HIS DOCUMENT IS THE PROPERTY OF HER BRITANNIC MAJESTY *S... CP(76) 12 COPY NO 10 May 1976 CABINET

advertisement

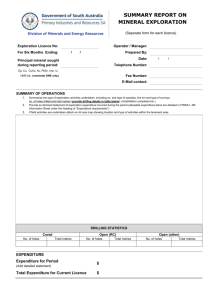

THIS DOCUMENT IS THE PROPERTY OF HER BRITANNIC MAJESTY *S GOVERNMENT CP(76) 12 COPY NO 10 May 1976 CABINET FIFTH ROUND OF OFFSHORE PETROLEUM PRODUCTION LICENSING: BRITISH NATIONAL OIL CORPORATION CONTRIBUTION TO COSTS Memorandum by the Secretary of State for Energy 1. On 15 April 1976 the MinisterialCommlttee on Energy (ENM) agreed that there should be a further round of offshore petroleum production licensing. The method and timing of the financing of the British National Oil Corporation^ (BNOC) participation in exploration and development arising from the fifth round is however the subject of a difference of opinion between the Chief Secretary, Treasury, and myself. 2. It is my view that BNOC should contribute its share (51 per cent) to the costs of exploration and development under fifth round licences, as the costs are incurred. The Chief Secretary, Treasury, has proposed that B N O C s contributions should be deferred until such time as they can be paid for out of revenues from successful developments. 3. E N M remitted this issue to a group consisting of the Chief Secretary, Treasury, the Chancellor of the Duchy of Lancaster, Lord Kearton and myself, which has not been able to reach an agreed solution. 4. A decision on this issue is urgently needed if the fifth round is not to be delayed. 5, This paper sets out the main arguments. I have reasoned my case at Appendix 1. The Chancellor of the Exchequer^ letter to the Prime Minister setting out his main views on the question is at Appendix 2. PUBLIC EXPENDITURE 6. Figures of Exchequer c a B h flows under the two alternative courses of action are shown in Appendix 3. In the next five years the additional costs to the Exchequer of BNOC contributing from the outset to exploration 1 and development costs are estimated to be £22 million and £13 million respectively. But as can be seen from the appendix early savings are more than offset in the long run by the repayment of deferred contributions with interest. 7, My view, that BNOC must contribute 51 per cent to costs from the outset is based on the following:­ a. The round must be a success. Deferment of BNOC'a contribution to costs diminish the round's attractiveness to potential applicants and introduces a serious risk of failure. b. Current participation negotiations have been given impetus by companies belief that a co-operative stance on participation will ensure favourable treatment in the fifth round allocation. This incentive to negotiate participation is diminished if the round is not seen to be attractive. 1 c. It would be difficult to reconcile the British Gas Corporation^ and BNOC(Ex)'s ability (established under previous Governments) to contribute from the outset, with a BNOC that was unable to contribute from the outset. BNOC would clearly be at a disadvantage vis-a-vis these corporations and indeed v i s - a - v i s private sector companies. This disadvantage would be compounded by the fact that BNOC are Inhibited from financing development costs from overseas borrowings because this borrowing counts in the Public Sector Borrowing Requirement, while companies such as British Petroleum have no such inhibition. d. A decision not to back BNOC with money at least to the extent that its private sector competitors enjoy would be very difficult to justify to the Party at large and to the Trades Union Congress. e. We have repeatedly given assurances that when in partner­ ship BNOC will act commercially. f. If BNOC is not a fully contributing partner from the outset its ability to influence a range of decisions will be diminished. g. B N O C s contribution and hence the burden on the Exchequer could only be deferred till perhaps the mid-1980s and would then have to be paid with interest, I do not believe it to be worth prejudicing the round for a deferment of a few years in B N O C s contribution. 8. Treasury Ministers went to defer for as long as possible B N O C s involvement In expenditure under licences, on the basis that every commercial organisation naturally seeks to defer making payments, if possible until there is revenue to cover them; that the BNOC does not have to buy Its way into these licences; and that if it did there would be additional public expenditure in the early years. Treasury Ministers also argue that with interest payable on any deferred contribution the success of the round will not be put at risk; but that if nonetheless it was considered that deferred terms might make the round less attractive, then other terms could be eased to compensate for this. I have looked at this last suggestion and am satisfied that adjustments to the financial terms (eg royalty) would have minimal compensatory effect due to their relative cheapness, and the point that they are expansible for tax purposes. CONCLUSION 9. In view of the importance that we attach to a successful fifth round, I invite my colleagues to agree that BNOC should pay its share of all exploration and development costs under fifth round licences, as and when those expenses are incurred. 