Document 11199498

advertisement

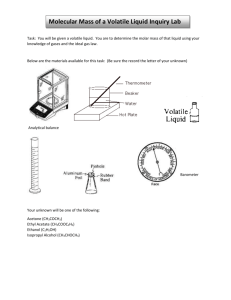

New Product Forecasting in Volatile Markets By Alexander Baldwin B.S. Economics, B.S. Political Science, University of Oregon 2008 And Jaesung Shin B.E. Industrial Engineering, Korea University 2007 MASSACHUSETTS INSTITUTE OF TECHNcLOC-Y JUL 17 2014 LIBRARIES Submitted to the Engineering Systems Division in Partial Fulfillment of the Requirements for the Degree of Master of Engineering in Logistics at the Massachusetts Institute of Technology June 2014 C2014 Alexander Baldwin and Jaesung Shin. All rights reserved. The authors hereby grant to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereafter created. Signature redacted ....................................... Signature of A uthor ... , . ............... .................... ;' -.................... Master of Engineering in Logistics Program, Engineering Systems Division May 13, 2014 Signature redacted Signature of A uthor ............... ........................................ E;, ... *............................. Master of Engineering in Logistics Program, Engineering Systems Division May 13, 2014 Certified by .................................. ( Siqnature redacted ................ Shardul Phadnis Postdoctoral Associate, Center for Transportation and Logistics Thesis Supervisor ninature redafed ............. Wg A ccepted by ............................... I .................................................... Prof. Yossi Sheffi IV Director, Center for Transportation and Logistics Elisha Gray II Professor of Engineering Systems Professor, Civil and Environmental Engineering New Product Forecasting in Volatile Markets By Alexander Baldwin And Jaesung Shin Submitted to the Engineering Systems Division in Partial Fulfillment of the Requirements for the Degree of Master of Engineering in Logistics at the Massachusetts Institute of Technology ABSTRACT Forecasting demand for limited-life cycle products is essentially projecting an arc trend of demand growth and decline over a relatively short time horizon. When planning for a new limited-life product, many marketing and production decisions depend on accurately predicting the life cycle effects on product demand. For products with stable market shares, forecasting demand over the life cycle benefits from the high degree of correlation with prior sales of similar products. But for volatile-share markets, rapid innovation continually alters the shape of available features and performance, leading to products with demand patterns that differ greatly from prior generations and forecasting techniques that rely more on judgment and naive expectations. In an effort to understand opportunities and limitations of quantitative forecasting in a specific volatile-market context, we hypothesized certain characteristics about the shape and volatility of the demand trend in volatile-market product, and tested them using sample stable and volatilemarket data from a partner firm. We found significant differences in quantifiable characteristics such as skew and variance over the life cycle, presenting an opportunity for supply chain stakeholders to incorporate life cycle effects into forecasting models. Thesis Supervisor: Shardul Phadnis Title: Postdoctoral Associate, Center for Transportation and Logistics 1 Acknowledgements We would like to thank the following people for their contributions to our research: " Our adviser, Shardul Phadnis for his guidance and advice " Employees of ElectricCol, who have responded our inquiries on an at-least weekly basis and shared a wealth of knowledge and experience about their supply chain * Our families and friends, especially the SCM class of 2014, for providing knowledge, nourishment, and emotional support! ElectricCo is the firm with which we collaborated on the project. The name has been changed. 2 CONTENTS ...................................................................................... List of Figures .................................. List of Tables.............................................................................................................................. Introduction ............................................................................................................................. 1 1.1 1.2 1.3 2 Stable and V olatile M arkets........................................................................................... M otivation: Impact on the Firm .................................................................................. Research Objective ......................................................................................................... Literature Review ................................................................................................................ Forecasting M odels and Methods ............................................................................... 2.1 ................................................................................... Expert Judgm ent 2.1.1 Hybrid and Survey Judgm ent M ethods ............................................................... Econometric Methods.............................................15 2.1.3 M ethods............................................................................................................................. 2.1.2 3 7 7 10 12 13 13 14 15 17 18 Evaluating Shipment Behavior ....................................... M easuring Skew ................................................................................................... 3.2.1 M easuring Rate of Growth/D ecline.................................................................... 3.2.2 M easuring V ariance............................................................................................. 3.2.3 20 3.1.1 3.1.2 3.2 M easuring M odality ............................................................................................ Results................................................................................................................................ 3.2.4 4.1 4.2 18 19 21 22 24 24 26 Segm entation ................................................................................................................ Skew ........................................................................................................................... 26 Rate of Growth/D ecline ............................................................................................. V ariance .................................................................................................................... M odality ....................................................................................................................... 30 4.3 4.4 4.5 5 6 ........................................................................... Segmentation ........................................................................................................ D e-Trending ......................................................................................................... p 3.1p 4 5 28 31 33 D iscussion.............................................................................................................................. Segmentation ................................................... 5.1 Skew ............................................................................................................................... 5.2 35 Skew - Implications for Sales Forecasting ............................................................. Skew - Implications for Capacity Planning and Inventory Management ....... 5.2.2 ........................................... Rate of Growth/Decline 5.3 36 5.2.1 5.3.1 Rate of Growth/Decline - Implications for Sales Forecasting ............................ 3 35 35 37 37 38 5.4 V ariance....................... 5.4.1 5.4.2 . --....... ............ ... ............................................................ Variance - Implications for Inventory Management........................................... V ariance - Implications for Capacity Planning .................................................. 5.4.3 39 40 40 V ariance - Implications for Sales Forecasting .................................................... M odality.........................................................................................................................41 41 41 5.6 M odality - Implications for Capacity Planning .................................................. Volatility and Capital-Intensiveness .......................................................................... 5.7 Additional Lim itations & Future Research............................................................... 43 5.7.1 Product and Industry Choice ............................................................................... 43 5.7.2 V ariation and Exogenous Effects ........................................................................ V alidity of Judgm ent M ethods ............................................................................ 