Do General Managerial Skills Spur Innovation?

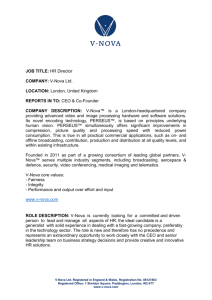

advertisement