New Opportunities for Equity

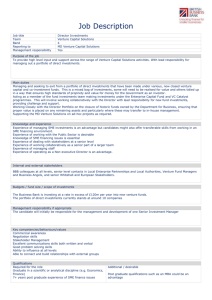

advertisement