43 5.5 5.5.1 5.7.3 5.7.4 42 44 Sales Forecasting, Capacity Planning, and Inventory Management Strategies...... 45 5.8 Conclusion ..................................................................................................................... 46 References.....................................................................................................................................47 Glossary of Terms.........................................................................................................................49 4 LIST OF FIGURES Figure 3-1: Research D esign...................................................................................................... 17 Figure 3-2: Example of De-Trending Effect ............................................................................ 20 Figure 4-1: Monthly Shipments, Product 1 .............................................................................. 34 Figure 5-1: Conceptual Rule-Based Range Forecast............................................................... 36 Figure 5-2: Conceptual Slope & Segment-Based PLC Forecasting ........................................ 39 5 LIST OF TABLES Table 4-1: Summary of Results ................................................................................................. 26 Table 4-2: Descriptive Statistics and Segment Lengths .......................................................... 27 Table 4-3: Relative Lengths of Product Segments ................................................................... 28 Table 4-4: Skew Statistics............................................................................................................. 29 Table 4-5: Average % Rate of Growth/Decline (EMA) - Stable Products............... 30 Table 4-6: Table 4-6: Average % Rate of Growth/Decline (EMA) - Volatile Products.......... 31 Table 4-7: Hypothesis Test Results - Permutation.................................................................... 31 Table 4-8: Coefficients of Variation........................................................................................ 33 Table 4-9: Hartigan's Dip Test for Modality............................................................................. 34 6 INTRODUCTION Imagine that your company is introducing an innovative new durable product to market. You have been involved in this market for more than a decade, with a stable, leading position relative to the competition, so you have a large degree of influence on product technology and trends. In such a stable market, forecasting and managing product demand is a relatively straightforward task, with gradual changes in products and demand trends. With this level of stability, historical sales data accurately predicts demand for new product introductions. On the other hand, consider introducing an innovative durable product into a more volatile market where product life cycles are shorter, technological changes are revolutionary, and as a result each firm's share of the market varies greatly between product generations as consumers polarize around feature sets in a manner that is difficult to predict. How many products do you need to product in this sort of market? Many important decisions will be made as a result of your forecast: new capital investments will be made in a factory for the new technology, a sales channel will be created to attract new customers, and your distribution network will have to be modified to deliver the product to those customers. If your product is successful, you will need to quickly add capacity along the supply chain. If your product is not successful, you will need to sunset the product in order to free capital resources to focus on the next generation of the product or other markets. 1.1 STABLE AND VOLATILE MARKETS A good deal of supply chain theory is based on assumptions of relative stability in market share. This is evident in the prevalence of econometric forecasting models that use historical sales data for a certain product to predict its future demand. This approach relies 7 on the implicit assumption that the future demand will exhibit the same pattern(s) observed in the past - an approach that does not work for products whose features and performance evolve quickly, and the resulting harder-to-predict volatile reception from the market. We will develop these two archetypes: stable versus volatile markets, to help illustrate the additional challenge of planning, producing, and distributing new products outside of the classical stable market bounds. In order to do this, we will first explore volatility as the primary independent influence on product demand, and will go on to perform a quantitative comparison of volatility-dependent demand patterns in the Methods chapter. From the long-term perspective of the product life cycle, one way to approach volatility in demand is by defining it as a function of volatility in market share - the relative share of each product in the market. This is an appealing independent variable because it is relatively easy to quantify for most durables industries. But we acknowledge several exogenous effects that influence volatility in market shares (Armstrong 2001a): * The rate of change in productfeatures and technology, which is closely related to the length of the product life cycle. When this rate is high, frequent new entry into the market constantly shifts the array of features available to the consumer, making it difficult for the firm to estimate where its product's features will fall in relation to other products. Due to this uncertainty, prior products' sales history does not correlate well with new product demand. * Consumer understandingofproduct category - much as the rate of change in features confounds producers' expectations about the market, rapidly changing features impact consumers' purchasing decisions - for instance, in the smartphone 8 market, a new product with a voice-control mechanism might initially cause consumers to polarize around it, only to find out after several months' experience that the feature is not that useful. * The rate of entry and exit in the market. Products with shorter life cycles and new technology are more of a gamble for firms. On the upside, volatility in the market can work to the firm's advantage if judged accurately, and the relative length of payback period on an investment is shorter - both features that entice firms to enter the market. However, there is more risk involved, lowering the overall expectation of return and increasing the frequency of financially-motivated exits. Regardless of the level of volatility, firms seek quantitative forecasting techniques in order to accurately manage activities and assets on a large scale. The alternative is the use of naive and judgment methods, which may complement quantitative forecasting methods but are known to be ineffective as standalone measures. We generally found that the established methods (which will be surveyed in detail in Chapter 2, LiteratureReview) are heavily biased toward stable-market conditions, leaving a motivational gap: for limitedlife cycle products in volatile markets, what specific quantitative analysis can be conducted given the only arm's-reach data is the recent sales data for the new product in question? The fact that demand for limited-life products begins and ends at zero within a clearly-defined time frame means that a life cycle-driven trend between each data point signals something about trends in the near future. If we can identify meaningful life-cycle characteristics of the demand line, it implies a forecasting framework that draws quantitative significance from the trend in demand itself. 9 1.2 MOTIVATION: IMPACT ON THE FIRM All activities related to marketing, producing, and distributing products are impacted by trends in demand new products throughout the product life cycle. Vernon (1966, 1979)2 first described phases of the cycle: In the introductionphase of the product, firms have finite time frame opportunity to adjust output in line with the market's reaction to the newly-released product; during the subsequent growth and maturity of the product, firms anticipate a peak in sales that will not only determine long-run profitability, but set a definitive trend for the future; and during the decline at the end of the life cycle, a timely decision needs to be made about when to phase the product out in favor of the next generation. In order to satisfy the motivational goal of identifying meaningful demand signals, we first identify who might benefit from greater accuracy in the processes generally referred to as "forecasting". We group these stakeholders into three lenses through which the supply chain is perceived and managed: The first is long-range salesforecasting, which is largely concerned with the overall financial performance of a product. This group is less interested in short-term sales variation as it is matching overall sales volume to quarterly demand expectations. As such, an important feature to this group may be the skew in sales volume: when in the product life cycle will the firm achieve the expected level of demand? If there is a reliable expectation of high sales early on, and that level is not obtained, then forecasters can 2 Vernon's work focused on the effects of a technology's product life cycle on international trade; however, the underlying assumptions about the nature of products' growth and decline are frequently generalized to specific market segments or products. See Porter (1980) as an example. 