

The unique source of inefficiency in a one-to-one matching equilibrium is randomness

of equilibrium strategies. The expected allocation in equilibrium, however, is always

guaranteed to be efficient. Naturally, the one-to-one setting is a special case of a

multiple vacancy problem with equal-sized firms. If the number of vacancies does not

vary among firms the following statement holds true:

17

Firm M

Firm M-1

Firm M

Firm M-1

Firm 2

Firm 1

Firm 2

Firm 1

b

b

Figure 3: Supports with variable vs. constant firm size

Corollary 3. Fix a multiple vacancy problem (q, s) with equal-sized firms, i.e. sm = s

for all firms m. Firms of better quality submit higher maximal bids bm and higher

minimal bids bm .

As a consequence better firms expect to hire better workers and thus:

Corollary 4. The expected allocation in the matching equilibrium of a multiple vacancy

problem with equal-sized firms is efficient (assortative).

Firm size variation induces a a fundamental feature which cannot be observed in the

one-to-one setting. The expected allocation in matching equilibrium turns inefficient.

An example of this feature is provided by section 2.

Theorem 2 (Inefficiency in expectation). The expected allocation in the matching

equilibrium of a multiple vacancy problem is, in general, inefficient.

Figure 3 shows potential supports with firm size variation on the left and the typical

pattern for equal-sized firms on the right. The following theorems provide deeper

insights into matching equilibrium:

18

Theorem 3 (Decreasing returns to scale). Fix a multiple vacancy problem (q, s)

with two firms m and l of equal (or sufficiently similar) quality q ≡ qm = ql . Without

loss of generality assume firm m to be bigger than l, i.e. sm > sl . Then,

(1) firm l pays on average higher wages than firm m and thus,

(2) firm l expects to hire a better average worker than firm m.

(3) Firm l’s profit per worker exceeds firm m’s but

(4) firm m’s profit exceeds firm l’s.

Proof of Theorem 3. The average worker quality firm m expects to hire when bidding b comes from the expected number of workers hired at bids below b and firm m’s

number of vacancies sm . Firm m’s expected payoff at b, Vm (b, g−m ) is thus:

Vm (b, g−m ) = qm sm

1

Gj (b)sj + (sm + 1) − sm b.

2

X

Fj ∈F\Fm

(9)

(1) Since sm > sl by Equation (7) we have that gm (b) < gl (b) for all b ∈ [bm , bm ] ∩ [bl , bl ]

and bm < bl .22 This proves the claim.

(2) is implied by (1).

22 This

holds true except bm = 0 in case of which firm m’s strategy would attach an atom to 0 whereas firm l’s

strategy does not.

19

(3) Now by Proposition (3) define b ≡ bm = bl . Exploiting Equation (7)

X

Vm (b, g−m )

1

= qm

Gj (b)sj + (sm + 1) − b

sm

2

Fj ∈F\Fm

X

1

= q

Gj (b)sj + sl + (sm + 1) − b

2

Fj ∈F\{Fm ,Fl }

X

sm 1

+

= q

Gj (b)sj − b + q sl +

2

2

Fj ∈F\{Fm ,Fl }

X

sl 1

< q

Gj (b)sj − b + q sm + +

2

2

(10)

Fj ∈F\{Fl ,Fm }

=

Vl (b, g−l )

.

sl

(4)

1

Gj (b)sj + (sm + 1) − sm b

2

Fj ∈F\Fm

X

1

= sm q

Gj (b)sj − b + qsm sl + qsm (sm + 1)

2

Fj ∈F\{Fm ,Fl }

X

1

> sl q

Gj (b)sj − b + qsl sm + qsl (sl + 1)

2

Vm (b, g−m ) = sm qm

X

(11)

Fj ∈F\{Fl ,Fm }

= Vl (b, g−l ).

Remark 2 implies the above theorem to hold true as well if qm − ql > 0 is sufficiently

small.

Thus, smaller firms pay –ceteris paribus– on average better wages in the matching

20

equilibrium to obtain better workers. A valid intuition for this result is as follows. If

firms are restricted to offer a single wage, it is immediate that higher bids are more

costly to larger firms. Section 6 —analyzing the case in which firms are allowed to

post one wage per vacancy— puts this intuition in perspective. To the extent to which

the number of vacancies can be considered a firm’s choice in real markets, Theorem 3

hints at the existence of an optimal number of workers, holding everything else fixed,

if relevant costs are considered. The subsequent lemma confirms our intuition that

–ceteris paribus– better firms accrue higher profits:

Lemma 1 (Profits increase in firm quality). Fix a multiple vacancy problem (q, s)

with two firms m and l of equal size s ≡ sm = sl . Without loss of generality assume

firm m to be better than l, i.e. qm > ql . Then, firm m’s profits exceed firm l’s.