10. If however agreement cannot be reached on this basis, then in the interests of settling the issue as soon as possible, to avoid dele ring the round I am prepared to ptx forward the following as a compromise:BNOC will as the standard pattern meet its share of exploration costs as they arise leaving open for decision case by case whether BNOC should pay its share of development coats as tbey arise, or defer them to be met out of revenue with an appropriate rate of interest. AWB Department of Energy 10 May 1976 3 CJQN4FHMNTM0. TH3 CA;53 FOR 1 PAT A3 YOU GO' 30UTJB Objectives I n o r d e r "to achieve success i n the round i t v i e w t h a t B2J0C must c o n t r i b u t e i s my 5 1 ^ t o c o s t s from the BNOC must b e g i n to b u i l d up i t s e x i s t i n g c a p a b i l i t y to f u l f i l its intended beginning w i l l role. outset. if it is F u l l p a r t n e r s h i p from the enable i t to g a i n experience and influence decisions. 2. My main arguments (a) a r e as follows The a t t r a c t i o n o f the package i s e s s e n t i a l success of the rotmd. failure. to We cannot r i s k a To add the f u r t h e r burden of d e f e r r e d c o s t s t o what i s a l r e a d y a tough package w i l l , i n the view of our a c t as a s u b s t a n t i a l d i s i n c e n t i v e application. consultants, to F a i l u r e of the round would be p o l i t i c a l l y embarrassing, would l o s e confidence i n the tTK S h e l f and income from f u t u r e finds, Employment i n o i l r e l a t e d i n d u s t r i e s would be jeopardised. For comparison purposes i t is worth mentioning t h a t the I r i s h and Greenland p r o v i s i o n s a r e l e s s onerous than propose, This i s mainly because n e i t h e r has a s p e c i a l o i l (b) what we country tax. The imminence of the round has added impetus to c o m p - n i e s ' participation. . w i l l i n g n e s s to negotiate This i s because they expect the round to be a t t r a c t i v e . If l e s s a t t r a c t i v e by i n s i s t i n g terms a r e made on BlfOC b e i n g c a r r i e d through, the development stage t h i s f o r getti^.7; companies to t h e n e g o t i a t i n g w i l l become v e r y much l e s s effective. lever table C o n t r i b u t i o n from the s t a r t by BNOC would u n d e r l i n e the Government's intention t h a t J3II0C should be a b l e t o behave commercially ( a p o i n t on which many HMO ' a s s u r a n c e s have been g i v e n ) . We a r e seeking f u l l o i l company B t a t u s BNOC w i t h aocess from the s t a r t t o and d e o i s i o n t a k i n g . for information D e f e r r e d payment could w e l l i n v o l v e a t worst p a r t i a l s u r r e n d e r o f v o t i n g r i g h t s and diminished s t a t u s a t the best. f As a f u l l p a r t n e r BNOC w i l l be b e t t e r a b l e t o influence investment p o l i c i e s t o the advantage of t h e UK o i l r e l a t e d industries, BHOC would a l s o have more i n f l u e n c e over the pace of e x p l o r a t i o n and thus could a i d the achievement of d e s i r e d d e p l e t i o n ^ policies. The burden, on the Exchequer of BHOC c o n t r i b u t i n g from the s t a r t 2 3 r e c o g n i s e d , r e l a t i v e l y modest. but the c o a t s a r e i BlIOCs i n i t i a l o u t l a y on e x p l o r a t i o n i s estimated t o be £50m between 1977 and 1983, - I f t h i s were c a r r i e d by p r i v a t e p a r t n e r s the r e a l saving could be s m a l l e r as ( companies a r e o f t e n a b l e t o expense such c o s t s f o r t a x purposes, 1 The a d d i t i o n a l net burden on the Exchequer by the pay as you go r o u t e of development c o s t s might approximate t o £100m a y e a r i n 1 9 8 2 - 1 9 8 4 , £150­ 200m nxoaa). D e f e r r i n g c o n t r i b u t i o n would result i n the burden on the iixchequer b e i n g d e f e r r e d to 1986-1989i t o g e t h e r with any i n t e r e s t t h - t might be agreed on the c o n t r i b u t i o n (Xl75m a t 1 $ ) , I t in q u e s