10 adjust their expectations accordingly, rather than hoping they will make it up in the next quarter! The second group is capacityplanning, which is concerned with making the right level of production capacity available in a timely fashion. This may include the construction of facilities, hiring of labor and procurement of equipment required to produce the product. In order to be profitable, production management must keep asset utilization high while not running out of capacity. Consequently, the rate ofgrowth/decline in product demand is very important - how fast will the product ramp up, and how will capacity be made available to meet this ramp? Additionally, the modality of the product becomes relevant; can capacity planners expect a single peak in demand for a smooth transition, or should they expect multiple peaks - key questions to determining how much flexibility is required in the supply chain. The third and final group is inventory management, a discipline which extends across the supply chain, from the management of stocks of inbound of raw materials and components, to the maintenance of these stocks in production buffers, to the stocking of products in outbound channels to ensure availability to customers. Inventory management is largely concerned with the variancein sales on a short-term basis, so it can position inventory to meet the demand of the market while limiting unnecessary expenditure of resources in doing so. Choosing appropriate levels of inventory stocks is vital at the introduction of a new product, as an early shortage can harm the overall success of the product, especially in volatile markets. Other important questions arise here too, such as whether will variance in demand will decrease or remain volatile throughout the product lifespan. 11 1.3 RESEARCH OBJECTIVE In the prior discussion, we identified skew, rate ofgrowth/decline, variance, and modality as important demand signals to three key supply chain groups. The key research question is thus: do volatile market products behave consistently along these criteria, and if so, to what degree do they differ from stable market products? To answer this question, we will establish hypotheses around each signal in Chapter 3, Methods, and test them in a case in Chapter 4, Results. If we can reliably establish significant gap between stable and volatile product behavior, it implies a framework for making decisions about producing new products. For instance, if a firm can expect a certain direction of skew for new products in volatile markets, it can adjust its long-range forecasting process accordingly depending on the expected level of volatility. Similar decisions can be made for capacity planning decisions regarding rate of growth/decline and modality, as well as for inventory management regarding variance. 12 2 LITERATURE REVIEW The foundational principle that applies in forecasting new products is that "new" is but one part of the larger product life cycle; that is to say that all product life cycles have introduction, growth, maturity, and decline phases as asserted by Vernon (1966). Life cycles for many durable products are relatively short (Bayus 1994) which means new product introductions are frequent and critical to the success of firms that produce them. There is a notable amount of survey research comparing the effectiveness of various forecasting methods on new products (Armstrong 2001a). Regardless of any accuracy measured in backward-looking terms, a practicable forecasting model must be robust enough to manage inconsistencies from real-world data inputs and at the same time be capable of yielding actionable outputs. Selecting from models in and of itself can be a difficult task, that is presently approached in a very sophisticated manner; Ching-Chin et al (2010) note that "no standard procedure for new product sales forecasting currently exists," and go on to suggest advanced techniques like the use of rule-based learning algorithms to aid forecasters in selecting a forecasting model. 2.1 FORECASTING MODELS AND METHODS A wide range of sales forecasting models are available, but the most relevant to this research are those that posit an application to new product introductions and include context for the product life cycle. Armstrong's (2001a) compilation of articles on the topic is a frequently-cited authority on the range of options available. Two large categories of forecasting methods exist: judgment methods - which can further be divided into expert, survey and hybrids thereof - and purely statistical econometric forecasting. 13 2.1.1 Expert Judgment Methods Judgment methods rely on human intuition to predict the eventual time and magnitude of the product peak. One of the most basic categories of judgment forecasting is referring to the opinions of experts (Armstrong 2001a). Expert opinions may be aggregated, using the Delphi technique (Rowe 2001), which provides a structured framework for collecting experts' opinion while avoiding common sources of bias. In some cases, expert opinions have been found to best quantitative methods in forecasting new products (Basu 1977). Experts' forecasts can be "bootstrapped", wherein the most accurate forecasts amongst experts are decomposed into independent numerical coefficients (Armstrong 2001b). Although this is an innovative way to infer quantitative causality from judgment-derived data, because of the large degree of extrapolation and inference, it is better suited to crosssectional research than time series forecasts like those used in new product forecasting (Armstrong 2001b). Another expert method is expert system forecasting, which is the most recommended process for new product forecasting (Collopy 2001). Rather than bootstrapping expert forecasts for implicit understanding, expert system methods seek to identify and measure the explicit underlying forces in an expert forecast in order to form complete system models with quantitative variables that can be adjusted for different forecasting situations. A salient example of an expert system forecasting component is the Bass model (1969) that provides the foundational technology diffusion model that estimates the whole-market adoption of a new product based on coefficients of innovation and imitation in the market space. In an extension, Norton and Bass (1987) go on to apply this to the high technology 14 space by overlaying a substitution scheme for successive generations of similar products rather than looking at adoption as a single mode. Further extensions to product diffusion model such as Qin (2012) look at the marketplace as a stochastic system, providing methods to estimate and control for uncertainty. Chien et al (2010) go even further with a stochastic approach, attempting to create a comprehensive decision-making framework based on stochastic diffusion theory that provides detailed forecasts for capital costs, pricing, and demand planning. 2.1.2 Hybrid and Survey Judgment Methods Judgment methods may also involve surveys, as in conjoint analysis (Wittink 2001), where consumers are given sample attributes of products and asked to rank their interest or willingness to pay, which is then extrapolated to establish sales figures based on market shares. This sort of analysis is most effective in stable markets, where both producer and consumer understanding of the markets is high. Hybrid quantitative-judgment forecast methods exist, such as rule-based forecasting (Armstrong 2001a), a hybrid method that is apt at using quantitative sales history, domain knowledge, and empirical research to develop rules including thresholds, breakouts and casual force implications to form and adjust any manner of quantitative forecast. 2.1.3 Econometric Methods Econometric forecasting methods focus on the use of statistics and casual variables derived directly from observed data, rather than experts. Econometric forecasting largely relies on regression models, which are relatively straightforward to compute - the greater challenge in econometric forecasting being the methodical selection and testing of 15 variables (Armstrong 2001a). Typically, the most robust and accurate econometric models are those that are relatively simple (often linear regressions with just a few variables), and validated through a range of statistical tests that identify issues like misspecification (Allen 2001). A recent example of econometric forecasting in practice is Tanaka (2010), who uses regression analysis to forecast expected results using prior generations of the same or similar products as an allegory, with positive results, although this example is from a slower-moving, stable-market situation. In volatile markets where features are changing rapidly and producers and consumers have limited information about the market, the accuracy of econometric forecasting will be lower as past products don't correlate well with new products (Allen 2001). 