Proof of Lemma 1. Let firm m hypothetically offer bl . Then,

1

Gj (bl )sj + (s + 1) − sbl

2

Fj ∈F\Fm

X

1

= sqm

Gj (bl )sj + (s + 1) − sbl

2

Fj ∈F\{Fm ,Fl }

X

1

> sql

Gj (bl )sj + (s + 1) − sbl

2

Fj ∈F\{Fl ,Fm }

X

1

= sql

Gj (bl )sj + (s + 1) − sbl

2

Vm (bl , g−m ) = sqm

X

(12)

Fj ∈F\Fl

= Vl (bl , g−l ),

which proves the claim.

Moreover, bigger firms –ceteris paribus– draw more benefit from a quality increase than

21

their smaller competitors:

Theorem 4 (Comparative statics in firm quality). Fix a multiple vacancy problem

(q, s) with two firms m and l of equal (or sufficiently similar) quality q ≡ qm = ql .

Without loss of generality assume firm m to be bigger than l, i.e. sm ≥ sl . Then, firm

m’s benefits more than firm l if

(1) all firms enjoy an equal relative increase in quality or

(2) only firms m and l enjoy an equal increase in quality or

(3) firms m or l face an equal quality increase one at a time.

Theorem 4 suggests that bigger firms –ceteris paribus– enjoy additional incentives

for self-improvement than their smaller competitors. Likewise they enjoy additional

motivation to improve firms’ production technology in the market. These results

can be cautiously interpreted as a stylized argument of a static model explaining a

dynamic market feature. It appears increased incentives to self-improve and improve

the structural environment are compatible with a positive correlation of firm quality

and size over time.

The maximal total surplus in a multiple vacancy problem is achieved by strictly

assortative matching. The performance of any allocation mechanism can be measured

in relation to the optimal total surplus:

Definition 3. In a multiple vacancy problem, the performance of an allocation

mechanism is the ratio of its expected total surplus in equilibrium to the total surplus

achieved by an assortative (efficient) allocation.

22

If markets grow large we expect the performance of a matching mechanism to improve.

To put this intuition to the test I analyze the implications of a market being large.

Markets can be perceived as large for different reasons. First, the number of workers

increases while the set of expanding firms is fixed:

Theorem 5 (Replication of workers). Fix a multiple vacancy problem (q, s). If

every firm grows at the same rate k ∈ N performance of the matching equilibrium is

(roughly) constant in k.23

Thus, increasing the market by expanding the set of workers and simply creating

additional openings at existing firms does unsurprisingly not improve the performance

of a match. As a consequence, the number of allocated workers is a sub-optimal measure

when referring to the size of a matching market. A very different conclusion can be

reached if the number of firms becomes large:

I analyze the limiting case of infinitely many firms with dense quality. Consider the

following variation of a multiple vacancy problem. The set of firms is given by a

continuum [0, M ] representing firm quality. An arbitrary density function24 s over

this interval represents firm size/firm type frequency.25 Continuing to rule out excess

demand respectively supply of workers the set of workers is given by a an interval

RN

RM

[0, N ] with a frequency density of η 26 such that η(x)dx = s(x)dx to ensure market

0

0

balance.

23 Performance

is constant ignoring a negligible integer problem caused by discreteness of a multiple vacancy

problem. This is explained in the proof.

24 The density function is arbitrary up the the point that it is a smooth positive bounded function with a

bounded first derivative.

25 Firm size does not have any bite in this definition. If firms and workers are dense the workers hired by every

firm are a set of measure 0 and infinitely similar (equal).

26 Assume η to satisfy the same assumptions as s.

23

Theorem 6 (Dense firms). If firm quality is dense the unique matching equilibrium

is efficient (assortative).

Proof of Theorem 6 by example.

(1) In what follows Theorem 6 is proved for a particular dense multiple vacancy problem.

The proof for the general case is provided in the appendix.

Assume F = [0, 4], s(x) = 1 ∀x ∈ [0, 4] and likewise W = [0, 4] with a frequency of

η(x) = 1 ∀x ∈ [0, 4]. Let f ∈ F denote a particular firm and w ∈ W a particular

worker. Bids are —as is standard throughout the paper— denoted by b.