t i o n a b l e whether i t i s worth p r e j u d i c i n g the round f o r a d e f e r m e n t ^ o f Exchequer burden starting i f i ^ Y ^ j ^ r y a e a r s time. BGC & BNOC(Ex) contribute to costs as they arise, BNOC would be seen as a half-heated participant compared with these corporations if it was not able to contribute. BNOC would also he at a disadvantage in comparison with these corporations and with the private sector. If BNOC were to follow the practice of major companies such as BP in borrowing abroad to finance its developments then the Exchequer costs would be eliminated. While X understand that B N O C s foreign borrowing would count as part of the public sector borrowing requirement, this should not be an inhibiting factor if BNOC are to be allowed to compete on level terms with the private sector. \ '.. Treasury Chambers, Parliament Street, SW1P 3 A G O1-90O 1204- PRIME MINISTER . - F i f t h Round North Sea L i c e n s e s Government C o n t r i b u t i o n to C a p i t a l I have seen E N ( 7 6 ) 9 , Costs in which the S e c r e t a r y of State for r e p o r t s ' a disagreement with the T r e a s u r y about one aspect proposed f i n a n c i a l terms to make my p o s i t i o n 12th April. 2. I t may help i f BNOC- should start, clear his contributing having access round l i c e n s e s , in advance of in f u t u r e and development expenditure, a Government c o n t r i b u t i o n also give 3, costs The q u e s t i o n option to j o i n automatic obligation individually. the o i l . interest My s u g g e s t i o n to c o n t r i b u t e . its share during of is is the making. although that exploration stage. Provided is powers the BNOC has a declared safeguarded. should c o n t r i b u t e that there Each case There should be a strong put up c a s h , but that process that I b e l i e v e we can in once a f i e l d then i s whether i t as they a r i s e . large. at the development us h a l f I think the p u b l i c to e x p l o r a t i o n , and the d e c i s i o n making licensing Participation commercial, from and a pact to p l a y in d e c i s i o n to i n f o r m a t i o n like Lord. to e x p l o r a t i o n participation interest' licenses. agree partner p h a s e , and through 'carried We a l l to be an a c t i v e we need through the o r d i n a r y will and I should the EN meeting on Monday fifth*rbund the sums I n v o l v e d are not p a r t i c u l a r l y s e c u r e the access the Corporation to information I "see.no case f o r fifth I s e t out my p o s i t i o n a f r e s h . participate KeaKton would l i k e for of Energy to development should be no should be negotiated presumption t h a t HMG w i l l the c a p i t a l costs / contributed should not be retroactively out contributed companies, retrospectively in exchange f o r the Continental the investment out of the r i g h t until revenue. repayment.of any f i e l d s to e x p l o i t it discovered share of contribution We would have to decide whether, before the f u l l valuable finance ,fields finable its to an o i l i t s own share of discovered. to r a i s e If, the c a p i t a l But I b e l i e v e capital commercial expenditure development c o s t s . real capital, to developing any oil then BNOC has the power to package.should in the normal c a s e , there be will . approach, not only r e a s o n s , but because of and the public N It investment; resources itself contribution. for the p r o s p e c t i v e s e c t o r borrowing to f i n a n c e calls requirement 50 per cent of on if future i s no answer to say t h a t t h i s would be the d i f f i c u l t y during the development and of p u b l i c stage. lies any BNOC c a p i t a l in r a i s i n g Our p r o j e c t i o n s expenditure and r e c e i p t s f o r a Government take from any new f i e l d s but not f o r were abandoned date.. that the whole l i c e n s e the Government were r e q u i r e d .finance the u n e x p e c t e d l y , any 1 I c e n s e e . f i n d s ' himself I t 1s important to maintain t h i s profitable of approach to the c o s t s of 1 public to i n t e r e s t on the company, to be r e q u i r e d the necessary r strictly public I t would be wrong f o r the Government, in conceding a franchise be no p u b l i c out of the the f i e l d share of c o s t s to c o n s t r u c t e d on the assumption t h a t , 5..j if seems to me the c o r r e c t commercial contribute. sufficient development c o s t s were recouped, BNOC would have to c o n t r i b u t e negotiations. resources on HMG's share of produced the costs the which i t made on behalf BNOC. 4. " This mineral The company would be e n t i t l e d the c a p i t a l nevertheless This means that S h e l f , would be r e q u i r e d to finance revenue to pay back the p u b l i c share of revenue. contribution. 