16 3 Methods As mentioned earlier, the primary research question is whether a difference in demand trends exists in between stable and volatile products. We suggested 4 quantitative characteristics of a demand trend line: skew - whether peak sales volume is reached earlier or later in the life cycle, modality - whether products experience one or more peaks in demand during the product life cycle, rate ofgrowth/decline, how fast demand for the product ramps up and down during the life cycle, and variance in demand for the product. The following sections describe quantitative hypotheses, tests, and metrics to for each characteristic. As a case study, we computed each of these statistics using shipment data from a partner firm, the results of which will be discussed in the following chapter, Results. Measures of Dependent Variable Independent Variable Exogenous Effects Length of Product Life Cycl+ ........ Dependent Variable Trend Of Product Trend Of Product HI Skewness of It-----------Shipm ents Rate of Change in Product + Characteristics Consu------er -Shipments Consumer Volati Iity of , H2 Modalityof Market Understanding&of Unertadig f aret + H3 Variance of Shares Product Category -----------------+ Shipm entsfac cle Lifecycle -- - -- ----- . .... Rate of Entry/Exit From Market H4 Rate of - --Growth/Decline in Shipments :+ Producers' Expected Rate of Risk/Return Proxy for Dependent Variable SimnsDmn Simns Throughout ughout Growth/ Decline by Phase Figure 3-1: Research Design 17 ... J Dmn Throughout ughout 3.1 PRODUCT SHIPMENT DATA PREPARATION To begin, sample shipment data must be obtained to use as a proxy for demand data. Because of this implied relationship, we avoid cases products for which demand is known to exceed supply. Sample products must be identified as belonging to stable or volatileshare markets, and as the tests use will be sensitive to sample size, the use of more products will yield higher statistical significance. We will generally test hypothesized features of volatile market products, using stable market products as a base. 3.1.1 Segmentation For rate ofgrowth/decline, we are interested in the performance over the life cycle, for instance: does variance decrease over time for new products or remain consistent? To enable such an assessment, we developed a quantitative segmentation method based on the general logic proposed in Vernon's (1966) theory to segment the product data into the four phases: introduction, growth, maturity, and decline: " The first bound, between the 'introduction' and 'growth' phases, is defined where the slope of the pattern first transitions from positive accelerating to positive linear. " The second bound, between the 'growth' and 'maturity' phases, is defined at the peak of the first mode. " The third bound, between the 'maturity' and 'decline' phases, is defined where the slope transitions from negative decelerating to negative linear, working backward from the end of the time series. Because of the inherent noise in weekly and monthly shipment data, rate of growth/decline was smoothed on an exponential moving average basis, (as detailed in the section 3.1.2 - Measuring Rate of Growth/Decline). We were aware that if modality turned 18 out to be multi-modal or uniform, it would confound these results, so we were careful to track the positive-trending phases from the left and negative-trending phases from the right. With the higher rate of variation inherent in volatile products, we knew there may be a need to adjust the smoothing to achieve reasonable bounds for the first and last phases. We also expected that some demand spikes and dips might be so large that we would need to ignore a single-month reversal in slope, so the final criteria was that any trend reversal signaling a bound between segments had to be two months in length. 3.1.2 De-Trending Shipments over the entire life cycle of a product are necessarily non-stationary in nature, as they move from zero, to a peak, and back to zero rather than varying around the mean. In order to calculate metrics that involve variance, de-trending of the data was required to remove the influence of the non-stationary trend. To de-trend, we calculated exponential moving average (or EMA, as detailed in section 3.2.2 - MeasuringRate of Growth/Decline), and took the difference from the original trend. The monthly de-trended residual DTM for each monthly shipment SHM and EMAM is thus: (1) DTM = SLM 19 - EMAM 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 Month Original -De-Trended Figure 3-2 - Example of De-Trending Effect 3.2 EVALUATING SHIPMENT BEHAVIOR With the four characteristics clearly defined, metrics needed to be chosen to test for significance. Each metric was selected based on assumptions about the dataset, as noted below. Each of the metrics below were calculated for each product, and aggregated for both stable and volatile product groups. Segmentation would be used for rate of growth/declineand variance since we were interested in their change over time, as opposed to skew and modality, which are features of the overall product life cycle distribution. Data was summed to the monthly level unless otherwise noted - given the short lifespan of these products, monthly bins provided a significant number of samples without excess variation. 20 3.2.1 Measuring Skew We expected volatile products to have a skew that is more positive than stable products, exhibiting a peak in demand that occurs earlier in the product life cycle due to the faster proliferation of these technologies: HA: The difference between volatile group and stable group skew is positive Ho: The difference between volatile group and stable group skew is negative or 0 Because of this, we chose the nonparametricskew method to evaluate skew. This statistic is particularly resilient for evaluating d because it is capable of evaluating the direction of the skew, and is unaffected by scale shift that might happen across the skew - an important feature due to the supposed non-linear growth pattern proposed in the classic product life-cycle theory. Given a sample mean ?, sample median Md, and sample standard deviation s, the nonparametric skew statistic for a sample series x is defined as: (1) - Sk = Md S A formal statistical test would help to underscore the significance of the results. However, undertaking a case study with a firm will involve a small sample of products, from a large population about which we can make few assumptions about the nature of the distribution. Under these conditions, the best technique would be a resampling technique such as a permutation test. We elected to use a simple nonparametric permutation test for the difference between the means of both distributions. First a permuted resampling for each group's sample xA and xB is undertaken by permuting the two sample sizes where n is the sample size and r is a random variable between 1 and n. 21 (2) P(n,r) = n (n - r)! This is repeated numerous for a large number of permutations p (a large number like 10,000), and a P-value is calculated by taking the average of the differences of means for all permutations p: (3) p Alternatively, if the case were that a large, normally-distributed sample of products in the population we could perform a two-sample T-test between mean skew of the volatile products Xi and stable products X2 by calculating a two-sample independent T statistic for unequal sample sizes and variances (2) and comparing the corresponding results to a probability density table for the t distribution (P-values). (4) Sk 1 - Sk 2 3.2.2 Measuring Rate of Growth/Decline As with skew, we expected the slope of volatile products shipment volume to grow faster and fall off faster, making for the following statistical hypothesis for each segment: HA: The difference between volatile group and stable group slope is positive Ho: The difference between volatile group and stable group slope is negative or 0 22 Here a decision was required whether to use simple or exponential moving averages (SMAs and EMAs). EMAs were chosen because inherently have less lag than SMAs - for the segmenting exercise we were looking for a tool to identify breakouts from a trend, and for volatile markets the switch. EMAs were calculated on a monthly basis for the raw monthly series values xt and smoothing output values st, and a is an inputted smoothing factor 0 < a < 1. (5) XO SO st =--a xt-1 + -a)s=_1,t > 0 We would begin with a neutral EMA smoothing factor of .5, and would adjust it downward if premature segments occurred during the segmentation exercise. EMAs would be calculated for each product and product group's phase, and expressed as the percentage change so as to remain proportionally correct for comparison and future extrapolation: (6) St - St-1, t > 0 St-i To test our hypothesis, we would perform the same permutation test for the two groups as was conducted for skew in the prior section, 3.2.1 - MeasuringSkew. 