Assume the efficient outcome in matching equilibrium. Formulating the firm’s problem

as a worker choice problem –equivalent to a bid choice problem if there is a one-to-one

relation between bids and workers– the firm chooses a worker w to maximize f ·w −b(w),

b(w) being the bid necessary to hire worker w. Thus, to support the efficient allocation

it has to be true that b0 (f ) = f. As a result, b(w) =

w2

2

+ c where c denotes a constant

determined by the fact that b(0) = 0 and thus, c = 0 in this example.27

Thus, every firm f bidding

f2

2

constitutes a matching equilibrium of this dense multiple

vacancy problem since no firm has a unilateral incentive to deviate if others don’t.

Further, it is the clearly the only equilibrium in pure strategies.

Thus, if the number of firms becomes large and average quality differential shrinks,

Theorem 6 indicates (near) efficient outcomes in markets if there are many firms.

Increasing the number of firms by quality extension has a similar effect on efficiency.

This is straightforward to show in a market with equal-sized firms. In this special case

it also easy to see that while welfare loss vanishes, the assortative allocation is not

27 There

are always infinitely many functions satisfying the firms’ incentive compatibility constraint. The unique

price funcyion can always be identified by normalization of b(0) = 0.

24

restored.28 In the general case it is however unclear how to increase the number of

firms by quality extension while holding firm-size variation fixed. As a consequence of

these findings, the notion of a large matching market should be reserved to markets

with an abundant number of competing firms.

A single worker replica of a multiple vacancy problem is the one-to-one matching

problem obtained by separating each firm of a multiple vacancy problem into separate

entities each posting a single vacancy. The firm quality of the spin offs equals the

original parent company’s quality.

Definition 4. A single worker replica of a multiple vacancy problem (q, s) is itself

a multiple vacancy problem (q R , sR ) in which each firm of the original problem is divided

into single entities each posting a single vacancy.

A single worker replica of a multiple vacancy problem admits an analysis of increased

competition in the market while holding the total number of vacancies and their

underlying quality fixed. In an analogy to a goods market a single worker replica of

a multiple vacancy problem features increased competition without the increase of

an analogue to supply. Since a single worker replica is a multiple vacancy problem

with equal-sized firms by definition, Corollary (4) establishes the unique matching

equilibrium to be assortative in expectation. Call the original multiple vacancy problem

of a single worker replica its total merger.

Corollary 5 (Total merger). Fix a multiple vacancy problem and consider its single

worker replica. The expected allocation of the unique matching equilibrium in the single

worker replica is assortative (efficient). This is not true for its total merger.

28 Consider

adding firms on top of the quality range. The effect on the bidding between low-quality firms is

ambiguous but will not overturn the internal rivalry effect.

25

One can derive from equation (7) that firm size variation is particularly harmful from

an efficiency perspective if better firms are bigger.

Corollary 6 (Merger of top firm). Fix a multiple vacancy problem (q, s). If the

top firm M demerges into single entities, welfare loss in the match decreases and vice

versa.

5 Wage compression

As a benchmark for wage comparison I introduce a counterfactual competitive equilibrium.

5.1 Competitive equilibrium

Definition 5. A competitive equilibrium of a multiple vacancy problem is defined

C ) ≥ 0 satisfying (1) individual rationality for each

as a wage vector wC = (w1C , ..., wN

vacancy and (2) incentive compatibility for every firm m:

(1) qm · j − wjc ≥ 0 for all Wj ∈ W (Fm ) and

(2) qm · j − wjc ≥ qm · k − wkc for all Wj ∈ W (Fm ) and Wk ∈ W (−Fm ).

I refrain from unnecessarily complicating this definition by introducing the notion of an

allocation since any competitive equilibrium is necessarily efficient (assortative) if firms

can discriminate between workers (see e.g. Shapley and Shubik [1971], Agarwal [2015]).

The above definition requires a wage per worker, does however not imply wages paid

within a firm to be necessarily different. To show, in general, that this definition does in

fact not admit an equilibrium in which firms do not discriminate between their workers

consider a simple example with ten firms of equal size:

26

Example 1. Let q = (q1 , ..., q10 ) and s = 2 for all firms. Let wi be the wage offered

by firm firm i for both workers it hires in the market. Incentive compatibility implies

prices to be increasing in quality and existence to necessitate

qm

ql

≥

s[m−l]+sl +sm −1

s([m−l]+1

for

m > l, s[m − l] denoting the total number of vacancies of firms better than l but worse

than m. Since this inequality has to be satisfied also for every pair of consecutive firms

there exists a non-discriminating equilibrium satisfying Definition 5 if among other

conditions F10 is at least about 20, 000 times better than F1 .

