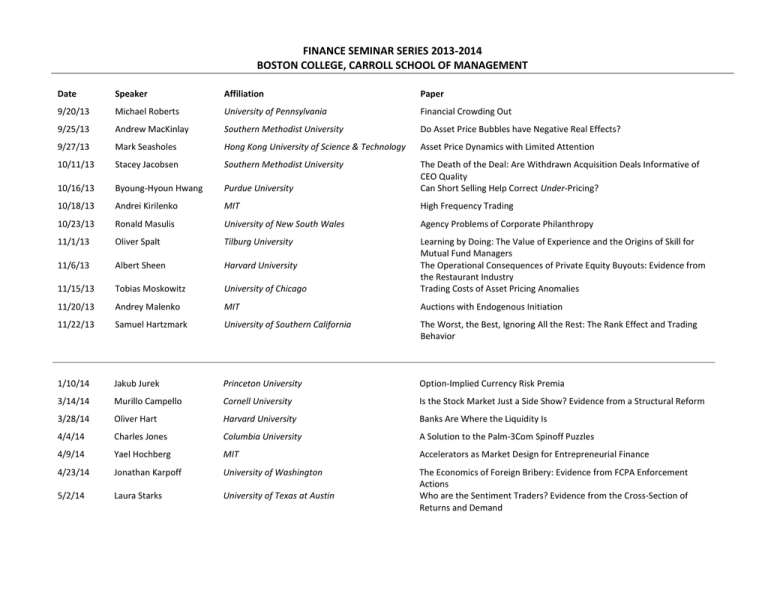

FINANCE SEMINAR SERIES 2013-2014 BOSTON COLLEGE, CARROLL SCHOOL OF MANAGEMENT

advertisement

FINANCE SEMINAR SERIES 2013-2014 BOSTON COLLEGE, CARROLL SCHOOL OF MANAGEMENT Date Speaker Affiliation Paper 9/20/13 Michael Roberts University of Pennsylvania Financial Crowding Out 9/25/13 Andrew MacKinlay Southern Methodist University Do Asset Price Bubbles have Negative Real Effects? 9/27/13 Mark Seasholes Hong Kong University of Science & Technology Asset Price Dynamics with Limited Attention 10/11/13 Stacey Jacobsen Southern Methodist University 10/16/13 Byoung-Hyoun Hwang Purdue University The Death of the Deal: Are Withdrawn Acquisition Deals Informative of CEO Quality Can Short Selling Help Correct Under-Pricing? 10/18/13 Andrei Kirilenko MIT High Frequency Trading 10/23/13 Ronald Masulis University of New South Wales Agency Problems of Corporate Philanthropy 11/1/13 Oliver Spalt Tilburg University 11/6/13 Albert Sheen Harvard University 11/15/13 Tobias Moskowitz University of Chicago Learning by Doing: The Value of Experience and the Origins of Skill for Mutual Fund Managers The Operational Consequences of Private Equity Buyouts: Evidence from the Restaurant Industry Trading Costs of Asset Pricing Anomalies 11/20/13 Andrey Malenko MIT Auctions with Endogenous Initiation 11/22/13 Samuel Hartzmark University of Southern California The Worst, the Best, Ignoring All the Rest: The Rank Effect and Trading Behavior 1/10/14 Jakub Jurek Princeton University Option-Implied Currency Risk Premia 3/14/14 Murillo Campello Cornell University Is the Stock Market Just a Side Show? Evidence from a Structural Reform 3/28/14 Oliver Hart Harvard University Banks Are Where the Liquidity Is 4/4/14 Charles Jones Columbia University A Solution to the Palm-3Com Spinoff Puzzles 4/9/14 Yael Hochberg MIT Accelerators as Market Design for Entrepreneurial Finance 4/23/14 Jonathan Karpoff University of Washington 5/2/14 Laura Starks University of Texas at Austin The Economics of Foreign Bribery: Evidence from FCPA Enforcement Actions Who are the Sentiment Traders? Evidence from the Cross-Section of Returns and Demand