23 3.2.3 Measuring Variance Our general hypothesis for variance is that the volatile group would exhibit higher variance in monthly shipment volume due to more volatility in demand for the product, thus we would be exploring the difference between the two groups: HA: The difference between volatile group and stable group variation is positive Ho: The difference between volatile group and stable group variation is negative or 0 Because variance is sensitive to trends, we elected to use the de-trended dataset, so we would be exploring the variation of the actual data set from its moving average. To measure variation we chose coefficient of variation (CV) as the key metric, because it allowed us to place products with different sales volumes on the same terms for comparison. Given the sample mean k, and sample standard deviation s, the coefficient of variation is calculated as: (7) CV=- S To test our hypothesis, we would perform the same permutation test for each segment in the two groups as was conducted for skew in the prior section, 3.2.1 - MeasuringSkew. 3.2.4 Measuring Modality Our general hypothesis was that stable market products would tend to center around a single mode, where the shifting share in volatile markets would drive multiple modes into the data series. Several published statistical tests exist asses the modality of a distribution. Since the presumption is that the volatile group has more than one mode (rather than 24 exactly 2, or more), we elected a test one that would test both groups against a null hypothesis of unimodality and detect any number of additional modes. Hartigan's dip test for unimodality (Hartigan 1986), which essentially tests for the presence of convexity, satisfied these conditions well. Using a statistical package (Maechler 2013), we can easily test each product the following hypothesis: HA: The product's shipments are not unimodal, i.e. multi-modal Ho: The product's shipments are unimodal The dip-test incorporates its own probability density, with P-values being the primary output, so we can compare the average P-values for each product group. 25 4 RESULTS A partner firm interested in the consequences provided sample products to test our methods. Eight products were provided from markets with stable market shares, and four products were provided from markets with volatile shares. Despite these small sample sizes, all tests and statistics were completed as planned in the prior chapter. In all cases, the data provided by the partner firm proved complete and robust enough to perform valid statistical analysis. Given the limitations of the study, our primary criteria for empirically confirming a hypothesis was directional corrections on the comparison of the mean for given statistics. Under rigid evaluation for statistical significance, some tests had relatively low confidence levels, the implications of which will be discussed at length in the final section. Table 4-1: Summary of Results Expectation for Volatile Products Greater Right Skew Empirical Result Confirned Statistical Significance Medium Rate of Growth/Decline Greater Rate Confinmed Low Variance Modality Greater Variance Multi-Modal Confirned Inconclusive Low None Measure Skew 4.1 SEGMENTATION Using the second-derivative segmentation method described in the prior chapter, we were able to successfully establish segment lengths for most products. As we noted in the methods, we adjusted the smoothing coefficient to .4, which yielded demand lines with clear segment signals that were unaffected by short-term trend reversals when using the logic that we would ignore a single-month change. 26 Due to the limited time window for the product selection, some products did not have complete life cycle data, so some inferences were made based on expected production life data given by the partner firm. For instance, if we had 28 months' worth of data and a clear signals for phases 1-3, and the product was expected to be 36 months, we inferred that final phase would be 8 months long. This was taken into account for the proportion of the decline phase, however, it was not weighed in any future statistics Table 4-2: Descriptive Statistics and Segment Lengths Stable Group Monthly Shiipmnnts (Units) Product # of Mos Producti 32 Product3 36 Product4 10 Product7 Product8 24 15 ProductO 44 Productl1 35 Product12 59 Mean Median Stdv 524,768 456,729 1,437,278 300,215 123,259 1,094,463 1,523,081 195,965 534,656 499,380 1,668,976 216,031 138,559 745,540 1,013,593 85,324 215,445 185,608 721,014 246,869 63,032 1,076,313 1,229,610 217,952 Mean Median Stdv 93,740 2,950,793 178,195 117,167 86,700 2,040,000 128,141 58,925 67,154 2,262,407 123,488 128,161 Seginent Length (Months) Intro Growth Mat. Decline 5 13 6 3 9 8 9 8 2 3 4 3 6 5 4 5 11 5 14 15 7 11 14 8 10 17 14 36 Volatile Group Product # of Mos Product2 14 Product5 28 Product6 Product9 24 41 Intro Growth Mat. Decline 2 2 3 3 6 7 3 16 2 5 9 7 9 10 16 7 For segment proportion, we found very little difference between stable and products. The figure below shows the proportions of each phase relative to the life cycle, along with an estimated mean value for a future 3-year product. Although the volatile group showed slightly higher deviation, given that the means were so close for practical purposes (the same for intro and growth phases), we felt it was not necessary to perform any statistical tests for the two groups. 27 Table 4-3: Relative Length of Product Segments Stable Group Product Intro Producti 6% 14% 31% 39% Product3 Product4 Product7 8% 11% 13% 36% 17% 13% 14% 42% 29% 46% Product8 17% 25% Productl0 11% 18% 32% 39% Product 1 11% 26% 23% 40% Product12 8% 14% 17% 61% 11% 4 0.31 20% 7 0.40 24% 9 0.31 44% 16 0.19 Growth Maturity Decline Statistics Mean Exp: 3-Yr Product CV Volatile Group Product Intro Product2 Product5 Product6 Product9 14% 7% 8% 17% 21% 11% 21% 22% 43% 25% 29% 22% 21% 57% 42% 39% Mean 12% 19% 30% 40% Exp: 3-Yr Product CV 4 0.41 7 0.29 11 0.31 14 0.37 Growth Maturity Decline Statistics 4.2 SKEw The skew test was conducted using the non-parametric (NP) skew statistic for the data series. For this figure, positive values indicate right-hand skew, with where the peak in 28 demand occurs earlierin the life cycle, and negative values indicate left-hand skew. We hypothesized that volatile products showed positive skew due to rapid growth, and the data reflected this: mean and median were .35 and .40 for the volatile group, as opposed to .09 and .14 for the stable group, respectively. The permutation test returned P-values of .15, representing a 85% level of confidence in the results. Given that this is a small sample of real-world data, we believe this represents a result that is directionally correct. With a CV below .5 for the volatile group, the mean and median have a moderate level of robustness in scale for extrapolation. By contrast, the stable group had a much wider range, from -0.32 to 0.51, with a mean skew near 0. Table 4-4: Skew Statistics Stable Group Product Product7 Product12 Productll Product3 Productl ProductIO Product4 Product8 Volatile Group NP Skew Product NP Skew -0.32 -0.24 -0.23 -0.05 0.33 0.34 0.41 0.51 Product9 Product2 Product6 Product5 0.45 0.41 0.40 0.15 0.09 0.14 Mean 0.35 0.40 0.14 0.39 Statistics Mean Median Median Stdv CV Hypothesis Testing - Permutation P-Value 0.15 29 RATE OF GROWTH/DECLINE The trend in growth/decline was calculated using the % change of each month's exponential moving average (EMA), for each of the segments. On average, the volatile group showed more exponential growth in the introduction phase (13 1% vs 117%) and in the growth phase (33% vs 23%), as well as a faster fall off from the peak in the maturity phase (-11% vs -6%). Table 4-5: Average % Rate of Growth/Decline (EMA) - Stable Products Stable Group Product Intro Growth Productl 164% 44% Product3 67% 12% Product4 152% 27% Product7 Product8 Productl0 88% 121% Productl1 Product12 Maturity -1% 0% De cline 44% 11% 15% -9% -13% -9% -13% 99% 126% 9% 25% -13% -6% -13% -10% 117% 4 23% 7 -6% 9 -12% 16 0.30 0.61 0.81 0.11 Statistics Average Avg Months CV 1 Absolute Values Are Taken for Decline Phases The volatile group showed more variance around this result in all phases except maturity - 4.3 we noted that in some cases the fall-off in the maturity phase was gradual, whereas in other cases it appeared to be more of a declining step function change. Given the variation present (CV's largely greater than or equal to .3), we would not recommend extrapolating on these results, with the possible exception of decline phase for the stable group, all of which had a smooth exponential decline that appeared to be fully planned in advance. 