This result shows that, in general, firms do not offer equal wages in competitive

equilibrium according to Definition 5. To mirror the assumption of matching equilibrium

that every firm is bound to offer a single wage to all its incoming employees we can

weaken the incentive compatibility condition in Definition 5. Modeling firms’ preference

for non-discrimination we instead require competitive wages to be such that no firm

has an ex post incentive to lower or increase its one and only wage to obtain a different

set of workers.

Definition 6. A non-discriminating competitive equilibrium restricts firms to

pay equal wages to all workers it hires in the market. It consists of a wage vector

N D ) ≥ 0. wND satisfies individual rationality of firms and no firm

wND = (w1N D , ..., wM

wants to change its wage to hire a different set of workers.

Observe that this definition does not necessitate efficiency.

Lemma 2. Non-discriminating competitive equilibrium fails existence in the

class of all multiple vacancy problems.

Since there is no competitive equilibrium in which firms remunerate all their workers

equally, I resort to the general competitive equilibrium in 5 as benchmark. As mentioned above, the unique allocation supportable by wages in competitive equilibrium

27

is assortative. There is a range of wages supporting the efficient allocation in the

one-to-one setting. In particular, there is a upper bound, the worker-preferred wages

P

P

wnc =

qi as well as a lower bound, the firm-preferred wages wnc =

qi . Arguing

i<n

i≤n

about wage compression the firm-preferred wages being the smallest possible wages

in competitive equilibrium are the benchmark of interest. Since firms’ vacancies do

not have a direct strategic meaning if all firms are equal-sized, Kojima [2007] argues

that the argument of Bulow and Levin [2006] extends to the class of multiple vacancy

problems with equal-sized firms. However, competitive equilibrium in the multiple

vacancy case does in general not equal competitive equilibrium of its single worker

replica.

Proposition 4 (Upper bound of firm-preferred wages). The generalization of

the firm-preferred competitive equilibrium wages in a single worker replica is an upper

bound of the firm-preferred competitive equilibrium wages in its total merger.

Proof of Proposition 4. Let F (Wm ) be the firm hiring worker m in the assortative

allocation. Then, the generalization of the firm-preferred wages from the one-to-one

P

setting is wnC =

qF (Wi ) . Since every incentive compatibility constraint in a multiple

i<n

vacancy problem persists in its single worker replica, every competitive equilibrium of

the one-to-one problem is an equilibrium of its total merger.

Consider the following example showing that in general the firm-preferred equilibria do

not coincide:

Example 2. Consider a multiple vacancy problem with two firms (q, s) = ((1, 2), (2, 1)).

Solving the system of incentive compatibility constraints, the firm-preferred equilibrium

wages are wC = (0, 0, 2) whereas their counterparts in the single worker replica are

wC = (0, 1, 2).

28

The reason for this discrepancy is the deletion of incentive compatibility constraints

between vacancies posted by the same firm in a multiple vacancy problem. In turn, this

implies that the lowest wage paid by every firm has to be equal in both equilibria since

inter-firm incentive constraints persist. Thus, in general, wage differences between firms

persist in a multiple vacancy problem whereas wages within firms are compressed.29

5.2 Wage compression with multiple vacancies

Since the additional dimension of firm size variation significantly complicates proving

wage compression in the general multiple vacancy problem, I provide a proof for the

special case of equal-sized firms together with an argument that it’s logic extends to

almost all cases of relevance.

Theorem 7 (Profit gains in matching equilibrium). Fix a multiple vacancy

problem with equal-sized firms. Every firm has higher expected profits in the matching

equilibrium than in any competitive equilibrium.

Proof of Theorem 7.

30

Consider two firms with successive indices m − 1 and m

and define the sum of all vacancies of firms hiring below firm m as Sm . Then, firm m’s

profit in the firm-preferred competitive equilibrium is equal to

Vm =

s·m

X

qm · j − wjC .

(13)

s·m−1+1

29 An

algorithm to identify the worker-preferred competitive equilibrium can be found in the online appendix

of Agarwal [2015]. The process of finding the firm-preferred one is analogous.

30 This proof is inspired by the proof in the one-to-one setting presented in Bulow and Levin [2006]. The

extension, however, is not straightforward.

29

C

We know that ws·(m−1)+1

=

P

s · qi . Thus let Vm be a proxy for Vm :

i<m

V m = qm

s·m

X

j − s2 ·

X

qi

i<m

s·(m−1)+1

X

s−1

− s2 ·

qi .

