Document 11194904

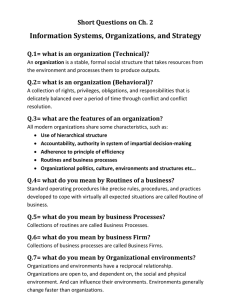

advertisement