30 Table 4-6: Average % Rate of Growth/Decline (EMA) - Volatile Products Volatile Group Product Intro Growth Maturity Decline Product2 Product5 237% 95% 120% 72% 45% 11% 49% 26% -6% -13% -19% -2% -14% -7% 131% 4 33% 7 -11% 11 -9% 0.60 0.61 0.30 0.92 Product6 Product9 -13% Statistics Average Avg Months CVI 14 Absolute Values Are Taken for Decline Phases Permutation tests revealed low to moderate statistical significance in the difference in the middle phases, and no significance in the beginning and end phases, which implies that the launch and end-of life trajectories of each product are similar. Table 4-7: Hypothesis Test Results - Permutation Hypothesis Testing - Permutation P-Value 4.4 Intro 0.63 Growth 0.30 Maturity 0.18 De cline 0.42 VARIANCE The first test for variance was whether the coefficient of variation (CV) of the volatile group exceeded that of the stable product group, which was performed using an 31 independent two-sample t-test. We first calculated the mean and median of the volatile group (.66 and .64 respectively), which came in higher than those in the stable group (.59 and .59). The results of the test itself yielded P-values of .3, and thus we arrived at an empirical conclusion that the volatile group is more variable, albeit with a very low level of statistical confidence (see table below). As is the case with skew, this is a defensible directional result given that this was a limited sample of real-world data, and the degrees of freedom in the test were limited accordingly. With a CVs below .5 in both cases, the results would be mildly useful for extrapolation. We also noted that CVs were had a wide range in the distribution. So far, our analysis has focused on the comparison of two ordinal categories (stable vs volatile), but these statistics open the possibility of looking at stable vs volatile as a scalar coefficient. 32 Table 4-8: Coefficients of N ariation Stable Group Product CV Product3 0.57 Producti Product4 Product8 Productl1 Product7 ProductO Product12 0.65 0.65 0.62 0.54 0.77 0.42 0.46 Statistics Mean Median Stdv CV 0.59 0.59 0.11 0.19 Vol atile Group Prod uct CV Prod uct6 0.67 Prod uct5 0.61 Prod uct2 0.87 Prod uct9 0.49 Mea Medi an Stdv CV 0.66 0.64 0.16 0.24 Hypothesis Testing - Permutation P-Value 4.5 0.32 MODALITY Although some products' profiles visually appear to be multi-modal, it was not proven under statistical testing; With the exception of product 11, no product showed anything approaching a statistically significant non-unimodality, with very high P-values of .70-.99. The empirical result is thus inconclusive; Product 1, for instance, exhibited a strong visual bimodal trend, despite a very high P-value. 33 Table 4-8: Hartigan's Dip Test for Modality Product P-Value Product2 0.97 Product2 Product3 Product4 Product5 Product6 0.80 0.73 0.86 0.95 0.71 Product7 0.90 Product8 0.98 Product9 Productl0 Product 1 1.00 0.77 0.18 Product12 0.99 ,--Visua IMo-de Tre-nd_ 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 Month Figure 4-1: Monthly Shipments, Product 1 34 5 DISCUSSION We empirically concluded that volatile-market products behave differently than stablemarket products in the case. Due to limited sample size and the consequent low level of statistical significance, these statistics would not make good estimators in a purely statistical econometric forecast, however their directional significance is still important: we generally found volatile products to have a right hand skew, greater rates of change, more modes or uniformity in distribution, and greater variance when compared with table products. In order to make the best use of these relationships, we will explore the implications through the three supply chain lenses mentioned earlier: salesforecasting, capacityplanning, and inventory management. 5.1 SEGMENTATION With our segmentation criteria using the rate of growth, we found that the length of the introductionphase was quite similar for all products; estimated to be 4 months for a 3-year product. This in itself is an interesting result - if further research were to be undertaken, firms might look for correlation amongst multiple products. The growth phases were similar for both product groups. Generally, demand for volatile products fell off faster in the maturity phase - which is consistent with behavior in a volatile marketplace where new entrant substitutes are frequently introduced to the market. The decline phase was similar in length for both product groups, indicating a firm-driven decision about phasing out the product. 5.2 SKEw All products displayed skew, but the volatile products showed a significant skew earlier toward the launch date. This is consistent with our reasoning that these products tend to 35 drive exuberant early-adoption demand whereas stable-market products embody technologies that are being adopted at a slower rate, with carefully planned adoption, i.e. large corporate customers phasing a new generation of equipment. 5.2.1 Skew - Implications for Sales Forecasting The primary implication of skew for sales forecasting is the fitting of sales expectations to an estimated quarterly distribution. One way our findings on skew could be implemented is to take a the results from a sample of volatile products and use regression to compute the expected skew, either distributed by quarter, or normalized to a percentile for the life of the distribution. By computing a regression, a confidence interval can also be established, against which each quarter's results can be evaluated in a rule-based system: a breakout from the established confidence interval would trigger subsequent quarters' forecasts to be adjusted, taking the actual value as the new estimator. Breakout Prior Range Forecast -- &V Actual Shipments - -- New Range Forecast Figure 5-1: Conceptual Rule-Based Range Forecast 36 Additionally, skew is also interesting because it implies an elongated thin tail later in the product's lifespan for volatile products. A critical decision must be made about when to cease production of the product, with profitability in the later stages being a key consideration given the high rate of obsolescence in volatile markets. The above method can be useful in generating accurate expectations sooner in the process because it gives and updated result for all quarters as each quarter moves on. 5.2.2 Skew - Implications for Capacity Planning and Inventory Management The question of the long tail is also interesting from capacityplanningand inventory management standpoints as it necessarily drives a decision about actively supporting the tail in inefficient, small batches vs ceasing production earlier and generating a large stock of legacy inventory. This trade-off, of lower production asset utilization vs. higher inventory carrying might result in differing strategies for a firm producing volatile products: If the relative cost of inventory is high, it might make sense to invest in multiple production lines of different scales - some firms have lower-efficiency reserve lines used for test lots, and low-volume production. If the relative cost of inventory is low, then it might make sense to carry it while carefully discounting along with the rate of obsolescence. In either stead, supporting a long tail requires creative thinking on behalf of capacity planners and inventory managers, who must clearly consider represent the relevant opportunity costs to the financial management of the firm. 5.3 RATE OF GROWTH/IDECLINE Generally, volatile products had faster growth in the introduction phase. This was expected, due to a twofold upward influence in a volatile market: the technology is diffusing at a high rate, and the product is gaining market share (as opposed to quickly 37 shrinking to the benefit of its competitors). Stable-market products had longer, planned ramps in growth. Slopes for volatile products during the middle phases were confounded by multiple modes and variation, making them effectively flat, with no conclusive peak in demand. By contrast, traditional products displayed more clearly defined growth and maturity phases. A limitation to these results is that amongst all of the metrics, slope is perhaps the most heavily influenced by production decisions as opposed to 'natural' market forces: at the beginning of the life cycle, growth is limited by available capacity - in a volatile market, firms may initially allocate less than the full expected level of capacity to mitigate against relatively high prospects of product failure. At the end of the life cycle, the phase-out decision often involves the consideration of internal opportunity costs around capitalization and inventory, rather than sizing production quantities to market demand. 