= qm s · m −

2

(14)

i<m

Due to assortativeness of the matching equilibrium there has to be a bid b such that

firm m expects to hire workers s · (m − 1) + 1 through s · m when bidding b. Moreover,

by the properties of matching equilibrium firm m − 1 is bidding b as well. As a firm’s

profit is equivalent for all bids supported by its strategy, we can express the profit

difference in the unique matching equilibrium between firms of consecutive rank with

respect to quality as follows:

s−1

Vm (b) − Vm−1 (b) = qm · s · s · m −

2

s−1

− qm−1 · s · s · m −

+ Gm (b) − Gm−1 (b)

2

= Vm − Vm−1 + qm−1 · s · (Gm−1 (b) − Gm (b)).

(15)

Thus, the profit difference in the unique matching equilibrium between firms of consecutive rank with respect to quality exceeds the difference between the proxys for

competitive equilibrium. Observing that this difference itself exceeds the true difference

between profits in competitive equilibrium completes the proof.31

Theorem 8 (Wage compression). A matching equilibrium of a multiple vacancy

problem with equal-sized firms exhibits wage compression. That is, every worker,

31 In

the firm-preferred competitive equilibrium of a multiple vacancy problem with equal-sized firms the wages

differentials of better workers to the worst worker within a firm necessarily increase in firm quality.

30

except the ones hired by firm 1 in competitive equilibrium, i.e. workers 1 to s1 , is paid

less in matching equilibrium (in expectation) than in any competitive equilibrium.

Bulow and Levin [2006] show that in the one-to-one setting all firms gain from the

introduction of a central clearing house. Whereas the clearing house profit of the

lowest quality firm is identical to its competitive equilibrium payoff, every other firm

gains strictly. As a consequence, every worker except the lowest quality worker earns

below their competitive equilibrium income. Since those wage differentials accumulate,

the better the quality of the worker the bigger her wage cut. By Theorem 8 and

by extension of this argument, this holds necessarily true for an environment with

equal-sized firms. Moreover, inspection of the proof of Theorem 7 reveals that these

results hold true with greater slack if firms are larger. As a consequence, the gain of

firms under the presence of a clearing house over competitive equilibrium is increasing

in firm size and so is the wage cut of workers.

Due to the fact that all those results hold with slack, and even more so for high quality

firms respectively workers, minor changes to the firm size distribution do not overturn

any of these results by a simple argument in the vein of continuity. In fact, firms gain

and workers lose from the introduction of a clearing house if locally firm quality and

size do not abruptly increase at the same time. Thus, the workforce typically carries

the welfare loss. In fact, it takes quite substantial differences in firm size and quality

between consecutively ranked firms to to induce inefficiencies which hurt both workers

and firms. Since firm qualities can vary along two dimensions is it is impossible to

pin down a condition in closed form for every multiple vacancy problem. For instance,

in a two firm model, in which a single vacancy firm 1’s quality is normalized to 1,

a ten times bigger and more productive firm 2 would provoke enough efficiency loss

31

to make firm 2 worse off than in competitive equilibrium. In such cases, while the

entire workforce always loses, it is possible for some of the workers to expect higher

wages under a clearing house. In fact, this might hold true for the marginal group of

workers at this decisive point. To be more precise, consider a two firm model with

firms of substantial quality and size differential. If sufficiently different, the expected

wage gap between workers s1 and s1 + 1 in the matching equilibrium exceeds their

wage differential in any competitive equilibrium. While wages among workers 1 to

s1 and s1 + 1 to s1 + s2 will still be compressed, the wages of worker s1 + 1 and its

immediate neighbors of better rank might potentially exceed their competitive level.

At the same time the better firm potentially earns below its competitive level due to

severe mismatch. The wage sum of the entire workforce, however, always falls weakly

short of its competitive level. Due to the accumulation of profit gains and wage loss

respectively, however, the relevance of these special cases vanishes in even fair sized

markets. Simulation shows that markets with 10, 50, 100 firms require extreme jumps

in the firm-size distribution together with extreme firm quality differences to induce

merely a few firms to lose respectively workers to gain from a central clearing house.

6 Discriminatory matching equilibrium

This section rises a single question: Are the results of this paper entirely driven by the

stark assumption that firms prefer a single wage over freedom to set multiple wages to

target different workers? Naturally, we would expect better firms to set higher wages if

firms were able to wage-discriminate between its employees. This intuition, however, is

deceiving. Call an equilibrium of the matching game in which firms are allowed to set

different wages for their vacancies a non-discriminatory matching equilibrium.

