Document 11244000

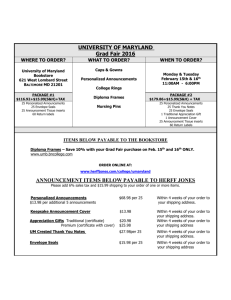

advertisement