5.3.1 Rate of Growth/Decline - Implications for Sales Forecasting Much like skew, slope is an early indicator of a product's eventual sales volume. Simply put, slope during the growth phase points in the direction of the peak demand, making for another opportunity for quantitative rule-basedforecasting.Once segment lengths have been established using the prior criteria, a sales volume can be predicted for the segment based on the expected length and slope of the segment. While in our results, the slope of the segment was logarithmic (% change each unit), if a different relationship is found, the formulation could be altered to use whichever method has the best fit. 38 Estimated Segment Lengths % Rate of Change IEstimated0 < Dy < 1 Inflection Point U Actual Sales E Forecast Sales Figure 5-2: Conceptual Slope & Segment-Based PLC Forecasting 5.4 VARIANCE Volatile products led stable products in overall variance as expected. Weekly variance was extremely high, with CV ranging exceeding 100% even for stable products. Pooled to monthly totals, CVs came in ranges much more suitable for use as a demand signal for inventory management activities, although for some volatile products, edge case variation outside the month bound drove it significantly higher. All parties making use of the monthly demand signal would do well to examine the sensitivity of varying the number of days/weeks in a month (in our case, 4-5-4 per quarter) if CV seems sporadically high, and seek an explanation - a seemingly innocuous repeating spike in demand variance may yield misalignments in the supply chain. While exploring the change in variance amongst the different product life cycle segments, we discovered an interesting result: all products exhibited similar variation during the introduction phase. The greatest difference in variation between the two product groups came in the middle phases. Variance for high-share products tended to diminish around 39 the peak, while low share products exhibited similar variance to the earlier and later phases. 5.4.1 Variance - Implications for Inventory Management The value of monthly variation is a primary input for inventory managers seeking to set cost-efficient levels of safety stocks throughout the supply chain. Setting an expectation based on the life cycle stage is important technique: if stable products 'stabilize' during the middle phases, inventory targets can be reduced for these periods, and many firms set targets accordingly as a matter of policy. However, efforts to do the same for volatile products may be fruitless if volatility remains constant throughout the life cycle, as was the case with our volatile product group. 5.4.2 Variance - Implications for Capacity Planning The key question for capacity planners in considering variance is, will production level need to vary on a short-term basis to mitigate for variance in demand? If variance is relatively low as in the case of the stable products in our group, capacity planners can optimize for a relatively smooth, planned level of output. With low variability in output, both labor and capital resources can be specialized in their respective tasks, avoiding some additional amount of overhead cost. With little variation in output, all resource utilization can remain high - ideal for both labor and capital-intensive industries. For volatile products, whose variation is much higher, planners may need to reserve for variable production rates in order to maintain profitability. Here again, the flexible production system becomes a valuable asset. Firms operating in these sorts of markets should take holistic view of their entire product line and construct flexible production lines 40 that take advantage of opportunities to pool the risk together. This may involve investing in flexible equipment and training employees in multiple skills. If the product allows for it, postponement strategies are effective. In making these decisions, capacity planners should be mindful upstream and downstream actors in the supply chain, as adjusting production volume on a short term basis may drive shocks in both directions. 5.4.3 Variance - Implications for Sales Forecasting Sales forecasting is primarily concerned with longer-term, quarterly results. We believe that for all practical purposes the change in sales between quarters is a trend, not random variation. Yet the change in variance for the monthly signal may be of interest to forecasters for stable products - our observation that the variance reduces in the middle of the life cycle means it may be used as a signal that the product is entering or leaving the middle phases. 5.5 MODALITY Our observations for modality were inconclusive; stable products were certainly unimodal, where volatile products had multiple modes, or a less well defined mode, with multiple small peaks around a center. Uniform distributions were not encountered in either product group - visually, each product had a recognizable central peak in its distribution over the time horizon. We believe that the lack of clarity for volatile products is significant - as it represents continuing volatility in a product's market share as a function of features/price even at peak demand. 5.5.1 Modality - Implications for Capacity Planning The relevance of modality to capacity planners is twofold: first, the existence multiple modes means a 'dip' or downtime in the center of production will occur wherein fewer 41 resources are required. For labor planning, this may mean furloughs, and for capital planning, the usefulness of flexible-output production will be useful VOLATILITY AND CAPITAL-INTENSIVENESS As discussed in the beginning of this paper, volatility presents a key challenge for capitalintensive industries like the manufacture of durable goods: in order to be profitable, firms must make efficient utilization of their assets, and thus must carefully consider the opportunity costs of capitalization. Large firms, from automobiles to semiconductors, often make billion-dollar bets with their go-to-market decisions. Under normal circumstances, it seems that firms taking this level of risk would naturally want to avoid the lower margins and higher uncertainty of volatile products. An interesting paradox is created - large, capable, capital intensive firms want to avoid participating in competitive, volatile markets because they have low apparent economic profits (via high opportunity costs of producing more stable profitable products). But in doing so, they may be avoiding the markets where the highest rate of innovation occurs - 5.6 another sort of opportunity cost. When the market demands innovation, eventually a space is created wherein a disruptor can take advantage of their competitors' wariness. An example of this is electric passenger cars in the US - despite researching the idea for decades, the established automakers were hesitant to invest the billions required to develop scaled production and maintenance infrastructure, leaving room for Tesla Motors to capture growing customer value in that market. 42 5.7 ADDITIONAL LIMITATIONS & FUTURE RESEARCH 5.7.1 Product and Industry Choice We tested ten products from one firm in one industry. Based on the complementary role this firm plays with both upstream and downstream products, as well as its overall prevalence, we believe our results are robust enough to extend to most durable goods, but variation is expected, most of which depending on the product lifespan. Future research might attempt to compare these statistics across multiple firms and industries in order to assess which methods are best 5.7.2 Variation and Exogenous Effects While we have found a good deal of significance, coefficients of variation for all products remained high. The motivation is to overcome the real-world problem of finding significance in a very noisy dataset in order to make marketing and production decisions. There will be some periods in any product's life cycle where the noise will confound any signal of a transition between phases. This is especially true for volatile products that exhibit high levels of variation and multi-modal demand patterns. Additionally, many exogenous factors might have influenced the shipment trend. No realworld market is perfectly competitive - in durable goods industries firms tend to enter long-term relationships with upstream and downstream firms wherein pricing, quantity, timing, and even product design is heavily coordinated. In such an environment, a single large B2B customer may have enough purchasing power to determine the overall success of a product, exemplifying the sort of uncertainty that defines volatile markets. Future research might assess how the competitiveness of upstream and downstream firms thus influence the level of volatility in a market. 43 Exogenous factors may also drive shocks into the dataset - production delays, bullwhips, and macro events all influence sales. While these effects were qualitatively assessed to be minimal for our products, we cannot rule out their significance. Shocks may also have a 'make it or break it effect': even if by coincidence, we can imagine how a shortage or recall lasting just several might cause a product to miss its window of opportunity for growth in the volatile environment. Future research might examine rates of recovery for products that have experienced these effects. 