32

Theorem 9 (Robustness of matching equilibrium). Fix a multiple vacancy problem (q, s). The unique non-discriminatory matching equilibrium remains an equilibrium

if firms are allowed to set one wage per vacancy.

However, this is not the only equilibrium in a discriminatory setting. In fact, there are

multiple equilibria in which firms post wages for all their vacancies between bm and bm .

i (b) be the offer density of firm m’s ith vacancy.

Let gm

Lemma 3 (Multiple equilibria). Every strategy combination such that

sm

P

i (b) =

gm

i=1

sm · gm (b) for all firms m and all bids b–gm (b) being firm m’s non-discriminatory

matching equilibrium strategy–constitutes a discriminatory matching equilibrium of a

multiple vacancy problem.

Proof of Lemma 3. If

sm

P

i (b) = s · g (b) for all firms except m and all bids b,

gm

m

m

i=1

firm m faces the same probability distribution as in the discriminatory problem. That

is, if the lowest bids of all vacancies by firm m is b, it expects to hire the same worker

with its lowest ranked bid as in the non-discriminatory equilibrium. Thus, Theorem 9

proves the claim.

As a consequence, every multiple vacancy problem has multiple equilibria in which

firms bid over identical intervals. Even more striking, these are the only discriminatory

matching equilibria of a multiple vacancy problem since no firm gains by conditioning

their vacancies’ strategies on each other.

Theorem 10 (Uniqueness of equilibrium type). The equilibria described in Lemma

3 are the only discriminatory equilibria of a multiple vacancy problem.

The mechanics behind this surprising result are briefly discussed in the description

of the numerical example in section 2.1. There cannot be any discriminatory pure

33

strategy equilibrium for the same reasons as discussed when restricting firm to pay

a single wage to all it workers. A discriminatory matching equilibrium of a multiple

vacancy problem does not resemble the matching equilibrium of its single worker replica

because vacancies of a firm do not consider each other as competitors. Thus, if at any

bid b only vacancies of one firm are competing, this firm is not optimizing.

The payoff of a vacancy declines due to internal rivalry if additional vacancies are

competing over the same interval. Thus, a large firm will disperse its bidding over a

wider interval than a small firm. In equilibrium, every vacancy has to be indifferent

over the firm’s entire support.

It is important to note that all results provided in this paper hold qualitatively true

for any matching equilibrium. If one considers the set of all equilibria there are two

extremal ones. The non-discriminatory and one where no pair of vacancies within a

firm overlap in bidding. Call the latter the perfectly discriminatory equilibrium. There

are two minor differences between those equilibria. First, the perfectly discriminating

equilibrium marginally reduces wage compression by adding wage intra-firm variation.

And secondly, the expected allocation in the former is marginally less efficient although

overall expected efficiency does not change. To provide intuition consider the following

example:

Example 3. Consider an example with 2 firms and 3 workers. Firms’ qualities and

sizes are given by their index. The non-discriminatory equilibrium produces a wage

vector of ( 23 , 1, 34 ) and assigns worker 2 with certainty to firm 2. It’s other worker is

basically determined by a coin flip. The discriminatory equilibrium produces a wage

5

19

vector of ( 12

, 1, 12

) and assigns workers 1 and 3 in expectation to firm 2. The bigger

the market the lesser the difference.

34

7 Conclusions

In real-world matching markets firms typically post multiple vacancies. Incorporating

this fact as a feature of a central clearing house model has far-reaching consequences.

When multi-unit firms bid strategically for their vacancies, two forces are simultaneously

at play:

1. Localized competition leads firms to compete with a relatively small set of similarlyproductive firms, as opposed to market-wide. This force exists in the singlevacancy setting as well.

2. Internal rivalry leads larger firms to offer, on average, lower wages. Thus, wages

decrease in market concentration. This force is unique to the multiple-vacancy

setting.

While both forces affect the distribution of surplus among firms and workers, the second

force also impacts the efficiency of the allocation. Internal rivalry causes large firms to

not compete aggressively for workers, leading to an inefficient allocation where large

firms end up with worse workers on average, conditional on their quality. Furthermore,

because internal rivalry creates downward pressure on wages, wage compression becomes

even worse in multiple-vacancy settings.32

The equilibrium of my model features limited intra-firm variation in wages. This feature

is consistent with real-world evidence from the NRMP [Niederle et al., 2006] that firms

prefer not to discriminate between workers which hold equal positions in the firm.