2 - CQNfIDENTIAL of necessary available already allow which may be d i s c o v e r e d , As M i n i s t e r s / public - the know, expenditure the situation public expenditure already d i f f i c u l t field situation enough. effect. be borrowing to finance will In most c a s e s , be ( i n d i r e c t l y ) field is BNOC investment in field problems finance these terms eased. principle rather given the success of e q u a l l y tough resale of some of In the e a r l y y e a r s of contribution. to 1 raise the f i e l d the Irish arrangements) ­ the essential Such when the c o n s t r a i n t s on the package concessions of than a Government c a p i t a l the field, contribution on p u b l i c tightest. The S e c r e t a r y of S t a t e has argued t h a t , included viable). the BNOC o i l , than to compromise on the and would be more a c c e p t a b l e be always companies be a b l e f u t u r e "revenues, extending over the l i f e expenditure w i l l in the available some other element of of a Government c a p i t a l would a f f e c t will remains of companies w i l l in n e g o t i a t i n g the r e n t a l , rate, etc., borrowing needed. the s o l u t i o n might be to a d j u s t royalty The f o r e c a s t s (which seems u n l i k e l y , fee, their of the BNOC involvement it will the package as a whole seems u n a t t r a c t i v e and Norwegian governments the l i c e n s e Some of the should be improved and the o i l finance if r a t h e r than using development p r o v i d e d the c a p i t a l any c a s e , licensees of ensuring t h a t resources a l r e a d y assume that the o i l TOO per cent of -In security in r a i s i n g development, on the s t r e n g t h to ensure i t s So. the l e n d e r s ' ­ have a the p r o s p e c t i v e cash r e s o u r c e s . (which has the e f f e c t be a v a i l a b l e for programmes. own i n t e r n a l l y - g e n e r a t e d 8. dire;t I do not see why these terms need n e c e s s a r i l y disincentive 7^ To r e q u i r e on those assumptions development would reduce, pro tanto the amounts a v a i l a b l e other p u b l i c expenditure 6. projected in the l i c e n s e , if my terms were the whole round might become a f l o p . / not b e l i e v e I do this not believe this is a real The f i r s t depletion is that to change o f policy (EH(76)4) and o f of drop the the indicate in (-without saying main p o t e n t i a l idea this of a strict supplies f round' year. depletion I licenses. to importance suggest We c o u l d say t h a t it necessary t h e number industry flow of and t o us much f r e e r of of to adjust with the the terms were Policy. ( D . W. H . ) A p r i l , 1976 of the any designated negotiate individual smaller continuously to B u t 1n d o i n g s o , we the consequent the c r e d i b i l i t y with was o p e n t o applicants new e x p l o r a t i o n . a 'flop' ^ to could licenses licensees. within the t h a t we I n s t e a d , we i s s u e new block of t o o damaging t o negotiations a particular the defend a separate for rather policy. industry, of go announced B u t we c o u l d increasing of a studied and b e g i n s h o u l d a v o i d any r i s k Sea we have a l r e a d y intention t h a n we h o p e d , we w o u l d be a b l e offshore 1f which, idea how many) t e r m s c a s e by c a s e , a n d i f the the who have c o u r s e were t h o u g h t This course would leave maintain But aj-s, t w o a l t e r n a t i v e s we s h o u l d , on b a l a n c e , to the terms our company t o make a b i d area. given above. officials round t h i s a fairly if of Admittedly, offshore general there that is by r e f e r r i n g Alternatively, confidence The a d v i c e have a f i f t h conservation reasons we s h o u l d a b a n d o n a l t o g e t h e r new l i c e n s e s . Intention the -.. round. policy slower w i t h simply danger, consider. 1976 l i c e n s i n g 10. would happen, f o r considered we s h o u l d 9. this damage t o the Governments the North 1 KXPLOTfATIOii UTATH CASH ioo;/ (PAY-AS-YOU-GO) 197.; i .;icj^) j ) (CARHIHD INTEREST) 1977 -2 1970 -5 1979 -5 1930 -10 19O1 -15 1902 -10 -117 1983 - 3 -126 *9 1984 - 70 +2A 1935 * 76 *66 +270 +1B7 -13 4-^30 19-7 *399 19R9 +5G1 -M84 19?0 *359 +49T 1991 +510 +A99 t437 +43T UOT^S: 1. Exploration costs based on 50 wells drilled, average cost ££Jewell, 5l£ net by BNOC. 2. Carried interest at rate 7ji for illustrative purposes.