5.7.3 Validity of Judgment Methods Because of the multitude of limitations in a purely quantitative assessment of demand profiles, we would not recommend that any firm transition to making decisions on a purely quantitative basis, whether it be econometric, or our notional PLC rule-based algorithm, or otherwise. Judgment must still carry some weight - in fact, many of the agreements and relationships that we listed as confounding factors actually enhance forecast accuracy when the firm strives to fulfill its exact commitments (which can be explained as transition from pure make-to-stock to partial make-to-order). When a firm builds what it commits to suppliers and customers, and suppliers and customers do likewise, a resilient supply chain is born! Further research into resilient supply chain methods might further the understanding of when and how to best use judgment methods for both marketing and production decisions. Of particular interest to us is the practice sharing forecasts up and down the supply chain. 44 5.7.4 Sales Forecasting, Capacity Planning, and Inventory Management Strategies Choosing these three lenses proved to be a very useful tool in decidingwhat to measure, a key component of any firm's operational strategy. Each presents an opportunity for further research. To look into salesforecasting, a survey of firms with regards to volatile markets would be an interesting way to assess overall effectiveness of different methods. Such a survey could define common characteristics of various forecast methods - in terms of inputs, calculations, and outputs - as well as ask how firms vary their forecasting based on the perceived volatility of markets. Accuracy could also be assessed, both qualitatively and quantitatively. Our discussions on new products via the lens of capacityplanningbrought flexibility into the forefront of new product theory. Future research might explore the trade-offs of level of flexibility given a range of demand patterns, and how firms mitigate against volatility in their production plans. The lens of inventory management reminded us what a challenge it can be to manage a high level of volatility in a new product market. Using our method, an expected level of variance can be calculated for the entire lifespan, and traditional inventory theory would have firms carry more inventory as a buffer to expected volatility, albeit at a high cost. The practical counter to this additional cost is to invest in supply chain innovations like postponement or use instruments like risk-sharing contracts to mitigate for the uncertainty. But how do these well-established techniques perform with regard to new products? 45 5.8 CONCLUSION This thesis accomplished both its motivational and research aims, in the specific sense of empirical findings to support the proposed relationships in data, as well as in the general sense that these results are consistent with intuitive thinking about the nature of volatile markets. The research question was whether demand patterns for volatile products had anything in common, and whether they differed from traditional products. We answered 'yes' to both questions, with significant correlation, using metrics that would allow a likewisemotivated firm to conduct the same sort of analysis. The motivating question was whether firms may use this knowledge to make better decisions about marketing and producing volatile products. This was done by looking through the lenses of sales forecasting, capacity planning, and inventory management. The high degree of significance in the research results allowed us to demonstrate sample statistical forecasts, as well as propose heuristics for making decisions on production flexibility, inventory management and phase out decisions. In all of our discussions, we highlighted key-trade-offs to consider when deciding how to market andproduceproducts in volatile markets. Many firms struggle to make datadriven decisions when metrics do not properly align to such trade-offs. In the case of volatile markets, shortening life cycles and lead times leave little room for error, a problem to which evolving from judgment-based methodology to an informed quantitative method is an effective solution. 46 REFERENCES Allen, P.G. and R. Fildes (2001). Econometric Forecasting. In Armstrong J.S. (ed) Principlesof Forecasting(303-308). Norwell, MA: Kluwer Academic Publishers Armstrong, J.S. (2001a). Introduction. In Armstrong J.S. (ed) PrinciplesofForecasting(2-11). Norwell, MA: Kluwer Academic Publishers Armstrong, J.S. (2001b). Bootstrapping: Inferring Experts' Rules for Forecasting. In Armstrong J.S. (ed) PrinciplesofForecasting(171-184). Norwell, MA: Kluwer Academic Publishers Bass, F.M. (1969). A New Product Growth Model for Consumer Durables. Management Science 15 (5) 215-227. Basu, S. & R. Schroeder (1977). Incorporating Judgments in Sales Forecasts: Application of the Delphi Method at American Hoist & Derrick. Interfaces. 7 (3) 18-27 Chien, C. et al (2010). Manufacturing Intelligence for Semiconductor Demand Forecast Based on Technology Diffusion and Product Life Cycle. InternationalJournalofProduction Economics, 128 496-509 Ching-Chin, C. et al (2010). Designing a Decision-Support System for New Product Sales Forecasting. Expert Systems with Applications, 37 1654-1665 Collopy, J.S & F (2001). Expert Systems. In Armstrong J.S. (ed) PrinciplesofForecasting(285296). Norwell, MA: Kluwer Academic Publishers 47 Hartigan J.A., & P.M. Hartigan (1985). The Dip Test of Unimodality. The Annals ofStatistics 13 (1), 70-84 Maechler, M (2013). Diptest: Hartigan'sdip test statisticfor unimodality - correctedcode. Retrieved from http://cran.r-project.org/web/packages/diptest/index.html April 2014 Norton, J.A & F.M. Bass (1987). A Diffusion Theory Model of Adoption and Substitution for Successive Generations of High-Technology Products. Management Science 33 (9) 10691086 Porter, M. (1980). Competitive Strategy: Techniques for Analyzing Industries and Competitors (283-285). New York, NY: The Free Press Qin, R. & D. Nembhard (2012). Demand Modeling of a Stochastic Product Diffusion over the Life Cycle. InternationalJournalofProductionEconomics, 137 201-210 Rowe, G (2001). Expert Opinions in Forecasting: The Delphi Technique. In Armstrong J.S. (ed) PrinciplesofForecasting(125-144). Norwell, MA: Kluwer Academic Publishers Tanaka, K (2010). A Sales Forecasting Model for New-Released and Nonlinear Sales Trend Products. Expert Systems with Applications 37 7387-7393 Vernon, R. (1966). Investment and International Trade in the Product Cycle. The Quarterly JournalofEconomics, 80 (2) 190-207 Vernon, R. (1979). The Product Cycle Hypothesis in a New International Environment. Oxford Bulletin of Economics andStatistics, 41 (4) 255-267 Wittink, D.R. (2001). Forecasting With Conjoint Analysis. In Armstrong J.S. (ed) Principlesof Forecasting(147-167). Norwell, MA: Kluwer Academic Publishers 48 GLOSSARY OF TERMS Capacity Planning- The discipline or division(s) of a firm concerned with the construction of facilities, hiring of labor and procurement of equipment in order to produce a product. Decline Phase - The fourth and final phase of the product life cycle, where sales of the product end. Growth Phase - The second phase of the product life cycle, where the product fully expands into its potential market on an order of magnitude that tends toward its peak demand. Introduction Phase- The first phase of the product life cycle in which the initial market reaction to the entry of the product occurs. Maturity Phase- The third phase of the product life cycle, where the product reaches its full extent into the market. Modality - The degree to which demand for a product is centered around one or more peaks over time. Naive Forecasting- A forecasting methodology that where the pending period's demand is predicted to be exactly the same as the last period's demand. ProductLife Cycle - The entire life cycle of a product, from development, to production, to legacy support and end of life. In this paper, we bound the life cycle to the lifetime of product sales. Rate of Growth/Decline- The rate at which demand for product(s) is increasing or decreasing over time. Sales Forecasting- The discipline or division(s) of a firm concerned with accuracy of forecasts over large intervals - quarters and years; and the consequent long-range financial performance of a product. Skew - The tendency of the distribution of a product's sales over time to tend toward the beginning or end of the life cycle. Stable Market - A market where market shares vary gradually over time, as influenced by gradual change in product features, widespread consumer understanding of products, and accurate producer understanding of market segments. Risk is relatively low and entry and exit are of low frequency. Variance - The level of volatility in product demand that external to the life cycle trend. Volatile Market - A market where shares vary rapidly over time, as influenced by rapid change in features, and limited consumer and producer understanding of products and market segments. Risk is higher and market entries and exits are frequent. 49