32 As

such, this paper argues that the example presented in Kojima [2007], while intriguing, relies on strong

assumptions.

35

I find that local inefficiencies do not vanish when markets become large, but they

vanish as a fraction of total market surplus. In this sense, the potential efficiency loss

is of greater concern in smaller markets.33 In this connection, it is worth noting that

high-skill labor markets are frequently quite small, including many NRMP specialties

markets. Therefore, the efficiency loss studied in this paper has the potential to be

quantitatively relevant.

33 An

extremal example for this claim is provided by the numerical example in section 2, in which a central

clearing house only slightly outperforms a random allocation process.

36

References

Nikhil Agarwal. An empirical model of the medical match. American Economic Review,

105(7):1939–1978, 2015.

Georgy Artemov. Matching and price competition: would personalized prizes help?

International Journal of Game Theory, 36:321–331, 2008.

Jeremy Bulow and Jonathan Levin. Matching and price competition. American

Economic Review, 96(3):652–668, 2006.

Vincent P. Crawford. The flexible-salary match: A proposal to increase the salary

flexibility of the national resident matching program. Journal of Economic Behavior

and Organization, 66(2):149–160, 2008.

Vincent P. Crawford and Elsie M. Knoer. Job matching with heterogeneous firms and

workers. Econometrica, 49(2):437–450, 1981.

David Gale and Lloyd Stowell Shapley. College admissions and the stability of marriage.

The American Mathematical Monthly, 69(1):9–15, 1962.

John William Hatfield and Paul R. Milgrom. Matching with contracts. American

Economic Review, 95(4):913–935, 2005.

Ulrich Kamecke. Wage formation in a centralized matching market. International

Economic Review, 39(1):33–53, 1998.

Alexander S. Kelso, Jr. and Vincent P. Crawford. Job matching, coalition formation,

and gross substitutes. Econometrica, 50(6):1483–1504, 1982.

37

Fuhito Kojima. Matching and price competition: Comment. American Economic

Review, 97(3):1027–1031, 2007.

Michael Kremer. The o-ring theory of economic development. The Quarterly Journal

of Economics, 108(3):551–575, 1993.

Alan B. Krueger and Larry H. Summers. Efficiency wages and the inter-industry wage

structure. Econometrica, 56:259–294, 1988.

Muriel Niederle. Competitive wages in a match with ordered contracts. American

Economic Review, 97(5):1957–1969, 2007.

Muriel Niederle, Deborah D. Proctor, and Alvin E. Roth. What will be needed for the

new gastroenterology fellowship match to succeed? Gastroenterology, 130(1):218–224,

2006.

Alvin E. Roth. The evolution of the labor market for medical interns and residents: A

case study in game theory. Journal of Political Economy, 92(6):991–1016, 1984.

Alvin E. Roth. The economist as engineer: Game theory, experimentation, and

computation as tools for design economics. Econometrica, 70(4):1341–1378, 2002.

Alvin E. Roth. The origins, history, and design of the resident match. Journal of the

American Medical Association, 289(7):909–912, 2003.

Alvin E. Roth and Elliott Perranson. The redesign of the matching market for american

physicians: Some engineering aspects of economic design. American Economic

Review, 89(4):748–780, 1999.

38

Alvin E. Roth and Marilda A. Oliveira Sotomayor. Two-sided matching: a study in

game-theoretic modeling and analysis. Econometric Society Monographs. Cambridge

University Press, Cambridge, 1990.

Alvin E. Roth and Xiaolin Xing. Jumping the gun: Imperfections and institutions

related to the timing of market transactions. American Economic Review, 84(4):

992–1044, 1994.

Lloyd Stowell Shapley and Martin Shubik. The assignment game i: The core. International Journal of Game Theory, 1(1):111–130, 1971.

39

Appendix

Proofs omitted from the text

Proof of Proposition 1. (a) In case of pure strategies, there must be a firm with an incentive

to reduce its bid or outbid an opponent marginally. (b) Suppose there was an interval in

which only one firm bids. This firm cannot be optimizing. (c) Suppose b > 0 is the smallest

bid by any firm in equilibrium. Then, at least one firm bidding b would do better when

bidding 0 instead. (d) Fix a bid b and identify the set of firms H offering a price b just

below b. In order for one such firm, say firm h, to offer a price b just above b we have to

P

P

have

sm · gm (b) ≥

sm · gm (b). The sum over all h ∈ H establishes the claim. (e)

m∈H\h

m∈H\h

Suppose m were to make offers just below b and above b but not in between. Thus, for every

b ∈ (b, b)

qn ·

X

Fj ∈F \Fm

X

sj · Gj (b) −

sj · Gj (b) ≤ b − b.

