Solow Economic Growth Model

advertisement

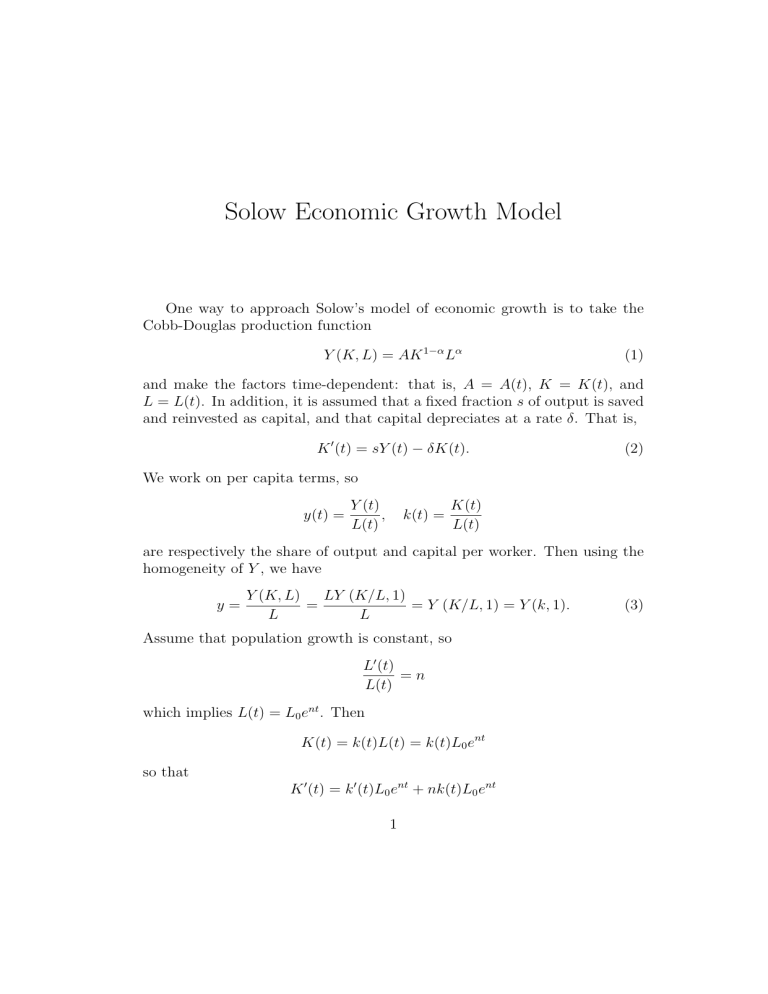

Solow Economic Growth Model One way to approach Solow’s model of economic growth is to take the Cobb-Douglas production function Y (K, L) = AK 1−α Lα (1) and make the factors time-dependent: that is, A = A(t), K = K(t), and L = L(t). In addition, it is assumed that a fixed fraction s of output is saved and reinvested as capital, and that capital depreciates at a rate δ. That is, K 0 (t) = sY (t) − δK(t). (2) We work on per capita terms, so y(t) = Y (t) , L(t) k(t) = K(t) L(t) are respectively the share of output and capital per worker. Then using the homogeneity of Y , we have y= LY (K/L, 1) Y (K, L) = = Y (K/L, 1) = Y (k, 1). L L Assume that population growth is constant, so L0 (t) =n L(t) which implies L(t) = L0 ent . Then K(t) = k(t)L(t) = k(t)L0 ent so that K 0 (t) = k 0 (t)L0 ent + nk(t)L0 ent 1 (3) by the product rule. Then the assumptions (2) about capital give K 0 (t) = sY (t) − δK(t) = sL(t)y(t) − δk(t)L(t) = sL0 ent y(t) − δk(t)L0 ent so that k 0 (t)L0 ent + nk(t)L0 ent = sL0 ent y(t) − δk(t)L0 ent . Divide by L0 ent to make this k 0 (t) = sy(t) − (n + δ)k(t). Now from equations (3) and (1) we have y(t) = Y (k(t), 1) = A(t)k(t)1−α , (4) so our differential equation for the capital per worker k(t) is k 0 (t) = sA(t)k 1−α − (n + δ)k. (5) This is a first-order nonlinear differential equation. If A(t) = a, a constant, then equation (5) is separable: dk k α−1 dk dt = = , sak 1−α − (n + δ)k sa − (n + δ)k α which after the substitution u = k α can be integrated to give the solution α1 sa sa , k(t) = k0α − e−(n+δ)αt + n+δ n+δ (6) where k0 = k(0). Now the exponential term in this solution gets small as t → ∞, so the capital per worker has the finite limit k(t) → sa n+δ α1 and similarly, using equation (4), the per-capita output tends to a finite limit y(t) → a sa n+δ 2 1−α α . This seems at odds with actual history, at least in most of the world. Most economies have seen growth in capital and output that not only keeps up with population, but dramatically exceeds it. What is missing? Solow argued that the missing factor is productivity growth. Suppose that A(t) = aeζt , where ζ is the rate of increase in productivity. Then the differential equation (5) for k is k 0 (t) = saeζt k(t)1−α − (n + δ)k(t). This isn’t separable, but it can be written k α−1 dk + (n + δ)k α = saeζt , dt which after multiplication by αeα(n+δ)t can be put in the form d α(n+δ)t α e k = αsae(α(n+δ)+ζ)t dt and integrated. The solution is k(t) = k0α − αsa α(n + δ) + ζ −α(n+δ)t e αsa eζt + α(n + δ) + ζ α1 . Note that this agrees with our earlier solution (6) if ζ = 0. But if ζ 6= 0, k(t) does not tend to a finite limit: in fact, as t → ∞ the first term gets small and ζ k(t) → Ce α t for a constant C that depends on α, s, a, and ζ. Using equation (4), we have ζ ζ y(t) → aeζt (Ce α t )1−α = Ee α t for another constant E. So in this model both the capital and output per worker tend toward exponential growth at a rate αζ that depends only on the rate of productivity growth ζ and the exponent α from equation (1), and not on the savings rate s or the population growth rate n. 3