(16)

Fj ∈F \Fm

sj ·gj (b) = q1m for every b in the interval.

P

P

sj · gj (b0 ) >

This must also be true for a b0 marginally above b. But then

sj · gj (b)

P

As firm m does not bid in the interval (d) implies

Fj ∈F \Fm

Fj ∈F

Fj ∈F

in contradiction of (d). (f ) Suppose that no firm bids in (b, b).Then, there is a lowest bid

b0 above b. At least one firm cannot be optimizing at b0 . (g) Suppose firm m bids b with

positive probability. By (b) and (f) there is some firm just bidding below b. This firm cannot

be optimizing.

Proof of Proposition 3. If firm l is good enough to compete at b, so is firm m. Firm size

will –conditional on quality– determine the length of the interval over which a firm randomizes

but not its upper bound.

Proof of Corollary 3. Assume firm Fm ’s quality to exceed Fl ’s, i.e. qm ≥ ql . Then, by

Proposition 3 bm ≥ bl . Now, since gm (b) ≥ gl (b) ∀b ∈ [bm , bm ] ∩ [bl , bl ] by Equation (7) and the

fact there is no b > bm at which Fl bids, the claim has to be true.

40

Proof of Corollary 4. The statement follows directly from Corollary 3 and the fact that

Equation 7 implies that gn (b) ≥ gm (b) if gn (b) > 0 and qn ≤ qm .

Proof of Theorem 2. A single pair of firms, similar enough in quality, with the better firm

being the bigger one, implies that result. See the numerical example in section 2.

Proof of Theorem 4.

(1) Create a new multiple vacancy problem (q 0 , s) with q 0 = k · q for k > 1.34 By Equation (7)

an equal relative increase in the quality of all firms causes all strategies to shrink by a factor

of k. Thus, the resulting matching equilibrium of (q 0 , s) resembles the matching equilibrium

of (q, s) in so far that everything which holds true for (q, s) at b, holds true for (q 0 , s) at k · b.

Thus, every firm’s profit will increase by the factor k. Point (4) of Theorem 3 then proves the

claim.

(2) Create a new multiple vacancy problem (q , s) with qi = qi ∀Fi ∈ F \ {Fm , Fl }. Let all

parameters and variables with an refer to the new problem whereas standard notation refers

to the original problem. Let q ≡ qm

= ql = q + for a sufficiently small > 0 and b ≡ bm = bl

and b ≡ bm = bl . For all firms Fi with Gi (b) = 0 in (q, s) it will hold true that Gi (b ) = 0 in

(q , s). Thus, Fm ’s and Fl ’s expected lowest-ranked worker when offering their maximal bid is

the same as in the original problem. Since the increase of profits for Fm and Fl is a first order

change whereas there is a second order change in prices due to decreased strategies of all firms

except Fm and Fl competing at b both firms expect higher profits in the matching equilibrium

of the new problem. Point (4) of Theorem 3 now proves the claim.

(3) By the argument in (2) either firm’s profit increases if it is the only firm facing an increase

in quality. Point (4) of Theorem 3 now proves the claim.

Proof of Theorem 5. Consider a multiple vacancy problem (q, s) and its k-th multiple with

respect to firm size (q, sk ) with sk = k · s. The stated result is independent of how we generate

a sufficient number of workers to fill all vacancies. Consider 2 cases:

34 The

proof goes through with k < 1 as well.

41

(1) (Replication by quality extension) Multiplying the number of workers by k and extending thereby the top worker’s quality from N to k · N in line with Definition 1 of a multiple

vacancy problem will by Equation (7) divide each firm’s strategy by k and not change the sets

of firms competing with each other. To be more precise, if firm m bids b in the original problem

it will bid k · b in the new problem. If every firm hires k times as many workers with a k times

better average we would expect production to increase by a factor of k 2 . Due to an integer

problem caused by discreteness this is not true. Consider firm F1 hiring workers W1 to Ws1

in the original problem and consequently 1 to k · s1 in the new problem. It’s production will

increase from 12 q1 (s1 + 1) s1 to k 2 · 21 q1 s1 + k1 s1 . This is simply caused by our convention

of setting the quality of the lowest-ranked worker in the market to 1. Consider worker skills

to be measured as intervals on a continuum, i.e. the lowest worker’s productivity is uniformly